Prescription Drugs Segment based on Type Bolsters Anti-Obesity Drugs Market Growth

According to our new research study on "Anti-obesity Drugs Market Forecast to 2031 – Global Analysis – by Type, Drug Class, Application, Route of Administration, and Distribution Channel," the market was valued at US$ 15.85 billion in 2024 and is projected to reach US$ 177.27 billion by 2031; it is anticipated to record a CAGR of 35.3% from 2025 to 2031. The report emphasizes the anti-obesity drugs market trends, along with drivers and deterrents affecting the market growth. The mounting prevalence of obesity and increased awareness and demand for weight management solutions contribute to the growing anti-obesity drugs market size. However, the side effects and safety concerns hamper the market growth. Further, the expansion in emerging economies is expected to emerge as a new market trend in the coming years.

Surging Prevalence of Obesity Bolsters Anti-Obesity Drugs Market Growth

According to the report published by the World Obesity Atlas, the prevalence of obesity is projected to increase from 14% in 2023 to 24% by 2035, affecting nearly 2 billion individuals. The number of overweight and obese people is expected to increase from 2.6 billion in 2020 to over 4 billion by 2035, marking a rise from 38% to over 50% of the world's population, excluding children under five. The increasing obesity prevalence has resulted in a large patient population suffering from chronic conditions that impact daily functioning and have significant implications for mortality. Anti-obesity drugs, also known as weight loss drugs, include pharmaceutical treatments aimed at helping individuals manage obesity and related health conditions. These medications work by influencing appetite regulation, fat absorption, and metabolism. They can improve weight loss outcomes, especially for patients with obesity-related health issues, while enhancing quality of life. Thus, the rising obesity rates and awareness of associated health risks, such as diabetes, cardiovascular diseases, and certain types of cancer, fuel demand for anti-obesity drugs.

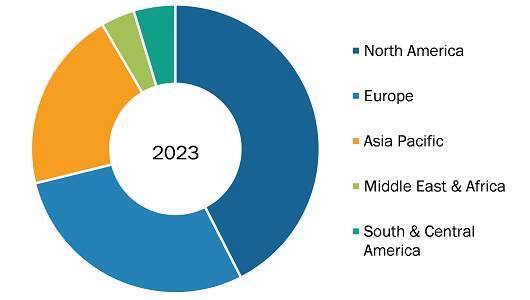

Anti-obesity Drugs Market Share, by Region, 2024 (%)

Anti-obesity Drugs Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Prescription and OTC ), Drug Class (GLP-1 Agonist, Lipase Inhibitors, MC4R agonist, and  others), Application (Appetite Suppression, Inhibition of Fat Absorption/Digestive Enzymes, Metabolic Enhancement, and Combination), Route of Administration (Oral and Parenteral), and Distribution Channel (Hospital Pharmacies, Online Channel, and Retail Pharmacies), and Geography

Anti-obesity Drugs Market Global and Regional Overview 2031

Download Free Sample

Source: The Insight Partners Analysis

Scope of Anti-obesity Drugs Market Report:

The anti-obesity drugs market analysis has been carried out by considering the following segments: type, drug class, application, route of administration, and distribution channel, and geography. Based on type, the anti-obesity drugs market is bifurcated into prescription and OTC. The prescription segment held the largest share of the market in 2024. Anti-obesity prescription medications aid in weight loss in patients with obesity (BMI ≥30) or those who are overweight (BMI ≥27) with associated comorbid conditions such as hypertension or type 2 diabetes. The drugs are effective when they are combined with exercise and diet. According to the National Institutes of Health, on average, at 1 year, adults on prescription medication as part of a lifestyle program lose 3%-12% more initial body weight than individuals in a lifestyle program without medication. Fewer data exist for children 12 years and older, but the ranges seem similar. The FDA has authorized six of these medications—orlistat (Alli, Xenical), phentermine-topiramate (Qsymia), naltrexone-bupropion (Contrave), liraglutide (Saxenda), semaglutide (Wegovy), and tirzepatide (Zepbound)—for chronic use. Four of these medications are approved for use in children aged 12 years and older and adults. Another approved medication, setmelanotide (IMCIVREE), is reserved for individuals who have been diagnosed with one of four particular rare genetic diseases such as Bardet-Biedl syndrome (BBS), POMC deficiency, PCSK1 deficiency, and leptin receptor (LEPR) deficiency, which must be verified through genetic testing.

The established efficacy of GLP-1 treatments has fueled a boom in pharmaceutical development and investment, with new therapies in the pipeline. In March 2025, Roche and Zealand Pharma signed an exclusive collaboration to co-develop and co-commercialize petrelintide, an amylin analog, as a single agent and in combination with Roche's lead incretin compound, CT-388.

Growing rates of obesity worldwide, elevated public awareness, and greater acceptance of medical weight loss options are driving demand. To capitalize on this momentum, players in the market are seeking strategic partnerships. In April 2025, Hims & Hers, a direct-to-consumer telehealth company, partnered with Novo Nordisk to provide a bundled option featuring access to Wegovy—Novo Nordisk's top obesity medication—along with a Hims & Hers membership, with prices beginning at US$ 599 per month. The strategy represents a move toward aligned, consumer-facing care models within the emerging obesity treatment landscape.

By drug class, the anti-obesity drugs market is segmented into GLP-7 agonists, lipase inhibitors, MC4R agonists, and others. The GLP-7 Agonist segment held the largest share of the market in 2024. GLP-1 agonists segment further subsegmented into Semaglutide, Liraglutide, Tirzepatide.

The increasing use of GLP-1 (glucagon-like peptide-1) receptor agonists has transformed the weight management therapy landscape. Originally designed for type 2 diabetes, semaglutide (Ozempic, Wegovy) and liraglutide (Saxenda) have proven effective in facilitating weight loss by increasing satiety, slowing gastric emptying, and inhibiting appetite through central nervous system mechanisms. These drugs have become well established in the marketplace as a result of their two-in-one value—treating obesity and its related comorbidities, such as cardiovascular disease and metabolic syndrome. As obesity incidence rises globally, the need for non-surgical pharmacological treatments is surging, supported by positive regulatory frameworks, shifting treatment recommendations, and rising awareness. Pharmaceutical companies are responding by stepping up R&D and forming strategic partnerships to enhance their pipeline of therapeutics. In November 2023, AstraZeneca entered into an exclusive license agreement with Eccogene to develop ECC5004, an oral, once-daily GLP-1RA for obesity and obesity-related conditions. In January 2025, Novo Nordisk announced positive Phase 1b/2a results for amycretin, a once-weekly subcutaneous dual GLP-1/amylin receptor agonist. Likewise, strategic partnerships are defining market development. In October 2024, Amneal Pharmaceuticals and Metsera partnered on the broad-scale development of new weight-loss medications. In March 2025, OPKO Health and Entera Bio partnered to develop the first oral dual GLP-1/glucagon agonist.

Based on application, the anti-obesity drugs market is categorized into appetite suppression, inhibition of fat absorption/digestive enzymes, metabolic enhancement, and combination. The appetite suppression segment held a largest share of the market in 2024. Pharmaceutical firms are developing and marketing new therapies to treat the worldwide obesity crisis. In May 2025, Novo Nordisk's oral formulation of Wegovy (semaglutide) gained the US Food and Drug Administration (FDA) approval, a breakthrough in chronic weight management therapies. The oral form is designed to provide patients with a more convenient alternative to injectable therapy, possibly improving accessibility and compliance. In April 2025, Eli Lilly's oral GLP-1 receptor agonist, orforglipron, showed promising results in early trials, offering another possible route for appetite suppression in weight management. Increased attention to appetite suppression therapies signals a broader movement toward the treatment of obesity via pharmacologic means for blocking hunger-reducing mechanisms, thus preserving weight loss and improving patient outcomes.

In terms of route of administration, the anti-obesity drugs market is bifurcated into oral and parenteral. The oral segment dominated the market in 2024. The oral route of administration is fueling the demand for anti-obesity medicines, with Xenical (orlistat), Contrave (naltrexone/bupropion), and Qsymia (phentermine/topiramate) taking the front line owing to their ease of administration, compliance, and ease of access. Xenical, a lipase inhibitor, prevents the absorption of dietary fat and is available on prescription and over the counter as Alli, an easily accessible commodity for consumers. Contrave pairs an opioid antagonist and an antidepressant to reduce cravings and appetite, providing a two-pronged approach that targets neurological and behavioral factors of obesity. Qsymia, which contains phentermine and extended-release topiramate, is a combination of an appetite suppressant/stimulant and a medication used to treat seizures. It is prescribed to support long-term weight management in overweight and obese adults, alongside a reduced-calorie diet and increased physical activity. These oral medications are gaining popularity worldwide as non-surgical or non-injectable solutions. In March 2024, Taisho Pharmaceutical introduced Alli (orlistat) as the first over-the-counter oral anti-obesity drug in Japan. In January 2025, Currax Pharmaceuticals initiated the first TV ad campaign for Contrave, seeking to raise public awareness of its benefits in appetite control. Vivus has strengthened Qsymia's worldwide presence by getting market approval within the UAE in 2023. These developments underscore the efforts of the industry to improve awareness and access to oral anti-obesity medication, reaffirming their central place in the emerging weight management era.

Per distribution channel, the anti-obesity drugs market is categorized into hospital pharmacies, online channel, and retail pharmacies. The hospital pharmacies segment dominated the market in 2024. Hospital pharmacies are spearheading the development of anti-obesity drugs through specialized, clinically monitored dispensing of high-tech pharmacotherapies. They make sure the controlled distribution of Wegovy, Saxenda, Zepbound, and Imcivree is commonly applied in complicated conditions with comorbidities such as diabetes or cardiovascular disease. Cleveland Clinic (US), King's College Hospital (UK), Singapore General Hospital (Singapore), and Apollo Hospitals (India) are incorporating hospital pharmacy services into multidisciplinary programs for the treatment of obesity. These environments deliver the medications, extensive patient education, frequent monitoring, and compliance support. The Obesity Centre of Singapore General Hospital utilizes hospital pharmacy protocols to oversee long-term pharmacotherapy. At the same time, Apollo's bariatric care units include in-house pharmacists to monitor anti-obesity medication regimes. Such consolidation maximizes patient outcomes and security. The rising prevalence of obesity is propelling hospital pharmacies to provide cost-effective and professionally guided treatments.

Anti-obesity Drugs Market Analysis: Based on Geography

The geographic scope of the anti-obesity drugs market includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), South & Central America (Brazil, Argentina, and the Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa).

The World Health Organization, World Obesity Atlas, The U.S. Food and Drug Administration, The Lancet Journal, World Obesity Federation, World Economic Forum, Centers for Disease Control and Prevention (CDC), the International Diabetes Federation (IDF), the Organization for Economic Co-operation and Development (OECD) are primary and secondary sources referred to while preparing the anti-obesity drugs market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com