The silicon carbide market was valued at US$ 712.85 million in 2019 and is projected to reach US$ 1,810.56 million by 2027; it is expected to grow at a CAGR of 12.5% from 2019 to 2027.

Silicon carbide, also known as carborundum, is a semiconductor material widely used in electronics and semiconductor industries. The physical hardness of silicon carbide makes it fit for use as an abrasive in processes such as honing, water jet cutting, grinding, and sand blasting. It is also used in the components of pumps used to drill and extract the oil in oilfield applications. Rising demand for silicon carbide in various application industries has led to an increase in the investments by manufacturers, governments, and research institutes in its production.

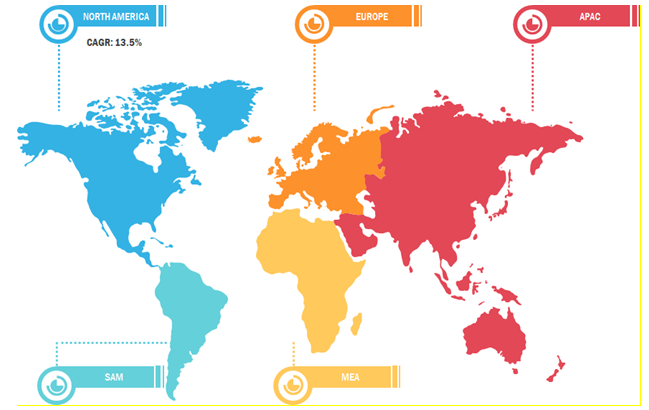

The silicon carbide market in North America is expected to grow at the highest CAGR during the forecast period. The growth of the market in this region is mainly attributed to the increasing adoption of this material owing to its improved electrical performance, compact size, power management capabilities, and high reliability. The power electronics industry is one of the major consumers of silicon carbide as the semiconductor reduces energy loss and increases life as well as efficiency of power devices. Moreover, power electronic devices operating efficiently and effectively at higher temperatures are essential to satisfy several demands such as high-performance, quick charge-time, and others. Also, the growing steel industry in the US is likely to drive the silicon carbide (SiC) market growth as the material is applied as a deoxidizing agent as well as a major raw material in refractory production in the industry.

Effect of COVID-19 upon Silicon Carbide Market

As of March 2021 the US, Brazil, India, Russia, Spain, and the UK are among the worst-affected countries in terms confirmed cases and reported deaths. The COVID-19 has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Chemical and materials is one the world’s major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns because of this outbreak. China is the global hub of manufacturing and largest raw material supplier for various industries. The shutdown of various plants and factories in China is affecting the global supply chains and negatively impacting the manufacturing, delivery schedules, and sales of various materials. Various companies have already announced possible delays in product deliveries and slump in future sales of their products. In addition, the global travel bans imposed by countries in Europe, Asia, and North America are suppressing the business collaboration and partnership opportunities. Thus, these factors have been restraining the growth of the chemicals and materials industry, and other markets related to this industry.

Silicon Carbide Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Market Insights

Proliferation of Electronics and Semiconductors Industries Fuels Silicon Carbide Market Growth

Silicon carbide is a semiconductor, and it is being used widely in electronics and semiconductors industries as a replacement to silicon. It offers greater breakdown electric field strength, band gap, and thermal conductivity, along with enabling a wider range of p- and n-type control required for the construction of a device. For instance, silicon has a band gap of ~1.12, whereas silicon carbide offers a band gap of ~3.26. Similarly, thermal conductivity for silicon carbide is 1490 W/m-K, which is significantly higher than the thermal conductivity of silicon—150 W/m-K. A majority of silicon carbide is being used to make diodes that are used in power supplies and hybrid modules such as PV7.

According to the statistics cited by the Semiconductor Industry Association (SIA), global sales of semiconductors witnessed a hike of 6% from October 2019 to October 2020, reaching a market value of US$ 39 billion. Moreover, 2021 is likely to be a promising year for semiconductors businesses as per the predictions by the World Semiconductor Trade Statistics (WSTS) organization. The global sales of semiconductors are expected to grow by 8.4% in 2021 compared with the sales in 2020. According to The Insight Partner’s analysis, the global electronics industry is expected to register an annual growth rate of 5–6% from 2020 to 2021, and North America and Asia Pacific are expected to register a higher growth than other regions during the same period. Thus, such promising statistics depict the growth of electronics and semiconductor industries, making them a lucrative market segment for the global silicon carbide market vendors.

Type Insights

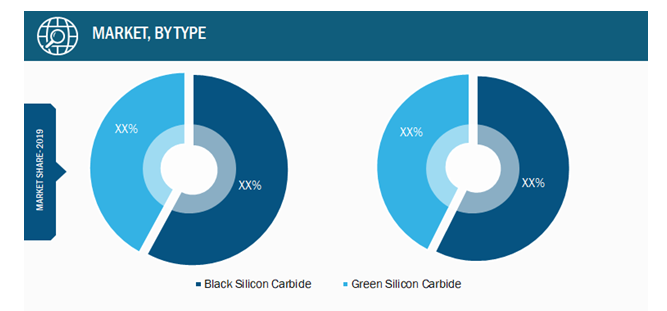

Based on type, the silicon carbide market has been segmented into black silicon carbide and green silicon carbide. The black silicon carbide segment accounted for a larger market share in 2019, and the green silicon carbide segment is expected to register a higher CAGR in the market during the forecast period. Black silicon carbide is an extremely hard man-made mineral that possesses high thermal conductivity along with high strength at elevated temperatures, e.g., at 1000°C, SiC is 7.5-times stronger than aluminum oxide. SiC has a modulus of elasticity of ~410 GPa and can operate with the desired strength at temperatures up to 1600°C; also, it does not melt at normal temperature but dissociates at 2600°C. Black silicon carbide is usually available in the form of blocks, gains, and powder. It is employed as bonded and industrial abrasives, coated abrasives, refractories and ceramics, and refractories and ceramics. Black silicon carbide powder is widely utilized for grinding nonferrous materials, finishing tough and hard materials, and filling up ceramic parts due to its lower cost.

Silicon Carbide Market, by Type – 2019 and 2027

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

End-Use Industry Insights

Based on end-use industry, the silicon carbide market has been segmented into automotive, aerospace and aviation, military and defense, electronics and semiconductor, medical and healthcare, steel, and others. The electronics and semiconductor segment accounted for the largest market share in 2019, and the automotive segment is expected to register the highest CAGR in the market during the forecast period. Silicon carbide can be sedated as n-type by nitrogen or phosphorus also as p-type by boron, beryllium, aluminum, or gallium. Metallic conductivity can also been achieved by heavy doping with boron, aluminum, or nitrogen. The use of silicon carbide is advantageous in fast, high-temperature, and high-voltage devices as it confers dramatic increase in the efficiency of devices. It is highly beneficial in high-voltage applications owing to its capability, compactness, and efficiency. Power semiconductors made from silicon carbide outperform common silicon semiconductors on the back of their capability of withstanding voltages up to 10-times greater than those tolerated by ordinary silicon. Electric and driverless vehicles with onboard charging units and traction inverters are prime application areas of SiC semiconductors. The new high-voltage batteries mainly represent one of the major obstacles to the adoption of hybrid and electric vehicles. With SiC, car manufacturers can shrink the size of the batteries while reducing the total cost of an electric vehicle. Owing to the high voltage resistance, silicon carbide-based components can outperform the gallium nitride-based systems that can withstand the voltage of more than 1000 V. Thus, SiC are a valuable raw material in the development of electric vehicles, solar power inverters, and sensor systems.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Silicon Carbide Market: Strategic Insights

Market Size Value in US$ 712.85 Million in 2019 Market Size Value by US$ 1,810.56 Million by 2027 Growth rate CAGR of 12.5% from 2019-2027 Forecast Period 2019-2027 Base Year 2019

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Silicon Carbide Market: Strategic Insights

| Market Size Value in | US$ 712.85 Million in 2019 |

| Market Size Value by | US$ 1,810.56 Million by 2027 |

| Growth rate | CAGR of 12.5% from 2019-2027 |

| Forecast Period | 2019-2027 |

| Base Year | 2019 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

The players operating in the silicon carbide market include AGSCO Corp, Fiven ASA, ESK-SIC GmbH, and others; the key companies implement the mergers and acquisitions, and research and development strategies to enlarge customer base and gain significant share in the global market, which also allows them to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the silicon carbide market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the silicon carbide market from 2017 to 2027

- Estimation of global demand for silicon carbide

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the silicon carbide market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the silicon carbide market size at various nodes

- Detailed overview and segmentation of the market, as well as the silicon carbide industry dynamics

- Size of the silicon carbide market in various regions with promising growth opportunities

Silicon Carbide Market – by Type

- Black Silicon Carbide

- Green Silicon Carbide

Silicon Carbide Market – by End-Use Industry

- Automotive

- Aerospace and Aviation

- Military and Defense

- Electronics and Semiconductor

- Medical and Healthcare

- Steel

- Others

Company Profiles

- Fiven ASA

- AGSCO Corp

- Carborundum Universal Limited

- ESD-SIC

- ESK-SIC GmbH

- Futong Industry Co. Limited

- Electro Abrasives, LLC

- Washington Mills

- Tifor B.V.

- Grindwell Norton Ltd.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The major players operating in the global silicon carbide market are Fiven ASA, AGSCO Corp, Carborundum Universal Limited, ESD-SIC, ESK-SIC GmbH, Futong Industry Co. Limited, Electro Abrasives, LLC, Washington Mills, Tifor B.V., Grindwell Norton Ltd., and many others.

In 2019, the silicon carbide market was predominant by Asia-Pacific at the global level. The primary factor driving the growth of the silicon carbide market is the increasing application of silicon carbide in the automotive, electronics & semiconductor, medical, and other industries. In addition to that, favorable conditions for production activities, in addition to the growing market demand, have attracted global companies to make strategic investments in this region. Growing investments in research & development activities and increasing the use of silicon carbide in multiple industrial sectors are propelling the market growth in this region. These silicon carbide materials are basically added in modest quantities for the performance enhancement of the end-product. Currently, electrical & semiconductor are the popular end-use industry for silicon carbide usage.

Between the two segments of type, black silicon carbide segment has led the market in 2019. Black silicon carbide (SiC) is known as an extremely hard man-made mineral that possesses high thermal conductivity along with high strength at elevated temperatures (mainly at 1000°C, SiC is 7.5 times stronger than Al2O3). SiC has a modulus of elasticity of about 410 GPa, with no decrease in strength up to 1600°C; also, it does not melt at normal temperature but instead dissociates at 2600°C. Black silicon carbide is usually available in the form of blocks, gains, and powder. It is employed as Bonded & Industrial Abrasives, Coated Abrasives, Refractories & Ceramics, Refractories & Ceramics. Black silicon carbide powder is widely utilized for grinding nonferrous materials, finishing tough & hard materials, as well as filling up ceramic parts due to its lower cost.

The List of Companies - Global Silicon Carbide Market

- Fiven ASA

- AGSCO Corp

- Carborundum Universal Limited

- ESD-SIC

- ESK-SIC GmbH

- Futong Industry Co. Limited

- Electro Abrasives, LLC

- Washington Mills

- Tifor B.V.

- Grindwell Norton Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Silicon Carbide Market

Mar 2021

Construction Additives Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Cement Additives, Concrete Admixtures (Precast Concrete and Ready-Mix Concrete), Paints and Coatings Additives, Adhesives and Sealants Additives, Plastic Additives, Bitumen Additives, and Others], and Application (Residential, Commercial, Infrastructure, and Others)

Mar 2021

Oil Pollution Remediation Materials Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Physical Remediation (Booms, Skimmers, and Adsorbent Materials), Chemical Remediation (Dispersants and Solidifiers), Thermal Remediation, and Bioremediation]

Mar 2021

Greenhouse and Mulch Film Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Greenhouse Films and Mulch Films), Material (LLDPE, LDPE, HDPE, EVA, PHA, PVC, PC, and Others), and Application (Vegetable Farming, Horticulture, Floriculture, and Others)

Mar 2021

Plastic for SLS 3D Printing Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Polyamide, Thermoplastic Polyurethane (TPU), Polyether Ether Ketone (PEEK), and Others) and End-Use Industry (Healthcare, Aerospace & Defense, Automotive, Electronics, Others)

Mar 2021

Carbon Fiber-Based SMC BMC Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Resin Type (Polyester, Vinyl Ester, Epoxy, and Others) and End-Use Industry (Automotive, Aerospace, Electrical and Electronics, Building and Construction, and Others)

Mar 2021

Thermoplastic Adhesive Films Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Material (Polyethylene, Polyamide, Thermoplastics Polyurethane, Polyester, Polypropylene, Polyolefins, Copolyamides, Copolyesters, and Others); Technology (Cast Film and Blown Film); Application (Membrane Films, Barrier Films, and Blackout Films); End Use (Textile, Automotive, Electrical and Electronics, Medical, Ballistic Protection, Lightweight Hybrid Construction, and Others)