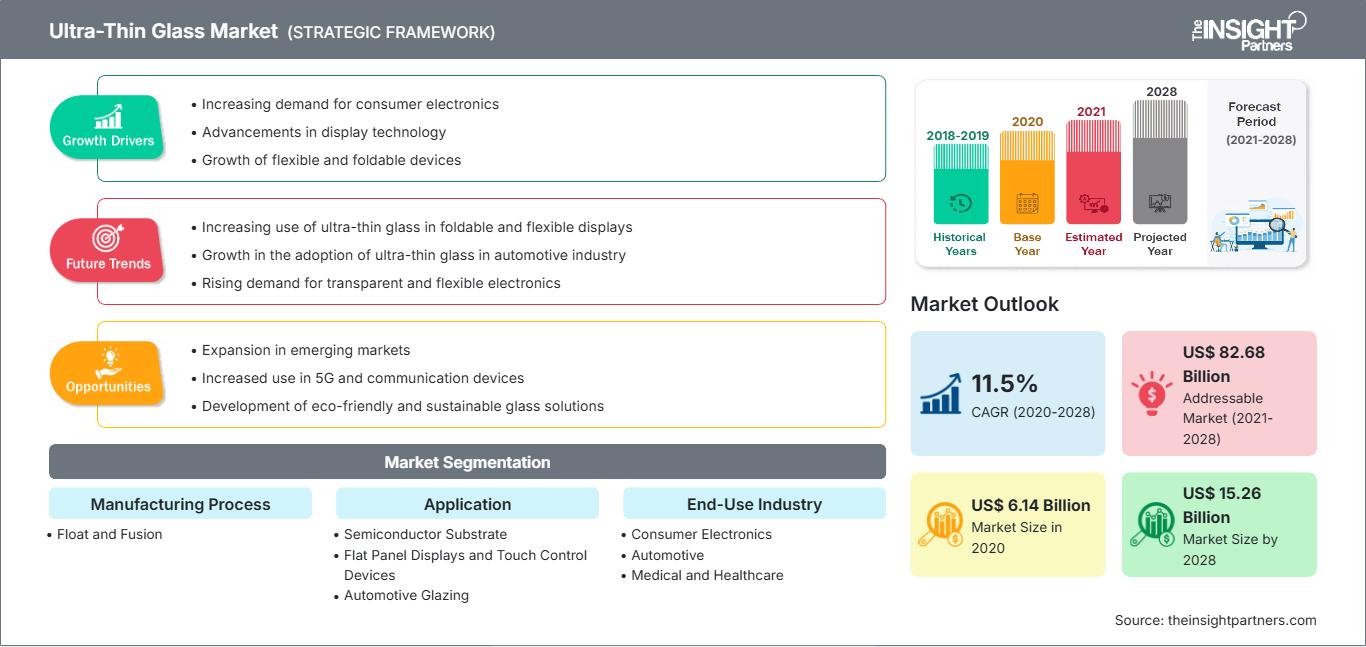

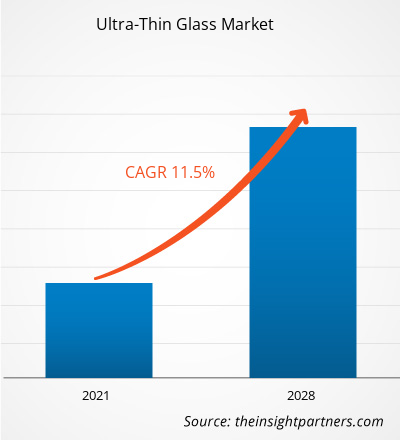

[연구 보고서] 초박형 유리 시장 규모는 2020년 61억 3,956만 달러였으며, 2028년에는 152억 6,474만 달러에 이를 것으로 예상됩니다. 2021년부터 2028년까지 연평균 성장률(CAGR) 11.5%로 성장할 것으로 예상됩니다.

초박형 유리는 두께가 1~2mm 미만인 유리입니다.

이온 교환을 통한 화학 강화는 첨단 기술 응용 분야에 사용되는 초박형 유리를 강화하는 데 일반적으로 사용됩니다.경화 초박형 유리는 긁힘에 강하고 반경 수 밀리미터까지 구부릴 수 있습니다. 초박형 유리는 내식성, 투명성, 유연성, 뛰어난 가스 및 수분 차단성, 높은 내충격성 등의 특성을 지니고 있어 평판 디스플레이, 자동차 유리 등 다양한 응용 분야에 적합합니다. 2020년 아시아 태평양 지역은 세계 초박형 유리 시장에서 가장 큰 매출 점유율을 기록했습니다. 중국은 초박형 유리의 최대 소비국으로 아시아 태평양 시장 점유율의 50% 이상을 차지합니다. 중국은 스마트폰 및 LCD와 같은 모든 유형의 가전제품의 주요 제조 허브입니다.현재 진행 중인 COVID-19 팬데믹은 화학 및 소재 산업의 상황을 크게 변화시켰고 초박형 유리 시장의 성장에 부정적인 영향을 미쳤습니다.

신종 코로나바이러스 확산 방지 조치 시행은 상황을 악화시켰고 여러 산업의 성장에 부정적인 영향을 미쳤습니다. 자동차 및 가전제품과 같은 산업은 국가 및 국제 경계의 갑작스러운 폐쇄로 인한 운영 효율성의 급격한 왜곡과 가치 사슬의 붕괴로 부정적인 영향을 받았습니다. 여러 산업의 성장 둔화는 세계 시장의 초박형 유리 수요에 부정적인 영향을 미쳤습니다. 그러나 각국이 사업 운영을 재개할 계획에 따라 향후 몇 년 동안 초박형 유리 수요가 전 세계적으로 증가할 것으로 예상됩니다. 팬데믹으로 인해 재택근무 문화와 온라인 교육이 확대되고 있습니다. 따라서 노트북, 스마트폰, 기타 통신 기기 등의 제품에 대한 수요가 증가하고 있습니다. 자동차 및 가전제품 등 다양한 산업 분야에서 초박형 유리 수요가 확대되고, 주요 제조업체들의 대규모 투자가 예상 기간 동안 초박형 유리 시장 성장을 견인할 것으로 예상됩니다.이 보고서의 일부, 국가 수준 분석, Excel 데이터 팩을 포함하여 모든 보고서에 대한 사용자 정의를 무료로 받을 수 있을 뿐만 아니라 스타트업 및 대학을 위한 훌륭한 제안 및 할인을 이용할 수 있습니다

초박형 유리 시장: 전략적 통찰력

-

이 보고서의 주요 주요 시장 동향을 확인하세요.이 무료 샘플에는 시장 동향부터 추정 및 예측에 이르기까지 데이터 분석이 포함됩니다.

스마트폰, 노트북, TV 및 기타 전자 제품과 같은 전자 제품 사용 증가로 인해 가전 산업이 호황을 누리고 있습니다. 가전 제품은 기술 세계에서 필수품이 되었습니다. 모든 세대의 사람들이 스마트폰, 스마트워치 및 노트북에 의존하고 있습니다. 가전 산업이 성장함에 따라 제조업체는 지속적으로 고급 고품질 제품 제공에 주력하고 있습니다. 초박형 유리는 가전 산업에서 중요한 역할을 합니다. 터치 및 디스플레이 패널, 센서 및 카메라 시스템에 사용됩니다. 내식성, 투명성, 유연성 및 가스 차단 기능과 같은 초박형 유리의 다양한 특성은 가전 산업의 다양한 응용 분야에 적합합니다. 중국은 가전 제품 산업을 주도하고 있습니다. 중국은 주요 평판 디스플레이 제조업체 중 하나입니다. 중국 스마트폰, 피트니스 트래커, TV 및 기타 전자 제품에 대한 수요가 급증하고 있으며, 이는 초박형 유리 제조업체에게 수익성 있는 기회를 제공합니다. 중국은 새로운 인프라 구축을 강화했습니다. 인공지능, 산업 인터넷, 사물 인터넷(IoT) 구축을 촉진하고, 5G 상용화 속도를 가속화하여 전자 정보 제조 산업을 새로운 발전 단계로 끌어올리고 관련 산업의 고급화를 더욱 촉진했습니다. 세계 인구 리뷰(World Population Review)에 따르면 중국의 휴대전화 사용자는 16억 명, 인도의 휴대전화 사용자는 12억 8천만 명입니다. 2018년 애플은 약 2,250만 대의 스마트워치를 출하했습니다. 이는 2017년 1,770만 대보다 증가한 수치입니다. 2018년 핏빗은 약 550만 대의 스마트워치를 출하했고, 삼성은 약 530만 대를 출하했습니다. 따라서 빠르게 성장하는 가전 산업은 초박형 유리 수요를 촉진하고 있습니다.

최종 사용 산업 분석

가전 부문은 2020년 세계 초박형 유리 시장에서 가장 큰 점유율을 차지했습니다. 초박형 유리는 LCD, OLED, 스마트폰, 웨어러블 기기 등 다양한 기기에 사용되는 평면 패널 디스플레이 및 터치 패널 디스플레이와 같은 전자 제품 제조에 널리 사용됩니다. 전 세계적으로 혁신적이고 기술적으로 진보된 전자 제품에 대한 수요가 증가함에 따라 초박형 유리 수요는 향후 몇 년 동안 증가할 것으로 예상됩니다.

제조 공정 분석

제조 공정별로는 퓨전 공정이 2020년 초박형 유리 시장의 매출을 주도했습니다. 오버플로우 다운드로우(overflow downdraw) 방식으로도 알려진 퓨전 공정은 디스플레이 패널용 평면 초박형 유리 제조에 널리 사용됩니다. 코닝은 공중에 떠 있는 특수 유리를 최초로 개발한 회사로, 이는 퓨전 공법의 핵심 특징입니다. 유리는 용융 금속과 접촉하지 않으며, 이는 플로트 유리 공법에 비해 퓨전 공법의 근본적인 장점입니다.

초박형 유리 시장의 주요 기업으로는 코닝(Corning Incorporated), AGC(AGC Inc.), 닛폰 일렉트릭 글래스(Nippon Electric Glass Co., Ltd.), 쇼트(SCHOTT AG), 센트럴 글래스(Central Glass Co., Ltd.), CSG 홀딩(CSG Holding Co., Ltd.), 이머지 글래스(Emerge Glass), 닛폰 시트 글래스(Nippon Sheet Glass Co., Ltd), 신이 글래스 홀딩스(Xinyi Glass Holdings Limited), 뤄양 글래스(Luoyang Glass Co., Ltd.) 등이 있습니다. 시장의 주요 기업들은 인수합병(M&A) 및 제품 출시와 같은 전략을 통해 지역적 입지와 고객 기반을 확대하고 있습니다.

초박형 유리 시장The Insight Partners의 분석가들은 예측 기간 동안 초박형 유리 시장에 영향을 미치는 지역별 동향과 요인을 면밀히 분석했습니다. 이 섹션에서는 북미, 유럽, 아시아 태평양, 중동 및 아프리카, 그리고 중남미 지역의 초박형 유리 시장 부문 및 지역별 현황도 살펴봅니다.

초박형 유리 시장 보고서 범위

| 보고서 속성 | 세부 |

|---|---|

| 시장 규모 2020 | US$ 6.14 Billion |

| 시장규모별 2028 | US$ 15.26 Billion |

| 글로벌 CAGR (2020 - 2028) | 11.5% |

| 이전 데이터 | 2018-2019 |

| 예측 기간 | 2021-2028 |

| 다루는 세그먼트 |

By 제조 공정

|

| 포함된 지역 및 국가 |

북미

|

| 시장 선도 기업 및 주요 회사 프로필 |

|

초박형 유리 시장 참여자 밀도: 비즈니스 역학에 미치는 영향 이해

초박형 유리 시장은 소비자 선호도 변화, 기술 발전, 그리고 제품 이점에 대한 인식 제고 등의 요인으로 인한 최종 사용자 수요 증가에 힘입어 빠르게 성장하고 있습니다. 수요가 증가함에 따라 기업들은 제품 라인업을 확장하고, 소비자 니즈를 충족하기 위한 혁신을 추진하며, 새로운 트렌드를 적극 활용하고 있으며, 이는 시장 성장을 더욱 가속화하고 있습니다.

- 을 얻으세요 초박형 유리 시장 주요 주요 플레이어 개요

- 초박형 유리 산업의 진보적 추세는 플레이어가 효과적인 장기 전략을 개발하는 데 도움이 됩니다.

- 선진 및 개발도상 시장에서 성장을 확보하기 위해 회사가 채택한 사업 성장 전략

- 2019년부터 2028년까지 글로벌 초박형 유리 시장에 대한 정량적 분석

- 다양한 산업에서 초박형 유리 수요 추정

- 시장 성장을 예측하기 위해 산업에서 운영되는 구매자와 공급업체의 효율성을 보여주는 포터 분석

- 경쟁 시장 시나리오와 초박형 유리 수요를 이해하기 위한 최근 개발

- 초박형 유리 시장 성장을 주도하고 제한하는 요소와 결합된 시장 추세 및 전망

- 글로벌 초박형 유리 시장 성장과 관련하여 상업적 관심을 뒷받침하는 전략에 대한 이해는 의사 결정 프로세스에 도움이 됩니다.

- 다양한 노드의 초박형 유리 시장 규모 시장

- 글로벌 초박형 유리 시장과 산업 역학에 대한 자세한 개요 및 세분화

- 성장 기회가 유망한 다양한 지역의 초박형 유리 시장 규모

제조 공정별 초박형 유리 시장

- 플로트

- 퓨전

용도별 초박형 유리 시장

- 반도체 기판

- 평면 패널 디스플레이 및 터치 제어 장치

- 자동차용 글레이징

- 기타

최종 사용 산업별 초박형 유리 시장

- 가전제품

- 자동차

- 의료 및 헬스케어

- 기타

회사 프로필

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd.

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd.

- 과거 분석(2년), 기준 연도, CAGR을 포함한 예측(7년)

- PEST 및 SWOT 분석

- 시장 규모 가치/거래량 - 글로벌, 지역, 국가

- 산업 및 경쟁 환경

- Excel 데이터세트

최근 보고서

관련 보고서

사용 후기

구매 이유

- 정보에 기반한 의사 결정

- 시장 역학 이해

- 경쟁 분석

- 고객 인사이트

- 시장 예측

- 위험 완화

- 전략 기획

- 투자 타당성 분석

- 신흥 시장 파악

- 마케팅 전략 강화

- 운영 효율성 향상

- 규제 동향에 발맞춰 대응

무료 샘플 받기 - 초박형 유리 시장

무료 샘플 받기 - 초박형 유리 시장