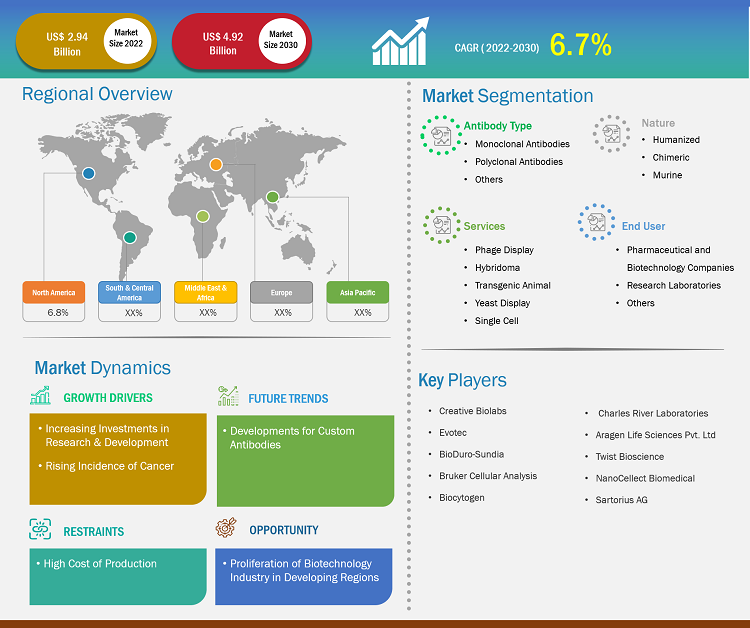

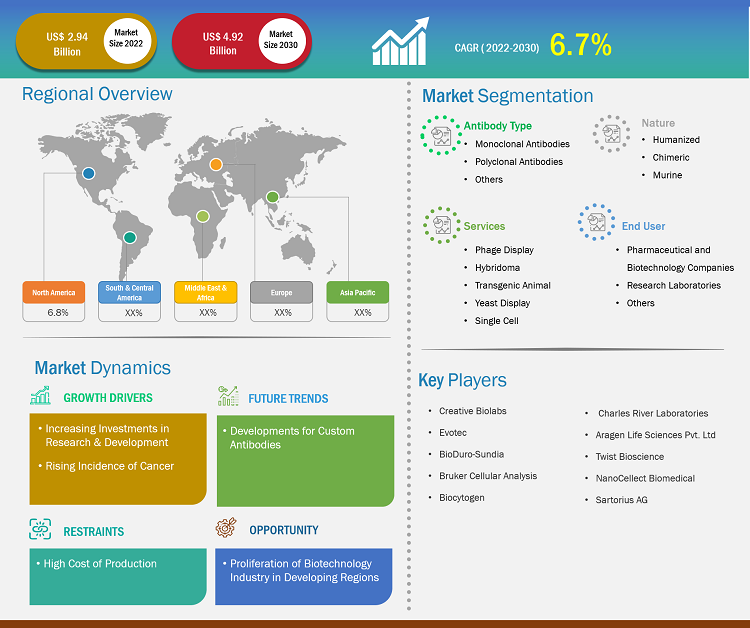

The antibody discovery market size is projected to surge from US$ 2.94 billion in 2022 to US$ 4.92 billion by 2030; the market is estimated to grow at a CAGR of 6.7% during 2022–2030.

Analyst Perspective:

The report includes growth prospects owing to the current antibody discovery market trends and their foreseeable impact during the forecast period. Factors such as the increasing prevalence of chronic diseases worldwide and rising demand for personalized medicine fuel the growth of the antibody drug discovery market. The geriatric population is at high risk of chronic diseases such as cancer, autoimmune diseases, and infectious diseases, which reflects a need for biologics and drugs for treatment.

In addition, there is an increasing focus on developing safer antibodies. For example, Humira is a humanized antibody that is less likely to cause side effects than traditional mouse antibodies. Such safer antibodies are expected to become more common with the growing emphasis on drug safety. However, the antibody discovery market growth is limited by stringent regulatory policies and the surging demand for alternative drugs such as gene therapy and small molecule drugs. Additionally, technological advancements such as phage display, high-throughput screening, and bioinformatics are facilitating the discovery and development of new antibodies. This results in a more efficient and cost-effective drug development process and creates lucrative growth opportunities for the market.

Market Overview:

The expansion of biopharmaceutical industry, which is highly focused on biologics, results in a higher demand for antibody research services than before. Increased collaborations between industry players and academic institutions facilitate resource sharing and accelerated antibody discovery. The shift toward patient-centered drug development, emphasizing personalized medicine and patient preferences, boosts the antibody discovery market.

Continued technological advancements such as high-throughput screening, phage display, and next-generation sequencing have resulted in improved efficiency and speed of antibody discovery processes. Increased funding for research and development activities from government organizations and private companies also spurs antibody discovery initiatives. Monoclonal antibodies are gaining popularity in therapeutic applications due to their specificity and effectiveness in targeting specific antigens, resulting in increased demand for antibody research services. Therefore, the growing demand for antibody-based therapies and the preference for outsourcing are likely to have a significant impact on the antibody discovery marketforecast in the next few years.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Antibody Discovery Market: Strategic Insights

Market Size Value in US$ 2.94 billion in 2022 Market Size Value by US$ 4.92 billion by 2030 Growth rate CAGR of 6.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Antibody Discovery Market: Strategic Insights

| Market Size Value in | US$ 2.94 billion in 2022 |

| Market Size Value by | US$ 4.92 billion by 2030 |

| Growth rate | CAGR of 6.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Increasing Investments in Research & Development Propel Market Growth

Antibodies, including monoclonal and polyclonal, find applications in academic, research, and pharmaceutical institutes and organizations, wherein they are used in several R&D activities related to drug and biomarker development, and other therapeutic and clinical diagnostics product development. Small and medium-sized companies focus on raising their R&D investments every year. In April 2020, the US federal government assigned US$ 3.5 billion to the Biomedical Advanced Research and Development Authority (BARDA) under its Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide financial support for the manufacturing, production, and procurement of vaccines, diagnostics, therapeutics, and small molecule active pharmaceutical ingredients (APIs), among others. For example, in September 2022, Abzena (a leader in biologics and antibody-drug conjugates) announced intentions to expand its research and development capabilities in Cambridge to aid in rapid antibody discovery. Further, Bio-Rad, a pharmaceutical company, provides 10,000 antibodies, along with antigens, reagents, and buffers, to develop in vitro diagnostic tests. Therefore, the increasing investments by pharmaceutical companies in research and development activities related to antibody discovery to develop better treatment options for various diseases propels the antibody discovery market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

The antibody discovery market analysis has been carried out by considering the following segments: antibody type, nature, services, and end user.

Based on antibody type, the antibody discovery market is segmented into monoclonal antibodies, polyclonal antibodies, and others. The monoclonal antibodies segment held the largest market share in 2022. Moreover, the same segment is anticipated to register the highest CAGR of 6.9% during 2022–2030. Monoclonal antibodies (mAbs) are designed to interact specifically with diseased cells without harming healthy cells. Cancer therapy is one of the significant application areas wherein monoclonal antibodies are used. These are widely accepted biologics and are expected to present a billion-dollar opportunity to pharmaceutical manufacturers during the forecast period. Moreover, patients and physicians are becoming increasingly aware of mAb therapy applications. As a result, the approval of blockbuster mAbs as effective treatments of various indications is expected to favor the antibody discovery market during the forecast period. Drugs such as Avastin, Herceptin, Remicade, and Rituxan have been approved by the FDA for treating cancer, rheumatoid arthritis, Crohn's disease, ulcerative colitis, etc.

The market, based on nature, is segmented into human and humanized, chimeric, and murine. The human and humanized segment held the largest antibody discovery market share in 2022, and the same segment is anticipated to register a higher CAGR during the forecast period. Human and humanized antibodies are engineered genetically by grafting complementarity-determining regions (CDRs) from a non-human antibody with the desired antigen binding specificity into the corresponding CDRs of another antibody, which is more prominently derived from humans. These antibodies are gaining significant acceptance and popularity owing to their higher specificity and stability, and lesser costs. Additionally, human and humanized antibodies have exhibited attractive clinical efficacy in clinical studies.

The antibody discovery market, based on service, is divided into phage display, hybridoma, transgenic animal, yeast display, and single cell. The phage display segment dominated the market share in 2022, and the same segment is anticipated to register the highest CAGR of 7.3% during the forecast period. The phage display technique is used for in vitro antibody selection. Viruses that infect bacteria are mainly used as gene vectors for the expression of antibody fragments (proteins), which are typically single-chain variable fragments (scFv) or Fab fragments present on the virus. The expressed antibody fragments can then be examined for binding to a specific target of interest. Speed, simplicity, and cost-effectiveness associated with the process of identification of binders are among the major advantages of phage display technology.

Based on end user, the antibody discovery market is divided into pharmaceutical and biotechnology companies, research laboratories, and others. The pharmaceutical and biotechnology companies segment held the largest antibody discovery market share in 2022, and the same segment is anticipated to register a higher CAGR of 7.2% during 2022–2030. Pharmaceutical and biotechnology companies account for a significant part of the antibody discovery process because of their capabilities to identify antibodies for any specific disease and produce them on commercial scales. The elevating demand for high-specificity antibodies for drug discovery and development; growing research in the areas of proteomics and genomics; increasing need for antibodies for identifying new targets and assays; and rising R&D activities in several therapeutic areas such as cancer, HIV/AIDS, immunodeficiency diseases, and blood disorders are the critical factors driving the demand for antibody discovery products, solutions, and services in pharmaceutical and biotechnology companies.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

The scope of the antibody discovery market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 1.29 billion in 2022 and is projected to reach US$ 2.20 billion by 2030; it is expected to register a CAGR of 6.8% during 2022–2030. The North American market is segmented into the US, Canada, and Mexico. Market growth in the region is determined by an increase in the prevalence of cancer, the strong presence of the antibody research industry, and technological advancements in the R&D sector.

According to the American Cancer Society, ~1.8 million new cancer cases were diagnosed and ~606,520 deaths related to cancer were recorded in the US in 2020. This bolsters the need for therapeutic antibodies, thereby fueling the market growth. Asia Pacific is expected to register the highest CAGR during 2022–2030. The Asia Pacific antibody discovery market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. China held the largest market share in 2022, and India is expected to show a significant growth rate in the market. The biopharmaceutical industry in China is undergoing a tremendous shift, evolving from a generics-focused landscape to a thriving innovation hub. Additionally, progress in industrialization, and the application of novel drugs, high-end medical devices, and techniques contribute to the market growth in China. Further, the growing number of market players focusing on countries in Asia Pacific for their geographic expansion and other growth strategies, the rising count of research centers, and a notable increase in government funding fuel the antibody discovery market in Asia Pacific.

Key Player Analysis:

Creative Biolabs, Evotec, BioDuro-Sundia, Bruker Cellular Analysis, Biocytogen, Charles River Laboratories, Aragen Life Sciences Pvt. Ltd, Twist Bioscience, NanoCellect Biomedical, and Sartorius AG are among the key players profiled in the antibody discovery market report.

Recent Developments:

Companies operating in the antibody discovery market adopt strategic initiatives such as mergers and acquisitions, partnerships, etc. A few of the recent market developments are listed below:

- In January 2024, Biocytogen Pharmaceuticals Co Ltd launched a new sub-brand named RenBiologics to represent the company’s Antibody Discovery business division. RenBiologics business is expected to cover the out-licensing/co-development of the company’s extensive library of fully human antibodies, as well as the licensing of RenMice, a fully human antibody/TCR discovery platform of Biocytogen Pharmaceuticals.

- In December 2023, Biocytogen Pharmaceuticals Co Ltd announced an antibody evaluation, option, and license agreement with Ona Therapeutics to design biopharmaceuticals against advanced cancer types. Under the terms of the agreement, Biocytogen Pharmaceuticals Co Ltd granted Ona access to evaluate its proprietary RenMice-derived fully human antibodies against a specific tumor target, with an option to exclusively license selected antibodies for the development, manufacturing, and commercialization of antibody-drug conjugates (ADCs) in mutually agreed indications and territories.

- In June 2022, Evotec SE announced a collaboration with Janssen Pharmaceutica NV, one of the companies of Johnson & Johnson for drug discovery. Under the collaboration, Evotec SE is meant to evaluate its TargetAlloMod platforms for the discovery of first-in-class therapeutic candidates with novel modes of action and Janssen Pharmaceutica NV will facilitate the same.

- In August 2021, Sartorius AG entered into a partnership with McMaster University to improve the manufacturing processes of antibodies and other virus-based treatments for diseases such as COVID-19, cancer, and genetic disorders. This partnership with McMaster University led to impactful research that made important treatments available at a greater scale.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Antibody Type, Nature, Service, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Antibody discovery, a nuanced endeavor, refers to the complicated process of discovering novel antibodies. This endeavor involves the search for antibodies that recognize and bind to specific targets, with applications extending to diagnostics and therapy. Antibody discovery methods such as phage display and hybridoma technology are widely used. Their use is essential to the search for antibodies that recognize and bind to specific targets, paving the way for applications in diagnostics and therapeutic interventions. The resulting outcome of this process plays a crucial role in developing novel drugs, vaccines, diagnostics, and various therapeutic modalities. By enabling researchers to produce antibodies tailored to recognize and target precise antigens, the scale of antibody discovery is of paramount importance.

Key factors that are driving the antibody discovery market are the increasing investments in research & development and the rising incidence of cancer.

The CAGR value of the antibody discovery market during the forecasted period of 2022-2030 is 6.7%.

The monoclonal antibodies segment held the largest share of the market in the global antibody discovery market and held the largest market share of 82.6% in 2022.

The phage display segment dominated the global antibody discovery market and held the largest market share of 35.8% in 2022.

The molecular spectroscopy market majorly consists of the players such Creative Biolabs, Evotec, BioDuro-Sundia, Bruker Cellular Analysis, Biocytogen, Charles River Laboratories, Aragen Life Sciences Pvt. Ltd, Twist Bioscience, NanoCellect Biomedical, and Sartorius AG.

Charles River Laboratories and Evotec are the top two companies that hold huge market shares in the antibody discovery market.

Global antibody discovery market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North America regional market is expected to grow with a CAGR of 6.8% during 2022–2030. Market growth in this region is attributed to the increasing prevalence of cancer, the strong presence of the antibody research industry, and technological advancements in the R&D sector help in the market expansion. An upsurge in funding further enables the development of new technologies, pooling of resources and expertise across countries and organizations, and conducting research work into existing antibody treatments. This has led to a better understanding of the immune system, and the development of effective and targeted antibodies. Additionally, the increased funding allows scientists to conduct large-scale clinical trials that are mandatory to evaluate the effectiveness of a particular antibody. The Asia Pacific molecular spectroscopy market is expected to grow at the highest CAGR of 7.3% during 2022–2030. China is predicted to hold the largest share of the market in 2022, and India is expected to show a significant growth rate in the market. China is predicted to hold the largest market share in 2022, and India is expected to show a significant growth rate in the market. The biopharmaceutical industry in China is undergoing a tremendous shift, evolving from a generics-focused landscape to a thriving innovation hub. Additionally, progress in industrialization, and the application of novel drugs, high-end medical devices, and techniques contribute to the antibody discovery market growth in China. Further, the growing number of market players focusing on countries in Asia Pacific for their geographic expansion and other growth strategies, the rising count of research centers, and a notable increase in government funding fuel the antibody discovery market growth in Asia Pacific.

The List of Companies - Antibody Discovery Market

- Creative Biolabs

- Evotec

- BioDuro-Sundia

- Bruker Cellular Analysis

- Biocytogen

- Charles River Laboratories

- Aragen Life Sciences Pvt. Ltd

- Twist Bioscience

- NanoCellect Biomedical

- Sartorius AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Antibody Discovery Market

Feb 2024

Bioprocessing Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Instruments, and Consumables and Accessories), Scale of Operation (Commercial Operations and Clinical Operations), Process (Downstream Bioprocess and Upstream Bioprocess), Application (Monoclonal Antibodies, Vaccines, Recombinant Protein, Cell and Gene Therapy, and Others), End User (Biopharmaceutical Companies, Contract Manufacturing Organization, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Feb 2024

Bioproduction Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product (Biologics and Biosimilars, Vaccines, Cell and Gene Therapies, Nucleic Acid Therapeutics, and Others), Application (Rheumatoid Arthritis, Hematological Disorders, Cancer, Diabetes, Cardiovascular Diseases, and Others), Equipment (Upstream Equipment, Downstream Equipment, Bioreactors, and Consumables and Accessories), End User (Biopharmaceutical Companies, Contract Manufacturing Organizations, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Feb 2024

ELISA Diagnostic Test Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Adoption (Human and Veterinary), Test Type (Sandwich ELISA, Indirect ELISA, Competitive ELISA, and Multiple & Portable ELISA), Application (Autoimmune Diseases, Infectious Diseases, Cancer Diagnosis, Protein Quantification, and Others), End User (Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, Veterinary Hospitals & Diagnostic Laboratories, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Feb 2024

Swine Diagnostics Market

Size and Forecasts (2022 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type [Immunoassays Kits, PCR Kits, Hemagglutination Inhibition (HI), and Others], Sample Type (Blood, Oral Fluids, Nasal Swabs, Tissue Samples, and Others), Disease [African Swine Fever (ASF)/Classical Swine Fever (CSF), Respiratory Diseases, Porcine Circovirus, Porcine Epidemic Diarrhea, Swine Dysentery, and Others], End User (Veterinary Hospitals, Veterinary Clinics, and Other End Users), and Geography

Feb 2024

Microbial Identification Methods Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Method (Genotypic, Phenotypic, and Proteotypic), Type (Bacterial Identification System, Microbial Enumeration System, Bacterial Resistance Identification Systems, Microbiology Analyzer, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America)

Feb 2024

Biopharmaceuticals Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Monoclonal Antibodies, Recombinant Vaccines, Conventional Vaccines, Recombinant Growth Factors, Purified Proteins, Recombinant Proteins, Recombinant Hormones, Recombinant Enzymes, Cell & Gene Therapies, Cytokines/Interferon/Interleukins, and Others) and Application (Oncology, Inflammatory & Infectious Disease, Autoimmune Disorders, Metabolic Disorders, Hormonal Disorders & Growth Failure, Cardiovascular Diseases, Neurological Diseases, and Others)

Feb 2024

GMP Cell Therapy Consumables Market

Forecast to 2028 - COVID-19 Impact and Global Analysis by Product (Kits, Reagents/Molecular Biology Reagents, Growth Factors/Cytokines and Interleukins, and Others), Cell Therapy (NK Cell Therapy, Stem Cell Therapy, T-Cell Therapy, and Others), Process (Cell Collection and Characterization/Sorting and Separation, Cell Culture and Expansion/Preparation, Cryopreservation, Cell Processing and Formulation, Cell Isolation and Activation, Cell Distribution/Handling, Process Monitoring and Control/Readministration/Quality Assurance, and Others), and End Use (Clinical, Commercial, and Research)

Feb 2024