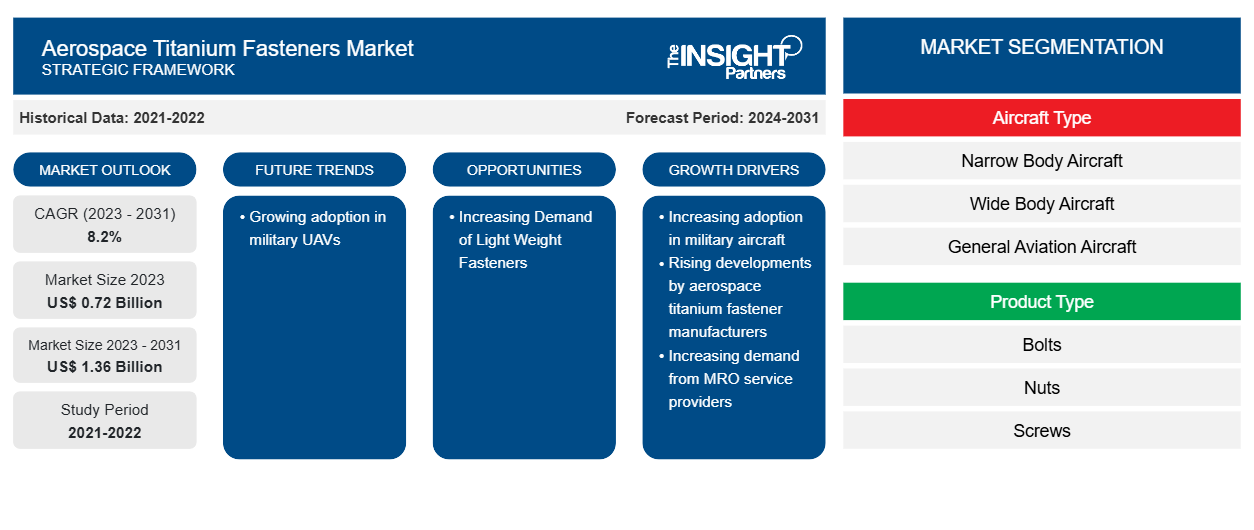

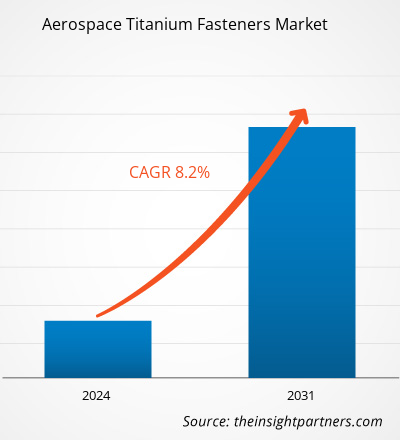

Se prevé que el tamaño del mercado de sujetadores de titanio para la industria aeroespacial alcance los 1.360 millones de dólares en 2031, frente a los 720 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 8,2 % durante el período 2023-2031. Es probable que la creciente adopción de vehículos aéreos no tripulados militares siga siendo una tendencia clave en el mercado.

Análisis del mercado de sujetadores de titanio para la industria aeroespacial

Algunos de los actores clave que operan en el mercado global de sujetadores de titanio para la industria aeroespacial incluyen a LISI Aerospace, Apollo Aerospace Components Limited, Howmet Aerospace Inc, KLX Inc y 3V Fasteners. El mercado está fragmentado y cuenta con una gran cantidad de actores que atienden la demanda nacional e internacional. Las empresas atienden constantemente la demanda generada por sus respectivas flotas regionales, lo que impulsa aún más el crecimiento de los sujetadores de titanio en la industria aeroespacial.

Descripción general del mercado de sujetadores de titanio para la industria aeroespacial

El ecosistema del mercado de sujetadores de titanio para la industria aeroespacial es diverso y está en constante evolución. Sus partes interesadas son los proveedores de materias primas, los fabricantes de sujetadores de titanio para la industria aeroespacial y los usuarios finales. Los principales actores ocupan lugares en varios nodos del ecosistema del mercado. Los proveedores de materias primas proporcionan materiales a los fabricantes de sujetadores, quienes luego los utilizan para fabricar y diseñar los productos finales. El producto final luego se suministra a los fabricantes de aeronaves, fabricantes de componentes y proveedores de MRO a través de diferentes medios, como ventas directas a través de distribuidores de la empresa o ventas de terceros a través de distribuidores externos. Los fabricantes de equipos originales o de componentes de aeronaves luego integran los productos de sujeción a sus respectivos productos de ensamblaje.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de sujetadores de titanio para la industria aeroespacial: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de sujetadores de titanio para la industria aeroespacial

Demanda creciente de proveedores de servicios MRO

Las operaciones de mantenimiento, reparación y revisión (MRO) consisten en la inspección periódica, la rectificación de defectos, la revisión, el reemplazo y la incorporación de la modificación de la aeronave para la aeronavegabilidad continua de una aeronave y sus partes. Las aeronaves reciben un servicio periódico que ayuda a reemplazar y reparar varias piezas aeroespaciales, como el tren de aterrizaje y el motor, para el funcionamiento óptimo de la aeronave. Por lo tanto, el aumento del gasto en MRO para aeronaves militares y comerciales está impulsando posteriormente el crecimiento del mercado de sujetadores de titanio aeroespaciales. Por ejemplo, en marzo de 2021, Sichuan Airlines adjudicó un contrato de servicios MRO de cinco años a MTU Maintenance para sus aviones A319, A320 y A321. En abril de 2021, IndiGo Airlines extendió su contrato MRO con Air France Industries KLM Engineering & Maintenance para su flota A320. Además, otros desarrollos en los años 2022 y 2023 relacionados con las actividades MRO basadas en contratos en diferentes regiones han impulsado el mercado de sujetadores aeroespaciales en diferentes regiones en el pasado. Además, el crecimiento del sector MRO de aeronaves es otro factor importante que probablemente impulsará también el mercado de sujetadores de titanio para la industria aeroespacial en los próximos años.

Demanda creciente de sujetadores livianos

Los actores de la industria de la aviación global enfatizan la fabricación, integración o montaje de materiales livianos en los modelos de aeronaves. Las autoridades de aviación, los fabricantes de aeronaves, los fabricantes de componentes de aeronaves, los proveedores de servicios MRO y las fuerzas militares buscan materiales livianos para cada componente para extender el rango de vuelo de la aeronave y aumentar la eficiencia del combustible. La aleación de titanio se ha convertido en un material estructural esencial para la aviación civil , ya que los fabricantes de aeronaves civiles avanzadas lo utilizan ampliamente. Además, actualmente hay muchas aplicaciones de sujetadores de titanio en la producción de una aeronave. Por ejemplo, las aplicaciones de sujetadores de titanio en una aeronave incluyen trenes de aterrizaje, motores a reacción, aspas de ventilador, alas, hélices, fuselaje y diferentes tipos de ejes. Además, las entregas futuras esperadas de aviones comerciales de alrededor de 40.000 unidades para fines de 2042, también es probable que generen nuevas oportunidades para los proveedores del mercado en los próximos años.

Análisis de segmentación del informe de mercado de sujetadores de titanio para la industria aeroespacial

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de sujetadores de titanio aeroespaciales son el tipo de aeronave, el tipo de producto, la aplicación y el usuario final.

- Según el tipo de aeronave, el mercado se segmenta en aeronaves de fuselaje estrecho, aeronaves de fuselaje ancho, aeronaves de aviación general, aeronaves de carga, helicópteros y aeronaves militares. El segmento de aeronaves de fuselaje estrecho tuvo una mayor participación de mercado en 2023.

- Según el tipo de producto, el mercado se segmenta en pernos, tuercas, tornillos, remaches y otros. El segmento de pernos tuvo una mayor participación de mercado en 2023.

- Según la aplicación, el mercado se segmenta en superficies de control de vuelo, fuselaje, motor, interiores y tren de aterrizaje. El segmento de fuselaje tuvo una mayor participación de mercado en 2023.

- Según el usuario final, el mercado está segmentado en fabricantes de aeronaves, proveedores de servicios MRO y fuerzas militares. El segmento de fabricantes de aeronaves tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de los sujetadores de titanio para la industria aeroespacial por geografía

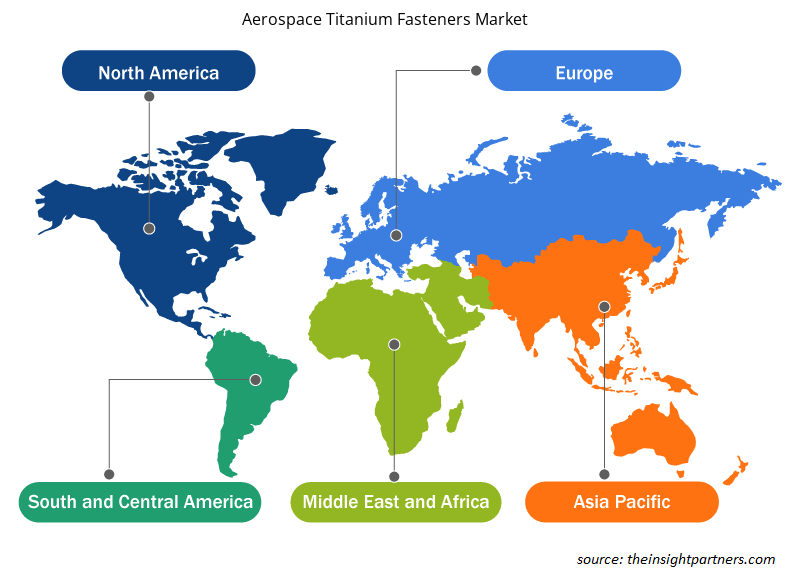

El alcance geográfico del informe del mercado de sujetadores de titanio aeroespaciales se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

En 2023, América del Norte dominó el mercado, seguida de Europa y la región de Asia Pacífico. Además, es probable que Asia Pacífico también experimente la CAGR más alta en los próximos años. Estados Unidos dominó el mercado de sujetadores de titanio aeroespaciales de América del Norte en 2023. Estados Unidos tiene la industria aeroespacial más grande del mundo. Según las estadísticas de la Administración Federal de Aviación (FAA), entre 2022 y 2043 se prevé que el número de aviones en la flota de los principales transportistas estadounidenses crezca de 3.915 a 5.925, lo que se atribuye al crecimiento de los viajes aéreos. Algunos de los mayores fabricantes de aviones del mundo, a saber, Boeing, Lockheed Martin, Textron, Gulfstream y Airbus, tienen sus bases de fabricación establecidas en Estados Unidos. Además, es probable que los sujetadores y otros componentes de aeronaves tengan una gran demanda debido a un aumento en los pedidos de aviones de aviación comercial y de negocios, lo que conduce a impulsar eventualmente el mercado de sujetadores de titanio aeroespaciales.

Perspectivas regionales del mercado de sujetadores de titanio para la industria aeroespacial

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sujetadores de titanio para la industria aeroespacial durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sujetadores de titanio para la industria aeroespacial en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sujetadores de titanio para la industria aeroespacial

Alcance del informe sobre el mercado de sujetadores de titanio para la industria aeroespacial

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 0,72 mil millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | 1.360 millones de dólares estadounidenses |

| CAGR global (2023 - 2031) | 8,2% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de aeronave

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sujetadores de titanio para la industria aeroespacial: comprensión de su impacto en la dinámica empresarial

El mercado de sujetadores de titanio para la industria aeroespacial está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sujetadores de titanio para la industria aeroespacial son:

- Metales XOT

- Leeart Industry Co. Ltd. (Industria Leeart)

- Especialidades B&B Inc.

- Sujetadores 3V

- LISI Aeroespacial

- Aeroespacial Cherry

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sujetadores de titanio aeroespaciales

Noticias y desarrollos recientes del mercado de sujetadores de titanio para la industria aeroespacial

El mercado de sujetadores de titanio para la industria aeroespacial se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los desarrollos en el mercado de sujetadores de titanio para la industria aeroespacial:

- MEIDOH Co., Ltd., líder internacional en la producción de elementos de fijación para automóviles, se complace en anunciar que ha adquirido Pilgrim Screw Corporation, conocida comercialmente como Pilgrim Aerospace Fasteners (“Pilgrim”). (Fuente: MEIDOH Co Ltd, comunicado de prensa, enero de 2024)

- TriMas (NASDAQ: TRS) anunció hoy que TriMas Aerospace ha obtenido contratos plurianuales con Airbus de Toulouse, Francia. Las operaciones Monogram Aerospace Fasteners y Allfast Fastening Systems de TriMas Aerospace obtuvieron nuevos contratos de suministro de Airbus, lo que amplía la actividad de ventas de elementos de fijación de ingeniería de la empresa en Europa. (Fuente: TriMas, comunicado de prensa, febrero de 2020)

Informe sobre el mercado de sujetadores de titanio para la industria aeroespacial: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sujetadores de titanio para la industria aeroespacial (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de sujetadores de titanio aeroespaciales y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de sujetadores de titanio para la industria aeroespacial, así como dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado de sujetadores de titanio para la industria aeroespacial que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de sujetadores de titanio para la industria aeroespacial

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sujetadores de titanio para la industria aeroespacial

Obtenga una muestra gratuita para - Mercado de sujetadores de titanio para la industria aeroespacial