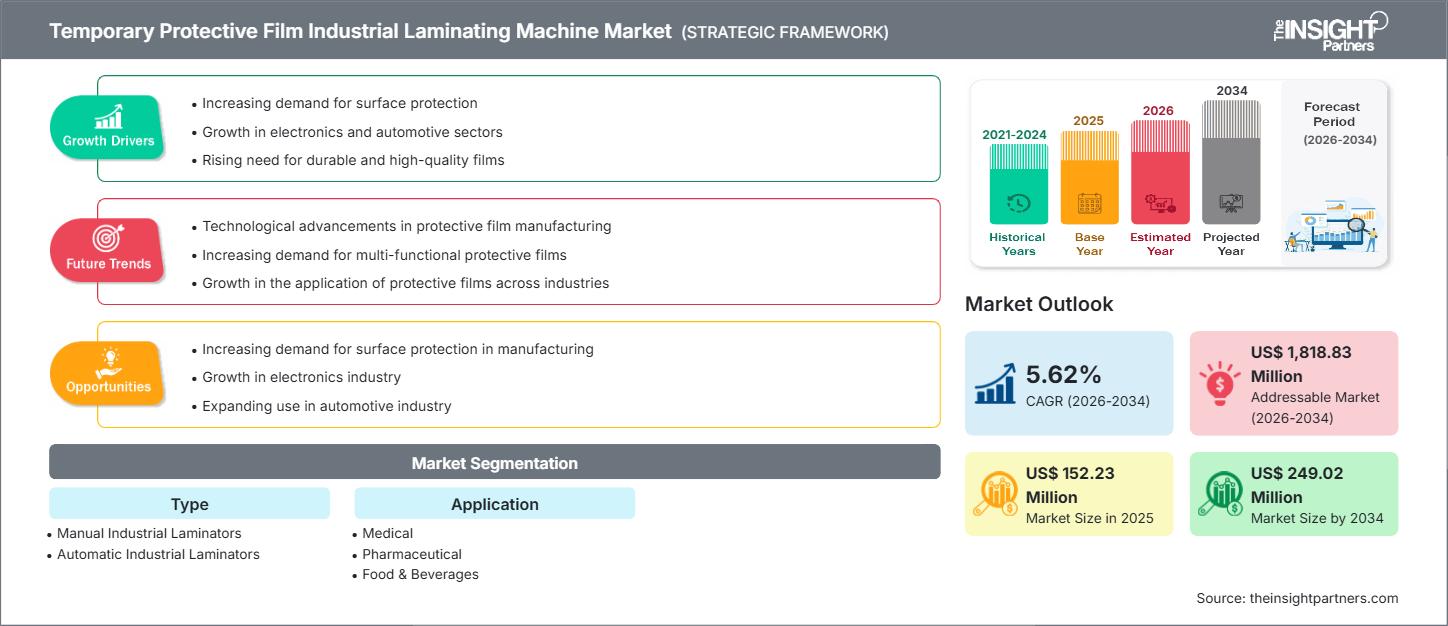

Se espera que el tamaño del mercado de máquinas laminadoras industriales de películas protectoras temporales alcance los US$ 249,02 millones para 2034, desde los US$ 152,23 millones de 2025. Se prevé que el mercado registre una CAGR del 5,62 % durante el período 2026-2034.

Análisis del mercado de máquinas laminadoras industriales de películas protectoras temporales

El mercado de máquinas laminadoras industriales de películas protectoras temporales está en expansión debido a la creciente demanda de protección de superficies de alta calidad en diversas industrias, como la electrónica, la automoción y la construcción. Estas máquinas son cruciales para la aplicación de películas protectoras durante la fabricación, el transporte y la instalación de componentes delicados y de alto valor. Los avances tecnológicos, como la integración de la automatización, la monitorización basada en IoT y los sistemas de control de precisión, impulsan el crecimiento del mercado al mejorar la eficiencia operativa, reducir el desperdicio de material y garantizar una calidad y un rendimiento altos y constantes. La industria se centra en el desarrollo de máquinas laminadoras de precisión capaces de aplicar películas protectoras sin defectos ni contaminación, especialmente a medida que los productos finales se vuelven más complejos y sofisticados.

Descripción general del mercado de máquinas laminadoras industriales de películas protectoras temporales

Las máquinas laminadoras industriales de película protectora temporal son equipos esenciales que se utilizan para aplicar una capa de película protectora sobre diversas superficies planas o rollos de material (como metal, plástico, vidrio o piezas prepintadas) para protegerlos de arañazos, abrasión, suciedad o daños durante los procesos industriales, el almacenamiento y el transporte. Estas máquinas pueden ir desde sistemas manuales hasta sistemas automáticos altamente sofisticados. Entre sus características principales se incluyen la aplicación precisa, sistemas de corte (como el corte al borde) y la capacidad de manipular diversos sustratos y tipos de película. Su implementación garantiza la integridad del producto, reduce los residuos de productos dañados y ayuda a mantener un acabado perfecto, fundamental en sectores como la automoción y la electrónica de consumo.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de máquinas laminadoras industriales de películas protectoras temporales: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de las máquinas laminadoras industriales de películas protectoras temporales

Factores impulsores del mercado:

- Creciente demanda de protección de superficies en industrias clave: La rápida expansión y sofisticación de los sectores automotriz, electrónico (pantallas/pantallas táctiles) y de la construcción requieren el uso de películas protectoras temporales de alta precisión para salvaguardar componentes valiosos durante la producción y el tránsito.

- Cambio hacia la fabricación automatizada y de alta precisión (Industria 4.0): la creciente adopción de la automatización, la robótica y los principios de la Industria 4.0 en entornos de fabricación impulsa la demanda de máquinas laminadoras automáticas con control de precisión para lograr un mayor rendimiento y una calidad constante.

- Necesidad de prevención de daños en productos de alto valor: la creciente complejidad y el costo de los productos finales amplifican la necesidad de medidas de protección confiables para prevenir daños, abrasión o contaminación, lo que impulsa la adopción de soluciones de laminación avanzadas.

Oportunidades de mercado:

- Innovaciones y lanzamientos continuos de productos: existen oportunidades en el desarrollo de máquinas de próxima generación con funciones mejoradas, como análisis predictivo impulsado por IA para mantenimiento proactivo, interfaces de usuario mejoradas y mayor adaptabilidad a distintos tipos de películas y sustratos.

- Creciente enfoque en la sostenibilidad y las soluciones ecológicas: el mercado ofrece oportunidades para máquinas diseñadas para trabajar con materiales de película protectora ecológicos y biodegradables y para equipos que cuentan con tecnologías y procesos de ahorro de energía.

- Expansión en mercados emergentes: La rápida industrialización y el aumento de las actividades manufactureras en regiones como Asia-Pacífico presentan importantes oportunidades sin explotar para que los proveedores expandan su presencia geográfica y su oferta de productos.

Análisis de segmentación del informe de mercado de máquinas laminadoras industriales de película protectora temporal

Se analiza la cuota de mercado de las máquinas laminadoras industriales de películas protectoras temporales en varios segmentos para comprender mejor su estructura, potencial de crecimiento y tendencias emergentes. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por tipo:

- Laminadores industriales manuales

- Laminadores industriales automáticos

Por aplicación:

- Médico

- Farmacéutico

- Alimentos y bebidas

- Automotor

- Aeroespacial y defensa

Por geografía:

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de máquinas laminadoras industriales de películas protectoras temporales

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de máquinas laminadoras industriales de película protectora temporal durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de máquinas laminadoras industriales de película protectora temporal en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de máquinas laminadoras industriales de película protectora temporal

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 152,23 millones |

| Tamaño del mercado en 2034 | US$ 249,02 millones |

| CAGR global (2026-2034) | 5,62% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de máquinas laminadoras industriales de películas protectoras temporales: comprensión de su impacto en la dinámica empresarial

El mercado de máquinas laminadoras industriales de películas protectoras temporales está en rápido crecimiento, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de máquinas laminadoras industriales de películas protectoras temporales.

Análisis de la cuota de mercado de las máquinas laminadoras industriales de películas protectoras temporales por geografía

A menudo se proyecta que Asia-Pacífico será el mercado regional de más rápido crecimiento, mientras que América del Norte y Europa tienen una participación sustancial, impulsadas por una fabricación avanzada y estándares de alta calidad.

El mercado de máquinas laminadoras industriales de películas protectoras temporales muestra una trayectoria de crecimiento diferente en cada región debido a factores como la creciente adopción de fábricas inteligentes y la Industria 4.0. A continuación, se presenta un resumen de la cuota de mercado y las tendencias por región:

1. América del Norte

- Cuota de mercado: Posee una cuota de mercado significativa, impulsada por una sólida infraestructura de fabricación y estrictos estándares de calidad en los sectores automotriz, aeroespacial y electrónico.

-

Factores clave:

- Alta presencia de manufactura avanzada en automoción y aeroespacial.

- Fuerte demanda de soluciones de embalaje y protección de alta calidad.

- Énfasis en la automatización de fábricas y aplicaciones de la Industria 4.0 (especialmente en EE. UU. y Canadá).

- Tendencias: Inversión continua en laminadores industriales automatizadas y tecnología de laminación de precisión.

2. Europa

- Cuota de mercado: Se espera que represente una cuota de mercado significativa, caracterizada por un enfoque en la ingeniería de alta calidad y la adopción temprana de estándares ambientales.

-

Factores clave:

- Sectores robustos de automoción, construcción y manufactura de alto valor.

- Estándares estrictos de calidad y seguridad para productos manufacturados.

- Colaboraciones público-privadas centradas en la digitalización industrial.

- Tendencias: Creciente adopción de soluciones de laminación que se integran con procesos de fabricación avanzados; enfoque en características de máquinas que ahorran energía.

3. Asia Pacífico

- Cuota de mercado: El mercado regional de más rápido crecimiento, impulsado por la rápida industrialización y la expansión de los centros de fabricación.

-

Factores clave:

- Industrialización rápida, fabricación en gran volumen y economías orientadas a la exportación (China, India, Corea del Sur).

- El mercado de mayor tamaño para las industrias automotriz y de electrónica de consumo.

- Programas de inteligencia artificial y economía digital respaldados por el gobierno que apoyan la modernización de las fábricas.

- Tendencias: Alto crecimiento en la demanda de máquinas para fabricar películas protectoras impulsado por el aumento de la producción nacional y un floreciente mercado de envases.

4. América del Sur y Central

- Cuota de mercado: Región emergente con creciente adopción industrial.

-

Factores clave:

- La creciente adopción del marketing digital y del comercio electrónico está impulsando la demanda de embalajes protectores.

- Modernización gradual de la infraestructura manufacturera.

- Tendencias: Expansión de soluciones de laminación asequibles y escalables.

5. Oriente Medio y África

- Cuota de mercado: Mercado emergente con fuerte potencial de crecimiento.

-

Factores clave:

- Importantes iniciativas nacionales de transformación digital y desarrollo de infraestructura (por ejemplo, en los Emiratos Árabes Unidos y Arabia Saudita).

- Creciente integración de tecnologías de fabricación avanzadas.

- Tendencias: Enfoque en la protección de alta calidad para materiales de construcción y relacionados con el petróleo y el gas.

Densidad de actores del mercado de máquinas laminadoras industriales de películas protectoras temporales: comprensión de su impacto en la dinámica empresarial

El mercado de máquinas laminadoras industriales de películas protectoras temporales presenta una concentración moderada, con competencia entre fabricantes de equipos consolidados, proveedores especializados en películas protectoras y empresas de tecnología de automatización. Los principales fabricantes de maquinaria poseen una cuota de mercado significativa gracias a su amplia cartera de productos y capacidades de fabricación avanzadas.

El panorama competitivo está impulsando a los proveedores a diferenciarse a través de:

- Las empresas están desarrollando continuamente nuevas máquinas con tecnologías patentadas para características como la aplicación de películas de corte al borde y alta precisión para garantizar cero defectos, satisfaciendo las demandas de las industrias de altas especificaciones.

- Las soluciones incluyen cada vez más transportadores automáticos, monitoreo en tiempo real y diagnósticos remotos para alinearse con la Industria 4.0, lo que mejora la eficiencia y reduce la intervención manual.

- Los proveedores están creando máquinas y soluciones personalizadas para satisfacer aplicaciones específicas, como vidrio de gran formato o piezas de automóviles específicas, brindando mayor valor a clientes especializados.

Oportunidades y movimientos estratégicos

- Los grandes actores están participando en fusiones y adquisiciones o asociaciones para integrar tecnología avanzada (como IA) o asegurar una fuerte presencia en regiones clave, especialmente en el creciente mercado APAC.

- Las empresas están aprovechando la tendencia hacia la sostenibilidad desarrollando máquinas que manejan eficientemente materiales de película protectora biodegradables o reciclables y reducen el consumo de energía.

- Centrándonos en configuraciones de máquinas personalizables que ofrecen flexibilidad y seguridad para satisfacer los diferentes requisitos de volumen y sustrato de los clientes a nivel mundial.

Las principales empresas que operan en el mercado de máquinas laminadoras industriales de películas protectoras temporales son:

- HMT Manufacturing Inc

- Hsing Wei Machine Industry Co., Ltd.

- Maquinaria APL Pvt Ltd

- Surface Armor LLC

- Walco Inc

- Ashton Industrial Sales Ltd (Laminadores universales)

- Mecánica Ronzani SRL

- Maquinaria holandesa Crest BV

- Maquinaria de vidrio Jordon Inc.

Descargo de responsabilidad: Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Noticias y desarrollos recientes del mercado de la laminación industrial de películas protectoras temporales

- Por ejemplo, en septiembre de 2024, Ashton Industrial Sales Ltd. anunció el lanzamiento de la laminadora de película protectora OPTISTREAM™ BROADSWORD de 2500 mm.

- En septiembre de 2022, ASHTON INDUSTRIAL adquirió el 100% de los activos y el negocio de UNIVERSAL LAMINATORS Ltd., Oxfordshire.

- WALCO®, con tecnología de NOVACEL, ofrece la más amplia gama de máquinas laminadoras para la aplicación horizontal o vertical de películas protectoras temporales. WALCO® diseña las máquinas laminadoras más innovadoras, fiables, robustas y seguras.

Informe de mercado de máquinas laminadoras industriales de película protectora temporal: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de máquinas laminadoras industriales de película protectora temporal (2021-2034)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de máquinas laminadoras industriales de películas protectoras temporales y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de máquinas laminadoras industriales de películas protectoras temporales, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave.

- Análisis PEST y FODA detallado

- Análisis del mercado de máquinas laminadoras industriales de películas protectoras temporales que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia, que abarca la concentración del mercado, el análisis de mapas de calor, los actores principales y la evolución reciente del mercado de máquinas laminadoras industriales de películas protectoras temporales. Perfiles detallados de las empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de máquinas laminadoras industriales de películas protectoras temporales

Obtenga una muestra gratuita para - Mercado de máquinas laminadoras industriales de películas protectoras temporales