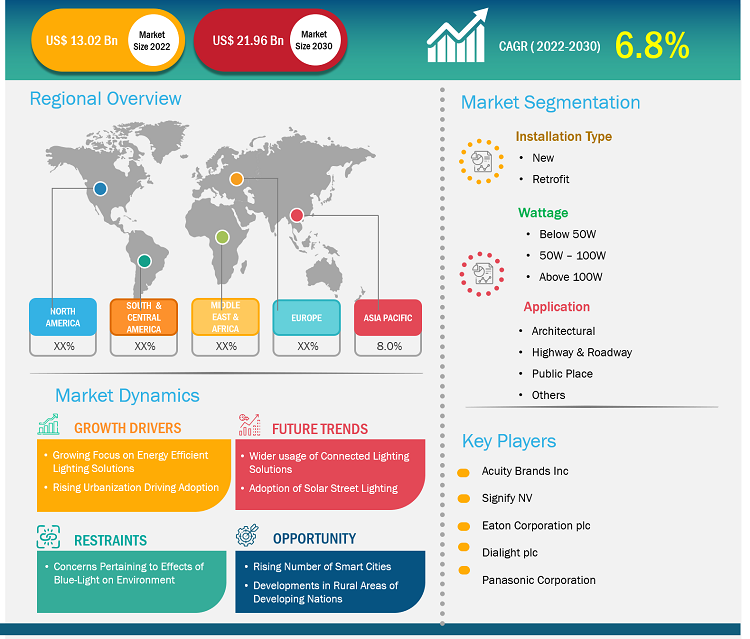

[Research Report] The outdoor LED lighting market is expected to grow from US$ 13.02 Billion in 2022 to US$ 21.96 Billion by 2030; it is estimated to grow at a CAGR of 6.8% from 2022 to 2030.

Outdoor LED Lighting Market Analyst Perspective:

The outdoor LED lighting market has experienced substantial growth over the past few years due to its long functional life, energy efficiency, and superior brightness. With technological advancements, the price points of these bulbs have also come down. The lighting of outdoor areas, including streets, roadways, parking lots, and pedestrian areas, was dominated by metal halide (MH) and high-pressure sodium (HPS) sources. These relatively energy-efficient light sources have been in use for many years and have well-understood performance characteristics. Advances in LED technology have resulted in the replacement of HPS and MH lights with LED lights for outdoor area lighting, with numerous advantages over MH and HPS sources. Well-designed LED outdoor luminaires can provide the needed surface illumination with less energy and improved uniformity compared to previous light sources. LED luminaires also have significantly longer life with better lumen maintenance. Other LED advantages include the omission of mercury, lead, or other known disposal hazards, and it can switch on instantly without restrike delay or run-up time. Further, while MH and HPS technologies have improved slightly over the years, LED technology has improved rapidly in terms of luminous efficacy, optical design, color quality, thermal management, and cost. Current LED product quality can vary significantly among manufacturers and is highly sensitive to thermal and electrical design weaknesses that can lead to rapid lumen depreciation or premature failure.

Outdoor LED Lighting Market Overview:

Outdoor LED lighting solutions have revolutionized the illumination technology of exterior spaces. Most LED fixtures for outdoor applications are designed to be energy-efficient, enhance aesthetics, and possess better functionality. Outdoor LED lighting solutions have low energy consumption and extended lifespan, rendering them cost-effective and eco-friendly. They offer versatile lighting options, from providing security to accentuating landscape. LED technology provides vibrant colors, crisp illumination, and customizable control through the integration of smart sensors and technologies.

Furthermore, their durability withstands harsh weather conditions, making them ideal for year-round use. Thus, it has been witnessing widespread application in residential setups, as well as commercial and industrial setups. For instance, these are being used for patio illumination, pathways of parks, security spotlights for commercial spaces, floodlights in stadiums, and runway lights in airports.

Strategic Insights

Outdoor LED Lighting Market Driver:

Rising Demand for Energy-Efficient Lighting to Drive Growth of the Outdoor LED Lighting Market

Energy efficiency is a cornerstone of modern sustainability efforts, and LED lights have emerged as a prime example of how technology can revolutionize energy consumption. The rising demand for energy efficiency in outdoor lighting systems can be owed to the growing focus on energy conservation and reducing greenhouse gas (GHG) emissions. LED lights have higher energy efficiency and thus consume much less power than traditional light. LED lighting for streetlight applications has often been powered by solar energy, which further reduces the GHG contribution.

Standardization bodies such as the US Department of Energy (DOE) and the International Electrotechnical Commission (ICE) have played pivotal roles in establishing the energy efficiency credentials of LED lights. The DOE’s ENERGY STAR program, for instance, sets stringent criteria for energy-efficient products. LED bulbs bearing the ENERGY STAR label are required to meet specific performance standards. While a standard incandescent 60-watt bulb consumes 60 watts of electricity, an ENERGY STAR-labeled LED bulb provides the same brightness for approximately 10 watts. Similarly, IEC 62612 specifies requirements for LED lamps used in general lighting services.

Again, standardization bodies such as the Illuminating Engineering Society (IES) and the International Commission on Illumination (CIE) have been striving to promote energy-efficient outdoor lighting solutions and have contributed to the establishment of energy-efficient norms and practices for outdoor LED lighting. The CIE’s TC4-58 Technical Committee focuses on standardizing measurement and assessment procedures for outdoor LED lighting, ensuring that these luminaires meet strict energy efficiency requirements. The IES, on the other hand, develops standards such as IES TM-21 to project LED lumen depreciation over time, guiding manufacturers and users alike toward selecting long-lasting and efficient lighting solutions.

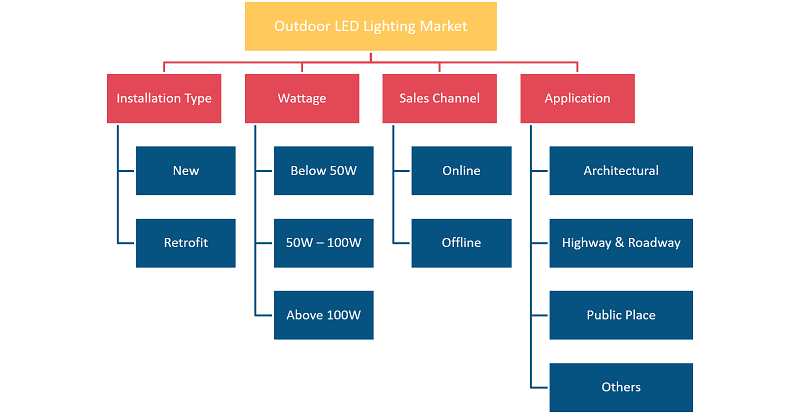

Outdoor LED Lighting Market Segmental Analysis:

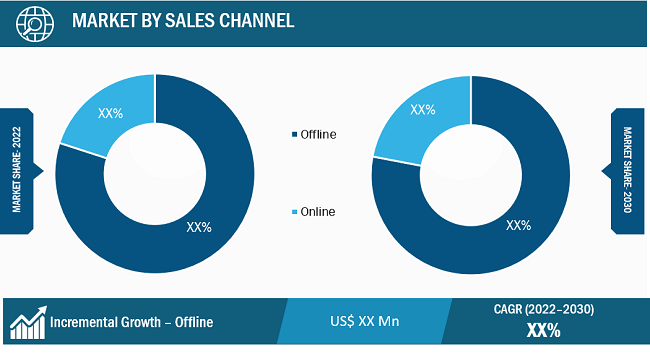

Based on installation type, the outdoor LED lighting market is bifurcated into new and retrofit. By wattage, the outdoor LED lighting market is divided into below 50W, 50W – 100W, and above 100W. By sales channel, the outdoor LED lighting market is bifurcated into online and offline. Offline sales dominated the market in 2022 since the government entities auctioned most outdoor projects, and the bidders purchased in bulk from the manufacturers through direct sales channels. Online sales were mostly restricted to the residential sector. Based on application, the outdoor LED lighting market is segregated into architecture, highways & roadways, public places, and others.

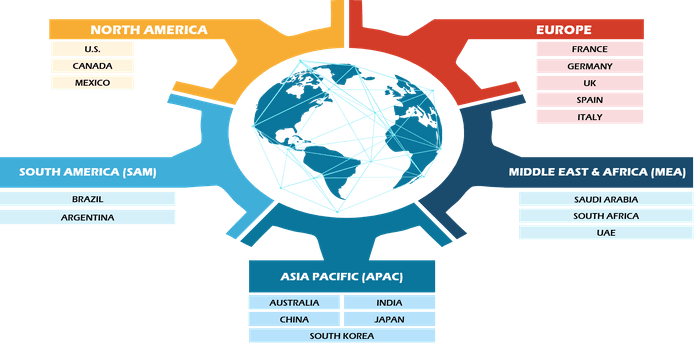

Outdoor LED Lighting Market Regional Analysis:

North America holds a substantial share of the outdoor LED lighting market. The US and Canada have been witnessing a significant expansion in their city limits and urban dwellings. The US, in a nationwide push for energy efficiency and environmental sustainability, is rapidly transitioning its street lighting systems to outdoor LED technology. The trend has been gaining momentum for the past few years and across several cities. For instance, the city of Chicago in 2016 announced plans to replace 270,000 streetlights with LED lights by 2021. The nation’s largest municipal street lighting system had replaced 210,000 streetlights with state-of-the-art LEDs by August 2020. The project was slightly hampered by the pandemic, which caused a shortage of semiconductors and supply chain disruption of the bulbs. The completion of the project is expected to save taxpayers US$ 100 million over ten years and avoid over 11,000 MT of CO2 annually. Similarly, in 2019, New York State’s Governor rolled out an ambitious LED program of replacing half a million streetlights with LEDs. The replacement is expected to save 482GWh per year and reduce carbon emissions in the state by ~40%, in comparison to 1990 levels, by 2030.

Asia Pacific is to witness the fastest growth rate during the forecast period. The region is witnessing a tremendous surge in population growth, coupled with rising urban development. Additionally, rural areas in several developing countries are also witnessing a rising penetration of electricity. The region is witnessing a luminous transformation, with several cities undertaking projects to replace sodium vapor street lamps with energy-efficient LED lamps. In January 2023, the Brihanmumbai Municipal Corporation of Mumbai, India, announced that it had completed 97% of changing sodium vapor lights to LED lights in the Mumbai suburban section. The project was initiated in 2018 and is expected to be completed by the end of 2023.

Similarly, the city of Kolkata plans to completely replace all 0.3 million streetlights in the city with energy-efficient LEDs by 2025. Till March 2023, half of the same had already been replaced. Additionally, there has been a steady rise in the number of smart cities across the region. For instance, the Smart Cities Mission by the Government of India is an urban renewal and retrofitting program under which 100 cities are being converted to smart cities. As Asia continues to embrace outdoor LED lighting, it signifies a commitment to sustainable urban development and a greener, brighter future.

Furthermore, LED lights offer versatility and durability, making them ideal for various outdoor applications, from street lighting to architectural illumination. The precise control enabled by LED systems allows for customizable lighting solutions, meeting the specific needs of varied urban environments. Moreover, the prospect of cost savings in energy bills and declining prices have been an attractive proposition for the price-sensitive population of several developing nations in the regions. This trend has led to the widespread utilization of outdoor LED lighting products in residential scenarios.

Outdoor LED Lighting Market Key Player Analysis:

The outdoor LED lighting market landscape consists of players such as Acuity Brands Inc, Dialight plc, Eaton Corporation plc, Guangzhou Anern Energy Technology Co Ltd, Hubbell Incorporated, IDEAL Industries Inc (Cree), OPPLE Lighting Co Ltd, Panasonic Corporation, RC Lighting Limited, and Signify NV. Acuity Brands Inc. and Signify NV are the top two players owing to the diversified product portfolio offered and extended market reach. The market is highly fragmented, with several manufacturers from the APAC region dominating the exports to developing countries globally.

Outdoor LED Lighting Market Recent Developments:

Companies in the Outdoor LED Lighting market highly adopt inorganic and organic strategies such as mergers and acquisitions. A few recent key outdoor LED lighting market developments are listed below:

- September 2023 – US LED, Ltd launched the Right Choice Series of outdoor LED luminaires, which has been designed to capitalize on the unmatched optical and thermal qualities exclusive to best-in-class LED technology.

- May 2023 – Signify NV launched new energy-efficient LED outdoor lights, which had been designed to perform in changing weather conditions and also consume lower power. The new products were designed to resist extreme sunlight, ultra-violet (UV) rays, heavy rain, and weather humidity up to 85% without resulting in corrosion or rust.

- May 2023 - Acuity Brands’ Cyclone Lighting released the Elencia luminaire, having high-performance optics and an updated, modern lantern styling for an upscale aesthetic to outdoor post-top illumination.

- May 2022 – Signify NV completed the acquisition of Fluence from ams OSRAM in a bid to strengthen its agricultural lighting portfolio. The acquisition strengthens the former’s global Agriculture lighting growth platform and also bolsters the company’s share in the North American horticultural lighting market.

- November 2020 – Acuity Brands’ Lithonia Lighting Outdoor launched WPX LED and ARC LED wall-mounted luminaires and the BarnGuard LED security light.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Installation Type, Wattage, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies

1. Cooper Industries plc (Eaton)

2. Cree, Inc

3. Dialight PLC

4. General Electric Company

5. Hubbell Incorporated

6. Osram Licht AG

7. Signify Holding

8. Syska Led Lights Private Limited

9. Virtual Extension

10. Zumtobel Group AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Outdoor LED Lighting Market

Apr 2024

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Apr 2024

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Apr 2024

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Apr 2024

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Apr 2024

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Apr 2024

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Apr 2024

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Apr 2024

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)