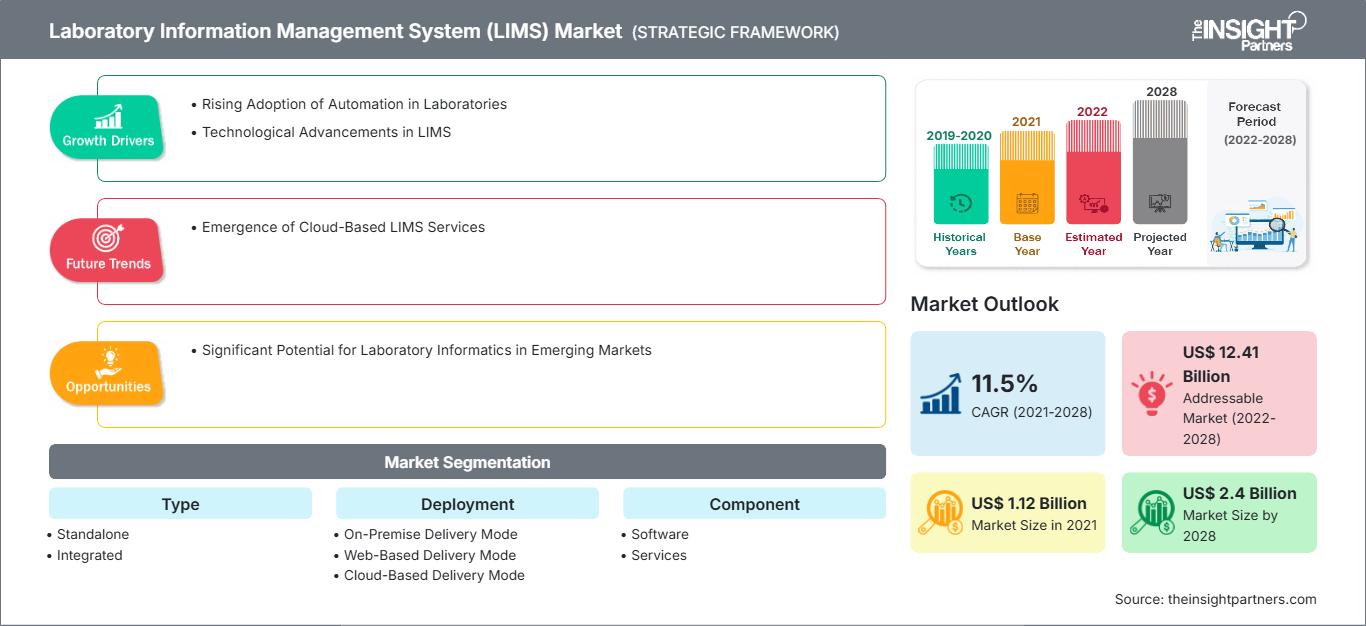

Laboratory Information Management System (LIMS) Market Dynamics and Trends by 2028

Laboratory Information Management System (LIMS) Market Forecast to 2028 - Analysis By Type (Standalone, Integrated); Deployment (On-Premise Delivery Mode, Web-Based Delivery Mode, Cloud-Based Delivery Mode); Component (Software, Services); Application (Sample Management, Workflow Automation, Records Management, Logistics Management, Enterprise Resource Planning, Decision Making); End-User (Hospitals & Clinics, Pharmaceutical Companies, Contract Research Organizations, Other End Users), and Geography

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Jul 2021

- Report Code : TIPHE100000954

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 216

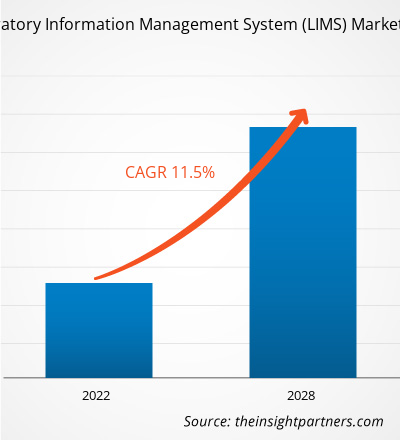

[Research Report] The Laboratory Information Management System (LIMS) Market was valued at US$ 1,122.36 million in 2021 and is projected to reach US$ 2,402.48 million by 2028; it is expected to grow at a CAGR of 11.5% from 2021 to 2028.

Market Insights and Analyst View:

Laboratory information management systems (LIMS) are used to manage various tasks in the laboratory, including workflow management, integrate instruments, records management, logistics management, decision making, enterprise resource planning, privacy, and security controls. Laboratories generate an ample amount of data that can be managed through LIMS. The rising adoption of automation in laboratories, and technological advancements in LIMS, are expected to propel the laboratory information management systems market growth during the forecast period.

Growth Drivers and Challenges:

Laboratory automation is emerging as an approach to minimize human involvement in laboratory processes. The automation of routine laboratory procedures with the help of dedicated workstations and system software helps increase laboratory efficiency and enables researchers to concentrate on important tasks along with avoiding human errors. The growing use of digital workstations, automated analyzers, and total laboratory automation (TLA) allows laboratory personnel to reassign activities and contribute a greater value to operations. Moreover, high volumes of data generated by laboratory systems is triggering the demand for effective data processing, analysis, and sharing methods, thereby highlighting the need of efficient and cost-effective solutions such as the LIMS. Further, growing demand for data integration is another factor contributing to the laboratory information management systems market growth. With pharmaceutical and biotechnological industries spending huge amounts on research and development activities, the scientific communities are generating huge volumes of data. The appropriate processing and interpretation of the collected data requires data integration solutions.

Informatics platforms save time and money as they help to avoid rework if error occurred, and other technical glitches persist. The LIMS solutions ensure that samples are only sent or assigned to instruments that are regularly monitored as well as accurately calibrated and maintained as per schedule. Due to technological developments and far exceeding complexities in laboratory process, the scope of LIMS has gone beyond data, process, and product management. Autoscribe Informatics launched an updated version of its Regulated Manufacturing LIMS, in March 2021; it is a configured solution based on the Matrix Gemini LIMS solution. The product is ideal for all manufacturing organizations, including the highly regulated industries such as medical devices and pharmaceuticals. Moreover, the companies are also upgrading their original automation platforms to meet the escalating demands of researchers and laboratory personnel. In July 2021, LabVantage Solutions, Inc. announced the launch of a new edition of its flagship LabVantage LIMS. The LabVantage LIMS 8.7 portal features systems that manage the laboratory’s data security, along with offering self-service access to external customers. It also allows laboratories to go live faster and at a lower total cost. Thus, the growing focus on effective clinical workflow management, leading to the rise in automation of laboratory processes, and developments and innovations by the market players are boosting the growth of global laboratory information management systems market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLaboratory Information Management System (LIMS) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Purchasing and implementing LIMS demand high investments; the overall cost also includes the license costs. Unlike many other areas, the cost of medical technology is not decreasing, whereas increasing application scope of these technologies leads to increased healthcare costs. Moreover, the high costs of these systems make them unaffordable for smaller lab facilities. Additionally, the end users need to bear the maintenance and servicing costs of these systems, which makes them expensive for average-sized research laboratories, majorly in the emerging markets. The costs of implementation of data organization, process automation, and digital transformation solutions are ~US$ 20,000; ~US$ 50,000; and ~US$ 60,000, respectively. Further, several LIMS providers are offering models implying license fees and subscription-based systems, which further escalate the costs. Thus, high costs associated with LIMS are restraining the market growth.

Report Segmentation and Scope:

The “Global Laboratory Information Management Systems Market” is segmented based on type, deployment, component, application, end user, and geography. Based on type, the laboratory information management systems market is segmented into standalone and integrated LIMS. Based on deployment, the laboratory information management systems market is segmented into web-based delivery mode, cloud-based delivery mode, and on-premises delivery mode. Based on component, the laboratory information management systems market is segmented into software and services. Based on application, the laboratory information management systems market is segmented into sample management, workflow automation, logistics management, enterprise resource planning, privacy and security controls and other applications. Based on end user, the laboratory information management systems market is segmented into hospitals & clinics, pharmaceutical companies, contract research organizations and others. The laboratory information management systems market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on type, the laboratory information management systems market is segmented into standalone and integrated LIMS. The standalone segment held the largest share of the market in 2021, however the integrated segment is anticipated to register the highest CAGR of 12.1% in the market during the forecast period. The integrated LIMS solution is a powerful combination of any offerings that use LIMS as the base. Integrated solutions handle complex processes, support regulatory compliance, and promote collaboration within the lab and among labs worldwide. Integrated LIMS can connect multiple facilities on a single, cloud-based platform for simplified, real-time access and sharing of data across laboratory networks. The growing demand for compact solutions and ease of operations, and various other advantages are likely to boost the growth of the integrated LIMS systems during the forecast period.

Based on deployment, the laboratory information management systems market is segmented into web-based delivery mode, cloud-based delivery mode and on-premises delivery mode. In 2021, the web-based delivery mode segment is likely to hold the largest share of the market, however cloud-based delivery mode segment is expected to grow at the fastest rate during the coming years. The cloud-based delivery mode is the more safe and standardized information system used to manage laboratory data and allows connecting the user to the computer via the internet or web browser, which further enables access to the data anytime, anywhere on any device. The cloud provides the same or more features with better reliability than web-based delivery mode. Cloud-based solutions are revolutionizing healthcare, driving operational excellence, and delivering a modern and engaging user experience.

Based on component, the laboratory information management systems market is segmented into software and services. The software segment is likely to hold the largest share of the market in 2021, however the services segment is anticipated to register the highest CAGR of 13.1% of the market during the forecast period. The LIMS systems improve efficiency in lab operations by cutting down on manual tasks and reducing human errors. The services offered by vendors include analysis and data management solutions, service partnerships, and financial solutions. The companies also provide training & support after deployment of solution. They provide multiple in-person training sessions and online training to operate and maintain the system. Increasing need for LIMS implementation, integration, maintenance, validation, and support are responsible for the growth of the services segment in the forecast period.

Based on application, the laboratory information management systems market is segmented into sample management, workflow automation, logistics management, enterprise resource planning, privacy and security controls and other applications. The sample management segment is likely to hold the largest share of the market in 2021, also the same segment is anticipated to register the highest CAGR of 12.6% of the market during the forecast period. The sample management features of laboratory information management systems enable a detailed track and trace information about any content of the laboratory, from reception, storage, experimentation, and exit. LIMS is a fully customizable system that is connected to the specific needs of the lab. The sample management module helps to manage the logistics of the contents of the lab. Efficient deployment of LIMS is also used to define exact locations to attach data of the chosen sample.

Based on end user, the laboratory information management systems market is segmented into hospitals & clinics, pharmaceutical companies, contract research organizations and others. The pharmaceutical companies segment is likely to hold the largest share of the market in 2021, however the contract research organizations segment is anticipated to register the highest CAGR of 12.2% of the market during the forecast period. Contract research organizations help various companies and organizations by conducting the clinical trials of their developed products and technologies. Benefits of implementing LIMS in CROs include inventory and storage management, data security & integrity, integration with third-party systems (ERP/HR/MRP, etc.), workflow management, sample management, project management, etc. The market of the CROs is increasing as it ultimately leads to the cost saving and time for conducting various research activities. Therefore, owing to the growing service uptake from contract research organizations, the market for LIMS in CROs is likely to grow significantly in the forecast period.

Regional Analysis:

Based on geography, the laboratory information management systems market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North American market for global laboratory information management systems consists of the US, Canada, and Mexico. The US is the largest market for global laboratory information management systems, followed by Canada and Mexico. The leading position of North America in the LIMS market is primarily attributed to the high regulatory standards followed by the pharmaceutical industry. The rising number of biobanks and the region is attributed to offering significant growth opportunities for market growth during the forecast period. In North America, the US is the largest market for laboratory information management systems. In the US, the need for LIMS is anticipated to witness growth due to the rise in R&D expenditures made by the companies situated in the US. LIMS helps in the field of R&D in industries such as pharma and biotechnology. The software helps store data, including information regarding sample management, instrument and application integration, electronic data exchange, and others. The increasing R&D expenditures made by companies situated in the US, is hence expected to fuel the growth of laboratory information management software market during the forecast period.

Asia Pacific accounted as the fastest growing region in the global laboratory information management systems market and was projected to grow at a faster pace over the forecast period. The growth of the laboratory information management systems market share in this region is primarily due to increasing number of clinical trials, need for further cost containment of clinical trials, and increasing number of pharmaceutical and biotech companies in this region. China and Japan account for the largest markets of laboratory information management systems in the Asia Pacific region. China has the world’s second-largest pharmaceutical market. The large population coupled with the rising non-communicable diseases and growing international pharma business in China are majorly driving the growth of the pharmaceutical companies in China. Favorable regulatory policies in China have increased the growth opportunity for the biotechnology companies in this country. In addition, the new regulatory framework is also encouraging innovation and improve data quality. This has increased the preference for global pharmaceutical players to establish a strong foothold in the country, thereby driving the adoption of LIMS.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global laboratory information management systems market are listed below:

- In October 2022, Thermo Fisher Scientific, Inc. released Edition 21.1 of SampleManager LIMS software, with features like HL7 support for analytical quality control (AQC). The new feature includes various advanced features such as data packaging and kit deployment, voice control, data support for data analysis, monitoring, and charting.

- In December 2022, LabVantage Solutions, Inc. released version 8.8 of its flagship LIMS platform, featuring numerous upgrades across all components. These factors are expected to boost the market growth over the forecast period.

- In December 2021, Thermo Fisher Scientific Inc. announced the acquisition of PPD, a leading global contract research organization (CRO), for US$ 17.4 billion. The purpose of the acquisition was to expand Thermo Fisher's capabilities in the CRO market and enhance its ability to serve the pharmaceutical and biotechnology industries.

LIMS

Laboratory Information Management System (LIMS) Market Regional InsightsThe regional trends and factors influencing the Laboratory Information Management System (LIMS) Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Laboratory Information Management System (LIMS) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Laboratory Information Management System (LIMS) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.12 Billion |

| Market Size by 2028 | US$ 2.4 Billion |

| Global CAGR (2021 - 2028) | 11.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Laboratory Information Management System (LIMS) Market Players Density: Understanding Its Impact on Business Dynamics

The Laboratory Information Management System (LIMS) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Laboratory Information Management System (LIMS) Market top key players overview

Covid-19 Impact:

COVID-19 has made a major impact on the healthcare industry with the coronavirus creating havoc across the globe. A high percentage of testing was handled through COVID-19-specific LIMSs installed in several laboratories, helping technicians ease works, sharing results through mails, and tracking the samples. To help in tackling the effect of COVID-19, market players aimed at launching novel solutions in the market. For instance, LabVantage launched the COVID-19 LIMS which is helpful in managing the unprecedented acceleration of the laboratory workflow and volume due to the pandemic. Several laboratories, CROs, research institutes, and pharma and biotech companies have worked uninterruptedly during the pandemic, thereby increasing productivity. Therefore, web-hosted solutions help achieve long operational life, decrease ownership cost, and offer excellent investment returns. For instance, LabWare Technologies has collaborated with the National Health Service to provide laboratory management software to healthcare settings across the United Kingdom. Similarly, in September 2020, Sunquest Information Systems, Inc. an Indian LIMS company has launched a comprehensive and flexible molecular and genetic laboratory information management system, Sunquest Mitogen LIMS for COVID 19 testing. All these factors support market growth for laboratory information management system in all the regions, thus having a positive impact on the market growth.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global laboratory information management systems market include Thermo Fisher Scientific Inc., Abbott, Illumina, Inc., LABWORKS, LabLynx, Inc., LabVantage Solutions, Inc., Accelerated Technology Laboratories, Inc., LabSoft LIMS by Computing Solutions, Inc., LabWare, and Autroscribe Informatics among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their laboratory information management systems market share.

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For