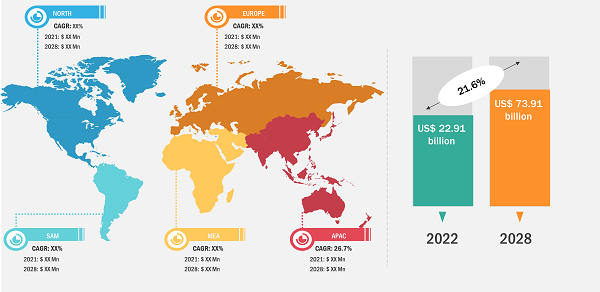

The unmanned aerial vehicle (UAV) market is expected to reach at US$ 73.91 billion by 2028; registering at a CAGR of 21.6% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Significant Growth in Delivery/Retail Drone Deployment to Provide Growth Opportunities for Unmanned Aerial Vehicle (UAV) Market During 2022–2028

The current UAV market comprises both recognized and new companies. Several significant players operating in the aerospace & defense industry are capitalizing on military-grade systems and associated technologies that can be utilized by the government for civil uses and commercial aviation. Simultaneously, new companies emerging from startups and academic institutes are propelling the growth of recreational UAVs and the initial stages of commercial applications. Further, these startups are witnessing high investments from established companies interested in investing in UAV-related technology. For instance, Intel Corporation has made significant investments in Yuneec, a commercial UAV manufacturer, and Airware and Precision Hawk, UAV software providers. Also, several partnerships between manufacturers and solution providers and other recognized vertical players can be noticed in the UAV market, for instance, the partnership between senseFly and Airware. Moreover, the investments in UAV technology noticed a shift from hardware to software. Players in the market are focused on providing comprehensive UAV solutions that demand new software systems.

The commercial UAV industry is witnessing significant growth in the fields of energy, agriculture, and construction, regardless of the lack of a proper regulatory framework. Apart from startups and small firms, large established companies and industries are also making significant investments in commercial UAV technologies. Further, the aerial imaging and data analysis field is bolstering. The major industries adopting UAV technologies include agriculture, construction, media & entertainment, and law enforcement.

Unmanned Aerial Vehicle (UAV) Market – by Region, 2022

Unmanned Aerial Vehicle (UAV) Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Camera, Sensors, and Others) and Software], Type (Fixed Wing, Multi Rotor, Single Rotor, and Hybrid), and Application (Military & Defense, Retail, Media & Entertainment, Personal, Agriculture, Industrial, Law Enforcement, and Construction), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Unmanned Aerial Vehicle Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Download Free Sample

Source: The Insight Partners Analysis

In Asia Pacific, the commercial UAV industry of China is witnessing high growth and development with the presence of the major commercial UAV manufacturer DJI, which holds more than 60% of the commercial UAV market share. The rapid growth of China’s UAV industry is supported by extensive R&D coupled with government initiatives to support the industry. Further, the commercial UAV industry of the region is witnessing high growth with the increasing adoption of UAVs for commercial applications. Moreover, growth is expected in the adoption of UAV technology in agriculture and construction sectors of the region due to the rising demand for precision agriculture and smart construction trends.

Moreover, the presence of two of the top five military spending countries (China and India) worldwide is another major factor catalyzing the deployment of military drones across Asia Pacific. This is further propelled by the need for strengthening the armed forces across respective countries due to rising tensions among countries of the region. For instance, the constant tensions among the countries of Asia Pacific, such as China-India, China-Taiwan, and India-Pakistan, are further generating new deployments of military drones across the countries and contributing to the growth of the UAV market across the region.

Based on component, the unmanned aerial vehicle (UAV) market is bifurcated into hardware and software. The hardware segment is further segmented into cameras, sensors, and others. The hardware segment is expected to dominate the unmanned aerial vehicle (UAV) market in 2022 and is expected to retain its dominance during the forecast period. UAVs are highly technological devices with complex infrastructure and include several different types of components to operate with different functions. These include cameras, sensors, frame (body), actuators, batteries, flight controllers, and GPS. There are different variants in the construction and frames of UAVs; however, some of the vital components used in all UAVs are motor frames, motors, flight and motor controllers, transmitters and propellers, receivers, and batteries or other energy sources. The selection of each component is considered very crucial to increase mobility while flying and reduce the weight of the UAV. The increasing production of UAVs for specific applications across different industries such as agriculture, military, energy, industrial, and e-commerce is driving the market for the segment. The demand for automation and automated support across these industries is another major factor supporting the deployment of UAVs across such industries worldwide. The key UAV companies providing hardware solutions to the commercial UAV market include DJI, Yuneec, EHang, Parrot, and senseFly. Also, key players providing military UAVs include General Atomics, Northrop Grumman, Textron Systems, Aeryon Labs Inc., and Insitu.

The key players operating in the unmanned aerial vehicle (UAV) market include DJI, Parrot SA, 3D Robotics Inc, Yuneec International Co Ltd, Airware, AeroVironment Inc, DroneDeploy, Northrop Grumman Corporation, PrecisionHawk Inc, and SenseFly SA. The unmanned aerial vehicle (UAV) market players are constantly working on the development of innovative solutions to cater to different end-use industry demands and remain competitive in the market.

- In November 2022, DJI launched three new products into its Mavic 3 series of drones that features advanced productivity tools for precision agriculture applications and end users.

- In February 2021, SenseFly launched eBee Ag fixed-wing mapping drone for farmers, agronomists, and service providers to efficiently capture aerial data and plant health insights for faster agronomic decision-making operations.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com