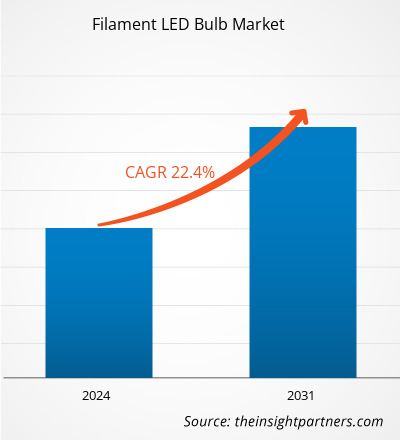

Le marché des ampoules LED à filament devrait atteindre 12 427,98 millions USD d'ici 2031, contre 2 163,19 millions USD en 2023. Le marché devrait enregistrer un TCAC de 22,4 % au cours de la période 2023-2031. Les progrès croissants de la technologie LED devraient rester une tendance clé du marché.

Analyse du marché des ampoules LED à filament

La croissance du marché est due au nombre croissant de projets de construction commerciale et résidentielle dans différentes régions. En outre, l'intérêt croissant pour les activités de rénovation et de remodelage des maisons, qui peut être lié à un soutien gouvernemental accru, en particulier dans les pays industrialisés, stimule également la demande d'ampoules LED à filament. L'augmentation des niveaux de revenus des consommateurs, l'évolution des modes de vie et l'adoption de cultures diverses en termes de décoration intérieure contribuent à cette transition.

Aperçu du marché des ampoules LED à filament

Les ampoules à filament LED améliorent l'apparence et la dispersion de la lumière des ampoules à incandescence tout en utilisant la technologie LED pour fournir un éclairage efficace et des performances fiables. Les ampoules à filament LED, communément appelées ampoules Edison, affichent de gros filaments lumineux à travers des boîtiers en verre transparent et ressemblent à des lampes à incandescence ou vintage à l'ancienne. Les ampoules à filament LED offrent l'apparence des ampoules à incandescence traditionnelles tout en offrant un éclairage économe en énergie et tous les autres avantages de l'éclairage LED traditionnel. Les ampoules à filament LED ont une durée de vie plus longue que les ampoules à incandescence.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des ampoules LED à filament

Augmentation de l'adoption des ampoules LED à filament dans les restaurants, les hôtels, les bars et les cafés

L'éclairage est un élément important dans la conception globale des restaurants et des cafés. Dans les cafés, les bars et les restaurants, une intensité lumineuse de 150 lux est généralement considérée comme appropriée. D'autres zones nécessitent 100 lux, la section de stockage des aliments nécessite 150 lux, la section de lavage nécessite 300 lux et la section de cuisson nécessite 500 lux. Les restaurants utilisent quatre types d'éclairage : l'éclairage général, l'éclairage d'accentuation, l'éclairage décoratif et l'éclairage naturel. Dans un café ou un restaurant, l'éclairage général est l'aspect le plus important. Un éclairage homogène est obtenu en plaçant les équipements d'éclairage dans un certain ordre en même temps. Les clients percevront le restaurant comme plus accueillant s'il présente une décoration générale décente. L'éclairage d'accentuation peut être utilisé pour attirer l'attention sur les aspects majeurs ou fantaisistes des restaurants, notamment la décoration, les plantes, les tables ou les marchandises. L'éclairage décoratif fait référence aux composants d'éclairage utilisés pour compléter la conception. L'éclairage traditionnel et moderne peut être utilisé pour créer un éclairage décoratif. Ainsi, diverses techniques d’éclairage utilisées dans les restaurants, les hôtels, les bars et les cafés favorisent l’adoption des ampoules LED à filament, contribuant ainsi à la croissance du marché.

Augmenter l'éclairage résidentiel

L'éclairage est en augmentation dans les zones résidentielles. L'utilisation d'ampoules LED dans les maisons diffère des autres caractéristiques des ménages, telles que le revenu du ménage et la propriété. Parmi les ménages gagnant moins de 20 000 $ par an, 39 % ont déclaré que les ampoules LED étaient leur principal choix d'éclairage intérieur, tandis que 54 % des ménages gagnant 100 000 $ ou plus par an utilisaient principalement des ampoules LED en 2020. Les ampoules LED à filament sont largement utilisées dans les zones résidentielles. Ainsi, l'éclairage résidentiel croissant génère davantage d'opportunités pour le marché des ampoules LED à filament.

Analyse de segmentation du rapport sur le marché des ampoules LED à filament

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des ampoules LED à filament sont le produit et l’application.

- En fonction du produit, le marché des ampoules LED à filament est divisé en types 0-25 watts, 25-40 watts, 40-60 watts et plus de 60 watts. Le segment 0-25 watts détenait une part de marché plus importante en 2023.

- En termes d'application, le marché est segmenté en résidentiel, restaurants et bars, hôtels, cafés et autres.café, and others.

Analyse des parts de marché des ampoules LED à filament par zone géographique

La portée géographique du rapport sur le marché des ampoules LED à filament est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

L'Europe a dominé le marché des ampoules LED à filament en 2023. En Europe, les plans d'action nationaux pour l'efficacité énergétique (NEEAP) et les plans d'action nationaux pour l'efficacité énergétique (NEEAP) visent à promouvoir les investissements dans l'entretien et la rénovation des bâtiments résidentiels et commerciaux. En outre, la volonté des consommateurs de dépenser des sommes importantes pour l'aménagement des espaces de vie a attiré leur attention sur les produits d'ameublement tels que les tapis et moquettes, ainsi que sur les systèmes d'éclairage avancés et stylisés qui améliorent l'attrait esthétique des intérieurs.NEEAPs) and the National Energy Efficiency Action Plans (NEEAPs), the National Energy Efficiency Action Plans (NEEAPs) aim to promote investments in the maintenance and refurbishment of residential and commercial buildings. Further, consumers’ willingness to spend important amounts on the styling of living spaces has drawn their attention to home furnishing products such as carpets and rugs, and advanced and styled

Aperçu régional du marché des ampoules LED à filament

Les tendances et facteurs régionaux influençant le marché des ampoules LED à filament tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des ampoules LED à filament en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des ampoules LED à filament

Portée du rapport sur le marché des ampoules LED à filament

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 2 163,19 millions de dollars américains |

| Taille du marché d'ici 2031 | 12427,98 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 22,4% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par produit

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des ampoules LED à filament : comprendre son impact sur la dynamique commerciale

Le marché des ampoules LED à filament connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des ampoules LED à filament sont :

- Lampes Crompton Ltd

- Havells Inde Ltd.

- Éclairage grand public Wipro

- MEGAMAN

- OSRAM GmbH

- Signify Holding (Philips)

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des ampoules LED à filament

Actualités et développements récents du marché des ampoules LED à filament

Le marché des ampoules LED à filament est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements du marché des ampoules LED à filament sont répertoriés ci-dessous :

- Feit Electric Company, Inc. (« Feit Electric »), une marque leader mondiale d'éclairage et de maison intelligente dont le siège social est en Californie, a annoncé aujourd'hui qu'un ensemble de brevets protège ses ampoules innovantes à filaments blancs visibles, les « brevets à filaments blancs ».

(Source : Trellix, communiqué de presse, octobre 2023.)

- de plus, davantage de lampes à filament LED ont été lancées en janvier par Life on Products, Inc. (Source : PamTen Inc, communiqué de presse, janvier 2023)

Rapport sur le marché des ampoules LED à filament et livrables

Le rapport « Taille et prévisions du marché des ampoules LED à filament (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des ampoules LED à filament aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Tendances du marché des ampoules LED à filament ainsi que dynamique du marché telles que les moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché des ampoules LED à filament couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents pour le marché des ampoules LED à filament

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des ampoules LED à filament

Obtenez un échantillon gratuit pour - Marché des ampoules LED à filament