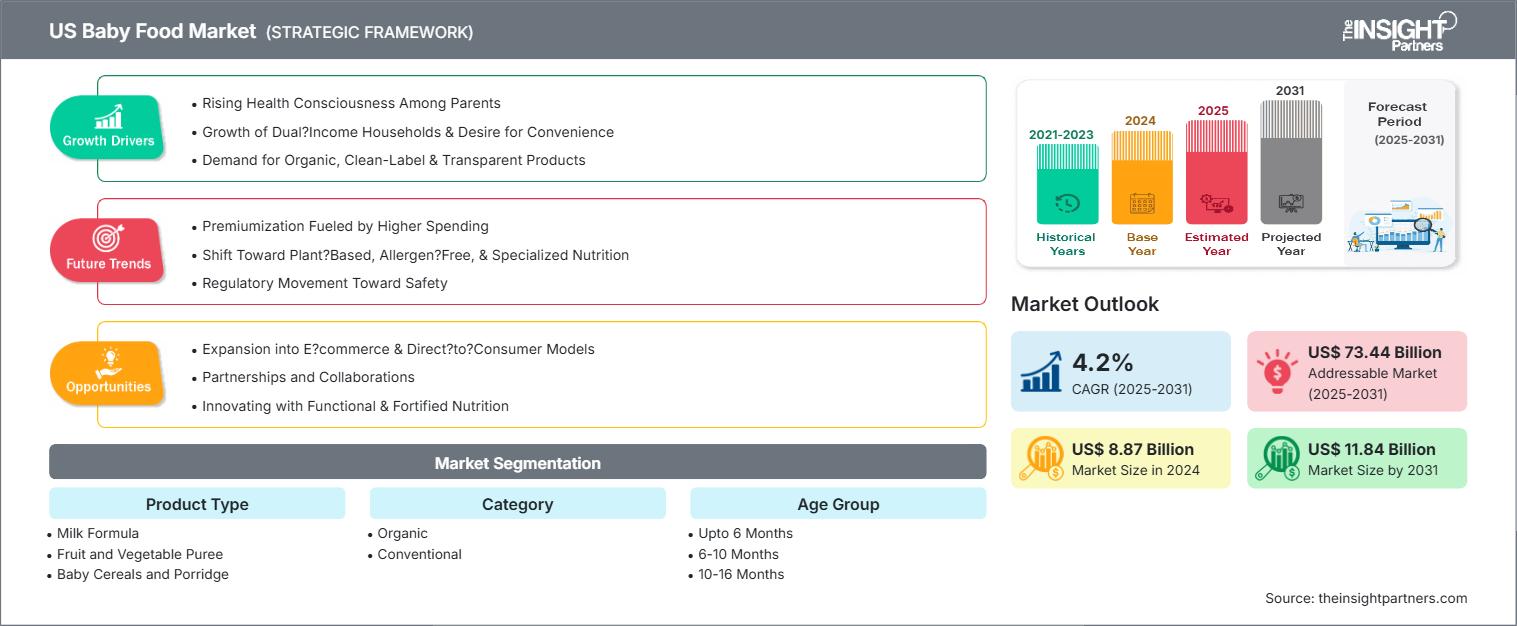

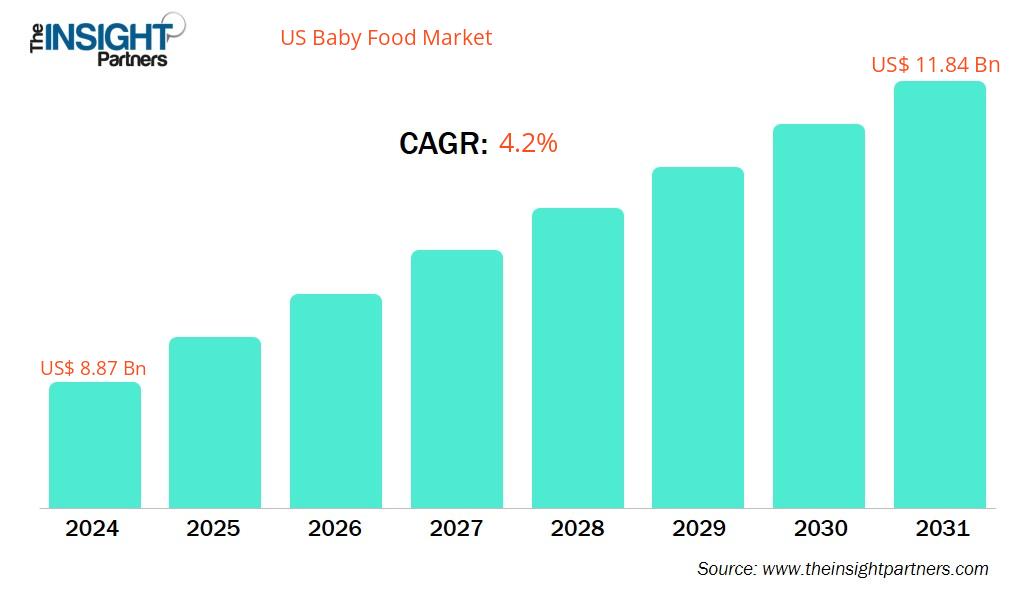

The US Baby Food Market size is projected to reach US$ 11.84 billion by 2031 from US$ 8.87 billion in 2024. The market is expected to register a CAGR of 4.2% during 2025–2031.

US Baby Food Market Analysis

The US baby food market is driven by increasing parental focus on health, nutrition, and convenience, with rising demand for organic, clean-label, and allergen-free products. Health-conscious millennials and Gen Z parents are influencing a shift toward transparent, sustainably sourced ingredients. This evolving consumer behavior presents strong growth opportunities for brands to innovate with fortified blends, plant-based options, and functional nutrition targeting immunity and development. Expanding e-commerce and direct-to-consumer models offer new avenues for market penetration and personalized product delivery. These drivers and opportunities reshape the market, encouraging continuous innovation and premiumization across all segments.

US Baby Food Market Overview

The US baby food market is experiencing steady growth, driven by rising health awareness among parents and increasing demand for organic, clean-label, and nutrient-rich products. Consumers are seeking convenient, safe, and natural options for infant nutrition, leading to innovation in product formats and ingredients. The market is also benefiting from the expansion of e-commerce, sustainable packaging trends, and a shift toward plant-based and allergen-free offerings. These factors collectively shape a dynamic and evolving landscape for baby food manufacturers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Baby Food Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Baby Food Market Drivers and Opportunities

Market Drivers:

- Rising Health and Nutrition Awareness: Parents are increasingly focused on providing balanced, nutrient-rich diets for their babies, fueling demand for wholesome and fortified baby food.

- Growing Preference for Organic and Clean-Label Products Concerns about artificial additives, GMOs, and preservatives are driving consumers toward organic, non-GMO, and clean-label baby foods.

- Increasing Dual-Income Households Time-constrained parents are seeking convenient, ready-to-feed options, pushing demand for pouches, jars, and single-serve packaging.

- Surging Trends in Millennial and Gen Z Parenting Younger parents prioritize transparency, sustainability, and ethical sourcing, influencing the types of baby food products they buy.

- Accelerating Food Allergies and Sensitivities Heightened awareness around infant allergies has led to demand for allergen-free and specialized baby food formulations.

Market Opportunities:

- Expansion of E-Commerce and Direct-to-Consumer Channels Online platforms and subscription models allow brands to reach tech-savvy parents with personalized offerings and convenient delivery.

- Development of Functional Baby Foods A strong potential for products targeting specific health benefits such as immunity, digestion, and brain development has been observed.

- Growth in Plant-Based and Vegan Baby Foods The rising popularity of plant-based diets among adults influences baby food, opening opportunities for dairy-free, meat-free infant nutrition.

- Customization and Personalized Nutrition With data and AI tools, companies can create tailored baby food plans based on age, health needs, and dietary restrictions

- Premiumization of Baby Food Products A growing demand for gourmet-inspired, small-batch, or superfood-enriched baby foods, as parents are willing to pay more for perceived quality, is being experienced.

US Baby Food Market Report Segmentation Analysis

To offer a comprehensive understanding of market dynamics, growth opportunities, and emerging trends, the US baby food market is typically segmented as follows:

By Product Type:

- Milk Formula A staple in infant nutrition, milk formula offers a vital alternative or supplement to breastfeeding, especially for newborns.

- Fruit and Vegetable Puree Popular for early weaning, these purees provide essential vitamins and minerals in an easily digestible form.

- Baby Cereals and Porridge Often, a baby's first solid food is iron-fortified to support growth and development.

- Pureed Meat Rich in protein and iron, pureed meats help meet the nutritional needs of growing infants transitioning to solids.

- Yogurt A source of calcium and probiotics, baby yogurt supports bone health and digestive function.

- Yogurt Melts Convenient, mess-free snacks made from freeze-dried yogurt, offering both taste and nutrition.

- Biscuits and Cookies Designed for teething and self-feeding, these snacks are often fortified with essential nutrients.

- Teether Crackers/Cookies Serve as both snacks and teething aids, helping soothe gums while encouraging independent eating.

- Puffed Baby Snacks Light, airy snacks are ideal for finger food training and sensory exploration in toddlers.

- Baby Snack Bars Portable and nutritious options made with fruits, grains, and natural sweeteners for toddlers on the go.

- Juices and Smoothies Provide hydration and fruit-based nutrition, often with added vitamins and no added sugar.

- Others Includes niche products like plant-based milk alternatives, soups, or supplements targeting specific dietary needs.

By Category:

- Organic Made from certified organic ingredients, this category appeals to health-conscious parents seeking clean, chemical-free nutrition for their babies.

- Conventional Widely available and more affordable, conventional baby food includes standard products that may contain non-organic ingredients but still meet safety and nutrition standards.

By Age Group:

- Up to 6 Months Primarily focused on milk formula and breastmilk substitutes to meet the exclusive nutritional needs of newborns.

- 6 to 10 Months Solid foods like purees and cereals should be introduced to complement milk and support early development.

- 10 to 16 Months Transition to more textured foods and finger foods to encourage self-feeding and chewing skills.

- 16 to 24 Months Increased variety of snacks and meals with balanced nutrition for growing toddlers' active lifestyles.

- 24 to 36 Months Products catering to toddlers' expanding tastes and independence, including more complex flavors and convenient snack options.

By Distribution Channel:

- Supermarkets and Hypermarkets The largest retail channel offering a wide product variety, competitive pricing, and in-store promotions.

- Convenience Stores Provide quick, on-the-go access to essential baby food products, catering to busy parents.

- Pharmacies and Drugstores Trusted for health-related baby products, often featuring specialized and prescription baby foods.

- Online Retail Rapidly growing channel offering convenience, a broader selection, and subscription services for personalized baby food delivery.

- Others Includes specialty stores, baby boutiques, and mass merchandisers that cater to niche consumer needs and premium products.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 8.87 Billion |

| Market Size by 2031 | US$ 11.84 Billion |

| CAGR (2025 - 2031) | 4.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

US

|

| Market leaders and key company profiles |

|

US Baby Food Market Players Density: Understanding Its Impact on Business Dynamics

The US Baby Food Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the US Baby Food Market top key players overview

US Baby Food Market Share Analysis by Geography

The US baby food market is expected to grow the fastest in the next few years. Emerging markets in the US also have many untapped opportunities for baby food providers to expand.

The US baby food market grows differently in each country owing to increasing parental awareness, rising demand for organic and clean-label products, rising prevalence of food allergies and sensitivities in infants, expansion of e-commerce and direct-to-consumer sales channels, and sustainable and eco-friendly packaging trends. Below is a summary of market share and trends by Country:

1. US

- Market Share: Steady growth driven by increasing health awareness and demand for premium products

-

Key Drivers:

- Rising parental focus on infant nutrition and health

- Growing demand for organic and clean-label baby food

- Convenience needs from dual-income households

- Increasing prevalence of infant food allergies and sensitivities

- Trends: Expansion of e-commerce and direct-to-consumer sales

US Baby Food Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Nestle SA, Reckitt Benckiser Group Plc, Royal FrieslandCampina NV, and Danone SA. Regional and niche providers such as The Hain Celestial Group Inc, Sun-Maid Growers of California, Little Spoon Inc, and Nature's Path are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Ensuring high nutritional value, organic certification, and adherence to safety standards

- Clear labeling of clean, non-GMO, and allergen-free ingredients to build consumer trust

- Wide availability through supermarkets, e-commerce platforms, pharmacies, and specialty stores

Opportunities and Strategic Moves

- Capitalize on parents' preference for natural, non-GMO, and additive-free baby foods.

- Develop functional foods targeting immunity, brain development, and digestion.

- Adopt eco-friendly packaging and sustainable sourcing to attract environmentally conscious consumers.

Major Companies operating in the US Baby Food Market are:

- Nestle SA

- The Hain Celestial Group Inc

- Reckitt Benckiser Group Plc

- Royal FrieslandCampina NV

- Hero Group

- Abbott

- HiPP

- Ausnutria Dairy Corporation Ltd

- China Mengniu Dairy Co Ltd

- Danone SA

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed:

- Sun-Maid Growers of California

- Once Upon a Farm

- Cerebelly

- Little Spoon Inc

- Nature's Path

US Baby Food Market News and Recent Developments

- Gerber Introduces Plant-tastic— The Brand's First Complete Range of Organic, Plant-Protein Foods Gerber, a baby food brand of Nestle SA, introduced Plant-tastic, the brand's first complete range of organic-for-toddlers, plant-protein foods. The pouches, snacks, and meals are all made with plant-based, nutrient-dense ingredients.

- New Grips on the Block! Earth's Best Unveils Line of Organic Play + Learn Finger Foods to Help Little Ones Learn to Self-Feed Earth's Best, a baby food brand of The Hain Celestial Group, Inc., launched a new line of organic "play + learn" finger foods designed specifically to help little ones practice and develop their motor skills throughout the weaning journey

US Baby Food Market Report Coverage and Deliverables

The " US Baby Food Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- US Baby Food Market size and forecast for all the key market segments covered under the scope

- US Baby Food Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- US Baby Food Market Market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US Baby Food Market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the US baby food market?

What are the factors driving the US baby food market?

Which are the leading players operating in the US baby food market?

What are the future trends in the US baby food market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For