Drug Development and Manufacturing Segment Based on Product Type Bolsters Cell and Gene Therapy Contract Development and Manufacturing Organization Market Growth

According to our new research study on "Cell and Gene Therapy Contract Development and Manufacturing Organization Market Forecast to 2031 – Global Analysis – by Service Type, Product Type, and End User," the market was valued at US$ 6.22 billion in 2024 and is projected to reach US$ 31.86 billion by 2031; it is anticipated to record a CAGR of 26.4% from 2025 to 2031. The report emphasizes the cell and gene therapy contract development and manufacturing organization market trends, along with drivers and deterrents affecting the market growth. Increasing clinical trials for innovative therapies and surging regulatory approvals and commercialization contribute to the growing cell and gene therapy contract development and manufacturing organization market size. However, the high manufacturing complexities hamper the market growth. Further, the rising integration of AI and digital transformation is expected to emerge as a new cell and gene therapy contract development and manufacturing organization market trend in the coming years.

Surging Regulatory Approvals and Commercialization Bolster Cell and Gene Therapy Contract Development and Manufacturing Organization Market Growth

Over the past few years, the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have streamlined their approval processes for cell and gene therapies. As of 2024, more than 1,000 clinical trials for gene therapies are ongoing worldwide, reflecting the expanding therapeutic potential and increasing regulatory support. The FDA has granted breakthrough status to several gene therapies, signaling its commitment to speeding up access to the treatments. This process has created a huge impact on the CDMOs, as companies need specialized contract manufacturers to handle the production demand for these therapies, especially during clinical trial phases.

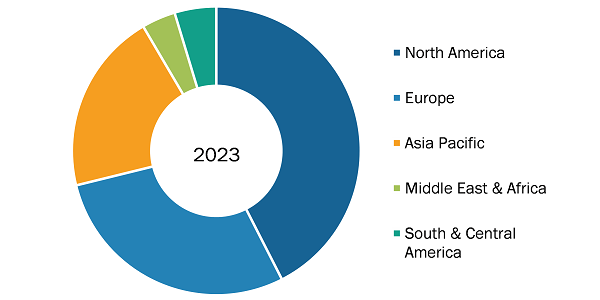

Cell and Gene Therapy Contract Development and Manufacturing Organization Market Share, by Region, 2024 (%)

Cell and Gene Therapy Contract Development and Manufacturing Organization Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Drug Development and Manufacturing, Testing and Regulatory Services, and Others), Product Type (Gene Therapy and Cell Therapy), End User (Pharmaceutical Companies, Biopharmaceutical Companies, and Others), and Geography

Cell and Gene Therapy CDMO Market Forecast & Trends to 2031

Download Free Sample

Source: The Insight Partners Analysis

The increasing number of FDA approvals and the rapid commercialization of gene therapies have led to outsourcing to CDMOs. Novartis, Gilead, and Bristol-Myers Squibb have partnered with CDMOs to scale production quickly and meet regulatory standards. In April 2025, the FDA approved prademagene zamikeracel (pz-cel), also known as Zevaskyn. It is the first autologous, cell-based gene therapy for the treatment of recessive dystrophic epidermolysis bullosa (RDEB). This approval represents a breakthrough for patients suffering from this devastating skin disorder. As the demand for such therapies grows, the CDMOs are essential in providing the infrastructure, regulatory expertise, and production scalability required for the commercialization of cell and gene therapy, thus driving the cell and gene therapy contract development and manufacturing organization market growth.

Scope of Cell and Gene Therapy Contract Development and Manufacturing Organization Market Report:

The cell and gene therapy contract development and manufacturing organization market analysis has been carried out by considering the following segments: service type, product type, end user, and geography.

Based on service type, the cell and gene therapy contract development and manufacturing organization market is segmented into drug development and manufacturing, testing and regulatory services, and others. The drug development and manufacturing segment held the largest share of the market in 2024. CDMOs play a crucial role in the pre-clinical and clinical drug development phases of cell and gene therapies (CGT). They provide expertise in vector design, cell line development, process optimization, and analytical testing. Manufacturing is a critical component, encompassing upstream and downstream processes. CDMOs offer services such as cell expansion, viral vector production, purification, and formulation. The surge in the clinical pipeline has amplified the need for specialized drug development and manufacturing services, leading biopharmaceutical companies to partner with CDMOs that possess the technical expertise, infrastructure, and regulatory know-how to bring these therapies to market.

CGT products require cleanrooms and bioreactors as well as skilled personnel capable of handling viral vectors, cell culturing, and gene editing technologies. Establishing such capabilities internally is impractical, especially for small to mid-sized biotech firms. For instance, building a commercial-ready cell therapy facility can cost over US$ 10 million, making outsourcing an attractive and cost-effective alternative. Lonza, Catalent, and WuXi Advanced Therapies are expanding their global CGT capabilities, offering end-to-end services from pre-clinical development to commercial manufacturing. Companies are outsourcing manufacturing services to CDMOs to mitigate risks and reduce costs associated with in-house production. According to the article titled “CMOs: Are You Ready for CGT Manufacturing?” published in March 2021, approximately 65% of the manufacturing process for cell and gene therapies is outsourced, compared to nearly 35% for traditional biologics.

Integrating artificial intelligence (AI) into manufacturing processes has enhanced efficiency and scalability. OmniaBio, a CDMO focused on cell and gene therapies, introduced a new manufacturing facility in Canada designed to meet the needs of cold chain logistics and the production of cell and gene therapies with the help of AI.

In terms of product type, the cell and gene therapy contract development and manufacturing organization market is bifurcated into gene therapy and cell therapy. The cell therapy segment dominated the market in 2024. Cell therapy aids in treating disorders and diseases by restoring/changing certain groups of cells or providing cells to carry therapy through the body. It forms or modifies cells outside the body before being introduced into the patient. The cells may derive from the patient (autologous cells) or a donor (allogeneic cells). Autologous therapies involve modifying a patient's cells to treat their disease. This approach is exemplified by chimeric antigen receptor T-cell (CAR-T) therapies, such as Kymriah (tisagenlecleucel) and Yescarta (axicabtagene ciloleucel), which are approved for B-cell malignancies, including acute lymphoblastic leukemia and non-Hodgkin lymphoma. These therapies have shown significant efficacy, with complete remission rates of up to 54% in certain lymphoma cases. Allogeneic therapies utilize donor-derived cells, offering the advantage of immediate availability and the potential for off-the-shelf treatments. For example, lifileucel (Amtagvi) is an adoptive T-cell therapy for melanoma, which involves infusing expanded tumor-infiltrating lymphocytes into patients.

Over 360 clinical trials focusing on cell-based therapies are being studied to interpret the potential of these therapies for treating various disease indications. Therefore, the demand for advanced therapy development and manufacturing services is rising. Lonza and Catalent have invested in state-of-the-art facilities to meet the growing demand for cell-based treatments. Charles River Laboratories is investing in technologies to streamline manufacturing processes, aiming to reduce production timelines by up to 60%. This acceleration is essential to meet the increasing demand for personalized therapies. As manufacturing capabilities advance and regulatory landscapes evolve, these therapies are becoming integral components of modern healthcare.

By end user, the cell and gene therapy contract development and manufacturing organization market is categorized into pharmaceutical companies, biopharmaceutical companies, and others. The biopharmaceutical companies segment dominated the market in 2024. Biopharmaceutical firms, especially small and medium-sized enterprises (SMEs), often lack the extensive infrastructure required for the complex processes involved in cell and gene therapy production. Collaborating with CDMOs allows these companies to access advanced manufacturing technologies and expertise without the substantial capital investment needed for in-house facilities. This partnership model is beneficial for startups and SMEs aiming to bring innovative therapies to market.

Established biopharmaceutical companies, including Lonza, Catalent, and Thermo Fisher Scientific, have expanded their services to include cell and gene therapy manufacturing. In 2020, Catalent's acquisition of MaSTherCell, a Belgian gene and cell therapy manufacturer, underscored its commitment to advancing cell and gene therapy capabilities. Collaborations between biopharmaceutical companies and CDMOs facilitate the sharing of risks and resources, accelerating the development process, and further enhancing cell and gene therapy contract development and manufacturing organization market growth. In June 2024, Charles River Laboratories International and the Gates Institute at the University of Colorado Anschutz Medical Campus entered into a lentiviral vector CDMO agreement. Gates Institute will leverage Charles River’s premier cell and gene therapy CDMO expertise for the development of GMP-grade lentiviral vectors for CAR T-cell therapies, advancing treatment options for hematological cancers. Such partnership models enable biopharmaceutical companies to focus on R&D while ensuring that manufacturing processes meet the rigorous standards required for cell and gene therapy products. Thus, as the cell and gene therapy sector expands, the symbiotic relationship between biopharmaceutical companies and CDMOs will be essential for bringing innovative therapies to patients in need.

Cell and Gene Therapy Contract Development and Manufacturing Organization Market Analysis: Based on Geography

The geographic scope of the cell and gene therapy contract development and manufacturing organization market includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), South & Central America (Brazil, Argentina, and Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa).

Statistics Canada, World Population Prospectus, Globocan, Brazilian Health Regulatory Agency (ANVISA), Alliance for Regenerative Medicine (ARM), and the Food and Drug Administration (FDA) are among the primary and secondary sources referred to while preparing the cell and gene therapy contract development and manufacturing organization market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com