SAS INSTITUTE, ORACLE CORPORATION, BAE SYSTEMS, OPENTEXT CORPORATION, AND FISERV, INC. – PROMINENT MARKET PARTICIPANTS IN ANTI-MONEY LAUNDERING SOFTWARE MARKET

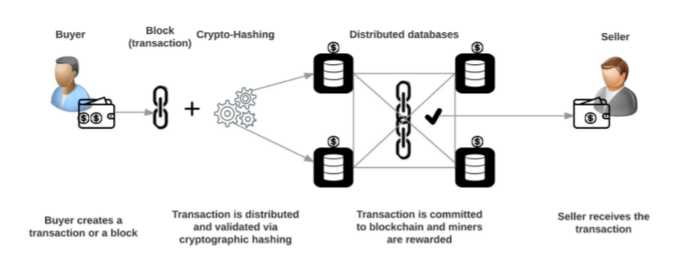

Anti-money laundering software is deployed for meeting the legal requirements of the financial institutions for preventing and reporting the activities of money laundering. Increasing online transactions and rise in concerns regarding fraudulent transactions has steered the adoption of anti-money laundering software globally. Further, supportive government regulations is supplementing the growth of the anti-money laundering software market to a notable extent. Several innovative technology-based tools and products are currently available to detect, track, and prevent money laundering. The software helps in monitoring suspicious activities and customer behavior.

The most prominent market players in anti-money laundering software market are ACI Worldwide, SAS Institute, Oracle Corporation, BAE Systems, Accenture, Verafin Inc., Safe Banking Systems LLC, Eastnets Holding Ltd., Ascent Technology Consulting, and Opentext Corporation among others for a considerable share of the market owing to their product offerings to the market.

Market leaders are involved in taking up various market initiative such as expanding footprint across the world and meet the growing demand of its customers, focusing towards product enhancements by implementing advance technologies, and signing partnership, contracts, joint ventures, funding, and inaugurating new offices across the world to maintain brand name globally. For instance, recently, Verafin was selected by Union Bank (US) to implement loud-based BSA/AML and fraud detection (FRAMLx) software to present financial crime investigators with highly-targeted fraud alerts and multi-channel AML. Further, in 2018, Verafin unveiled FRAMLx, which is an enhancement of its Fraud detection and Anti-Money Laundering (FRAML) software. This new solution permit the institutions to fetch more insight on customer behavior, combine it with their investigations, and thus, detect suspicious activity more accurately. Furthermore, in 2017, SAS Institute announced its partnership with Sumitomo Mitsui Financial Group, Inc. With this partnership Sumitomo Mitsui Banking Corporation uses SAS AI for detection and reporting transactions which is in breach of AML regulations. Subsequently, introduction of such initiation are expected to provide this market with lucrative growth opportunities.

Many well-known as well as small local companies are present in the market to provide diversified software solutions to their customers. The larger firms are adopting the strategy of partnership, contractual alliances for the deployment of anti-money laundering software solutions to enhance their customer portfolio and expand footprint in different geographies. Few on the important market initiatives from the industry are mentioned below:

| Year | News | Country |

| 2019 | Oracle announced its partnership with Arachnys, to provide cloud-native CRI platform of Arachnys to get integrated with and enhance Oracle’s Financial Services Financial Crime and Compliance Management (FCCM) solution suite. | North America |

| 2018 | Mphasis and BAE Systems partnered to launch global Centre of Excellence (CoE) in Fraud Detection and Anti-Money Laundering. The partnership will see the formation of a Centre of Excellence, a virtual team created to deliver BAE Systems’ anti-money laundering and fraud detection and prevention solution, NetReveal. Mphasis will utilise their global delivery capability to help implement the technology to banking, financial services and insurance organisations. | Europe |

| 2018 | BAE Systems launched Match Exclusion a new algorithm engine within its flagship NetReveal Transaction Filtering solution, a major update to the capabilities of its Anti-Money Laundering (AML) and Watch List Management (WLM) solutions. | Europe |

| 2017 | ACI announced its collaboration with Payment21, to permit payment service providers (PSPs) to deal with merchants anti-money laundering (AML)-compliant Bitcoin acceptance through ACI’s UP ecommerce Payments solution. | Europe |