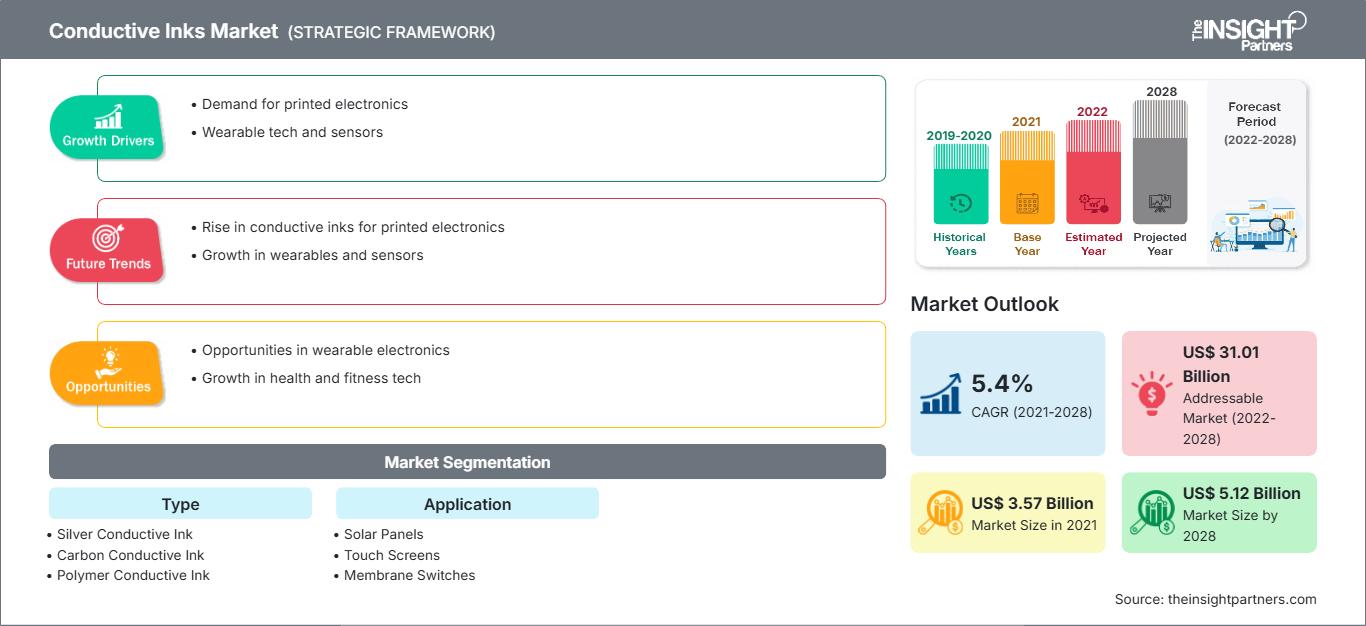

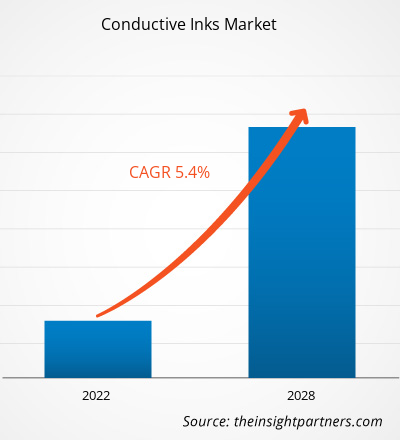

[Informe de investigación] Se espera que el mercado de tintas conductoras crezca de US$ 3.565,80 millones en 2021 a US$ 5.119,80 millones en 2028; se estima que crecerá a una CAGR del 5,4% de 2022 a 2028.

Gobiernos de todo el mundo han promulgado restricciones ambientales para incentivar a las industrias a reemplazar materiales pesados en dispositivos por materiales modernos y ligeros. Además, el deseo de los consumidores por dispositivos electrónicos pequeños y ligeros ha impulsado a la industria de la electrónica de consumo a miniaturizar sus productos. Asimismo, se espera que el rápido crecimiento de las aplicaciones basadas en el IoT y la creciente tendencia a la miniaturización impulsen la demanda del mercado de tintas conductoras. El uso cada vez mayor de teléfonos inteligentes y dispositivos conectados impulsa la necesidad de sensores más pequeños y ligeros con bajo consumo de energía y un rendimiento mejorado, lo que estimula la demanda de miniaturización. China domina toda la cadena de valor del negocio global de fabricación de productos electrónicos y está invirtiendo fuertemente en nuevas técnicas para crear rápidamente productos electrónicos miniaturizados. Por lo tanto, la creciente demanda de miniaturización en teléfonos inteligentes, wearables y otros dispositivos, junto con el aumento de la demanda de dispositivos electrónicos eficientes, impulsa el tamaño del mercado de tintas conductoras.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de tintas conductoras: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado de tintas conductoras

Muchas industrias de electrónica flexible e impresa se enfrentaron a la escasez de mano de obra debido a la pandemia de COVID-19. La demanda de tinta conductora en aplicaciones electrónicas impresas, como la impresión de etiquetas RFID utilizadas en los billetes de transporte público modernos y los desempañadores de parabrisas en vehículos automotrices, está contribuyendo al crecimiento del mercado de tintas conductoras. Además, la disminución de la producción en la industria automotriz ha impactado negativamente al mercado. Según la Organización Internacional de Constructores de Vehículos Motorizados (OICA), las ventas globales de todos los vehículos en 2019 y 2020 fueron de 91.227.182 y 78.774.320, respectivamente. Por lo tanto, la disminución en las ventas de vehículos está impactando negativamente al mercado, ya que la tinta conductora se utiliza para la aplicación de circuitos automotrices y desempañadores impresos, especialmente en las ventanas traseras, en vehículos automotrices. Sin embargo, desde mediados de 2021, la reanudación de los proyectos de extracción de petróleo está impulsando el crecimiento del mercado de tintas conductoras. Sin embargo, antes de la pandemia, el auge de la industria automotriz en Norteamérica, la creciente penetración de los vehículos eléctricos y la creciente concienciación sobre la salud impulsaron la demanda de miniaturización de dispositivos. La industria de la electrónica de consumo ha experimentado un crecimiento. Asimismo, la creciente demanda de dispositivos electrónicos pequeños y ligeros, como relojes deportivos wearables y dispositivos médicos electrónicos para monitorizar la salud, está impulsando el crecimiento del mercado de tintas conductoras.

Perspectivas del mercado: mercado de tintas conductoras

La creciente instalación de paneles solares impulsa el crecimiento del mercado de tintas conductoras

La creciente demanda energética exige el uso de fuentes de energía alternativas. Por ello, se utilizan fuentes de energía renovables, especialmente la energía solar, para generar electricidad. Se prevé que la creciente adopción de la energía solar para la generación de electricidad impulse la demanda de tecnología solar y aumente la implantación de paneles solares en los próximos años. Esto generará una oportunidad para el mercado de las tintas conductoras en aplicaciones fotovoltaicas. Mediante la impresión por inyección de tinta, la tinta conductora permite imprimir paneles solares fotovoltaicos orgánicos sobre superficies muy delgadas y flexibles. El sector solar (fotovoltaico) se ha visto sometido a una gran presión para reducir los costes de las materias primas y aumentar la eficiencia de la producción y así competir con las redes eléctricas existentes. En este caso, las tintas conductoras representan una solución potencial para la industria, impulsando así el mercado de las tintas conductoras.

Perspectivas basadas en tipos

Según el tipo, el mercado de tintas conductoras se segmenta en tinta conductora de plata, tinta conductora de carbono, tinta conductora de polímero, tinta conductora de cobre y otras. El segmento de tinta conductora de carbono tuvo la mayor participación de mercado en 2021. Las tintas conductoras de carbono son lubricantes, lo que proporciona baja fricción y excelente estabilidad térmica. Las tintas se utilizan en serigrafía, inmersión y dispensación con jeringas, y presentan una excelente adhesión al vidrio y una variedad de otros sustratos. A diferencia del material conductor convencional, las tintas de carbono son resistentes a la abrasión, el rayado, la flexión y las arrugas. El desarrollo de las tintas conductoras se vio favorecido por el rápido crecimiento del sector de la electrónica impresa. Los rellenos conductores de las tintas conductoras a base de carbono tenían una amplia oferta, bajo precio, buena estabilidad y mucho valor de aplicación. Nanoshel LLC, Henkel y Dycotec Materials Ltd, se encuentran entre los principales actores del mercado de tintas conductoras de carbono. La presencia de estos actores está contribuyendo al crecimiento del mercado.

Los actores que operan en el mercado de tintas conductoras se centran principalmente en el desarrollo de productos avanzados y eficientes.

- En 2022, la unidad de negocios DuPont Microcircuit and Component Materials anunció el lanzamiento de 5881, una nueva tinta/pasta conductora de plata/cloruro de plata para aplicaciones sanitarias.

- En 2021, DuPont anunció que había completado con éxito la adquisición de Laird Performance Materials, líder mundial en soluciones de gestión térmica y blindaje electromagnético de alto rendimiento.

Perspectivas regionales del mercado de tintas conductoras

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de tintas conductoras durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de tintas conductoras en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de tintas conductoras

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | 3.570 millones de dólares estadounidenses |

| Tamaño del mercado en 2028 | 5.120 millones de dólares estadounidenses |

| CAGR global (2021-2028) | 5,4% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de tintas conductoras: comprensión de su impacto en la dinámica empresarial

El mercado de tintas conductoras está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de tintas conductoras

El mercado de tintas conductoras está segmentado según el tipo y la aplicación. Según el tipo, el mercado se segmenta en tinta conductora de plata, tinta conductora de carbono, tinta conductora de polímero, tinta conductora de cobre y otras. En 2021, el segmento de tinta conductora de carbono lideró el mercado y representó la mayor participación de mercado. En términos de aplicación, el mercado está segmentado en paneles solares, pantallas táctiles, interruptores de membrana, dispositivos médicos, placas de circuitos impresos, sensores, elementos de calefacción, identificación por radiofrecuencia, antenas de teléfonos celulares, automoción y otros. En 2021, el segmento de placas de circuitos impresos lideró el mercado y representó la mayor participación de mercado. Geográficamente, el mercado de tintas conductoras está ampliamente segmentado en América del Norte, Europa, Asia Pacífico (APAC), Oriente Medio y África (MEA) y América del Sur (SAM). En 2021, APAC representó una parte significativa del mercado global.

Applied Ink Solutions; DuPont DE Nemours, Inc.; Henkel AG y CO. KGAA; Inkron OY; Inktec; Heraeus; Novacentrix; POLY-INK; Merck KGAA; y Vorbeck Materials Corporation se encuentran entre las principales empresas que operan en el mercado de tintas conductoras.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de tintas conductoras

Obtenga una muestra gratuita para - Mercado de tintas conductoras