Non-Ablative Lasers to Dominate Aesthetic Lasers Market Based on Type During 2022–2030

According to our new research study on "Aesthetic Lasers Market Forecast to 2030 – Global Analysis – by Type, Application, and End User," the aesthetic lasers market size was valued at US$ 2,895.17 million in 2022 and is projected to reach US$ 7,341.84 million by 2030. It is estimated to register a CAGR of 12.3% during 2022–2030.

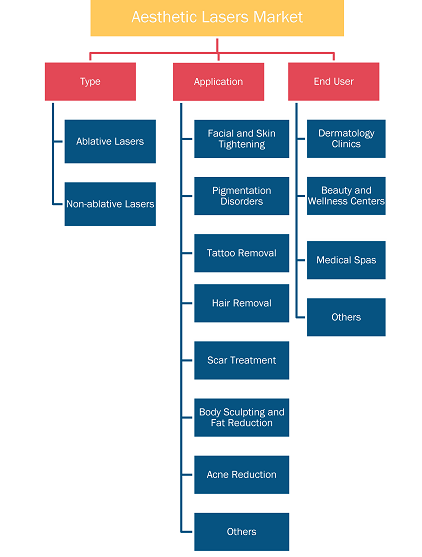

Based on type, the aesthetic lasers market is segmented into ablative lasers and non-ablative lasers. The ablative lasers segment is further bifurcated into carbon-di-oxide lasers and erbium lasers. Non-ablative lasers segment is further divided into Nd:Yag lasers, alexandrite lasers, intense pulse light (IPL), flash pulsed dye lasers, and others. In 2022, the non-ablative lasers segment held a larger share and is expected to record a faster CAGR during 2022–2030. Based on application, the aesthetic lasers market is classified into facial and skin tightening, pigmentation disorders, tattoo removal, hair removal, scar treatment, body sculpting and fat reduction, acne reduction, and others. In 2022, the facial and skin tightening segment held the largest share of the market, and the hair removal segment is expected to register the highest CAGR during 2022–2030. Based on end user, the aesthetic lasers market is classified into dermatology clinics, beauty and wellness centers, medical spas, and others. In 2022, the dermatology clinics segment held the largest share of the market, by end user, and is estimated to register a significant CAGR of 12.7% during 2022–2030.

Aesthetic Lasers Market Growth Report by Size, Share & Scope 2031

Download Free SampleAesthetic Lasers Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Ablative Lasers, Non-Ablative Lasers), Application (Facial and Skin Tightening, Pigmentation Disorders, Tattoo Removal, Hair Removal, Scar Treatment, Body Sculpting and Fat Reduction, Acne Reduction, Others), End User (Dermatology Clinics, Beauty and Wellness Centers, Medical Spas, Others), and Geography

Based on geography, the aesthetic lasers market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, South Africa, and the UAE), South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Technological Advancements in Aesthetic Laser Devices

Various laser-based devices used for cosmetic procedures, including unwanted hair removal, excess fat removal, anti-aging, and skin tightening, are categorized under aesthetic laser treatment. Technological advancements in devices, increasing awareness of aesthetic procedures, and surging cases of obesity are the main factors boosting the aesthetic lasers market growth. With the advanced, high-speed internet infrastructure and the increased use of social media, information is more accessible, and people are becoming more aware of aesthetic laser procedures. An increasing number of social media users and the sensitization of the masses to aesthetic procedures are being correlated with improved sales of aesthetic laser treatments.

The developments in laser therapy continue to streamline, optimize, and automate treatment devices, making them more efficient, accessible, and as noninvasive as possible. Laser technology has various navigational features, which help end users in the assessments by built-in diagnostics monitoring. For instance, aesthetic and medical laser manufacturer—Sciton—began using optical coherence tomography to capture images of the skin from the inside. As per the company, noninvasive imaging technology allows clinicians to evaluate the skin thoroughly and provide feedback about recommended setting requirements for optimal results. The laser manufacturer Cutera has updated its devices, including the time-tested excel V 532 nm and 1064 nm device for treating vascular and pigmented lesions. Adding a Dermastat handpiece, Cutera reportedly improved the device's efficacy by allowing clinicians to navigate better in narrow and difficult-to-reach areas, such as the corners of the eye. The company increased the laser’s spot size by increasing the excel V's power to maximize power density and energy delivery during treatment. The other technological advancements include increased wavelength capacities, longer dye lives, and interrogation systems—all of which improve the precision and accuracy of laser treatment.

Recent technological advances are likely to improve the aesthetic treatment of the skin significantly. The advancement of laser and light-based technologies is highly promising among skin rejuvenation treatments. New laser resurfacing techniques for skin rejuvenation provide advantages over conventional ablative lasers, including CO2 and erbium-YAG laser systems. Non-ablative and fractional lasers, although not as effective as ablative therapies, are associated with significantly lower complication rates and shorter recovery periods. New devices combining ablative and fractional technologies are available in the aesthetic lasers market, showing remarkable results.

Aerolase Corp, Lumenis Be Ltd, Cutera Inc, Bausch Health Companies Inc, Sciton Inc, SharpLight Technologies Ltd, EI EN SpA, Alma Lasers Ltd, and Cynosure LLC are among the leading companies operating in the aesthetic lasers market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com