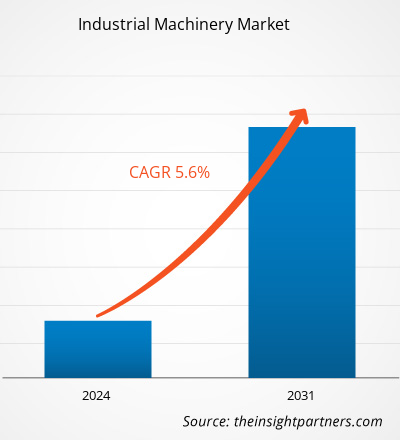

Se proyecta que el tamaño del mercado de maquinaria industrial alcance los 362.700 millones de dólares en 2031, frente a los 234.750 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 5,6 % entre 2023 y 2031. Es probable que el desarrollo de fábricas inteligentes y la creciente demanda de máquinas ecológicas sigan siendo una tendencia clave en el mercado de maquinaria industrial.

Análisis del mercado de maquinaria industrial

El mercado de maquinaria industrial está creciendo a un ritmo rápido debido a la creciente necesidad de reducir los costos operativos y la creciente adopción de maquinaria industrial de las industrias automotriz, de alimentos y bebidas, farmacéutica, manufacturera y otras. El mercado se está expandiendo de manera constante, impulsado por la creciente urbanización y automatización industrial . Además, los avances tecnológicos y la integración de la IA y la tecnología de impresión digital 3D están brindando oportunidades lucrativas para el crecimiento del mercado.

Descripción general del mercado de maquinaria industrial

La maquinaria industrial se refiere a cualquier equipo mecánico, eléctrico o electrónico que está diseñado y utilizado para realizar una función determinada y producir un resultado específico. Los fabricantes de plantas de fabricación utilizan esta maquinaria para cortar, dar forma, formar, laminar o coordinar procesos de producción. La maquinaria industrial desempeña un papel crucial en el apoyo a las actividades industriales en todo el mundo. La creciente digitalización, los avances tecnológicos y las iniciativas de la Industria 4.0 están creando oportunidades en el mercado.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de maquinaria industrial: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de maquinaria industrial

La creciente necesidad de reducir los costos operativos impulsa el mercado

Los menores costos operativos se traducen en mayores márgenes, lo que permite a las empresas diversificar su oferta de productos y acceder a nuevos mercados mediante iniciativas de reducción de costos. La creciente necesidad de las empresas de reducir los costos operativos aumenta la demanda de maquinaria tecnológicamente avanzada. Los fabricantes están integrando aplicaciones de IoT en estos dispositivos para brindar servicios mejorados, como monitoreo remoto, sistemas de retroalimentación central y otras funciones. Además, los fabricantes también están adoptando sensores mejorados, aplicaciones móviles y software integrado para optimizar sus procesos operativos al reducir los costos comerciales generales, lo que impulsa el mercado.

Avances tecnológicos: una oportunidad en el mercado de maquinaria industrial

Se espera que los rápidos avances tecnológicos impulsen la innovación en el mercado de maquinaria industrial durante el período de pronóstico. Además, las industrias manufactureras están adoptando tecnologías avanzadas como la inteligencia artificial, la impresión 3D y el análisis de big data para reducir los costos operativos, mejorar la productividad y obtener mayores ganancias. Sin embargo, la posible integración de la impresión 3D y la tecnología de IA está creando oportunidades de crecimiento para los actores nacionales e internacionales presentes en el mercado de maquinaria industrial.

Análisis de segmentación del informe del mercado de maquinaria industrial

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de maquinaria industrial son el tipo de maquinaria.

- Según el tipo de maquinaria, el mercado de maquinaria industrial se divide en maquinaria de envasado, equipos de procesamiento de alimentos, maquinaria de procesamiento de plásticos, máquinas herramienta para conformado de metales y maquinaria para trabajar la madera.

- El segmento de maquinaria de envasado está subsegmentado en máquinas llenadoras, máquinas paletizadoras, máquinas etiquetadoras, máquinas envolvedoras y otras. El segmento de equipos de procesamiento de alimentos está subsegmentado en rebanadoras y cortadoras, equipos de extrusión, depositadores y mezcladores, equipos de almacenamiento y refrigeración, y otros. El segmento de maquinaria de procesamiento de plásticos está subsegmentado en máquinas de moldeo por inspección, máquinas de moldeo por soplado, máquinas de moldeo por extrusión y otras. El segmento de máquinas herramienta para conformado de metales está subsegmentado en máquinas de presión, máquinas dobladoras, máquinas de fundición, máquinas punzonadoras y otras. El segmento de maquinaria para trabajar la madera está subsegmentado en tornos, rectificadoras, sierras de cinta y otras.

Análisis de la cuota de mercado de maquinaria industrial por geografía

El alcance geográfico del informe del mercado de maquinaria industrial se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur/América del Sur y Central.

En términos de ingresos, Asia Pacífico representó la mayor participación en el mercado de maquinaria industrial, debido a la creciente inversión en proyectos de infraestructura como transporte, energía y desarrollo urbano. La creciente necesidad de una variedad de equipos industriales, como maquinaria de construcción, equipos de movimiento de tierras y equipos de manipulación de materiales, está impulsando el mercado en la región.

Perspectivas regionales del mercado de maquinaria industrial

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de maquinaria industrial durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de maquinaria industrial en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de maquinaria industrial

Alcance del informe del mercado de maquinaria industrial

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 234,75 mil millones |

| Tamaño del mercado en 2031 | US$ 362,70 mil millones |

| CAGR global (2023 - 2031) | 5,6% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de maquinaria

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de maquinaria industrial: comprensión de su impacto en la dinámica empresarial

El mercado de maquinaria industrial está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de maquinaria industrial son:

- AB Electrolux

- Alfa Laval

- Compañía AMADA, LTD.

- Grupo GEA

- HAITIAN INTERNACIONAL

- Industrias pesadas Mitsubishi, Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de maquinaria industrial

Noticias y desarrollos recientes del mercado de maquinaria industrial

El mercado de maquinaria industrial se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de maquinaria industrial y las estrategias:

- En noviembre de 2022, Ingersoll Rand lanzó el martillo neumático de servicio pesado 135MAX para usos industriales. El martillo neumático 135MAX HD es el martillo neumático de última generación que se basa en la base establecida por el 119MAX para ofrecer un rendimiento y una potencia increíbles a un costo accesible, al tiempo que aprovecha un gatillo ajustable inspirado en las legendarias llaves de impacto de Ingersoll Rand para lograr mayor precisión y mejores resultados. (Fuente: Ingersoll Rand, comunicado de prensa, 2022)

Informe sobre el mercado de maquinaria industrial: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de maquinaria industrial (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de maquinaria industrial

Obtenga una muestra gratuita para - Mercado de maquinaria industrial