The animal health market is projected to reach US$ 126,500.20 million by 2028 from US$ 87,547.03 million in 2022; it is estimated to register a CAGR of 6.2% from 2022 to 2031.

Preventing animal disease and monitoring animal food supplies are vital to ensure safety of food supply. Breeding of healthy livestock guarantees a safe supply of food and keep selling prices stable. Zoonotic diseases can adversely affect public health, international trade, and the stability of the agricultural sector, resulting in a loss of millions of dollars owing to livestock trade halts, animal slaughters, and subsequent disease elimination efforts. In November 2017, Porcine reproductive and respiratory syndrome virus (PRRSV) that causes stillborn piglets costed the US farmers US$ 600 million. Disease free and healthy animals are therefore likely to result in safer food supplies, higher farm productivity, reduced environmental impacts, reduced use of antibiotics.

Factors such as increasing incidences of zoonotic diseases, rise in the demand for proteinaceous food, and initiatives by governments and animal welfare associations are expected to propel the growth of the animal health market during the forecast period. However, the use of counterfeit medicines, and high complexity and cost of animal drug development and approval processes are likely to pose a negative impact on the animal health market growth.

The animal health market is segmented based on product, animal type, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the market, emphasizing on parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the world's leading market players.

Strategic Insights

Lucrative Regions for Animal Health Market

Market Insights

Increased Adoption of Pets for Companionship

The adoption of pets is a significant animal healthcare market trend. More than 67% of American households own pets, totaling almost 400 million pets, including dogs, cats, horses, birds, and fish. As per American Society for the Prevention of Cruelty to Animals, ~6.5 million companion animals enter the countrywide animal shelters every year. The number of dogs and cats entering these shelters yearly has declined from ~7.2 million in 2011. This decline can be moderately explained by an increase in the percentage of animals adopted. As per the European Pet Food Industry Federation (FEDIAF), cats remain the most popular pets in European households with a stable population of 74.4 million in the region. Also, the popularity of dogs is growing as there were 66.4 million pet dogs in the EU (84.9 million in Europe and Russia) in 2017, compared to 63.7 million (82.2 million) in 2016.

Americans spent over US$ 75.5 billion on their pets in 2016, with an average total household expenditure of US$ 892 on pet food, veterinary services, supplies, and other services. Pets improve their owners’ overall health and well-being, and may help them live longer. Research shows dog owners have a 36% lower risk of dying from cardiovascular disease and an 11% lower risk of a heart attack. Hence, the trend toward the adoption of pets is likely to drive the market growth in the study period.

Increase in R&D Activities

Over the last two decades, the cost and time of developing an animal health product have both increased by >100% and six years, respectively. According to the Animal Health Institute’s Research and Development Survey, animal health companies spent US$ 663 million in 2006 in the R&D pertaining to new potential products as well as in the research for maintaining the long life of offered products. This constitutes a 7% increase over the spending reported in 2005. Innovative research accounts for 86% of total R&D spending, while the remaining 14% was occupied by the research required to ensure prolonged performance of existing products.

Investments by significant players are further likely to augment the market growth. For instance, Zoetis is focused on continuous innovation to develop animal health solutions meeting the needs of buyers. R&D is at the center of the company’s efforts to provide innovation outcomes that anticipate the future needs of veterinarians and livestock producers in their local markets. On January 30, 2020, Zoetis and Colorado State University signed an agreement to establish the Zoetis Incubator Research Lab and begin a research collaboration focused on exploring the livestock immune system to target new immunotherapies.

Product-Based Insights

Based on product, the animal health market is segmented into prescription and non-prescription. The prescription segment held a larger share of the market in 2022. The non-prescription segment is estimated to register a higher CAGR of 7.0% in the market during the forecast period. The prescription segment is further sub-segmented into vaccines, pharmaceuticals, feed additives, and diagnostics. The non-prescription segmented is further categorized into parasiticides, grooming products, and nutrition/supplements.

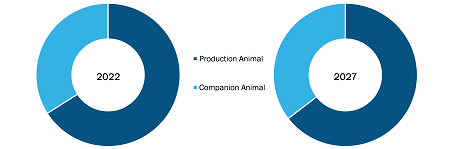

Animal Type-Based insight

Based on animal type, the animal health market is segmented into production animal and companion animal. The production animal segment held a larger share of the market in 2022. The companion animal segment is estimated to register a higher CAGR of 6.8% in the market during the forecast period.

Animal Health Market, by Animal Type – 2022 to 2031

Product launches and mergers and acquisitions are the highly adopted strategies by the players operating in the global animal health market. A few of the recent key product developments are listed below:

In February 2020, Vetoquinol SA announced the acquisition of Profender and Drontal product families from Elanco Animal Health. It will also acquire intellectual property, registrations and other rights currently owned by Bayer AG’s animal health business.

In January 2020, Nutreco N.V. announced investment in a Dutch company Kingfish Zeeland. The company aims to bring supplies of yellowtail kingfish to the US and European markets. The distribution will be done through a proprietary recirculating aquaculture system.

In March 2020, Bayer AG announced the launch of Care4Pigs initiative; this was launched in collaboration with the Farm Animal Welfare Education Centre (FAWEC) and the Korean Association of Swine Veterinarians (KASV). Under the collaboration, EUR 10,000 were granted to support innovation aimed at enhancing swine well-being.

In February 2020, Zoetis received FDA approval for Simparica Trio, a new combination parasite preventative for dogs. It is a first monthly chewable tablet launched in the US, which provides all-in-one protection from heartworm disease, ticks, and fleas, roundworms, and hookworms in dogs.

Company Profiles

- Merck & Co., Inc

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Cargill, Incorporated

- Zoetis Inc.

- Bayer AG

- Vetoquinol SA

- Nutreco N.V

- Virbac

- Elanco

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Have a question?

Akshay

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and Animal Type

Regional Scope

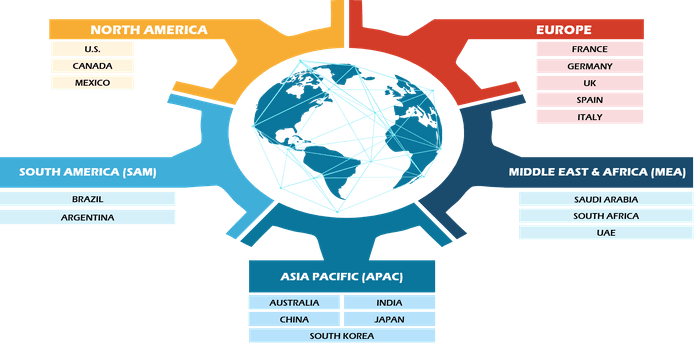

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Similar to human animals are also affected by various diseases, which result in behavioral changes, uneasy conditions, and less production, among others. Several types of diseases can adversely affect animal health, and the diseases may include zoonotic diseases, transboundary diseases, insect-borne diseases, and diseases of production and hygiene, among others. On the other hand, animals assist in building economies through various businesses. For instance, production or livestock animals guarantee a safe supply of food and keep selling prices stable, which in return helps in earning a good income. Therefore, it is essential to maintain good animal health. Animals can be kept healthy by taking measures for their health. Animal owners should regularly take their animals to veterans to diagnose problems related to their health. The animal should be regularly given vaccines to prevent diseases. Thus, such measures assist in marinating good animal health.

The growth of animal health market is driven by some key driving factors such as increasing incidences of zoonotic diseases, rise in demand for proteinaceous food, and initiatives by governments and animal welfare associations. However the use of counterfeit medicines, and high complexity and cost of animal drug development and approval processes are likely to restraint the market growth during the forecast period.

Developing a drug for animals is much complicated and is a bit expensive. The stringent government regulations for drug approvals are the biggest hurdles in the animal health industry. The drug development process can take up to 5–7 years and cost more than US$ 10 million before entering the stage of approval. In addition, animal medicines remain heavily regulated and are subjected to strict laws that protect animals and humans, as well as the environment. Thus, drug development for animals is quite costlier, and sometimes it may become a restraint for the animal health market.

The List of Companies - Animal Health Market

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Cargill, Incorporated

- Zoetis Inc.

- Bayer AG

- Vetoquinol SA

- Nutreco N.V

- Virbac

- Elanco

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Animal Health Market

Apr 2024

Bioprocessing Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Instruments, and Consumables and Accessories), Scale of Operation (Commercial Operations and Clinical Operations), Process (Downstream Bioprocess and Upstream Bioprocess), Application (Monoclonal Antibodies, Vaccines, Recombinant Protein, Cell and Gene Therapy, and Others), End User (Biopharmaceutical Companies, Contract Manufacturing Organization, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Apr 2024

Bioproduction Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product (Biologics and Biosimilars, Vaccines, Cell and Gene Therapies, Nucleic Acid Therapeutics, and Others), Application (Rheumatoid Arthritis, Hematological Disorders, Cancer, Diabetes, Cardiovascular Diseases, and Others), Equipment (Upstream Equipment, Downstream Equipment, Bioreactors, and Consumables and Accessories), End User (Biopharmaceutical Companies, Contract Manufacturing Organizations, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Apr 2024

ELISA Diagnostic Test Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Adoption (Human and Veterinary), Test Type (Sandwich ELISA, Indirect ELISA, Competitive ELISA, and Multiple & Portable ELISA), Application (Autoimmune Diseases, Infectious Diseases, Cancer Diagnosis, Protein Quantification, and Others), End User (Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, Veterinary Hospitals & Diagnostic Laboratories, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Apr 2024

Swine Diagnostics Market

Size and Forecasts (2022 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type [Immunoassays Kits, PCR Kits, Hemagglutination Inhibition (HI), and Others], Sample Type (Blood, Oral Fluids, Nasal Swabs, Tissue Samples, and Others), Disease [African Swine Fever (ASF)/Classical Swine Fever (CSF), Respiratory Diseases, Porcine Circovirus, Porcine Epidemic Diarrhea, Swine Dysentery, and Others], End User (Veterinary Hospitals, Veterinary Clinics, and Other End Users), and Geography

Apr 2024

Microbial Identification Methods Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Method (Genotypic, Phenotypic, and Proteotypic), Type (Bacterial Identification System, Microbial Enumeration System, Bacterial Resistance Identification Systems, Microbiology Analyzer, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America)

Apr 2024

Biopharmaceuticals Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Monoclonal Antibodies, Recombinant Vaccines, Conventional Vaccines, Recombinant Growth Factors, Purified Proteins, Recombinant Proteins, Recombinant Hormones, Recombinant Enzymes, Cell & Gene Therapies, Cytokines/Interferon/Interleukins, and Others) and Application (Oncology, Inflammatory & Infectious Disease, Autoimmune Disorders, Metabolic Disorders, Hormonal Disorders & Growth Failure, Cardiovascular Diseases, Neurological Diseases, and Others)

Apr 2024

GMP Cell Therapy Consumables Market

Forecast to 2028 - COVID-19 Impact and Global Analysis by Product (Kits, Reagents/Molecular Biology Reagents, Growth Factors/Cytokines and Interleukins, and Others), Cell Therapy (NK Cell Therapy, Stem Cell Therapy, T-Cell Therapy, and Others), Process (Cell Collection and Characterization/Sorting and Separation, Cell Culture and Expansion/Preparation, Cryopreservation, Cell Processing and Formulation, Cell Isolation and Activation, Cell Distribution/Handling, Process Monitoring and Control/Readministration/Quality Assurance, and Others), and End Use (Clinical, Commercial, and Research)

Apr 2024