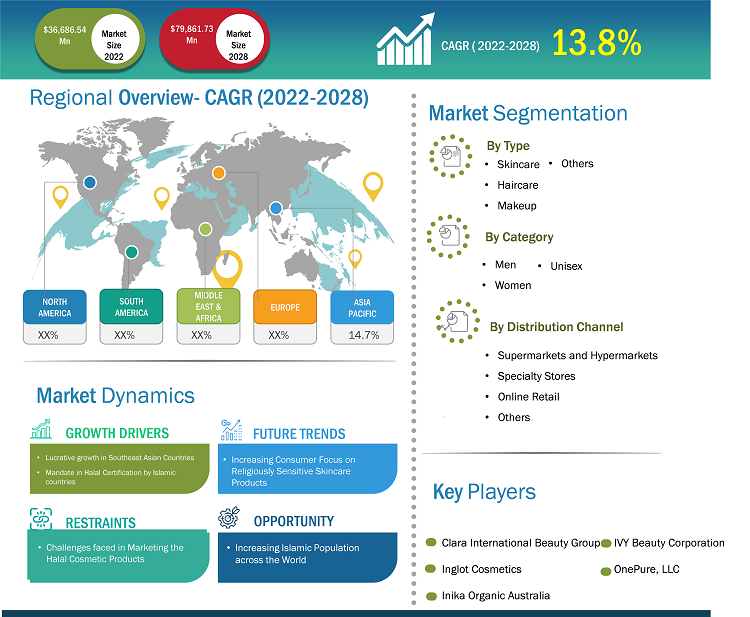

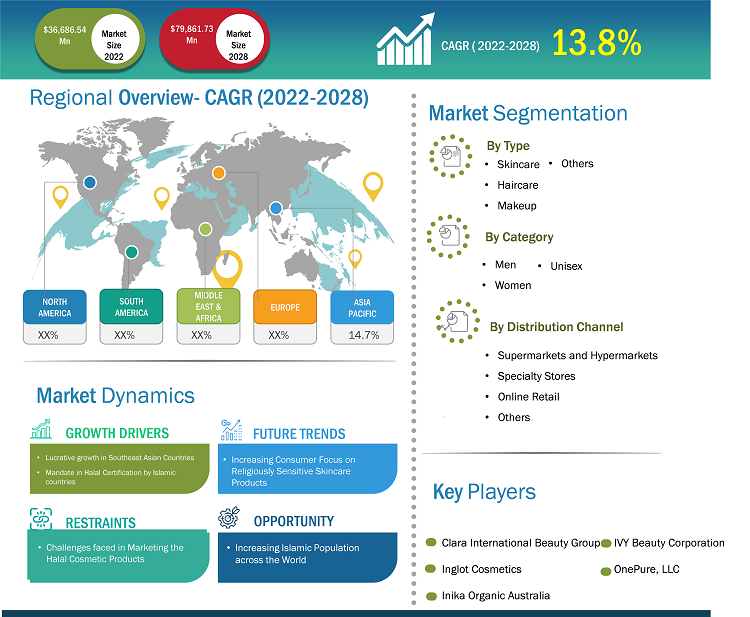

[Research Report] The halal cosmetics market is expected to grow from US$ 36,686.54 million in 2022 to US$ 79,861.73 million by 2028; it is estimated to grow at a CAGR of 13.8% from 2022 to 2028.

Market Insights and Analyst View:

Halal cosmetic products are cosmetic products that adhere to Islamic standards, i.e., cosmetic products free from pig-derived and other forbidden ingredients. Halal cosmetic products are also wudu–friendly (permeable to water), as required by Islamic standards. The halal cosmetic products are sourced and manufactured with ‘permissible’ ingredients under Islamic law. Halal cosmetic does not contain any alcohol or any ingredients from animals that are forbidden for Muslims.

Growth Drivers and Challenges:

Halal cosmetics have witnessed significant adoption among the Muslim population owing to the increasing demand for personal grooming and trending cosmetic and beauty products that adhere to religious loyalties. The growth of the global halal cosmetics market has driven due to the rise in purchasing power of the growing Muslim population across the globe. The desire of young Muslim women to associate their interest in fashion & makeup with Islamic loyalties in countries such as Saudi Arabia, Malaysia, Iran, UAE, and Indonesia and consumers equally interested in fashion and makeup trends have boosted the consumption of halal cosmetics, which will drive the global halal cosmetics industry. Moreover, some vegan varieties also extend the market opportunity for the non-Muslim population. For example, Eco trail, an Indian company, and UK-based PHB Ethical Beauty offer products that are not only Halal certified but also cruelty-free and free from harmful substances. This trend is being followed by leading global brands, such as The Body Shop and Forest Essentials, which, in turn, is supporting the market expansion. However, the prices of halal-certified cosmetics are much higher than standard cosmetic products, which can restrain market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Halal Cosmetics Market: Strategic Insights

Market Size Value in US$ 36,686.54 Million in 2022 Market Size Value by US$ 79,861.73 Million by 2028 Growth rate CAGR of 13.8% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Halal Cosmetics Market: Strategic Insights

| Market Size Value in | US$ 36,686.54 Million in 2022 |

| Market Size Value by | US$ 79,861.73 Million by 2028 |

| Growth rate | CAGR of 13.8% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global Halal Cosmetics Market” is segmented based on product type, category, distribution channel, and geography. Based on product type, the halal cosmetics market is segmented into skincare, haircare, makeup, and others. Based on category, the market is classified into men, women, and unisex. Based on distribution channel, the halal cosmetics market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The halal cosmetics market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

Based on product type, the halal cosmetics market is segmented into skincare, haircare, makeup, and others. The skincare segment held the significant share in the halal cosmetics market and is expected to register the significant growth over the forecast period. Most cosmetics contain ingredients that cause skin irritation and may have a long-term effect on health. As a result, halal cosmetics have proven to be an alternative and effective solution for consumers. Increasing disposable income coupled with adopting a modern lifestyle is presumed to be the significant factor potentially boosting the halal cosmetics market worldwide.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

Based on geography, the halal cosmetics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global halal cosmetics market was dominated by Asia Pacific, which accounted for US$ 14,838.48 million in 2022. Middle East & Africa is a second major contributor holding more than 20% share in the global market. Europe is expected to register the considerable growth at a CAGR of over 13.9% over the forecast period. has been noticed as one of the prominent markets for halal cosmetics due to the surge in awareness about cruelty-free products and the increased population. The rise in foreign direct investments also leads to regional economic growth. Moreover, Middle East & Africa has a large Muslim population, thus giving halal cosmetic products a lucrative opportunity for growth. Such factors have allowed global brands and online retailers to expand their offerings to capture the demand. Due to the demand for halal-certified products in the region, Saudi Arabian PIF (Public Investment Fund) launched its new Halal Products Development Company in October 2022. The company aims to manufacture personal care and cosmetic products locally in Saudi Arabia and export halal-certified products worldwide.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the halal cosmetics market are listed below:

- In November 2022, Iba Cosmetics, a Halal cosmetics manufacturer, partnered with Believe company based in Singapore. Believe company has invested US$ 10 million to partner with Iba Cosmetics to distribute and expand their retail market space across operating countries such as Middle Eastern and European and South Asia countries.

- In November 2022, Iba Cosmetics partnered with Believe company based in Singapore. Believe company has invested USD 10 million to partner with Iba Cosmetics to distribute and expand their retail market space across operating countries such as Middle Eastern and European and South Asia countries.

- In April 2022, Inika Organic launched its new cosmetics collection, Pure with Purpose. The range of products included in the group is Lash & Brow Serum, Hydrating Toning Mist, Eyeshadow Quads, Brow Palette, and more. These products are claimed to be 100% natural, vegan-certified, halal-certified, and cruelty-free.

- In August 2021, Kao Corporation, a Japanese manufacturer of halal-certified cosmetics, collaborated with lion corporation to develop recyclable packaging and minimize the plastic footprint.

Covid-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the consumer goods industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. Various halal cosmetic manufacturers had to temporarily close their operations or limit their production capacities, negatively impacting the growth of the halal cosmetics market. Also, in the early period of the crisis, manufacturers were majorly dependent on the existing inventory. Due to the pandemic-induced economic recession, consumers became more cautious and selective in purchasing decisions. Consumers significantly reduced nonessential purchases due to lower incomes and uncertain earning prospects, especially in developing regions. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxation in certain regulations, including lockdowns and travel bans. Post-pandemic consumers increasingly demand skincare and haircare products as there has been a growing trend of self-care post the COVID-19 pandemic. The growth of online retail during the pandemic has also provided growth opportunities for halal cosmetic manufacturers. Along with this, the relaxation of trade restrictions has led to the import and export of halal cosmetics, positively impacting the market.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global halal cosmetics market include Clara International Beauty Group; Inglot Cosmetics; Inika Organic Australia; IVY Beauty Corporation; MMA Bio Lab Sdn Bhd; OnePure, LLC; PT Paragon Technology and Innovation; PHB Ethical Beauty Ltd.; Sampure Minerals; and IBA Cosmetics among others.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Category, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on category, women is expected to be the fastest-growing segment during the forecast period. Female consumers are significantly opting for halal, natural & herbal cosmetics products, as they are more concerned about the long-term impact of chemicals on their skin and body, which is driving the women segment of the halal cosmetics market.

Rising awareness about cruelty-free and chemical-free products has propelled the growth of halal cosmetics market. Moreover, the increasing young population and popularity of halal cosmetics is sparking the demand for halal cosmetics market growth.

In 2021, the skincare segment held the largest market share. Skincare products are widely used daily by women as well as men. Increased concern for skin nourishment due to acne, scars, black spots, and dullness has fuelled the demand for skincare products in 2020.

During the forecast period, the skincare segment is expected to be the fastest-growing segment. The primary factors influencing the halal skincare demand include the growing demand for self-care or health-promoting products. Consumer inclination for health and well-being, as well as product innovation are expected to fuel market expansion.

The major players operating in the halal cosmetics market are Clara International Beauty Group, Inglot Cosmetics, Inika Organic Australia, IVY Beauty Corporation, MMA Bio Lab Sdn Bhd, OnePure LLC, PT Paragon Technology and Innovation, PHB Ethical Beauty Ltd., Sampure Minerals, and IBA Cosmetics.

In 2021, Asia-Pacific accounted for the largest share of the global halal cosmetics market. The high popularity of halal cosmetics among non-muslim consumers was the primary factor responsible for the high market share of the Asia Pacific region.

The List of Companies - Halal Cosmetics Market

- Clara International Beauty Group

- Inglot Cosmetics

- Inika Organic Australia

- IVY Beauty Corporation

- MMA Bio Lab Sdn Bhd

- OnePure, LLC

- PT Paragon Technology and Innovation

- PHB Ethical Beauty Ltd.

- Sampure Minerals

- IBA Cosmetics

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Halal Cosmetics Market

May 2022

Nicotine Pouches Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Strength (Less than 6 mg/g, 6 mg/g to 12 mg/g, and More than 12 mg/g), Flavor [Original/Plain, and Flavored (Mint, Berry, Citrus, Fruity, Others)], Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others)

May 2022

Housewares Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Cookware and Bakeware, Tableware, Kitchen Appliances, Bathroom Essentials, and Others) and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

May 2022

False Hair Products Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Hair Extension, Hair Wig, and Hair Pieces), Material (Human Hair and Synthetic Hair), End User (Men, Women, and Kids), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

May 2022

Mosquito Traps Market

Forecast to 2030 - Global Analysis by Product Type (Electric Shock Mosquito Killer, Photocatalytic Mosquito Killer, and Sticky Trap Mosquito Killer), Category (Outdoor and Indoor), Distribution Channel [Direct Sales (Direct Offline Sales and Direct Online Sales) and Retail Sales (Supermarkets & Hypermarkets, Specialty Stores, Online Retail, and Others)]

May 2022

Wicket Mailer Envelopes and Bags Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Material Type {Plastic [Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), and Others] and Paper}, Product Type (Poly Wicket Bags, Paper Wicket Bags, Poly Wicket Mailers, and Paper Wicket Mailers), and End Use (Banking & Financial Services, Courier & Logistics, Retail, and Others)