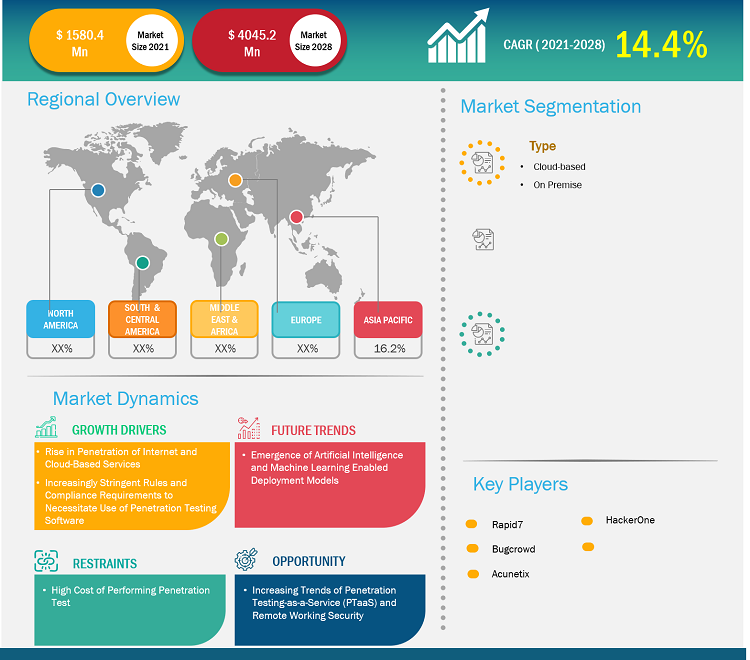

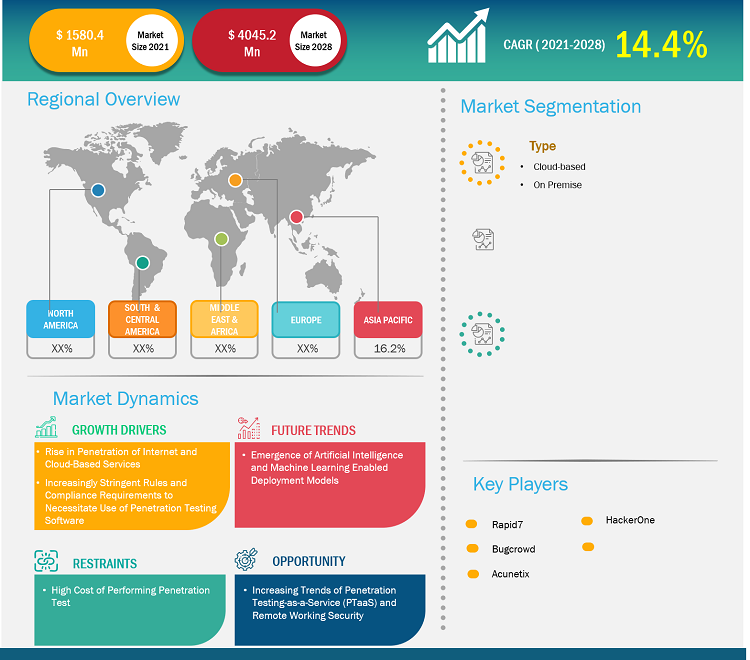

[Research Report] The penetration testing software market is expected to grow from US$ 1,580.4 million in 2021 to US$ 4,045.2 million by 2028; it is estimated to grow at a CAGR of 14.4% from 2021 to 2028.

Analyst Perspective:

The penetration testing software market has grown significantly and evolved in recent years. Penetration testing, also known as ethical hacking, evaluates computer systems, networks, and applications to identify vulnerabilities that malicious actors could exploit. Penetration testing software is crucial in conducting these assessments, helping organizations identify weaknesses in their security infrastructure and develop effective countermeasures. Several factors have contributed to the growth of the penetration testing software market. First and foremost, stringent regulatory requirements and compliance standards, like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), have compelled organizations to adopt robust security practices. Penetration testing software enables companies to meet these requirements and demonstrate their commitment to data protection.

Additionally, the rising adoption of cloud computing, Internet of Things (IoT) devices, and mobile technologies have expanded the attack surface for potential cyber threats. Penetration testing software helps organizations assess the security posture of these complex and interconnected systems, identifying vulnerabilities and providing recommendations for remediation.

The market offers a range of penetration testing software solutions, including commercial and open-source options. These tools provide functionalities such as vulnerability scanning, network mapping, password cracking, and exploit simulation. They often incorporate automation and reporting features to streamline the testing process and provide comprehensive assessment reports to clients. Key penetration testing software market players include established cybersecurity firms, niche software vendors, and open-source communities. The penetration testing software market is anticipated to continue its growth trajectory. The rise in adoption of technologies such as artificial intelligence (AI) and machine learning (ML) will likely shape the future of penetration testing, enabling more sophisticated and accurate identification of vulnerabilities. As organizations prioritize cybersecurity and invest in robust testing methodologies, the demand for penetration testing software will remain strong, fostering a competitive and dynamic market landscape.

Market Overview:

A cybersecurity defense technique called penetration testing aims to trick attackers by dispersing several traps and dummy assets throughout a system's infrastructure to mimic real assets. Additionally, it aids in identifying weaknesses in frontend/backend servers, unsensitized inputs vulnerable to code injection attacks, and other application systems. The market for penetration testing software has experienced a surge in need due to the rising number of cyber threats and data breaches across various industries. Organizations are becoming more aware of the significance of proactive security measures to safeguard their digital assets and protect sensitive information from unauthorized access.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Penetration Testing Software Market: Strategic Insights

Market Size Value in US$ 1,580.4 million in 2021 Market Size Value by US$ 4,045.2 million by 2028 Growth rate CAGR of 14.4% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Penetration Testing Software Market: Strategic Insights

| Market Size Value in | US$ 1,580.4 million in 2021 |

| Market Size Value by | US$ 4,045.2 million by 2028 |

| Growth rate | CAGR of 14.4% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Demand for Comprehensive Reporting and Compliance Audits to Drive Growth of Penetration Testing Software Market

The demand for comprehensive reporting and compliance audits is a significant driver fueling the growth of the penetration testing software market. In today's regulatory landscape, organizations are subject to various data protection and privacy regulations, such as GDPR, PCI DSS, HIPAA, and others. Compliance with these regulations is essential for avoiding legal penalties, maintaining customer trust, and protecting the organization's reputation. Penetration testing software plays a key role in helping organizations meet compliance requirements. These tools provide in-depth assessments of the security posture, identifying vulnerabilities and potential weaknesses in systems, networks, and applications. Organizations can proactively identify security gaps and take appropriate remedial actions by conducting thorough penetration tests.

Furthermore, penetration testing software generates detailed reports that outline the identified vulnerabilities, their severity, and recommended remediation measures. These comprehensive reports serve multiple purposes. First, they provide organizations with a clear understanding of their security risks, allowing them to prioritize and allocate resources for remediation efforts effectively. Second, the reports are evidence of due diligence during compliance audits, demonstrating that the organization has taken proactive measures to protect sensitive data and mitigate potential threats. The availability of comprehensive reports benefits internal stakeholders such as IT and security teams and plays a crucial role in effective communication with management, executives, and board members. These reports provide a tangible representation of the organization's security posture, enabling non-technical stakeholders to understand the risks and make informed decisions regarding cybersecurity investments and strategies.

Additionally, the demand for compliance audits drives the growth of the penetration testing software market. Organizations are increasingly required to undergo regular audits to validate their compliance with industry-specific regulations. Penetration testing software facilitates these audits by providing detailed documentation of the testing process, identified vulnerabilities, and the steps to address them. This documentation helps auditors assess the effectiveness of security measures and determine if the organization is meeting regulatory requirements. Overall, the demand for comprehensive reporting and compliance audits is a crucial driver of market growth for penetration testing software. The ability of these tools to generate detailed reports empowers organizations to proactively address security vulnerabilities, demonstrate compliance with regulations, and communicate their security posture effectively to stakeholders. As regulatory requirements evolve, the demand for robust penetration testing software with comprehensive reporting capabilities is expected to increase, driving further market growth.

Segmental Analysis:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

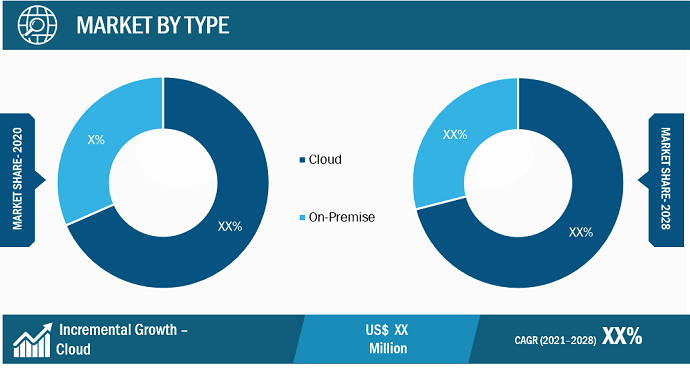

Based on type, the market is bifurcated into cloud-based and on-premises. The cloud-based segment held the largest share of the market in 2020 and is anticipated to register the highest CAGR in the market during the forecast period. The cloud segment has emerged as the dominant player in the penetration testing software market, holding the largest share. This is due to cloud-based solutions' flexibility, scalability, agility, and collaboration advantages. Cloud-based penetration testing software allows organizations to conduct tests from anywhere without significant hardware investments. It enables faster testing cycles, supports distributed teams, and offers built-in automation capabilities. Additionally, cloud-based solutions have robust security features and compliance certifications, instilling trust in organizations. As cloud adoption continues to rise, the demand for cloud-based penetration testing software is expected to drive market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

The North America penetration testing software market was valued at US$ 661.01 million in 2021 and is projected to reach US$ 1,635.87 million by 2028; it is expected to grow at a CAGR of 13.8% during the forecast period. North America has established its dominance in the penetration testing software market through several key factors contributing to its leadership position. First, North America has many major technology and cybersecurity companies, including industry leaders and innovators. These companies have played a vital role in driving the development and adoption of penetration testing software. Their strong presence and influence have shaped the market and set industry standards, attracting customers from various sectors. Secondly, North America has been at the forefront of addressing cybersecurity challenges and has implemented stringent regulations and compliance standards. The region's proactive approach to cybersecurity, driven by regulatory bodies such as the National Institute of Standards and Technology (NIST) and the Department of Defense (DoD), has heightened the demand for penetration testing software as organizations strive to meet these requirements. The need for robust security measures and regulatory compliance has further fueled North America's market growth.

Furthermore, North America has witnessed a high frequency of high-profile cyberattacks and data breaches, resulting in significant financial losses and reputational damage. These incidents have increased awareness among organizations about the importance of investing in effective cybersecurity measures, including penetration testing software. The region's proactive response to these cyber threats has propelled the market's growth as organizations seek to defend their digital assets and customer data. North America has a highly developed IT infrastructure and many organizations across various industries, including finance, healthcare, retail, and technology. These sectors, particularly vulnerable to cyber threats, have recognized the importance of penetration testing software in identifying and mitigating vulnerabilities. The region's strong economic growth and the increasing digitization of industries have further driven the demand for robust cybersecurity solutions, including penetration testing software.

Moreover, North America boasts a mature venture capital ecosystem, facilitating significant investments in cybersecurity startups and innovative technologies. This has fostered a vibrant ecosystem for penetration testing software providers, encouraging competition and driving innovation in the market. North America's dominance in the penetration testing software market can be attributed to its strong presence of technology and cybersecurity companies, proactive cybersecurity measures, high-profile cyber incidents, diverse industry sectors, mature venture capital ecosystem, and robust IT infrastructure. These factors have collectively contributed to North America's leadership position in the market, with the region persisting in driving growth and innovation in the penetration testing software sector.

Key Player Analysis:

The penetration testing software market analysis consists of the players such as Acunetix, Bugcrowd, Defendify, HackerOne, Intruder Systems Ltd, Netsparker Ltd., Pentest-Tools.com, Rapid7, Veracode, Inc., and HelpSystems. Among the players in the penetration testing software Defendify and Netsparker Ltd., are the top two players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the penetration testing software market. A few recent key market developments are listed below:

- In April 2022 - Rapid7 a leading provider of security analytics and automation, announced the formation of the Rapid7 Cybersecurity Foundation, a 501(c)(3) private foundation receiving all of its initial $1 million in funding from Rapid7. The Rapid7 Cybersecurity Foundation’s mission is to close the security achievement gap by making cybersecurity easier to access for the underrepresented and underserved.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Enterprise Size, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Rise in Penetration of Internet and Cloud-Based Services

Increasingly Stringent Rules and Compliance Requirements to Necessitate Use of Penetration Testing Software

The growing demand for Penetration Testing-as-a-Service (PTaaS) and Remote Working Security is anticipated to offer ample future growth opportunity to the Penetration Testing Software market solution providers over the forecast period of 2021 to 2028. Cloud-based penetration testing, also known as penetration testing-as-a-service, is becoming more popular in the cybersecurity business (PTaaS). PTaaS gives IT professionals the tools to do continuous penetration testing and act on the results. It entails a never-ending cycle of testing and correction. This continual cycle of testing and remediation in a PTaaS demonstrates that an ongoing testing and management program is required to battle the company's shifting security posture. Continuous security management, frequent vulnerability scanning, and automatic track changes feature enable traceability of application security improvements with PTaaS. One of the most significant advantages of outsourcing penetration is keeping up with the latest tools and cyber trends in the market. Following the outbreak of COVID-19, businesses worldwide embraced a cloud-based remote work culture. Many employees have begun accessing company data via insecure personal devices such as laptops, tablets, PCs, and cellphones, opening the door to attackers. As a result, remote working environments must be secured through remote security assessments. According to industry experts, several organizations have plans to continue working from home long after the pandemic has passed. In the future, this is projected to open up several prospects for PTaaS and remote working security evaluations.

Key companies in the Penetration Testing Software market include Acunetix, Bugcrowd, Defendify, HackerOne, Intruder Systems Ltd, Netsparker Ltd., Pentest-Tools.com, Rapid7, Veracode, Inc., and HelpSystems

The US is a significant contributor to the penetration testing software market in 2020. The United States hosts the world's most important number of botnet control servers. With technical developments in economies like the United States, the area can spend heavily on future technology. Web application penetration testing, mobile application penetration testing, and network penetration testing are priorities for public and private companies in the country.

Based on type, the global Penetration Testing Software market is segmented into on-premise, and cloud-based. The global Penetration Testing Software market is dominated by cloud-based segment in 2020, which accounted for ~68.4%, and it is expected to account for 71.0% of the total market in 2028.

Artificial intelligence (AI) and machine learning (ML) are more widely used in various industries. These sophisticated tools, ranging from chatbots to data analytics, allow businesses to optimize processes and gain a deeper understanding of their data. AI aids in the automation of pen-testing, allowing for a more significant scale. Human testers will not be replaced by AI or machine learning. Instead, it supplements their efforts and gives intelligence to help them make better decisions. AI and machine learning can assist the pen tester in gathering all of the data, analyzing it, and determining possible courses of action. For example, based on the data acquired, it can select the optimal social engineering assault (social engineering is the use of deception to manipulate people into disclosing confidential or personal information that can be used for fraudulent purposes). It might also be used to select the target hosts that should be targeted first since they have a higher chance of succeeding. The use of artificial intelligence and machine learning to improve the accuracy of results and the efficiency of evaluations is the future of penetration testing. It is also crucial to remember that pen testers must still use their experience and knowledge to determine the best line of action for completing the assessment.

The List of Companies - Penetration Testing Software Market

- Veracode, Inc.

- Rapid7

- Defendify

- Acunetix

- Bugcrowd

- HackerOne

- Intruder System Ltd

- Netsparker

- Pentest-Tools

- HelpSystems

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Penetration Testing Software Market

Jan 2022

Engineering Professional Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Consulting, Non-Consulting), Service Type (Designing and Construction, ESG, Program Management, Others), Sector (Private, Public), Vertical (Advanced Manufacturing, Infrastructure, Energy and Utilities, Environmental, Transportation, Others), Advanced Manufacturing (Data Center, Life Sciences, Electronics, and Semiconductor, EV and EV Battery, Others), Infrastructure (Buildings and Cities, Health Infrastructure, Telecommunication Infrastructure, Others), Energy And Utilities (Renewables, Energy Storage, Transmission and Distribution), Transportation (Aviation, Highways and Bridges, Ports and Maritime, Rail and Transit), Water (Water, Wastewater), and Geography (Americas, Europe, Asia Pacific and Middle East and Africa)

Jan 2022

Virtual Reality Puzzle Games Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Age (18 to 34 Years, Above 35 Years, 13 to 17 Years, and Upto 12 Years), Player Type (Single Player and Multi Player), and End Users (Individuals and Professionals)

Jan 2022

Inspection Software for Government Services Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software and Services), Services (Implementation and Deployment, Support and Maintenance, Training, and Consulting), Deployment (Cloud and On-premises), Application (Permitting and Licensing Management, Inspection and Scheduling Management, Contract Management, and Others), and End User (Local Government, State Government, and Federal Government)

Jan 2022

Spend Analytics for Electronics and Semiconductor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Component (Software and Service), Type (Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics), Deployment (On-premise and Cloud), and Application (Financial Management, Risk Management, Governance and Compliance Management, Supplier Sourcing and Performance Management, Demand and Supply Forecasting, and Others)

Jan 2022

Photonic Design Automation Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Service), Deployment (On-Premise and Cloud), Organization Size (SMEs and Large Enterprises), and Application (Academic Research and Industrial Research & Manufacturing)

Jan 2022

Voice-based Payments Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), By Enterprise Size (Large Enterprises and Small and Medium-Sized Enterprises), By Industry (BFSI, Automotive, Healthcare, Retail, Government, and Others), and by Geography

Jan 2022

Private 5G Network Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software, and Services); Frequency (Sub-6 GHz and mmWave), End User (Manufacturing, Energy and Utilities, Automotive, Military and Defense, Government and Public Safety, and Others)

Jan 2022

Unified Threat Management Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services); Deployment (Cloud and On-Premise); Enterprise Size (Large Enterprises and SMEs); and End Users (BFSI, Manufacturing, Healthcare, Retail, Government, IT & Telecom, and Others)