The drone simulator market is expected to grow from US$ 615.66 million in 2021 to US$ 1,435.14 million by 2028; it is estimated to grow at a CAGR of 12.9% during 2021–2028.

Since more than a decade, armed forces from several countries have been using drones. Ground troops are employing small drones regularly. Military spending on unmanned aerial vehicles (UAVs) is rising as a fraction of overall military spending, which is propelling the growth of specialist drone manufacturers and simulator software developers. For instance, the preliminary examination of the Department of Defense's budget request for 2019 revealed that US$ 9.39 billion was invested in drone procurements, research and development initiatives, and manufacturing in United States. The amount is increased by 26% from the amount invested in 2018. In 2019, orders for at least 3,447 new unmanned air, ground, and marine systems were placed, representing a threefold increase over orders placed in 2018. Military drones are already in use in about 95 nations across the world. Several drones are being developed specifically for surveillance purposes. Some drones, on the other hand, have been developed for vital missions, such as transporting weapons. Countries such as China, India, Germany, and Azerbaijan utilize remotely controlled unmanned aerial vehicles (UAVs) to carry weapons for defense forces. Furthermore, drones are employed as loitering weapons. Drones are also employed in real-time to collect data on ongoing and life-threatening military missions using their intelligence, surveillance, and reconnaissance (ISR) capabilities. Hence, the demand for drone simulators is increasing as a result of the factors listed above.

Impact of COVID-19 Pandemic on North America Drone Simulator Market

North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any factor affecting the performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, which has led governments to impose several limitations on industrial, commercial, and public activities in the country to control the spread of infection. Therefore, drone manufacturers and drone MRO service providers are witnessing significant loss during the pandemic. The drone manufacturers’ production volume decreased drastically, thereby hindering the adoption rate of different simulation solutions. However, the governments of the US and Canada have maintained their defense spending levels. For instance, the defense spending in the US reached US$ 778 billion in 2020, with a yearly increase on 4.4%. This has led several drone manufacturers, UGV manufacturers, and weapon and combat system manufacturers to expedite the procurement rate of simulation systems. As a result, the COVID-19 pandemic and its consequences have had a nominal impact on the drone simulator market in North America.

Lucrative Regions for Drone Simulator Providers

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Drone Simulator Market Insights

Increasing Investments in Research and Development for Military Simulation

Governments across the world are cutting military spending due to the dwindling financial resources owing to the COVID-19 outbreak. Many nations' military ministries are cutting training expenditures and downscaling their forces. As a result, the military's attention has shifted toward finding less expensive and more effective solutions to their needs. Real-time training is time-consuming and costly. Also, it necessitates a huge quantity of raw resources, such as gasoline and explosives, and consists of a high level of danger. Therefore, military ministries are increasingly preferring virtual training and simulation-based games that use technologies, such as big data, AI, and cloud computing. Military simulation and virtual training are becoming increasingly popular among military forces across the world because they are based on commercial-off-the-shelf (COTS) components, and they help minimize training expenses. The simulators are made at a minimal cost of development. The criteria are critical for the military to innovate massively in simulation-based training technology. Drone simulations are currently being used to train future soldiers and represent a real-time scenario using realistic digital settings. Hence, increased expenditures in simulation software drive the growth of the drone simulator market. In addition, several nations' defense ministries are restructuring and changing their militaries using new solutions, which is also bolstering the market growth.

Component-Based Market Insights

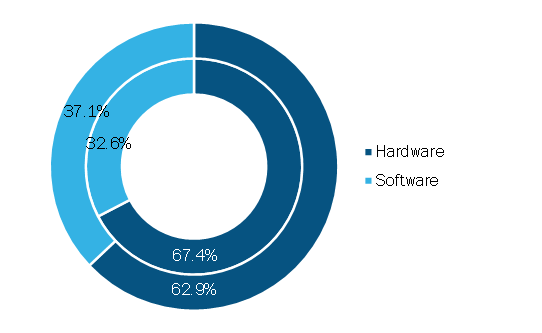

Based on component, the drone simulator market is bifurcated into hardware and software. In 2020, the hardware segment led the market, accounting for a larger market share.

Drone Simulator Market, by Component, 2020 and 2028 (%)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Simulator Type-Based Market Insights

Based on simulator type, the drone simulator market is segmented into fixed and portable. In 2020, the fixed segment accounted for a larger market share.

Drone Type-Based Market Insights

Based on drone type, the drone simulator market is segmented into fixed wing and rotary wing. In 2020, the fixed wing segment accounted for a larger market share.

Technology-Based Market Insights

Based on technology, the drone simulator market is segmented into augmented reality and virtual reality. In 2020, the virtual reality segment accounted for a larger market share.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Drone Simulator Market: Strategic Insights

Market Size Value in US$ 615.66 Million in 2021 Market Size Value by US$ 1,435.14 Million by 2028 Growth rate CAGR of 12.9% from 2021-2028 Forecast Period 2021-2028 Base Year 2021

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Drone Simulator Market: Strategic Insights

| Market Size Value in | US$ 615.66 Million in 2021 |

| Market Size Value by | US$ 1,435.14 Million by 2028 |

| Growth rate | CAGR of 12.9% from 2021-2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

The players operating in the drone simulator market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In March 2021, CAE announced that it has reached a formal agreement with L3Harris Technologies to buy L3Harris' Military Training business for US$ 1.05 billion (the "Acquisition"), subject to normal adjustments. The acquisition value is about 13.5 times the L3Harris Military Training business's estimated adjusted 2020 EBITDA, or about 10 times when cost synergies are factored in, which are expected to reach a range of C$35 to C$45 million (approximately US$ 28 to US$ 35 million) annually by the end of the second year following acquisition's closing.

- In March 2020, General Atomics Aeronautical Systems, Inc. (GA-ASI) installed a new Predator Mission Trainer (PMT) at its Flight Test and Training Center (FTTC) in Grand Forks, North Dakota. The aircraft flight simulator, produced by CAE, will be used to train the operators of MQ-9 Block 5 Remotely Piloted Aircraft (RPA). At the FTTC, GA-ASI offers a variety of pilot and sensor operator training for operators of GA-RPA ASI's systems. The new PMT adds to the FTTC's existing training capabilities, which includes a Block 1 simulator and Ground Control Systems (GCS).

The global drone simulator market has been segmented as mentioned below:

By Component

- Solution

- Services

By Simulator Type

- Fixed

- Portable

By Drone Type

- Fixed Wing

- Rotary Wing

By Technology

- Augmented Reality

- Virtual Reality

By Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Rest of SAM

Company Profiles

- L3Harris Technologies, Inc.

- General Atomics

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- HAVELSAN A.S.

- CAE Inc.

- SIMLAT UAS SIMULATION

- SINGAPORE TECHNOLOGIES ELECTRONICS LIMITED

- BLUEHALO

- Quantum3D

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , Simulator Type , Drone Type , and Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Growing Adoption of Drones in Military and Commercial Applications.

Increasing Investments in Research and Development for Military Simulation.

Defense spending across the world increased by 3.9% per year and was valued at US$1.83 trillion in 2020. Despite severe economic contractions caused by the COVID-19 pandemic and the series of lockdowns across many countries globally, worldwide expenditure on military and defense climbed dramatically from an average of 1.85% in 2019 to 2.08% in 2020 as military budgets were maintained. The growth of global defense spending has accelerated since 2018, but it is anticipated to decline in 2021 as the US defense budget is expected to flatten, and Asia-Pacific expenditure growth is slow. The US and China have raised their defense budgets, accounting for almost two-thirds of the entire increase in global spending in 2020. Furthermore, organizations are creating networks to encourage the use of drones, resulting in the growth of the drone simulator industry.

Based on component, the drone simulator market is bifurcated into software and hardware. The global drone simulator market is dominated by hardware segment in 2020, which accounted for 67.4%.

Several businesses and start-ups are currently studying and developing unmanned aerial vehicles (UAVs) with autonomous tools driven by artificial intelligence (AI) and machine learning (ML). The AI-powered simulators show the user how to deploy and control the drone in the field by plotting its expected flight path. For instance, Lockheed Martin, an aerospace and defense juggernaut, provides the ‘Desert Hawk III’ with a simulation system, as the drone intended for field usage can be piloted by a single operator. Before takeoff, the simulation system can control the drone's predicted timing, and any issues that arise during the flight may also be handled using the system. Similarly, AeroVironment, a US-based defense firm, offers a revolutionary line of military drones known as the Raven series that can fly independently along a path utilizing GPS coordination and computer vision.

The major players profiled in the market study of drone simulator market include Aegis Technologies; CAE Inc; General Atomics ; Havelsan AS; Israel Aerospace Industries Ltd; L3 Link Training & Simulation; Leonardo SpA; Sikan Nutzfahrzeuge GmbH; Simlat Uas Simulation; Singapore Technologies Electronics Limited and Zen Technologies Limited among others.

North America held the significant market share in year 2020, along with the notable revenue generation opportunities in Europe and APAC.

The List of Companies - Drone Simulator Market

- Aegis Technologies

- CAE Inc

- General Atomics

- Havelsan AS

- Israel Aerospace Industries Ltd

- L3 Link Training & Simulation

- Leonardo SpA

- Simlat Uas Simulation

- Singapore Technologies Electronics Limited

- Quantum3D

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Drone Simulator Market

Aug 2021

Aug 2021

Advanced Air Mobility Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software), Operation Mode (Piloted, Autonomous), Propulsion Type (Fully Electric, Hybrid), End Use (Passenger, Cargo)

Aug 2021

Airport Fueling Equipment Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5,000 Liters; 5,000–20,000 Liters; and Above 20,000 Liters), Aircraft Type (Civil Aircraft and Military Aircraft), and Power Source (Electric and Non-Electric)

Aug 2021

Satellite Optical Ground Station Market

Forecast to 2028 - Global Analysis by Operation (Laser Satcom and Optical Operations), Equipment (Consumer Equipment and Network Equipment), Application (Laser Operations, Debris Identification, Earth Observation, and Space Situational Awareness), and End User (Government and Military and Commercial Enterprises)

Aug 2021

Electro-Optics in Naval Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Technology (Camera, Sensor, and Laser Range Finder), Application (Target Detection, Identification, and Tracking; Surveillance; Fire Control; and Others), and End Use (Defense and Commercial)

Aug 2021

Commercial Air Traffic Management Market

Forecast to 2030 - COVID-19 Impact and Global Analysis By Type (Air Traffic Services, Air Traffic Flow Management, and Airspace Management), Component (Hardware and Software), Application (Communication, Navigation, Surveillance, Traffic Control, and Others), and Airport Class (Class I, Class II, Class III, and Class IV)