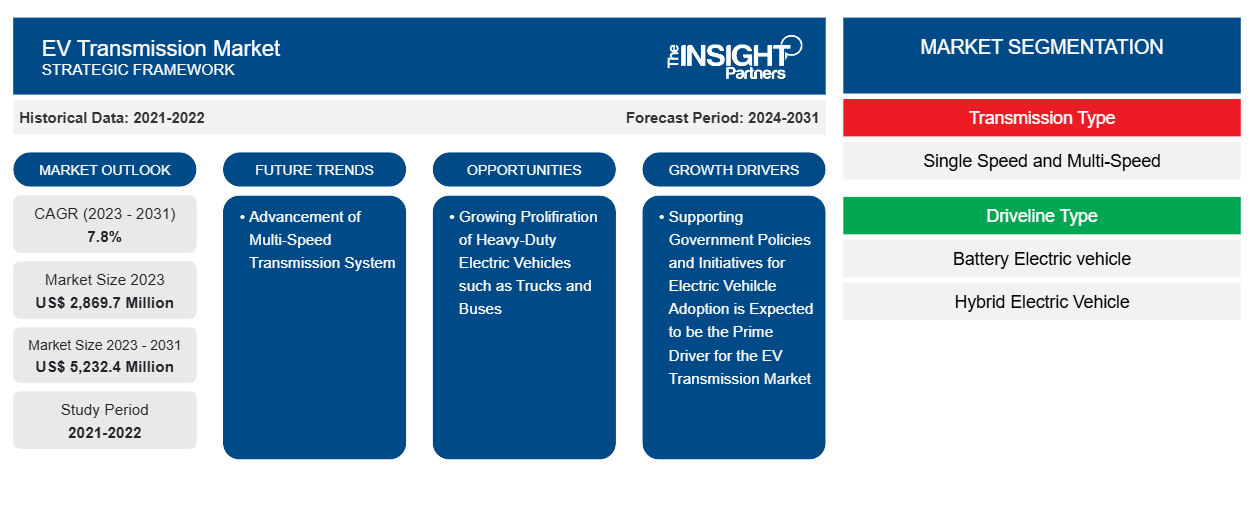

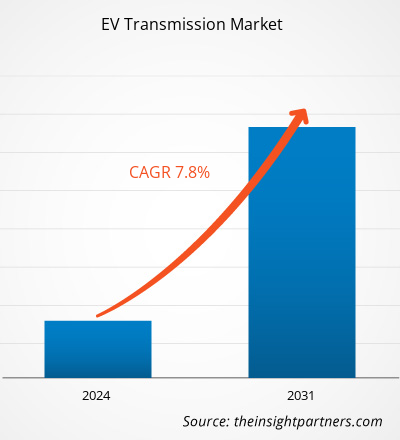

Se proyecta que el tamaño del mercado de transmisión de vehículos eléctricos alcance los 5232,4 millones de dólares estadounidenses para 2031, frente a los 2869,7 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 7,8 % entre 2023 y 2031. El creciente desarrollo de la industria de vehículos eléctricos está teniendo un impacto positivo en la demanda de sistemas de transmisión de vehículos eléctricos a nivel mundial. El objetivo principal de los sistemas de transmisión de vehículos eléctricos es gestionar la potencia de salida de los vehículos eléctricos y también distribuir la potencia a las ruedas. Se prevé que el creciente avance tecnológico en la industria del vehículo impulse el crecimiento del mercado durante el período de pronóstico.

Análisis del mercado de transmisión de vehículos eléctricos

El aumento de las ventas de vehículos eléctricos se debe a la creciente atención a la eficiencia del combustible y a la creciente preocupación por mitigar la contaminación ambiental. Se prevé que el creciente interés de los consumidores en los vehículos eléctricos impulse el crecimiento del mercado de transmisión de vehículos eléctricos a nivel mundial. El énfasis del gobierno en la adopción de alternativas más limpias en la vida diaria es otro factor importante que impulsa las ventas de vehículos eléctricos, lo que está teniendo un impacto positivo en el crecimiento del mercado a nivel mundial.

Descripción general del mercado de transmisión de vehículos eléctricos

El mercado de transmisión de vehículos eléctricos se clasifica en términos de tipo y tipo de transmisión. Según el tipo, el mercado se clasifica en una sola velocidad y varias velocidades. Según el tipo de transmisión, el mercado se divide en vehículos eléctricos a batería (BEV) y vehículos eléctricos híbridos (HEV). Se prevé que la creciente producción de vehículos eléctricos, a medida que la demanda está experimentando una tendencia al alza, impulse el mercado durante el período de pronóstico.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de transmisión de vehículos eléctricos: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

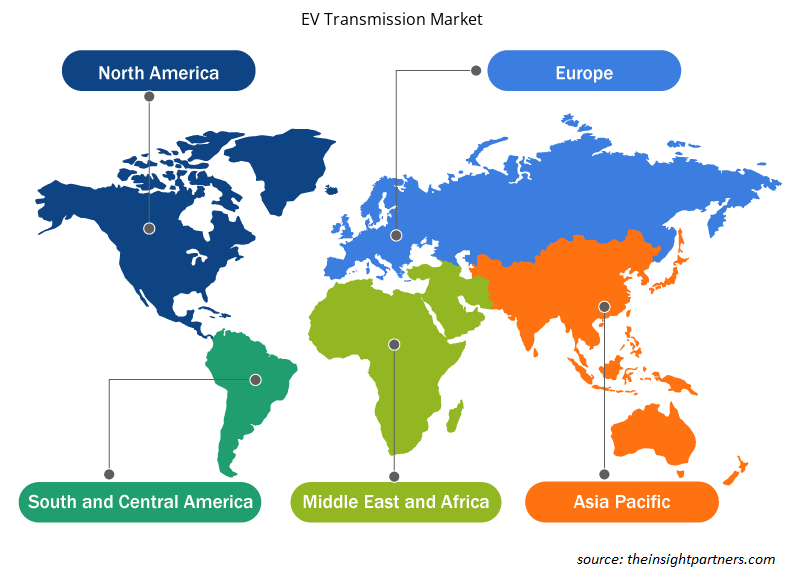

Perspectivas regionales del mercado de transmisión de vehículos eléctricos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de transmisión de vehículos eléctricos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de transmisión de vehículos eléctricos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de transmisión de vehículos eléctricos

Alcance del informe sobre el mercado de transmisión de vehículos eléctricos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 2.869,7 millones |

| Tamaño del mercado en 2031 | US$ 5.232,4 millones |

| CAGR global (2023 - 2031) | 7,8% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de transmisión

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de transmisión de vehículos eléctricos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de transmisión de vehículos eléctricos son:

- BorgWarner Inc

- Continental AG

- Porsche AG

- Corporación Eaton plc

- Dana Incorporated

- ZF Friedrichshafen AG

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de transmisión de vehículos eléctricos

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de transmisión de vehículos eléctricos

Obtenga una muestra gratuita para - Mercado de transmisión de vehículos eléctricos