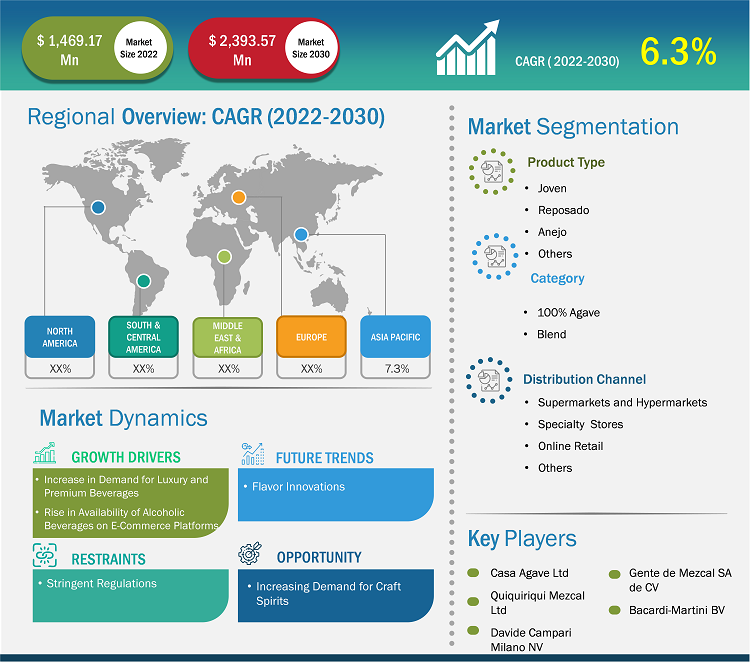

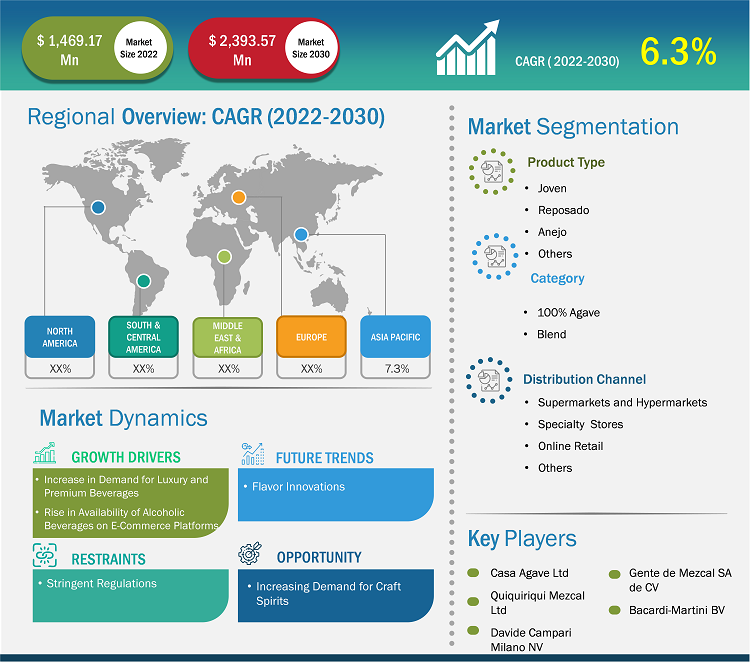

The mezcal market size was valued at US$ 1,469.17 million in 2022 and is expected to reach US$ 2,393.57 million by 2030; it is estimated to register a CAGR of 6.3% from 2022 to 2030.

Market Insights and Analyst View:

Mezcal is a distinctive Mexican spirit made from agave plants, primarily in the Oaxaca region. Unlike tequila, which is a type of mezcal made exclusively from blue agave, mezcal can be produced from various agave species, giving it a broader range of flavors and aromas. The surge in demand for mezcal can be attributed to its artisanal production methods, unique smoky flavor, and the growing appreciation for craft spirits. Consumers are increasingly seeking authenticity and diversity in their drinking experiences, which has led to mezcal gaining popularity among adventurous spirits enthusiasts and mixologists alike. Its cultural heritage and traditional production techniques have also contributed to its appeal, making it a sought-after choice for those looking to explore the rich world of agave-based spirits.

Growth Drivers and Challenges:

The rising demand for luxury and premium beverages has emerged as a driving force for the Mezcal market. One significant catalyst for this trend is the increase in the disposable income of consumers. As people's earnings have grown, they are more inclined to allocate a portion of their budget to indulging in high-end spirits such as Mezcal. This has opened up opportunities for premium Mezcal brands to thrive as consumers seek distinctive, elevated drinking experiences. Additionally, the influence of millennials cannot be understated. This demographic cohort has shown a particular penchant for spending on high-end beverages, driven by a desire for quality, authenticity, and unique flavor profiles. Mezcal aligns perfectly with these preferences, offering a handcrafted and artisanal product that resonates with the millennial demographic, contributing significantly to the surge in demand.

Moreover, the evolution of consumer preferences plays a pivotal role in driving the Mezcal market. Modern consumers increasingly seek unique and sophisticated spirits that go beyond the ordinary. With its intricate production process, smoky notes, and distinct flavors, Mezcal aligns well with this shift. It has become a symbol of refined taste and has gained a reputation as a premium beverage choice, attracting discerning consumers looking for a more elevated drinking experience.

The burgeoning cocktail culture has further contributed to Mezcal's ascent in the luxury beverage market. Mixologists and bartenders have embraced Mezcal as a versatile and premium ingredient for crafting unique and innovative cocktails. Its smoky and complex flavors add depth and character to drinks, making it a sought-after choice in upscale bars and restaurants. This has heightened Mezcal's visibility and spurred consumer interest in recreating these upscale cocktail experiences at home, further driving demand.

Lastly, the perception of Mezcal as a luxury product has been amplified by effective marketing strategies and distinctive packaging. Premium Mezcal brands have invested in sophisticated branding highlighting the product's artisanal origins, emphasizing its exclusivity. This marketing approach has attracted consumers looking for status symbols and unique gifting options, bolstering the demand for Mezcal in the luxury spirits market.

However, there are strict regulations that govern Mezcal production, labeling, and certification in Mexico. The Denomination of Origin for Mezcal, which protects Mezcal's geographical origin and traditional production methods, imposes a set of rules that can be burdensome for producers. For instance, to be labeled as "Mezcal," the spirit must be made from specific varieties of agave plants, primarily found in some areas of Mexico, and produced using traditional methods. The traditional method includes cooking in earthen pits or clay ovens, milling by hand, fermentation in stone or organic pits, and distillation with direct fire under copper or clay pots. Meeting these requirements can be costly or time-consuming, limiting the ability of smaller producers to enter the market and compete effectively.

Another regulatory challenge relates to certification and labeling. Producers must adhere to rigorous quality standards and undergo certification processes to carry the official "Mezcal" label. This can be a barrier for smaller, local producers who may not have the resources to navigate these bureaucratic procedures or invest in the necessary equipment and facilities. Furthermore, strict rules about labeling and advertising include specifying the type of agave used, the region of production, and the distillation process. Any deviations from these rules can lead to legal issues, making it essential for producers to comply meticulously. These regulatory constraints can restrict market entry, hinder innovation, and create compliance costs, particularly for small Mezcal producers.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mezcal Market: Strategic Insights

Market Size Value in US$ 1,469.17 million in 2022 Market Size Value by US$ 2,393.57 million by 2030 Growth rate CAGR of 6.3% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mezcal Market: Strategic Insights

| Market Size Value in | US$ 1,469.17 million in 2022 |

| Market Size Value by | US$ 2,393.57 million by 2030 |

| Growth rate | CAGR of 6.3% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The global mezcal market is segmented on the basis of product type, category, distribution channel, and geography. Based on product type, the market is categorized into joven, reposado, anejo, and others. By category, the market is bifurcated into 100% agave and blend. By distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. By geography, the global mezcal market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis:

Based on product type, the market is categorized into joven, reposado, anejo, and others. The reposado segment is expected to register the highest CAGR during 2022–2030. Reposado, which translates to "rested" in Spanish, represents a middle ground between the youthful boldness of joven and the aged complexity of anejo mezcal. It undergoes a relatively short aging process of two months to one year in oak barrels. This aging imparts a mellower character to the spirit, smoothing out some of the agave's sharper edges. While retaining the core agave flavors, reposado mezcal develops additional nuances, such as hints of vanilla, caramel, and wood. Its surging demand is due to its ability to balance the unaged vibrancy of joven and the refined complexity of anejo, making it a preferred choice for those seeking a smoother and more approachable mezcal experience.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

The mezcal market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America dominated the global mezcal market, and the regional market accounted for US$ 612.20 million in 2022. Europe is a second major contributor, holding more than 29% share of the global market. Asia Pacific is expected to register a considerable CAGR of over 7% during 2022–2030. Mezcal is gaining popularity among consumers in Asian countries such as China, India, Japan, and Australia. This consumer shift toward mezcal is mainly attributed to the rising health concerns. The rising preference for luxurious alcoholic beverages has increased the demand for mezcal, which is anticipated to propel the market growth in APAC.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

COVID-19 Pandemic Impact:

The COVID-19 pandemic initially hindered the global mezcal market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the mezcal supply. Various liquor stores were closed. However, businesses started gaining ground as previously imposed limitations were eased across various countries. Moreover, the introduction of COVID-19 vaccines by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the mezcal market, reported growth after the ease of lockdowns and movement restrictions.

Competitive Landscape and Key Companies:

Casa Agave Ltd, Quiquiriqui Mezcal Ltd, Davide Campari Milano NV, Gente de Mezcal SA de CV, Bacardi-Martini BV, Diageo Plc, Pernod Ricard SA, Meanwhile Drinks Ltd, Proximo Spirits Inc, and Madre Mezcal Inc are among the prominent players operating in the global mezcal market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Category, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on category, the mezcal market is segmented into 100% agave and blend. 100% agave category represents mezcal made exclusively from agave plants, with no other sugar sources added during fermentation or distillation. It embodies the traditional and authentic spirit of mezcal production, highlighting various agave species' unique flavors and characteristics. The demand for 100% agave mezcal has been steadily increasing due to consumer's growing appreciation for pure and unadulterated spirits. Discerning drinkers seek the true essence of mezcal, valuing the rich diversity of agave flavors and the dedication of mezcaleros in preserving centuries-old production methods. This category's surge in popularity can be attributed to a desire for transparency and authenticity in the mezcal market as consumers become more educated about the significance of 100% agave labeling.

Mezcal producers are increasingly experimenting with different agave varietals, aging methods, and flavor infusions, which cater to changing consumer preferences and provide unique selling points for their brands. One example of flavor innovation is the use of different agave varieties. While espadin agave is the most commonly used for Mezcal production, some producers explore lesser-known agave types such as tobala, tepextate, and arroqueno. Each agave variety brings its distinct flavor profile to the Mezcal, from earthy and vegetal to fruity and floral notes. This diversity allows consumers to explore various flavors within the Mezcal category, catering to various palate preferences.

Another avenue of innovation involves the aging process. Mezcal aging can occur in various containers, such as oak barrels, glass, or clay pots. Producers experiment with different aging periods and container types to impart unique flavors and aromas. For instance, extended aging in oak barrels can introduce hints of vanilla and caramel, enhancing the complexity of the final product. This approach mirrors the techniques often seen in the whiskey and wine industries, offering a bridge for consumers transitioning from those spirits to Mezcal.

Based on product type, the market is categorized into joven, reposado, anejo, and others. The reposado segment is expected to register the highest CAGR during 2022–2030. Reposado, which translates to "rested" in Spanish, represents a middle ground between the youthful boldness of joven and the aged complexity of anejo mezcal. It undergoes a relatively short aging process of two months to one year in oak barrels. This aging imparts a mellower character to the spirit, smoothing out some of the agave's sharper edges. While retaining the core agave flavors, reposado mezcal develops additional nuances, such as hints of vanilla, caramel, and wood. Its surging demand is due to its ability to balance the unaged vibrancy of joven and the refined complexity of anejo, making it a preferred choice for those seeking a smoother and more approachable mezcal experience.

The major players operating in the global mezcal market are Casa Agave Ltd, Quiquiriqui Mezcal Ltd, Davide Campari Milano NV, Gente de Mezcal SA de CV, Bacardi-Martini BV, Diageo Plc, Pernod Ricard SA, Meanwhile Drinks Ltd, Proximo Spirits Inc, and Madre Mezcal Inc among others.

In 2022, North America region accounted for the largest share of the global mezcal market. The North American region comprises developed and developing economies such as the U.S. and Canada, and Mexico. Several mezcal breweries have a strong foothold in the North American region. Key market players in the North American mezcal market include E.L. Silencio Holdings, Inc., Mezcal Vago, Ilegal Mezcal, Rey Campero, and many others. These breweries are constantly working towards innovation and developing different varieties of mezcal with improved tastes and qualities to attract new consumers and widen the consumer base in the region. The export of mezcal to several countries across North America will contribute to the rise in demand for mezcal in the region. Innovative programs aimed at marketing the product across North America will increase demand for mezcal in North America.

The rising demand for luxury and premium beverages has emerged as a driving force for the Mezcal market. One significant catalyst for this trend is the increase in the disposable income of consumers. As people's earnings have grown, they are more inclined to allocate a portion of their budget to indulging in high-end spirits such as Mezcal. This has opened up opportunities for premium Mezcal brands to thrive as consumers seek distinctive, elevated drinking experiences. Additionally, the influence of millennials cannot be understated. This demographic cohort has shown a particular penchant for spending on high-end beverages, driven by a desire for quality, authenticity, and unique flavor profiles. Mezcal aligns perfectly with these preferences, offering a handcrafted and artisanal product that resonates with the millennial demographic, contributing significantly to the surge in demand. Moreover, the evolution of consumer preferences plays a pivotal role in driving the Mezcal market. Modern consumers increasingly seek unique and sophisticated spirits that go beyond the ordinary. With its intricate production process, smoky notes, and distinct flavors, Mezcal aligns well with this shift. It has become a symbol of refined taste and has gained a reputation as a premium beverage choice, attracting discerning consumers looking for a more elevated drinking experience.

The List of Companies - Mezcal Market

- Casa Agave Ltd

- Quiquiriqui Mezcal Ltd

- Davide Campari Milano NV

- Gente de Mezcal SA de CV

- Bacardi-Martini BV

- Diageo Plc

- Pernod Ricard SA

- Meanwhile Drinks Ltd

- Proximo Spirits Inc

- Madre Mezcal Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Mezcal Market

Oct 2023

Corn and Wheat-Based Feed Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Corn-Based (Corn Gluten Meal, Corn Gluten Feed, and Other Corn-Based Feed) and Wheat-Based (Wheat Gluten, Wheat Bran, and Other Wheat-Based Feed)], Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others), and Geography

Oct 2023

Icing and Frosting Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Icing and Frosting), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Geography

Oct 2023

Fermented Flavor and Fragrance Ingredients Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fruity, Floral, Woody, Blends, and Others), Application (Food and Beverages, Personal Care Products, Cosmetics, and Others), and Geography

Oct 2023

Aroma Ingredients for Food and Beverages Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Synthetic (Terpenes, Aldehydes, Aliphatic, and Others) and Natural (Essential Oils, Herbal Extracts, Oleoresins, and Others)] and Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Sweet and Savory Snacks, RTE and RTC Meals, and Others)

Oct 2023

High-End Rum Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (White, Dark, and Gold), Category (Super Premium, Ultra-Premium, and Prestige & Prestige Plus), Nature (Plain and Flavored), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Oct 2023

Edible Oils and Fats Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Oil (Soybean Oil, Sunflower Oil, Palm Oil, Canola Oil/Rapeseed Oil, and Others) and Fats (Butter, Margarine, Palm Oil Based Shortening, and Vegetable Oil Based Shortening, and Others)] and Application [Food and Beverages (Bakery and Confectionery, Dairy and Frozen Desserts, RTE and RTC Meals, Snacks, and Others), Animal Nutrition, and Pharmaceuticals and Nutraceuticals]

Oct 2023

Flavor Masking Agents for Food and Beverages Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Sweet, Salt, Fat, Bitter, and Others) and Application (Bakery and Confectionery; Dairy and Frozen Desserts; Beverages; Meat, Poultry, and Seafood; Meat Substitutes; Dairy Alternatives; RTE and RTC Meals; and Others)

Oct 2023

Chicken Powder Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Low-Fat and Conventional) and Application [Food & Beverages (RTE and RTC Meals; Soups, Sauces, and Dressings; Savory Snacks; Noodles and Pastas; and Others), Dietary Supplements, Pet Food, and Animal Feed]