Rising Cases of Tooth Loss Contribute to Dental Implants Market Growth

According to our latest market research study, titled “Dental Implants Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Product, Material, and End User,” the market is expected to reach US$ 8,075.98 million by 2028 from US$ 4,824.96 million in 2021. It is estimated to grow at a CAGR of 7.6% from 2021 to 2028. The report highlights the trends prevailing in the dental implants market, and market drivers and deterrents. Rising cases of tooth loss, elevating demand for cosmetic dentistry, and technological developments in dental implants are driving the dental implants market. However, the lack of standardization of reimbursement policies, and the high costs of dental implants and bridges are hampering the market growth.

Based on product, the global dental implants market is segmented into dental bridges, dental crowns, dentures, abutments, and others. In 2020, the dental bridges segment held the largest share of the market. Moreover, the market for the dentures segment is expected to grow at the highest CAGR during 2021–2028. The dentures help improve the appearance of a smile and keep the structure of the mouth intact by supporting the structures around the cheeks and lips. Dental Implants are dental surgical devices positioned between the jaws for supporting dental prosthesis. These implants or frames are surgically placed below the gums into the jawbone. Various devices used as dental implants are categorized as plate-form dental implants and root-form dental implants. These implants are made of zirconium and titanium. Bridges and dentures are used to support the implanted artificial teeth and avoid slip or shift of teeth in the mouth during speaking and eating.

Before COVID-19 pandemic, dental treatment has been on the rise worldwide for several years. The pandemic substantially impacted the number of dental surgeries worldwide due to the discontinuation of practices. Based on the ADA Health Policy Institute’s analyses of new data collected by numerous federal agencies, dental expenditures in the US fell by 1.8%, to drop down to US$ 142.4 billion in 2020 from US$ 145 billion in 2019. According to a Health Policy Institute review of data from the Centers for Medicare and Medicaid Services, the Bureau of Economic Analysis, and the Census Bureau, per capita, dental spending declined from US$ 442 in 2019 to US$ 430 in 2020. As the oral treatment procedures involve direct contact with patients’ oral fluids, the risk of infection spread between the dental staff and the patients is high. Thus, disruptions in dental care services in 2020 restrained the dental implants market growth. After end of the first lockdown, dentists progressively returned to pre-COVID-19 dental care. However, according to the dental surgeons’ union, new hygiene and asepsis measures hampered the performances of clinics by ~40%, as they attended only 7–10 patients per day compared to the pre-COVID capability of 15–20 patients per day on an average. As per the French Union for Oral and Dental Health 2020, of 3,396 dental practice professionals (1,725 dentists and 1,671 assistants), only 2% of dental practice professionals were unable to return to work. Thus, the pandemic impacted the dental implants in 2020, but with the mitigation of the adversities with time, now the oral health treatment service providers are back to normal.

A few prominent players operating in the dental implants market are Danaher; Zimmer Biomet; Institut Straumann AG; Adin Dental Implant Systems Ltd; Dentium USA; DENTSPLY SIRONA Inc.; DIO.; Osstem UK; Bicon, LLC; and AVINENT Science and Technology.

Companies are launching new and innovative products and services to sustain their positions in the dental implants market. For instance, in January 2021, with the introduction of the Xeal and TiUltra surfaces in the US, Nobel Biocare invited dental practitioners to join the Mucointegration era. These novel surfaces are used on implants and abutments to improve tissue integration at every level. New Xeal abutments feature next-generation surface chemistry designed to promote soft-tissue attachment and The TiUltra surface promotes early osseointegration.

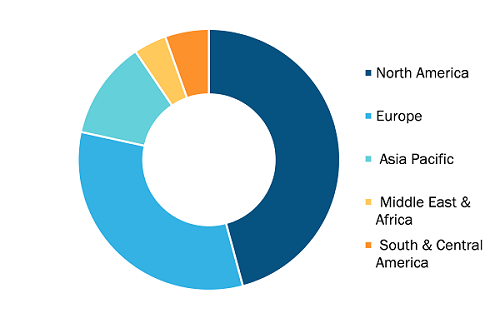

Dental Implants Market, by Region, 2021 (%)

Dental Implants Market Growth - Global Size, Share by 2028

Download Free Sample

Global Dental Implants Market Size, Share, and COVID-19 Impact Analysis – by Product (Dental Bridges, Dental Crowns, Dentures, Abutments, and Others), Material (Titanium Implants, Zirconium Implants, and Others), End-User (Hospitals & Clinics, Dental Laboratories, and Others), and Regional Forecast (2021–2028)

Dental Implants Market Growth - Global Size, Share by 2028

Download Free SampleGlobal Dental Implants Market Size, Share, and COVID-19 Impact Analysis – by Product (Dental Bridges, Dental Crowns, Dentures, Abutments, and Others), Material (Titanium Implants, Zirconium Implants, and Others), End-User (Hospitals & Clinics, Dental Laboratories, and Others), and Regional Forecast (2021–2028)

The report segments the dental implants market as follows:

The dental implants market is analyzed on the basis of product, material, end user, and geography. Based on product, the market is segmented into dental bridges, dental crowns, dentures, abutments, and others. The dental implants market, based on material, is categorized into titanium implants, zirconium implants, and others. Based on end user, the market is segmented into hospital & clinics, dental laboratories, and others.

In terms of geography, the dental implants market is segmented into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia Pacific), the Middle East & Africa (UAE, Saudi Arabia, Africa, and Rest of Middle East & Africa), and South and Central America (Brazil, Argentina, and Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com