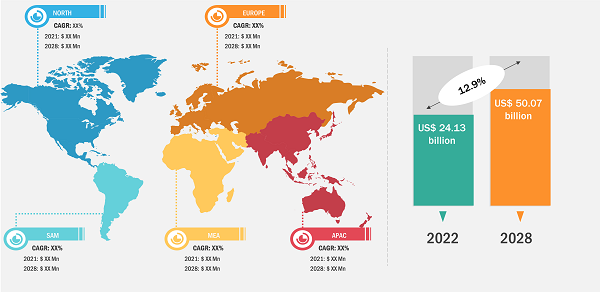

The managed security services market is expected to reach at US$ 50.07 billion by 2028; registering at a CAGR of 12.9% from 2022 to 2028, according to a new research study conducted by The Insight Partners.

Increase in Cybercrime to Provide Growth Opportunities for Managed Security Services Market Size During 2022–2028

Cybercrime is rapidly rising across the globe owing to the increase in the adoption of cloud services and bring your own device trend among offices. Businesses suffer huge losses owing to the rise in cybercrimes. Digital transformation across society is changing the way of business transactions. Many businesses conduct banking and financial transactions through online services. Cybercriminals are continuously attacking BFSI sectors to gain sensitive information for their monetary profit. This led the BFSI sector to become the most favorable destination for cyber criminals and extremely vulnerable to various forms of cyber-attacks. Phishing, distributed denial of service (DDoS), and ransomware are the most popular cyber-attacks the BFSI sector has witnessed in the last two years. Hence, the demand for managed security services in the BFSI sector is increasing, thereby contributing to the managed security services market growth.

Managed Security Services Market Share– by Region, 2022

Managed Security Services Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Service Type (Threat Management, Vulnerability Management, Log Management, SIEM, and Compliance Management), Threat Management Type [Managed Firewall, Managed IDS/IPS, Managed Virtual Private Network (VPN), Managed Anti-Virus and Malware, Managed Gateway Security, Managed Identity Access Management (IAM), Managed Data Loss Prevention (DLP), and Others], Deployment Type (Hosted MSS and CPE MSS), Enterprise Size (Large Enterprises and SMEs), Vertical (Retail, Manufacturing, BFSI, IT & Telecom, Healthcare, Government, Energy & Utility, Media, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

Managed Security Services Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis

Download Free Sample

The managed security services landscape is growing and evolving with innovative services to secure the IT infrastructure of organizations efficiently and proficiently. Due to the lack of a skilled workforce, many organizations are not capable enough to fully protect their IT infrastructure. Moreover, because of the increased sophistication of cyber-attacks, it is becoming very challenging for organizations to rely on and invest in their in-house security processes. Hence, many organizations are migrating from their in-house security processes to third-party MSSPs. MSSPs offer complete managed security services to organizations with round-the-clock monitoring of their IT infrastructure and protect them from potential threats and cyber-attacks. Present-day security processes demand a balance of device management, event monitoring, and incident response, as well as governance, risk, and compliance functions. Increasing number of cyber-attacks and ever-growing complex risk and compliance requirements have led to the demand for third-party specialized security service providers.

Organizations across verticals are migrating from traditional in-house IT infrastructure to cloud technology to manage their infrastructure growth. MSSPs are also looking at this as an opportunity to adopt a cloud-based service model. MSSPs are planning to offer consumption-based or on-demand managed security services to organizations. This deployment model is expected to gain more traction in the next few years. Similarly, organizations are also preferring cloud-based managed security services delivery model as compared to a fixed-price long-term contracts model, as the price charges are as per the usage. These factors are further contributing to the growth of the managed security services market share.

The COVID-19 pandemic positively impacted the managed security services market growth. To combat the rapid spread of the virus, industries across the globe adopted work-from-home policies, thereby increasing the risk of data theft and loss. This rise in the risk of data loss or cybercrimes fueled the demand for advanced security solutions and services across industries such as IT & telecom, healthcare, and energy & utilities. These factors positively impacted the managed security services market during the pandemic.

Based on vertical, the managed security services market size is segmented into IT & telecom, retail, BFSI, healthcare, government, manufacturing, energy & utility, media, and others. The BFSI segment accounted for the largest share in 2021 in the global managed security services market. With the changing business landscapes, financial institutions must think beyond just an automated banking service and focus on risk management techniques. In this highly competitive market, providing advanced, secure, and cost-effective solutions has become a necessity for the banking sector. To enhance the overall customer experience, banks are increasingly adopting new technologies such as satellite banking, automatic teller machines, biometrics, internet and mobile banking, and electronic funds transfer system. Securing the clients' confidential information is one of the major concerns in the banking industry and needs to be dealt with primarily. Managed security services offer various security features for the banking sector, such as network security, IAM, DDoS defense, and compliance management, which maintains the confidentiality of customers’ information.

The key players operating in the managed security services market include AT&T Inc, IBM Corporation, Dell Secureworks Inc, Trustwave Holdings Inc, Verizon Communications Inc, Symantec Corporation, Hewlett Packard Enterprise Co, CenturyLink, NTT Corporation, and British Telecommunications.

- In 2021, IBM Corporation announced the launch of its SASE services for cloud users. The services are designed to offer cloud security to both users and devices that have access to business resources.

- In 2021, SecureWorks entered into a strategic partnership with NEXTGEN to offer its cloud-based extended detection and response services in APAC.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com