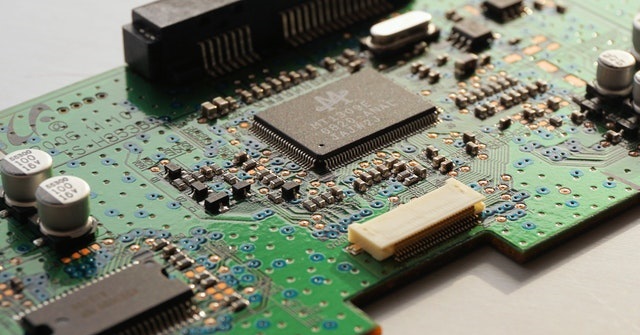

Complex IC designs being integrated into the latest electronics highlight the importance of semiconductor IP

The global Semiconductor IP market is estimated to be US$ 3,346.1 million in 2017 and is estimated to reach US$ 8,265.6 million by 2025. Since the advent of the semiconductor industry, the semiconductor IP has existed in the market with a relatively weaker presence and lesser recognition amongst the various players in the ecosystem. The prominent IC suppliers such as Intel, Fairchild, Texas Instruments, and Motorola had started developing proprietary SIP for internal usage purposes. Also, these SIPs used to be protected by the companies through patents, legal protections and trade secrets. Over the years, the designs of the ICs started getting more complex, and the size of ICs started reducing. Also, the volumetric requirement of the ICs increased over the years.

The global Semiconductor IP market is experiencing an intense growth with regards to the investments, new product developments, and deployment for future in the current scenario and is anticipated to rise in the coming years. The Semiconductor IP market consists of some well-established players across the globe, which invest huge amounts in order to deliver the most advanced product to the customers. Also, there are many stakeholders in the Semiconductor IP ecosystem that are involved in the end-to-end development of Semiconductor IP and ensuring that the best service is made available for the users. Government funding for research & development, automotive manufacturers, communication equipment manufacturers, strategic partnerships between chipset manufacturers, equipment vendors, network operators and Government bodies are anticipated to enable huge surges in the Semiconductor IP market over the forecast period.

Strong internet infrastructural deployments in the advanced countries coupled with the rolling out of advanced infrastructures such as 5G, fiber optic cables, will enable establishment of new use cases such as Fixed Wireless Access, Massive IoT and Critical IoT. Such advancements in the internet technology are driving individuals and businesses to harness the best out of the presented opportunity and maximize the revenue generation streams. It is estimated that each individual will have close to a dozen number of devices that would be connected over the internet by 2020. As per the Ericsson’s latest mobility report, the number of mobile subscriptions grew at $ percent year-on-year basis and has reached 7.9 billion in the first quarter of 2018. The number of mobile broadband subscriptions are growing at 20 percent year-on-year reaching a total of 5.5 billion in the first quarter of 2018. The number of mobile subscriptions exceeds the population in many countries, which is largely due to inactive subscriptions, multiple device ownership or optimization of subscriptions for different types of calls. As a result, the number of subscribers is lower than the number of subscriptions.

Today, there are around 5.3 billion subscribers globally compared to 7.9 billion subscriptions. Also, 98 million new mobile subscriptions was observed globally in first quarter of 2018. Huge populations of India and China are further proliferating the growing penetration of smart phones and other consumer electronic devices. Additionally, the Government initiatives towards digitalization of economies in these countries is leading to exponential growth of data traffic over the internet in these countries and also on a global scale for other developing economies. Brazil, Uruguay, Argentina, Chile, Colombia, UAE, Saudi Arabia, South Africa, Vietnam and Singapore are other major countries embracing the path of digitalization and resulting in huge influx of data over the internet.