The synthetic rubber market size is expected to grow from US$ 23,438 million in 2022 to US$ 33,383 million by 2030; it is estimated to register a CAGR of 4.5% from 2022 to 2030.

Market Insights and Analyst View:

Synthetic rubber is a man-made rubber manufactured in plants by synthesizing it from petroleum products. It can undergo elastic stretchability or deformation under stress; however, it can return to its previous size without permanent deformation. The different types of synthetic rubber are acrylic rubber, butadiene rubber, butyl rubber, ethylene propylene diene monomer (EPDM), fluoroelastomers, isoprene rubber, nitrile rubber polychloroprene, perfluoroelastomer, polysulfide rubber, silicone rubber, and styrene butadiene rubber. Ethylene propylene diene monomer rubber has excellent atmospheric aging resistance, meaning it is resistant to heat, ozone, and weather. Also, it has a good resistance to most water-based chemicals. It also has a great resistance to abrasives and tearing. EPDM rubber finds application in automotive weather-stripping and seals, glass-run channels, radiators, garden and appliance hoses, tubing, belts, electrical insulation, roofing membranes, and many other applications. Further, the synthetic rubber market growth is driven by increasing demand from applications such as tires, consumer goods, industrial goods, and others.

Growth Drivers and Challenges:

The major factor driving the synthetic rubber market size is the growing demand for tires. The demand for tires is increasing due to the strong growth of the automotive industry, increasing vehicle production in different countries, and rising consumer demand for automotive vehicles. China, the US, Japan, Germany, India, and Mexico are some of the major countries in the automotive production. China is the world's biggest manufacturer and the leading producer of cars. The country is highly involved in the production of personal passenger cars and commercial vehicles. The Chinese government has taken several initiatives to support automobile manufacturers in pushing the production capacity of the country to 35 million units of vehicles by 2025. The US is another largest car manufacturers in the world. Japan has the largest automotive industry in the world; it is a hub for more than ten major automotive manufacturers, including Suzuki Motor Corporation, Honda Motor Co Ltd, Toyota Motor Corporation, and Mitsubishi Motors Corporation. All these factors are driving the demand for tires, thus driving the growth of the market. Further, the electric vehicle has proven to be an essential technology in terms of reducing air pollution in densely populated areas and a promising option for contribution to energy diversification and the reduction in greenhouse gas emission objectives. Various benefits of electric vehicles include zero tailpipe emissions, the potential for greenhouse gas emissions reductions, better efficiency than internal combustion engine vehicles, etc. To encourage the adoption of electric vehicles, countries such as China, India, and the US have passed regulations. Electric vehicle adoption is expanding as technological progress in the electrification of two-wheelers, three-wheelers, buses, and trucks advances and their market grows. According to a report titled 'The Global EV Outlook 2020' from the International Energy Agency, the global stock of electric passenger cars continued to expand rapidly in 2019, reaching 7.2 million units, 40% higher than in 2018. The government in India is also taking various initiatives to promote the manufacturing of electric vehicles in the country. The increasing production of electric vehicles is also driving the market growth. However, the presence of substitute products such as natural rubber and the environmental consequences of the synthetic rubber production process are expected to hamper the growth of the global synthetic rubber market. Synthetic rubber is non-biodegradable in nature, and this is the most concerning environmental aspect of synthetic rubber. Synthetic rubber products take a very long time to decompose, which results in the accumulation of waste in landfills and natural environments.

Strategic Insights

Report Segmentation and Scope:

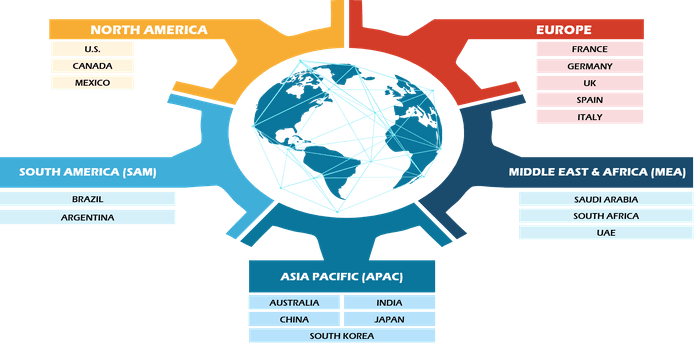

The "Global Synthetic Rubber Market" is segmented based on type, application, and geography. Based on type, the market is segmented into styrene-butadiene rubber, polybutadiene, fluoroelastomers, silicone rubber, nitrile rubber, EPDM, acrylic elastomers, butyl rubber, and others. The market is segmented based on application into automotive, consumer goods, industrial, medical, building and construction, and others. The automotive segment is further broken down into tire and non-tire applications. The market, based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on type, the market is segmented into styrene-butadiene rubber, polybutadiene, fluoroelastomers, silicone rubber, nitrile rubber, EPDM, acrylic elastomers, butyl rubber, and others. The styrene-butadiene rubber segment held a significant synthetic rubber market share and is expected to register significant growth over the studied period. Styrene butadiene rubber is usually very weak unless reinforcing fillers are incorporated. With the use of suitable fillers, this rubber becomes a strong rubber. Styrene butadiene rubber has similar chemical and physical properties to natural rubber. It has better abrasion resistance and poorer fatigue resistance. Demand for styrene-butadiene rubber is increasing sharply with the growing automobile industry. Styrene-butadiene rubber is used in tire and tire products, which also includes tread rubber. It is also used in mechanical goods, adhesives, floor tile, shoe soles, etc.

Regional Analysis:

Based on geography, the synthetic rubber market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global market was dominated by Asia Pacific. Asia Pacific market includes countries such as Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The region dominated the market due to the growing demand for tires as a result of the strong growth of the automotive industry in countries such as China, India, Japan, South Korea, and others. Moreover, the growing demand for synthetic rubber from applications such as consumer goods, medical, and industrial products is also fueling market growth.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the synthetic rubber market are listed below:

- In October 2016, Sabic introduced a new range of synthetic rubber products manufactured for the first time in Saudi Arabia at K2016.

- In 2021, DOW added a gum mixer to the Midland plant to increase its fluoro silicone rubber production capabilities and added a new liquid silicone rubber mixer at its Zhangjiagang (China) facility.

- In November 2021, Asahi Kasei concluded a partnership agreement with Shell (Shell Eastern Petroleum (Pte) Ltd.). Through this partnership, Shell Eastern Petroleum (Pte) Ltd. will be offering high-quality premium sustainable butadiene derived from plastic waste and biomass, and Asahi Kasei will be utilizing sustainable butadiene for the manufacturing of solution-polymerized styrene-butadiene rubber (S-SBR) at its Singapore plant.

- In November 2022, KazMunayGas started construction works on a new butadiene and synthetic rubber plant.

- In March 2018, MOL Group and the JSR Corporation completed the construction of a synthetic rubber plant in Hungary. The plant employs cutting-edge technology and will manufacture annually 60,000 tons of synthetic rubber.

- In May 2023, Arlanxeo announced a plan for the construction of a world-class rubber facility in Jubail, Saudi Arabia. The plant will produce two high-performance elastomers: ultra-high cis Polybutadiene (NdBR) and Lithium Butadiene Rubber (LiBR).

Covid-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in regions such as North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa hampered the growth of several industries, including the chemicals and materials industry. The shutdown of manufacturing units of companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. The negative impact of the pandemic on various industries negatively impacted the synthetic rubber market growth. The negative impact of the pandemic on industries such as automotive, consumer goods, medical, building and construction, and others adversely impacted synthetic rubber consumption. The significant decline in the growth of the automotive industry significantly impacted the demand for synthetic rubber in the global market. Due to the COVID-19 pandemic, the automotive industry for all types of cars was significantly affected. The automotive industry experienced a decline in sales of vehicles. This resulted in reduced demand for tires and different types of synthetic rubber.

However, various industries such as automotive, consumer goods, medical, building, and construction are coming on track after supply constraints affecting these industries are resolving gradually. Moreover, the rising demand for synthetic rubber from various application sectors such as tire, industrial, and others is substantially promoting the growth of the synthetic rubber market.

Competitive Landscape and Key Companies:

A few players operating in the global synthetic rubber market include BASF SE, Dow, Covestro AG, LANXESS, SABIC, DuPont, Huntsman International LLC, KURARAY CO LTD, ZEON CORPORATION, and Sinopec. Players operating in the market focus on providing high-quality products to fulfill customer demand. Players operating in the market also focus on adopting various strategies such as investment in research and development activities, new product launches, collaborations, and partnerships in order to stay competitive in the market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Have a question?

Shejal

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies

1.Basell Polyolefins India Pvt. Ltd.

2.Chevron Phillips Chemical Company

3.China Petroleum and Chemical Corporation

4.DuPont de Nemours Inc.

5.Eastman Chemical Company

6.Exxon Mobil Corporation

7.Hexion Inc.

8.Mitsubishi Chemical Corporation

9.Nova Chemicals Corporation

- Saudi Aramco

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Synthetic Rubber Market

Apr 2024

Construction Additives Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Cement Additives, Concrete Admixtures (Precast Concrete and Ready-Mix Concrete), Paints and Coatings Additives, Adhesives and Sealants Additives, Plastic Additives, Bitumen Additives, and Others], and Application (Residential, Commercial, Infrastructure, and Others)

Apr 2024

Oil Pollution Remediation Materials Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Physical Remediation (Booms, Skimmers, and Adsorbent Materials), Chemical Remediation (Dispersants and Solidifiers), Thermal Remediation, and Bioremediation]

Apr 2024

Greenhouse and Mulch Film Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Greenhouse Films and Mulch Films), Material (LLDPE, LDPE, HDPE, EVA, PHA, PVC, PC, and Others), and Application (Vegetable Farming, Horticulture, Floriculture, and Others)

Apr 2024

Plastic for SLS 3D Printing Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Polyamide, Thermoplastic Polyurethane (TPU), Polyether Ether Ketone (PEEK), and Others) and End-Use Industry (Healthcare, Aerospace & Defense, Automotive, Electronics, Others)

Apr 2024

Carbon Fiber-Based SMC BMC Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Resin Type (Polyester, Vinyl Ester, Epoxy, and Others) and End-Use Industry (Automotive, Aerospace, Electrical and Electronics, Building and Construction, and Others)

Apr 2024

Thermoplastic Adhesive Films Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Material (Polyethylene, Polyamide, Thermoplastics Polyurethane, Polyester, Polypropylene, Polyolefins, Copolyamides, Copolyesters, and Others); Technology (Cast Film and Blown Film); Application (Membrane Films, Barrier Films, and Blackout Films); End Use (Textile, Automotive, Electrical and Electronics, Medical, Ballistic Protection, Lightweight Hybrid Construction, and Others)