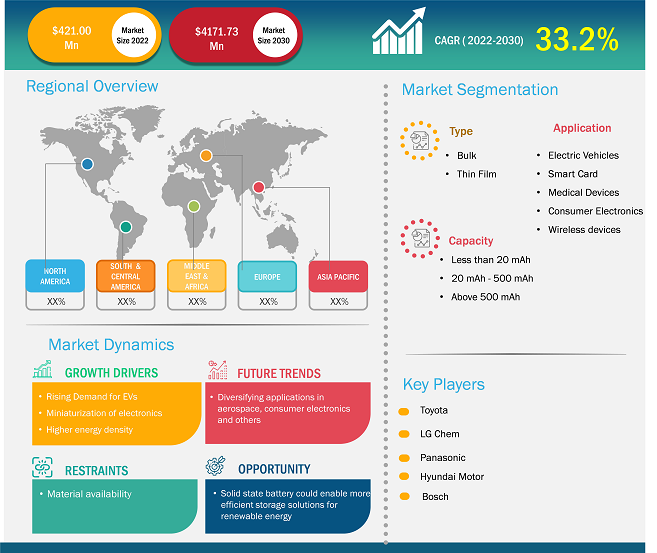

The Solid State Battery Market size is expected to grow from US$ 421.00 million in 2022 to US$ 4171.73 million by 2030; it is estimated to grow at a CAGR of 33.2% from 2022 to 2030.

Analyst Perspective:

Among the components of a lithium-ion battery are the cathode, anode, separator, and electrolyte. Liquid electrolyte solution is used in lithium-ion batteries found in smartphones, power equipment, and electric vehicles. A solid-state battery, however, uses a solid electrolyte rather than a liquid one. The majority of businesses anticipate that internal combustion engine vehicles (ICEVs) will be phased out and replaced by electric vehicles. It is crucial to expand the battery capacity of an EV battery in order for it to achieve the same level of mileage as the existing ICEV in order for it to become the undisputed leader in the industry. There are two methods for boosting capacity. The first step is adding more batteries. However, in this instance, the cost of the battery increases, and batteries take up a lot of room within the car. A solid-state battery offers a higher energy density than a Li-ion battery that uses a liquid electrolyte solution. There is no chance of explosion or fire. Thus, there is no need for safety components, which frees up additional room. The battery's capacity can then be increased by adding more active elements because of the additional space.

Solid State Battery Market Overview:

In the current market, the battery space in the electric vehicle is dominated by Li-ion batteries. For instance, according to a report by DNV GL, 95-99% of battery-powered transportation is powered by Li-ion batteries. These batteries have flaws. There is a massive strain on the world's cobalt supply for manufacturing these batteries. For instance, according to a study by the Karlsruhe Institute of Technology, shortages and cobalt price hikes may occur as a result of increasing demand for Li-ion battery manufacturing. Amidst this backdrop, the development of solid state batteries as an alternative to Li-ion batteries is gathering pace in the solid state battery market.

The current scenario for the solid state battery involves rapid development in technology and intellectual property. Major semiconductor players across the globe are engaged in developing solid state batteries for the growing electric vehicle market. Many players are intensively committed to developing alternatives to flammable liquid electrolytes present in lithium-ion batteries as the electric vehicle market is slowly realizing its potential.

The market is wide open for breakthroughs in technologies depicting high-rate performances. The current market lacks wholesome products without any compromises on rate performance, great energy density, strong safety, and scalable manufacturing. With such great potential in the market, market players are heavily involved in developing prototypes. For instance, according to an August 2023 report, Honda is on the verge of developing solid state batteries, which would reduce the battery pack weight by around 50%.

Strategic Insights

Solid State Battery Market Driver:

Increasing number of applications other than EVs to Drive Growth of Solid State Battery Market

The solid state batteries have been in the market and used in other commercial applications for a while now. They have been implemented in medical implants such as pacemakers for a long time. Other applications include IC (integrated circuits), high-end electronics and radio frequency identification. Market players are now involved in exploring other applications for the use of solid state batteries. The consumer electronics sector is set for an overhaul with the application of solid state batteries. This would result in greater energy density, faster charging times and enhanced safety. Despite these benefits, obstacles must yet be addressed before solid-state batteries are widely used. The cost of manufacturing the technology is now considerable, and there are problems with durability and performance in hot environments. Solid-state battery technology is being developed by well-known companies like Toyota, Samsung, and Dyson, demonstrating a strong trust in its potential.

Solid State Battery Market Segmental Analysis:

Based on application, the Solid State Battery Market is segmented into electric vehicles, smart cards, medical devices, consumer electronics, and wireless devices. Theoretically, lithium-ion batteries in electric cars might be replaced by solid-state batteries. Among the automakers who have already made investments in this technology are BMW, Ford, Toyota, and Volkswagen. However, mass production of solid-state battery cells is an expensive and immature process, and it is currently only done in laboratories in single copies. In comparison to lithium-ion batteries, solid-state batteries can store 50% more energy and have a far higher thermal stability.

Furthermore, nickel and cobalt, whose supply is constrained and whose prices are rising, are crucial components of lithium-ion batteries. Mitsubishi, Nissan, and Renault have declared a combined €23 billion investment in electric vehicles. By the middle of 2028, the alliance also hopes to establish broad commercial production of all-solid-state batteries (SSB). Toyota, a Japanese company, has been keeping an eye on the solid-state battery market for years and even owns the most patents in this field. The biggest automaker in the world raised the stakes, though, by pledging to invest more than US$13.5 billion by 2030 in the creation of the next generation of solid-state batteries. In 2020, a robust and high-performance all-solid-state battery was unveiled by Samsung. The prototype battery has a lifespan of more than 1,000 charge cycles and can power an EV for up to 800 kilometers on a single charge.

However, solid-state batteries have a chemical flaw that is inherent to them. Lithium dendrites, which are tiny, twig-like lithium particles that develop and can enter the battery, cause short circuits and other problems, causing them to start decaying after a number of charge-discharge cycles.

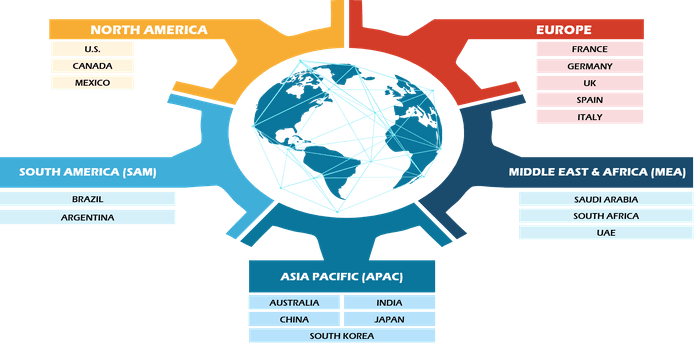

Solid State Battery Market Regional Analysis:

The Asia Pacific Solid State Battery Market was valued at US$ XX million in 2022 and is projected to reach US$ XX million by 2030; it is expected to grow at a CAGR of XX% during the forecast period. Asia Pacific holds one of the largest global Solid State Battery Market shares. Asia-Pacific is the world's largest market for EVs, and Japan, South Korea, and China are the countries leading the way in EV battery innovation. Six Japanese companies are among the top 10 patent holders for the technology, and the country is now dominating the world in solid-state battery development. More recently, Japan calculated that it needs US$24 billion in public and private investment to increase its capacity for battery production. By 2030, Japan's Ministry of Economy, Trade, and Industry hopes to secure 30,000 educated people for supply chains and battery manufacturing. In terms of solid-state battery development, a number of Asian businesses now hold the top rank. A Nikkei survey from earlier in July revealed that Toyota, a Japanese automaker, was in the lead globally in terms of solid-state battery patent filings with more than 1,331 patents. Between 2016 and 2020, the corporation grew its patent ownership by 40%. Since the 1990s, the automaker has researched solid-state batteries. It recently developed a functional prototype car, and by 2025, it hopes to introduce a commercially produced car using the new technology.

The second-largest holder of solid-state battery patents is Panasonic of Japan. A JV between Toyota and Panasonic has also been established to study and create the upcoming battery technology. Panasonic collaborates with a number of other businesses, including Tesla, Imec in Belgium, and a few more. Idemitsu Kosan, a petroleum refiner with 272 solid-state battery patents, is another Japanese business that is pioneering in the EV battery market. A crucial component of the new battery technology, solid electrolytes, are being developed by the company. To create battery materials, Idemitsu Kosan collaborates with Umicore, a company specializing in circular material technology based in Belgium.

Samsung SDI and LG Chem are in charge of the research and development of the new battery technology in South Korea. In contrast to its earlier objective of 2027, Samsung SDI is working to start producing solid-state batteries as early as 2023. The business has not disclosed its strategies for achieving this challenging goal or whether it has made any significant progress toward beginning commercial production.

Solid State Battery Market Key Player Analysis:

Solid State Battery Market Key Player Analysis:

The Solid State Battery Market analysis consists of the players such as Toyota, LG Chem, Panasonic, Hyundai Motor Company, Varta AG, Bosch, NGK Insulators, ZAF Energy Systems, and NEC Energy Solutions, which are among the key Solid State Battery Market players profiled in the report.

Solid State Battery Market Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Solid State Battery Market. A few market developments are listed below:

- In July 2023, Toyota revealed plans to create an electric vehicle (EV) solid-state battery with a range of 745 miles and a charge time of 10 minutes. Since the battery will give EVs the same driving range as conventional vehicles, many charging stops on lengthy journeys won't be necessary. Toyota has supported hydrogen-powered vehicles, but this advancement in EV batteries points to a change in the company's strategy for the post-ICE era.

- In 2020, a robust and high-performance all-solid-state battery was unveiled by Samsung. The prototype battery has a lifespan of more than 1,000 charge cycles and can power an EV for up to 800 kilometers on a single charge.

- In September 2023, Panasonic Holdings announced plans to begin selling all-solid-state batteries for tiny drones and industrial robots by 2029, while businesses like Toyota Motor are racing to create a safer lithium-ion battery substitute for electric automobiles.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies

1. BRIGHTVOLT INC.

2. CYMBET CORPORATION

3. Excellatron Solid State, LLC

4. Planar Energy Devices, Inc.

5. Polyplus Battery Companies

6. QUANTUMSCAPE CORPORATION

7. Robert Bosch GmbH

8. Solid Power

9. PROLOGIUM TECHNOLOGY

10. STMICROELECTRONICS N.V.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Solid State Battery Market

Apr 2024

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Apr 2024

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Apr 2024

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Apr 2024

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Apr 2024

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Apr 2024

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Apr 2024

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Apr 2024

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)