Scheduled Future Aircraft Deliveries and increased Popularity of Connected Electronic Modules Presents Growth Opportunities for Aircraft Computers Market

According to our latest market study, titled “Aircraft Computers Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Component, Type, Platform, and Fit Type,” the market is projected to reach US$ 7,140.12 million by 2028 from US$ 4,908.20 million in 2021. It is expected to grow at a CAGR of 5.8% from 2022 to 2028.

The growth of the aircraft computers market in North America is attributed to the presence of a large number of aircraft manufacturers, such as Boeing; Airbus; Lockheed Martin Corporation; Raytheon Technologies Corporation; General Dynamics Mission Systems, Inc.; and Northrop Grumman Corporation. The presence of a large number of aircraft providers along with increasing number of upcoming aircraft deliveries, is likely to propel the demand for aircraft computers which in turn drives the aircraft computers market in North America in the coming years. The rising demand for aircraft computers in unmanned aerial vehicles (UAVs) is another factor supporting the market growth in this region.

Collins Aerospace offers various aircraft computers, including DPC-4000 Display Processing Computer, Integrated Processing Computers, and FMC-4000 Flight Mission Computers. Canadian and US-based airlines, such as Delta Air Lines, American Airlines, Air Canada, United Airlines, and Southwest Airlines, placed numerous orders for commercial aircraft to be delivered between 2021 and 2025. For instance, in 2019, Delta Airlines ordered 95 units of A220 aircraft, out of which 12 were supplied until May 2020, and the rest are scheduled to be delivered by the end of 2023. Frontier Airlines has an order of ~175 units of A320 aircraft.

The production of new aircraft is expected to support the aircraft computers market over the forecast period. In 2020 Delta Airlines announced its partnership with IBM for its quantum computing. Thus, the increasing number of orders and partnerships is propelling the growth of the aircraft computers market in this region.

An increase in the number of aircraft orders (both commercial and military), owing to the rise in air passenger traffic and political instabilities between different countries, is propelling the demand for aircraft computers. The growing tourism industry worldwide and decreased fuel prices also boost the demand for new aircraft. Airbus delivered 49 aircraft in February 2022 compared to 30 aircraft in January 2022. It received 113 orders in February 2022, while only 36 in January 2022.

Further, in March 2022, Boeing received an order for 20 737 MAX airplanes from Arajet, a new Caribbean airline, specifically for the high-capacity 737-8-200 model with low operating costs and affordable travel options. Such a rise in aircraft deliveries will require additional hardware, such as aircraft flight control computers and other control systems, projected to augment the aircraft computer market size during the forecast period.

The aircraft computers market is analyzed on the basis of component, type, platform, fit type, and geography. Based on component, the market is bifurcated into hardware and software. The hardware segment accounted for the larger market share due to the increase in the demand for next-generation aircraft equipped with advanced features.

Based on type, the aircraft computers market is segmented into flight controls, utility & IFE systems, engine controls, and flight management computers. In 2020, the flight controls segment accounted for the highest share in the global aircraft computers market. Flight control computers are used in various aircraft, such as 3 computers for flight control in military aircraft, 5 major computers in A320, and 2 flight control computers in every 737 Max, contributing to the market's growth.

Based on platform, the aircraft computers market is segmented into fixed wing, rotary wing, and unmanned aerial vehicles (UAV). The fixed wing segment dominated the market in 2021 due to the presence of a large-size fleet and the number of computers used in a fixed wing aircraft.

Based on fit type, the aircraft computers market is segmented into line fit and retrofit. The line fit segment accounted for the largest share in 2021 due to the increasing number of new deliveries in the coming years. It is anticipated to hold potential demand for new installation of aircraft computers, which upticks the segment growth.

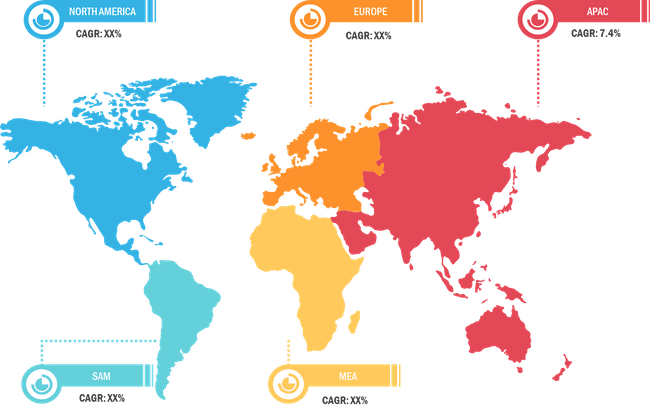

Based on geography, the aircraft computers market is segmented into five key countries, North America, Europe, Asia Pacific, the Middle East & Africa, and South America. North America held the largest revenue share in 2020, followed by Asia Pacific and Europe, respectively. The Asia Pacific market is projected to register the highest CAGR from 2021 to 2028.

Impact of COVID-19 Pandemic on Aircraft Computers Market

Several government bodies across the globe invested a substantial amount in the procurement of the aerospace industry despite experiencing economic turmoil. The global military spending in 2021 was increased by 0.7% compared to 2020, according to SIPRI. The aircraft computers market in 2020 and 2021 underwent high adoption from several global aircraft companies. Unfortunately, during the COVID-19 pandemic, the entire aviation industry came to a halt with minimal resources to foresee the future.

The outbreak decimated the demand for aircraft globally, which significantly lowered the volumes of orders among aircraft manufacturers. The crisis reduced the production of aircraft. Several aircraft production units in the US, France, Russia, and China were temporarily paused to adhere to the government rules regarding lockdown and physical distancing. Aircraft manufacturers witnessed a 14–15% reduction in the aviation market revenue. The decline in production volumes resulted in a delay in deliveries, which adversely affected the businesses of various component manufacturers and associated technologies. Market players implemented various strategies to fulfill the requirement of aircraft companies. For instance, in July 2021, Collins Aerospace launched its PerigonTM computer for a wide range of commercial and defense systems. Perigon is designed to meet future flight control and vehicle management demands due to its superior computational capacity, open-system architecture, and flexible configurability. Thus, the strategic implementation by market players across the region is positively impacting the market. The aircraft computers market analysis helps to understand the upcoming trends, new technologies, and macro and micro factors that are likely to influence the market in the coming years.

Key players operating in the aircraft computers market are BAE Systems; Garmin Ltd.; General Electric; General Dynamics Mission Systems, Inc.; Honeywell International Inc.; Lockheed Martin Corporation; Raytheon Technologies; SAAB AB; Safran Group; and Thales Group. The aircraft computers market report provides detailed market insights, which helps key players to strategize the growth in years to come.

Aircraft Computers Market – by Country, 2021 - 2028 (%)

Aircraft Computers Market Size, Share & Growth Report 2031

Download Free SampleAircraft Computers Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), Type (Flight Controls, Utility Controls & IFE Systems, Engine Controls, Mission Computers, and Flight Management Computers), Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, and Unmanned Aerial Vehicles), Fit Type (Line Fit and Retrofit), and Geography

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com