The EV test equipment market is expected to grow from US$ 35,072.54 million in 2021 to US$ 118,671.47 million by 2028; it is estimated to grow at a CAGR of 20.0% from 2022 to 2028.

EV test equipment is used to inspect various EV components such as batteries, motors, and other components to keep automotive parts ahead of the competition, provide guaranteed performance, and ensure customer safety and satisfaction. The test equipment is used in electric vehicles to assess the total vehicle performance, EV battery and charger testing, power electronics testing, and motor and dynamometer testing. Motor testing equipment is used to verify torque or electric signal and the high speed of an electric car, using sensors, voltage probes, and other software.

Electric car sales have been boosted by increased demand for alternative fuel vehicles and connected mobility. To minimize automotive emissions and pollution, several governments have adopted rules that encourage the use of electric vehicles. The EV test equipment market is predicted to develop due to the rising demand for EVs. Moreover, higher voltages allow for faster charging, resulting in the adoption of high-performance batteries, drivetrains, and chargers. As a result, the demand for EV test equipment and software is driven by technological advancements in new battery technologies, increasing demand for electronic functions and features in a vehicle, and stringent emission rules.

According to EV-Volumes.com, 2020 was an excellent year for PHEVs, with global BEV and PHEV sales reaching 3.2 million units. Europe registered 1.4 million electric vehicles in 2020, up 137% from 2019, even after the emergence of the COVID-19 pandemic. This increase was remarkably large for a market that was down by 20% year over year. Furthermore, Europe outperformed China in the EV market for the first time since 2015. Furthermore, many businesses are resuming public transportation services, requiring the implementation of numerous safety measures and standards.

The emergence of new software solutions, such as cloud-based digital solutions for real-time fleet management and acceleration in electrification, is shaping the global EV test equipment market. For instance, the charging management software offered by EVBox enables users to track, manage, and optimize their EV driving experience. Hence to monitor this, AI integrated efficient testing solutions will be in major demand over the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

EV Test Equipment Market: Strategic Insights

Market Size Value in US$ 35,072.54 million in 2021 Market Size Value by US$ 118,671.47 million by 2028 Growth rate CAGR of 20.0% from 2022 to 2028. Forecast Period 2022-2028 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

EV Test Equipment Market: Strategic Insights

| Market Size Value in | US$ 35,072.54 million in 2021 |

| Market Size Value by | US$ 118,671.47 million by 2028 |

| Growth rate | CAGR of 20.0% from 2022 to 2028. |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Impact of COVID-19 Pandemic on Europe EV Test Equipment Market

The COVID-19 outbreak and the path to recovery have had various impacts on the road networks. There was an increase in the purchase of EV test equipment across Europe in 2020. For instance, Germany, France, and Italy registered 55% higher electric car sales in Europe during the first half of 2020 than in 2019. The growth of the EV test equipment market in Europe is due to the rising need for manufacturers to comply with stricter European Union CO2 standards for new passenger cars and vans from January 2020. Germany–based VDE Institute specializes in science, standardization, product testing, certification, and application consulting. In 2019, The VDE Institute was appointed as a category A, B, and D technical service by the Federal Motor Vehicle Transport Authority, which enables it to perform tests on electric vehicles based on the Highway Traffic Act, the Vehicle Parts Act, and regulations according to the Agreement of the Economic Commission for a United Nations of Europe (ECE regulations). Testing and certification carried out by the VDE Institute ensure trouble-free mobility and data security in the overall system, which includes the charging infrastructure, charging stations, and wall boxes during a product’s early development phase for final approval (validation) tests. The presence of a large EV market, institutions with decades of experience in testing electrical safety, and growing requirements to test the electronic components integrated into the vehicle is propelling the growth of the EV test equipment market in Europe.

Lucrative Regions for EV Test Equipment Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

EV Test Equipment Market Insights

Innovative charging station technologies such as turbo charging, terra HP charging, smart charging systems, wireless power transmission, and bi-directional chargers are being developed by EV charging station firms. Such advancements in electric vehicle charging systems necessitate improved testing techniques. Testing systems for EV charging stations are available from companies including ROLEC, DEKRA, and TUV Rheinland. Smart charging is one of the most advanced charging systems. Smart charging allows for load balancing and proportional distribution of available power capacity across all active charging stations. It also facilitates the collection of critical charging data from various stations using a single cloud-based management platform.

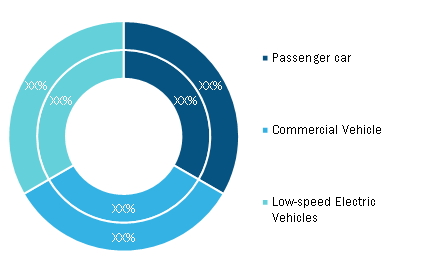

Vehicle Type-Based Market Insights

Based on vehicle type, the EV test equipment market is segmented intopassenger car, commercial vehicle, and low speed electric vehicles. In 2021, the passenger car segment accounted for the largest EV test equipment market share.

EV Test Equipment Market, by Vehicle Type, during 2021–2028 (%)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Equipment Type-Based Market Insights

Based on equipment type, the EV test equipment market is segmented into battery test equipment, motor test equipment, engine dynamometer, chassis dynamometer, transmission dynamometer, fuel injection pump tester, inverter tester, EV drivetrain test, on-board charger, AC/DC EVSE. In 2021, the battery test equipment segment accounted for the largest EV test equipment market share.

Application-Based Market Insights

Based on application, the EV test equipment market is segmented into EV Component and Drivetrain systems, EV charging, and Powertrain. In 2021, the powertrain segment accounted for the largest EV test equipment market share.

End-Users -Based Market Insights

Based on end-users, the EV test equipment market is segmented into OEMs, Tier 1 Suppliers, Research and Academics, Others. In 2021, the tier 1 suppliers segment accounted for the largest EV test equipment market share.

Market players adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the EV test equipment market forecast. A few developments by major players in the EV test equipment market report are listed below:

- NI's Engineering Innovation Centre (EIC) launch in Bangalore was announced in March 2022. The engineering facility will help NI's clients, partners, and startup firms serving the local aerospace and military sector. The EIC will also be utilized to teach the next generation of engineers in the aerospace & military industries about system understanding.

- In 2021, Keysight Technologies, Inc. and Proventia Oy teamed up to develop battery test solutions for electric vehicles (EVs). The partnership between Keysight and Proventia results in a location-independent, safe test facility that can be implemented quickly.

Company Profiles

- National Instruments Corporation

- Horiba Ltd

- Arbin Instruments

- Maccor Inc

- KEYSIGHT TECHNOLOGIES, INC

- Froude, Inc

- Dynomerk Controls

- Comemso electronics GmbH

- Durr Group

- TÜV RHEINLAND

- INTERTEK GROUP PLC

- TOYO SYSTEM CO., LTD

- WONIK PNE CO., LTD

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type, Equipment Type, Application, and End-Users

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Surge in global production and sales of EVs and support from governments are driving the growth of the EV test equipment market.

The market opportunity lies in developing countries. Developing countries have become a hub of opportunity for various markets, including the EV test equipment market. Further, integration of new technologies is presenting significant potential for the future growth of the EV test equipment market players.

Based on vehicle type, the EV test equipment market is segmented into passenger car, commercial vehicle, and low speed electric vehicles. In 2021, the passenger car segment led the EV test equipment market, accounting for the largest share in the market.

In 2021, APAC led the market with a substantial revenue share, followed by Europe and North America. APAC is a prospective market for EV test equipment manufacturers.

The major five companies in the EV test equipment market include National Instruments Corporation; KUKA AG; KEYSIGHT TECHNOLOGIES, INC.; teamtechnik Group; and TOYO SYSTEM CO., LTD.

Based on application, the EV test equipment market is segmented into EV component and drivetrain system, EV charging, and powertrain. In 2021, the powertrain segment led the EV test equipment market, accounting for the largest share in the market.

- National Instruments Corporation

- Horiba Ltd.

- Arbin Instruments

- Maccor Inc.

- KEYSIGHT TECHNOLOGIES, INC.

- Froude, Inc

- Dynomerk Controls

- Comemso electronics GmbH

- Durr Group

- TÜV RHEINLAND

- INTERTEK GROUP PLC

- TOYO SYSTEM CO., LTD

- WONIK PNE CO., LTD

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to EV Test Equipment Market

May 2022

Connected Vehicle Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Technology (5G, 4G/LTE, 3G & 2G), Connectivity (Integrated, Tethered, Embedded), Application (Telematics, Infotainment, Driving assistance, Others) and Geography

May 2022

Hydrogen Fuel Cell Train Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Technology (Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, and Others), Component (Hydrogen Fuel Cell Pack, Batteries, Electric Traction Motors, and Others), Rail Type (Passenger Rail, Commuter Rail, Light Rail, Trams, Freight, and Others) and Geography

May 2022

Automotive High Voltage Cable Market

Forecast to 2030 - Global Analysis by Vehicle Type [Battery Electric Vehicles (BEV), Plugin Hybrid Electric Vehicles (PHEV), and Plugin Hybrid Vehicles (PHV)], Conductor Type (Copper and Aluminum), and Core Type (Multi Core and Single Core)

May 2022

40-Ft Electric Boat Market

Forecast to 2030 - Global Analysis by Propulsion (Pure Electric, Hybrid, and Sail Electric), Battery Type (Nickel-Based, Lead-Acid, and Lithium-Ion), Application (Fishing, Recreational, and Others), Voltage Architecture (12 V, 24 V, and 48 V), and Boat Type (Trawlers, Catamarans, Yachts, Power Cruisers, and Others)