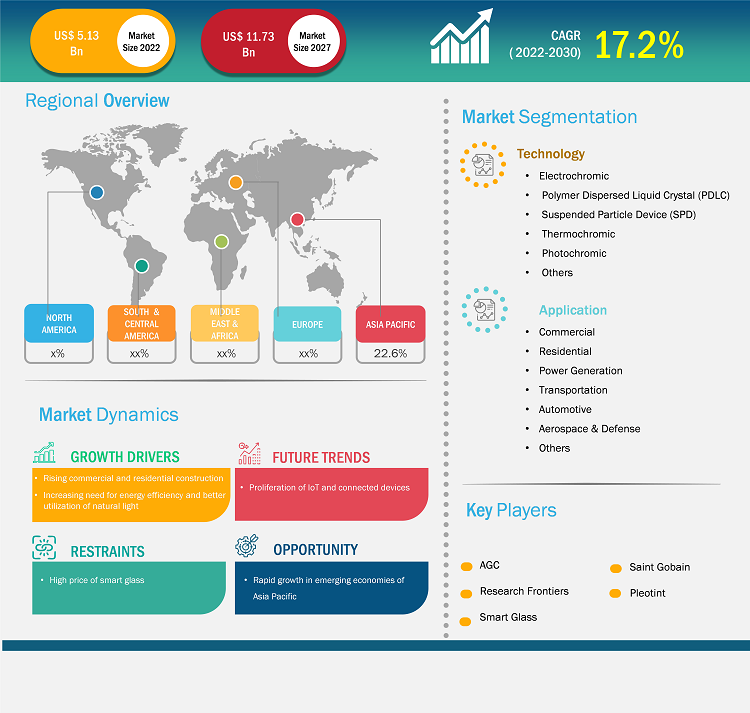

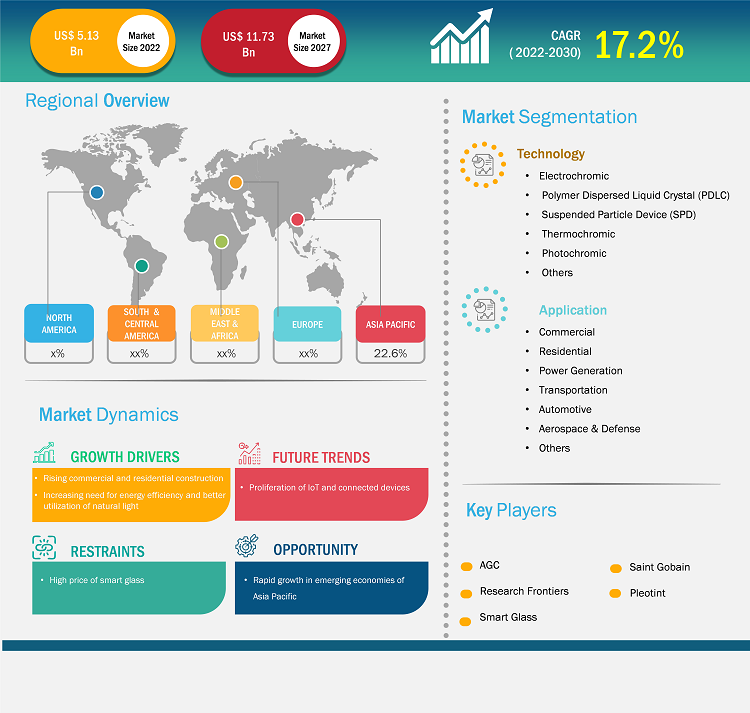

The smart glass market was valued at US$ 2.85 billion in 2018 and is projected to reach US$ 11.73 billion by 2027; it is expected to grow at a CAGR of 17.2% during 2019–2027.

Analyst Perspective:

The smart glass market has recently experienced remarkable growth and technological advancement, with several key areas driving this evolution. Augmented reality (AR) and virtual reality (VR) smart glasses have gained significant traction, expanding their applications beyond entertainment and gaming to fields such as automotive, data analytics, and industrial smart manufacturing. AR smart glasses have become increasingly popular due to their ability to overlay digital information onto the user's real-world environment. This technology has found practical use in various industries, such as healthcare, construction, and logistics, where hands-free access to crucial data and visual guidance is essential. Additionally, the augmented and virtual reality smart glasses market has continuously grown, with manufacturers competing to deliver more immersive and intuitive experiences. Switchable and electrochromic glass technology has played a vital role in transforming the smart glass industry. By adjusting the tint or opacity of the glass, these innovative solutions offer increased privacy, energy efficiency, and enhanced user comfort in architectural applications. These advancements have particularly influenced the smart glass and smart window market, attracting attention from commercial and residential sectors seeking to incorporate smart glass technologies into their buildings. Moreover, the automotive smart glass market has significantly developed, with manufacturers integrating smart glass technologies into vehicles. This inclusion enhances the driving experience by providing heads-up displays (HUDs), augmented navigation, and real-time information, all contributing to improved safety and convenience for drivers. The demand for active smart glasses has also risen, catering to users who seek dynamically changing lenses or adjustable visual enhancements. These glasses have features like photochromic lenses, offering adaptive eyewear for various lighting conditions and user preferences. In industrial smart manufacturing, smart glasses have revolutionized how workers interact with machines and access information on the factory floor. The integration of artificial intelligence (AI) glasses has enabled real-time data analysis, improving productivity and efficiency while reducing errors. As the smart glasses market continues to evolve, more players are entering the smart glasses industry, offering innovative solutions and improved functionality. Top smart glass brands strive to provide the best smart glasses, incorporating cutting-edge technologies and seamless user experiences.

Market Overview:

Smart glass is a kind of architectural glass that alters how much light it can transmit in response to temperature, voltage, or light changes. These panes are frequently used for internal partitions, windows, and skylights in residential and commercial buildings. With smart eyewear, manual and automatic controls are both feasible. Technologies for smart glass include electrochromic, photochromic, thermochromic, suspended-particle, micro-blind, and polymer-dispersed liquid-crystal devices. Smart glass creates climate-adaptive building shells when integrated into the building envelope. Blinds, shades, and other window treatments may not be necessary with smart windows. In addition to controlling natural light, the smart glass may limit UV and infrared light, display advertisements, and offer security.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Smart Glass Market: Strategic Insights

Market Size Value in US$ 2.85 Billion in 2018 Market Size Value by US$ 11.73 Billion by 2027 Growth rate CAGR of 17.2% from 2019-2027 Forecast Period 2019-2027 Base Year 2019

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Smart Glass Market: Strategic Insights

| Market Size Value in | US$ 2.85 Billion in 2018 |

| Market Size Value by | US$ 11.73 Billion by 2027 |

| Growth rate | CAGR of 17.2% from 2019-2027 |

| Forecast Period | 2019-2027 |

| Base Year | 2019 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Rise in Investment in Infrastructure Projects to Drive Growth of Smart Glass Market

The rise in investment in infrastructure projects has emerged as a crucial driver fueling the growth of the smart glass market. As governments and private sectors increasingly invest in modernizing and upgrading infrastructure, smart glass technologies are finding extensive applications in various projects, leading to a surge in demand for these innovative solutions. One area where smart glasses are making a significant impact is in the construction industry. Augmented reality (AR) smart glasses are utilized during the planning and construction phases to facilitate real-time collaboration, visualize building designs, and streamline stakeholder communication. These glasses enable on-site workers to access vital information, such as 3D models and instructions, without needing physical blueprints, resulting in increased productivity and reduced errors. Moreover, incorporating smart glass technologies in smart buildings has become a prominent trend. Switchable glass technology and electrochromic glasses are being integrated into energy-efficient buildings, optimizing natural lighting and regulating indoor temperature, leading to reduced energy consumption and enhanced occupant comfort. As sustainable building practices gain traction, the smart glass and smart window market is witnessing substantial growth, fueled by the demand for eco-friendly and energy-efficient solutions. The automotive smart glass market is also benefiting from increased infrastructure investments. As governments focus on developing smart cities and transportation systems, smart glasses are integral to advanced vehicles. Augmented reality (AR) HUDs and smart windows equipped with switchable glass technology are being adopted to improve automobile safety, navigation, and connectivity. Furthermore, the industrial smart manufacturing sector is leveraging smart glasses to enhance productivity and efficiency in infrastructure projects. Workers equipped with smart glasses can access real-time data, receive instructions, and troubleshoot issues instantly, reducing downtime and optimizing production processes. As infrastructure projects incorporate smart manufacturing practices, the demand for active smart glasses and AI-driven solutions is expected to grow. The growing investment in infrastructure projects acts as a catalyst for market growth in the smart glass industry. As more projects integrate smart glass technologies to enhance productivity, safety, and sustainability, the demand for AR and VR smart glasses, switchable glass, and other high-technology glass solutions will continue to rise. The convergence of infrastructure development and smart glass applications opens up lucrative opportunities for manufacturers and drives innovation in the smart glasses market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

Based on technology, the smart glass market is segmented into:

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Suspended Particle Device (SPD)

- Thermochromic

- Photochromic

- Others

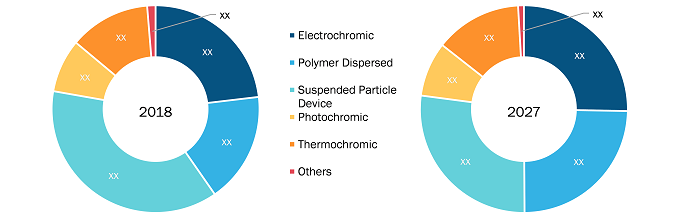

The suspended particle device (SPD) segment held the largest share of the market in 2018 and is anticipated to register the highest CAGR in the market during the forecast period. The suspended particle device (SPD) segment has emerged as the dominant player, holding the largest share in the smart glass market. SPD technology, also known as switchable glass technology, offers significant advantages, such as instant transition between transparent and tinted states, enabling dynamic control over light transmission and privacy. This versatility has garnered immense interest in both architectural and automotive applications. In the architectural sector, SPD smart glass is sought after for its ability to enhance energy efficiency, regulate indoor temperatures, and create interactive and visually appealing environments. Similarly, SPD smart glass is integrated into sunroofs, windows, and sun visors in the automotive industry, providing drivers and passengers with customizable shading options, advanced glare reduction, and improved comfort. As infrastructure investments rise, driving demand for smart glass technologies, the SPD segment is poised to maintain its leadership position, contributing significantly to the overall market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

The North America smart glass market was valued at US$ 10,433.33 billion in 2018 and is projected to reach US$ 15,386.11 billion by 2027; it is expected to grow at a CAGR of 5.1% during the forecast period. The smart glass market in North America has asserted its dominance, exhibiting robust growth and commanding the largest share of the industry. Several key factors have contributed to the region's market leadership. North America has been at the forefront of AR and VR technology development, with numerous companies and startups pioneering innovative applications for smart glasses in healthcare, education, and entertainment. This early adoption has created a strong foundation for the growth of the region's AR and VR smart glasses market. Additionally, North America's infrastructure investments have fueled the demand for smart glass technologies, particularly in the architectural sector. Implementing switchable glass technology, such as suspended particle device (SPD) smart glass, has gained popularity in the region due to its energy-efficient and sustainable features. As smart buildings and green initiatives become a priority, North American markets have witnessed a surge in demand for smart windows and glass solutions that regulate light and temperature, reducing energy consumption and enhancing occupant comfort. The automotive smart glass market has also flourished in North America, driven by the region's advanced automotive industry and the integration of smart technologies in vehicles. Adopting smart glasses, including switchable glass solutions, for sunroofs, windows, and heads-up displays (HUDs) has enhanced the driving experience, contributing to increased safety and convenience on the roads. Furthermore, leading smart glass technology companies and manufacturers in North America have played a pivotal role in the market's dominance. These companies have invested heavily in research and development, driving innovation and bringing cutting-edge smart glass products. Government support for smart infrastructure projects and sustainable building initiatives has further bolstered the smart glass market in North America. Policymakers have recognized the potential benefits of smart glass technologies in terms of energy efficiency, environmental conservation, and enhanced urban living, leading to favorable regulations and incentives that spur market growth.

Key Player Analysis:

The smart glass market analysis consists of the players such as AGC, INC., ArtRatio S.L., Compagnie de Saint-Gobain S.A., Corning Incorporated, GENTEX Corporation, Hitachi Chemical Co., Ltd., Pleotint LLC, Polytronix, Inc., Research Frontiers Incorporated, and Smartglass International Limited. Among the players in the smart glass GENTEX Corporation and Corning Incorporated are the top two players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the smart glass market. A few recent key market developments are listed below:

- In February 2022, Guardian Glass introduced ClimaGuard Neutral 1.0, developed to meet the new Part L UK Building Regulations for windows in new and existing residential builds. Guardian ClimaGuard Neutral 1.0, a thermal insulating coated glass for double-glazed windows, has an Ug-value of 1.0 W/m2K and offers improved aesthetics with a more neutral color and a lower reflection than other 1.0 U-value glass products for residential windows.

- In July 2021, Viracon, a single-source architectural glass fabricator, introduced Viracon PLUS Smart Glass powered by Halio, a breakthrough self-tinting smart glass solution that incorporates Halio, Inc.'s proprietary electrochromic technology into Viracon's insulated glass units. Viracon PLUS Smart Glass powered by Halio optimizes occupant comfort by autonomously adjusting tint levels to reduce energy consumption while natural light is maximized.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

The List of Companies - Smart Glass Market

- AGC, INC.

- ArtRatio S.L.

- Compagnie de Saint-Gobain S.A.

- Corning Incorporated

- GENTEX Corporation

- Hitachi Chemical Co., Ltd.

- Pleotint LLC

- Polytronix, Inc.

- Research Frontiers Incorporated

- Smartglass International Limited

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Smart Glass Market

May 2019

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

May 2019

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

May 2019

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

May 2019

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

May 2019

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

May 2019

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

May 2019

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

May 2019

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)