Hospitals Held Largest Share of Dental Bone Graft Substitute Market in 2022

According to our new research study on "Dental Bone Graft Substitute Market Forecast to 2030 – Global Analysis – by Type, Application, and End User ", the dental bone graft substitute market size is expected to grow from US$ 533.5 million in 2022 to US$ 1,011.2 million by 2030; it is anticipated to record a CAGR of 8.3% from 2022 to 2030. The report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing burden of periodontal diseases and oral cancer, and the growing demand for dental cosmetic procedures propels the market growth. However, the limitations and misconceptions associated with reimbursement policies are hampering the growth of the market. Digitization of dentistry with CAD/CAM technology will act as the new dental bone graft substitute market trend in the coming years.

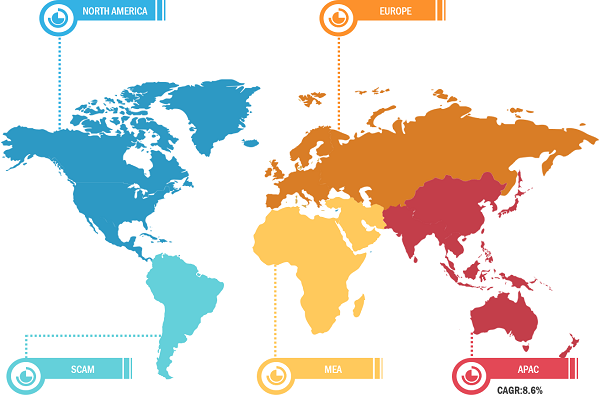

Dental Bone Graft Substitute Market, by Region, 2022 (%)

Dental Bone Graft Substitute Market SWOT Analysis Report 2031

Download Free SampleDental Bone Graft Substitute Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Hardware and Software), Causes (Stroke, Injury, Neurodegenerative Diseases, and Others), Disorder Type (Articulation Disorders, Phonological Disorders, Voice disorders or resonance disorders, Language Disorders, and Others), Age Group (Adults and Pediatric), End User (Healthcare Facilities, Speech Therapy Centers, Rehabilitation Centers, and Others), and Geography

Source: The Insight Partners Analysis

Upsurge in the Demand for Cosmetic Dentistry is Fueling the Dental Bone Graft Substitute Market Growth

Cosmetic dentistry can be a ray of hope for patients and practitioners, as individuals undergoing these procedures gain confidence through a winning smile, and cosmetic dentists attain high patient satisfaction and loyalty for their work. The number of dental implantation procedures and surgeries performed has increased significantly in the US. As per the American Academy of Cosmetic Dentistry, the US alone spent ~US$ 2.75 billion annually on cosmetic dentistry in 2021. Although patients in their 30s represented the largest segment inquiring about cosmetic dentistry procedures, interest spanned almost every age group. According to the OnePoll survey of 2,000 people in the US, 7 in 10 felt insecure about their teeth; 57% of Americans covered their mouth when laughing because of insecurities about their teeth, and 1 in 4 had received a negative comment about their teeth. Such insecurities are among the major reasons for an increasing number of cosmetic dentistry procedures performed annually in the US. The growing demand for dental cosmetic procedures also reflects patients' willingness to pay for these procedures. Losing a tooth can change the appearance of the entire mouth; thus, bone grafting is necessary for cosmetic dentistry to achieve a desirable result. A bone graft can prevent further degradation while allowing certain cosmetic restorations. Therefore, an upsurge in the demand for cosmetic dentistry is favoring the growth of the dental bone graft substitute market.

The dental bone graft substitute market, based on type, is segmented into autograft, allograft, xenograft, synthetic bone graft, and others. In 2022, the xenograft segment held the largest dental bone graft substitute market share followed by autograft. The same segment is expected to record the highest CAGR during 2022–2030. Autografts are commonly obtained from extraoral and intraoral sites, such as the mandibular ramus, mandibular symphysis, external oblique ridge, proximal ulna, iliac crest, or distal radius, of the individual undergoing treatment, as they are good sources of cortical and cancellous bone. Autografts are associated with higher surgical costs and involve significant surgical risks, e.g., pain, excessive bleeding, inflammation, and infection, limiting their application to smaller bone defects. Although other bone substitutes are routinely used to treat localized alveolar bone defects and maxillary bone grafts in dental applications, block-form autografts are still routinely used in alveolar ridge augmentation procedures. Autografts are the preferred material for complex augmentation procedures, such as posterior mandibular edentulous reconstruction, because only a few bone substitute materials can produce a volume of newly formed bone comparable to autograft materials.

The dental bone graft substitute market, by application, is segmented into socket preservation, ridge augmentation, periodontal dental regeneration, implant bone regeneration, and sinus lift. In 2022, the periodontal dental regeneration segment held the largest market share and is anticipated to record the highest CAGR during 2022–2030. In anticipation of an implant placement or fixed partial denture pontic site, socket preservation maintains bone volume post-extraction. This procedure helps compensate for the resorption of the facial bone wall. When implant placement must be delayed for patient or site-related reasons, socket preservation should be examined.

The market, by end user, is segmented into hospital, dental clinics, and others. In 2022, the dental clinics segment held the largest dental bone graft substitute market share and is expected to record the highest CAGR during 2022–2030. Dental clinics are smaller than dental hospitals. Dental clinics are mostly associated with universities and offer convenience to patients with reduced waiting time and services are cost-effective. A dental clinic provides all kinds of dental treatment facilities, such as periodontics, orthodontics, dental implants, teeth whitening, and preventive dentistry. The growth of dental clinics in the US is due to the rising prevalence of dental disorders and increasing disposable income. As the disposable incomes of people increase, the spending on personal healthcare, such as cosmetics, orthodontics, and grooming, also increases. For instance, as per the US Bureau of Economic Analysis in 2022, the disposable personal income in the US increased to US$ 18,360.78 billion in February from US$ 18,276.27 billion in January. The increasing number of dental clinics offering dental services is also expected to support dental bone graft substitute market growth during the forecast period.

Dentsply Sirona Inc, Dentium Co Ltd, Geistlich Pharma AG, ZimVie Inc, Keystone Dental Inc, Straumann Holding AG, Medtronic Plc, BioHorizons Inc, MEDOSIS, and LifeNet Health Inc. are among the prominent players profiled in the dental bone graft substitute market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and new product launches to meet the growing demand from consumers worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.

The dental bone graft substitute market is segmented as follows:

The dental bone graft substitute market analysis has been carried out by considering the following segment type, application, end user, and geography. The market, by type, is segmented into autograft, allograft, xenograft, synthetic bone graft, and others. Based on application, the dental bone graft substitute market is segmented into socket preservation, ridge augmentation, periodontal dental regeneration, implant bone regeneration, and sinus lift. The market, by end user, is segmented into hospital, dental clinics, and others. Geographically, the scope of the dental bone graft substitute market report is primarily divided into North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com