Increasing Demand from Automotive and Aerospace Industries Drives Growth of Broaching Machines Market Players During 2022–2028

According to our latest study on “Broaching Machines Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Type and End User,” the market is expected to grow from US$ 865.34 million in 2022 to US$ 1,113.24 million by 2028; it is estimated to grow at a CAGR of 4.3% from 2022 to 2028.

Broaching machines are used to perform several operations in the automotive, aerospace & defense, and metal industries, among other heavy industries. It is employed in the manufacturing of automotive and industrial components, and subassembly parts such as gears, shafts, and splines. Broaching is one of the most effective and efficient metal removal techniques developed for heavy industries. It is suitable for large-volume applications with close-fitting tolerance, which are typically seen in the automotive and aerospace industries. Broaching machines exhibit exceptional repeatability and deliver better part finish than other metal removal methods.

The rising defense expenditure across India, China, and other developing countries fuels the demand for various broaching machines, thereby accelerating the growth of overall broaching machines market. The policies favoring FDIs in these countries encourage several international private companies to invest in manufacturing capabilities in these countries to produce military equipment for the domestic defense forces. In 2021, the Government of China has spent ~US$ 293 billion on the procurement of military equipment and solutions. Further, the automotive sector in India and China is flourishing with the elevating passenger car sales across these countries, thereby leading to a huge demand for broaching machines. For instance, in 2021, total new vehicle sales in China stood at 26.3 million, accounting for a rise of ~3.8% over the sales recorded in the previous year.

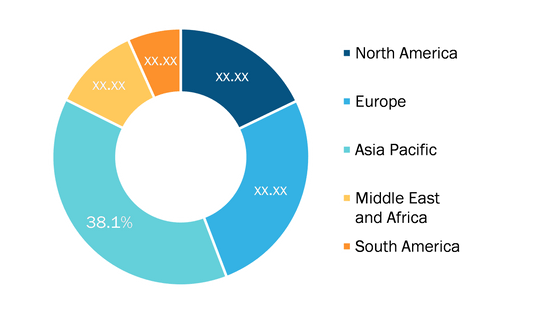

The broaching machines market is segmented on the basis of type, end user, and geography. Based on type, the market is segmented into horizontal broaching machine, vertical broaching machine, surface broaching machine, and others. Based on end user, the broaching machines market is categorized into automotive, metal fabrication, aerospace and defense, oil and gas, and others. Based on geography, the broaching machines market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). APAC accounted for a significant share of the overall market during 2021.

China is the world's largest broaching machining tools consumer, followed by the US, as a large number of machine manufacturers are based in the country. These countries are contributing significantly to the overall broaching machines market growth. The automotive, oil & gas, and railways industries in Asia Pacific receive significant investments owing to cheaper production and labor costs. The growing demand for broaching machine tools is also attributed to the need for accurate operations in engineering, and transportation equipment and industrial machinery manufacturing.

Impact of COVID-19 Pandemic on Asia Pacific Broaching Machines Market

International Production Networks (IPNs), a sophisticated form of global value chains (GVCs), have demonstrated their robustness and resilience in previous financial shocks in Asia, despite the susceptibility of these value chains to the spread of repercussions through supply chains. Issues such as the lack of containers and chips for shipping and the emergence of the delta variant of SARS-CoV-2 plagued global value chains in 2021. Unlike other regions, East Asia continued to export more machinery, especially in August 2021, than it did before the pandemic, which supported the broaching machines market growth in Asia Pacific.

Machinery exports in China, Japan, and ASEANs declined during the COVID-19 pandemic. In ASEAN countries, although machinery exports have fluctuated, general & electric machinery goods and precision machinery products have managed to maintain exports beyond the pre-pandemic levels. On the other hand, exports of transport equipment and precision machinery parts and components declined in July and August 2021. According to a survey by the United Nations Industrial Development Organization (UNIDO), manufacturing in India reportedly ceased after the implementation of the lockdown in 2020, except for the rice milling industry, which continued to operate but at 50% reduced production levels. Metals and chemical goods, automobiles, machinery and equipment, textiles, and other manufacturing businesses were among the most impacted sectors. Thus, the COVID-19 pandemic had a moderate impact on the overall broaching machines market.

A few of the key players operating in the broaching machines market are Nachi-Fujikoshi Corp, Federal Broach & Machine Company LLC, Hoffmann Räumtechnik GmbH, The Ohio Broach and Machine Co., and Stenhøj Hydraulik A/S.

Broaching Machines Market – by Region, 2021 and 2028 (%)

Broaching Machines Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Horizontal Broaching Machine, Vertical Broaching Machine, Surface Broaching Machine and Others), End-user (Automotive, Metal Fabrication, Aerospace and Defense, Oil and Gas, and Others) and Geography

Broaching Machines Market Size & Share Analysis Report 2031

Download Free Sample