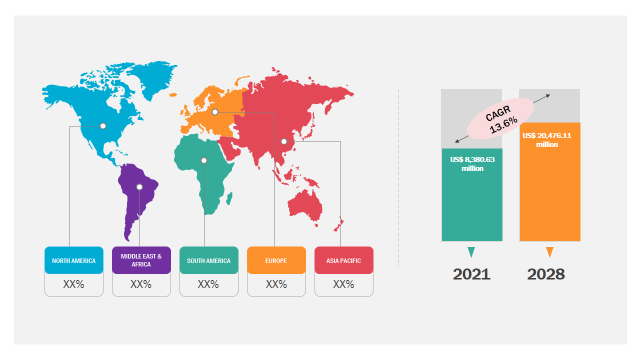

The eClinical solutions market is expected to reach US$ 20,476.11 million by 2028; registering at a CAGR of 13.6% from 2022 to 2028, according to a new research study conducted by The Insight Partners

The small and large companies operating in the eClinical solutions market are adopting various strategies, including regional expansion and technological advancements, to increase their market share. The rising number of government grants coupled with a growing number of rare diseases has supported the growth of the eClinical solutions market in recent years; furthermore, it is expected to continue a similar trend during the forecast period. Moreover, the rising adoption of cloud based platforms by biopharmaceutical companies is anticipated to create lucrative opportunities for the market growth in the coming years.

eClinical Solutions Market Strategies, Trends, and Forecast by 2031

Download Free SampleeClinical Solutions Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by Offerings {Software Solutions [Randomization & Trial Supply Management (RTSM), Clinical Data Management System (CDMS), Clinical Trial Management System (CLMS), Electronic Clinical Outcome Assessment (eCOA), Electronic Trial Master File (eTMF), Electronic Data Capture, and Others] and Services}, Delivery Mode (On-Premise, Cloud Based, and Web Based), Therapeutic Area (Cardiovascular, Diabetes, Metabolic Diseases, Gastroenterology, COVID-19, Rare Disease, Precision Medicine, and Others), Clinical Trial Phase (Phase I, Phase II, Phase III, and Phase IV), and End User (Contract Research Organizations, Medical Device Companies, Pharma/Biotech Companies, Hospitals & Clinics, and Others), and Geography (North America, Europe, Asia Pacific, and South and Central America)

North America held the largest market for advanced wound care, with the US holding the largest share of the regional market, followed by Canada and Mexico. The US held the largest share in 2021 and is expected to follow a similar trend over the forecast period. Clinical trial grants for orphan products are an effective method of successfully fostering and encouraging the development of new medical products, including medications and devices, for the treatment of rare diseases and other related conditions. The FDA’s Office of Orphan Products Development (OOPD) awards new clinical trial grants on a yearly basis. A major portion of funds for a given fiscal year provides continued funding of ongoing awards. As per the Food and Drug Administration, there are typically 60-85 ongoing grant projects each year, and OOPD awards approximately 5-12 new grants each year. The rapid rise in the cost of clinical trials in the past few years led to an increase in the number of new grants.

OOPD conducts ongoing grant evaluations to ensure extramural funded studies maintain grant agreement terms and minimize risk to people participating in the clinical research. As a result, the demand for clinical trial management solutions has grown in recent years; furthermore, it is expected to continue a similar trend during the forecast period. Thus, the rising demand for such solutions is supporting the growth of the eClinical solutions market.

The COVID-19 pandemic has positively impacted the eClinical solutions market. The impact of the crisis on the biopharmaceutical industry has improved patient-centricity and increased the adoption of eClinical digital platforms to manage clinical trial development programs. Numerous capital investments and co-development of new products focused on the advancement of clinical assets are increasing the number of Phase II and Phase III clinical trials. The total number of open trials (recruiting and enrolling by invitations) in 2021 doubled compared to 2019. Cloud based electronic data capture (EDC), randomization and trial supply management (RTSM)/interactive response technology (IRT), and integrated platforms are providing biopharmaceutical sponsors a unified view/approach of the trial workflow while improving efficiency with a smooth workflow approach.

A few of the key players involved in the eClinical solutions market are undertaking initiatives to expand their product portfolios and strengthen their market position. For instance, in October 2022, eClinical Solutions, one of the global providers of digital clinical software and services, bought together the life science leaders for its fourth annual client and partner conference elluminate Engage 2022, at Convene in Boston, Massachusetts. The meeting mainly focused on empowering the elluminate Clinical Data Cloud model to create new user experiences for interacting with clinical data amidst the healthcare industry’s growing volume and variety of clinical trial data.

Clario, Merge Healthcare (IBM), ALTEN Group, Signant Health, Oracle Corporation, Medidata Solutions, Parexel International Corporation, Bioclinica, Datatrak International, and Revele are the leading companies in the global eClinical Solutions market.

Some of the recent developments that are being offered by market participants are as follows:

- In March 2022, eClinical Solutions, one of the global providers of digital clinical software and services, announced key achievements from the year including the addition of 15 novel software and services clients and a 50% year over year (YoY) increase in elluminate (brand) revenue. The new customers serves the life sciences industry from clinical research organizations (CROs) like Translational Research in Oncology (TRIO) to leading pharmaceutical and biopharmaceutical companies,

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com