Growing Adoption of Open-Banking APIs to Provide Growth Opportunities for Digital Payment Market During 2021–2028

According to our latest market study on “Digital Payment Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Component, Deployment, Organization Size, and Industry,” the market was valued at US$ 89,045.67 million in 2021 and is projected to reach US$ 243,426.71 million by 2028; it is expected to grow at a CAGR of 15.4% from 2021 to 2028.

Financial services companies are recognizing the importance of open banking initiatives and application programming interfaces. Traditional banks understand that they must improve their digital capabilities to compete in the sector and avoid being disintermediated by new entrants with superior offers and services. For instance, numerous financial services companies such as PayPal, Wells Fargo, and Visa are supporting Open Banking projects. Also, in Europe, Open Banking initiatives are progressively becoming the norm because banks are legally required to make account information accessible via APIs under the Revised Payment Services Directive (PSD2), effective from 2018.

Open Banking APIs boost a bank's attractiveness and enable it to meet the changing expectations of existing clients and attract new ones. The APIs may also be used as a one-of-a-kind solution to boost customer interaction and respond to consumer requirements in a safe, agile, and future-proof way. Open Banking APIs are significant assets for financial services organizations because they allow them to expand service offerings, boost client interaction, and create new digital income channels, which would offer a significant opportunity for the digital payment market to expand during the forecast period.

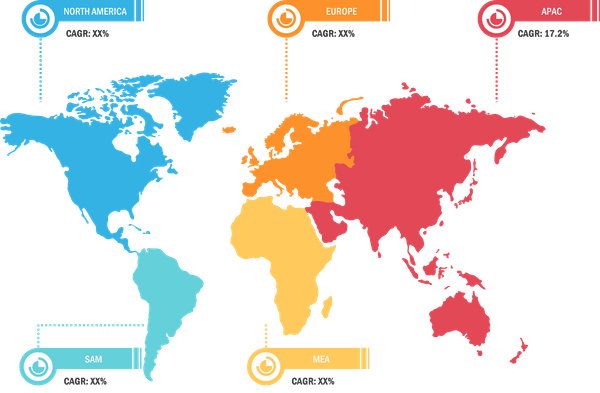

The digital payment market is segmented on the basis of component, deployment, organization size, industry, and geography. Based on component, the market is bifurcated into solution and services. The market for the solution segment is further segmented into payment gateway, payment processing, payment security and fraud management, point of sale, and payment wallet. The payment processing segment held the largest revenue share in 2020. Based on deployment, the digital payment market is bifurcated into on-premise and cloud-based. The cloud-based segment held a larger revenue share in 2020. Based on organization size, the market is bifurcated into small and medium enterprises and large enterprises. The large enterprises segment held a larger revenue share in 2020. Based on industry, the digital payment market is segmented into BFSI, retail and ecommerce, healthcare, travel and hospitality, media and entertainment, IT and telecom, and others. The BFSI segment held the largest revenue share in the market in 2020. Geographically, the digital payment market is segmented into five key regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM). North America held the largest revenue share in 2020, followed by Europe and APAC. The market in APAC is projected to grow at the fastest rate from 2021 to 2028.

Impact of COVID-19 Pandemic on Digital Payment Market

The COVID-19 pandemic has benefited the digital payment solutions industry. Businesses are facing new challenges due to the pandemic and the development of remote work environments. At least 58 governments in developing countries have adopted digital payments to give COVID-19 help, according to a World Bank survey of policy responses to the pandemic. At least 36 countries received the funds in fully functional accounts that may be used for saving or transactions in addition to withdrawing cash. Financial inclusion necessitates such extensive capability. Further, the emergence of the pandemic in 2020 has prompted a slew of challenges for global market operations. Healthcare infrastructures of developed economies have collapsed due to the rising number of COVID-19 cases. As a result, the public healthcare emergency will require the governments and market players to intervene and assist in the revival of market operations and revenue through collaborative efforts of research and development initiatives to recover the losses during the forecast period. In addition, the increased investments bode well for the industry in the following years.

ACI Worldwide, Inc.; Adyen; Financial Software & Systems Pvt. Ltd.; Fiserv, Inc.; Global Payments Inc.; Novatti Group Ltd.; PayPal Holdings, Inc.; Paysafe Limited; Block, Inc.; and PayU are among the key players operating in the global digital payment market.

Digital Payment Market – by Geography, 2020 and 2028 (%)

Digital Payment Market Growth Report | Size, Share Insights 2028

Download Free Sample

Digital Payment Market Forecast to 2028 - Analysis By Component (Solutions and Services), Deployment (On-Premises and Cloud-Based), Organization Size (Small and Medium Enterprises and Large Enterprises), and Industry (BFSI, Retail and Ecommerce, Healthcare, Travel and Hospitality, Media and Entertainment, IT and Telecom, and Others)

Contact UsDigital Payment Market Growth Report | Size, Share Insights 2028

Download Free SampleDigital Payment Market Forecast to 2028 - Analysis By Component (Solutions and Services), Deployment (On-Premises and Cloud-Based), Organization Size (Small and Medium Enterprises and Large Enterprises), and Industry (BFSI, Retail and Ecommerce, Healthcare, Travel and Hospitality, Media and Entertainment, IT and Telecom, and Others)

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com