Other Enzymes Segment, by Enzyme Type, to Account for Largest Share in Enzyme Replacement Therapy Market During 2022–2028

According to our latest study on “Enzyme Replacement Therapy Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Enzyme Type, Therapeutic Conditions, Route of Administration, and End-User,” the market is expected to grow from US$ 9,673.39 million in 2021 to US$ 15,184.70 million by 2028; it is expected to grow at a CAGR of 6.8% from 2022 to 2028. The report highlights the key factors driving the market growth and prominent players with their developments in the market.

Based on enzyme type, the global enzyme replacement therapy market is segmented into alglucosidase alfa, velaglucerase alfa, agalsidase beta, imiglucerase, galsulfase, idursulfase, and other enzymes. The other enzymes segment is likely to account for the largest market share during 2022–2028. By therapeutic conditions, the market is segmented into Gaucher's disease, Fabry's Disease, Pompe's Disease, SCID, MPS, and other therapeutic conditions. The Gaucher’s disease segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period. Based on route of administration, the global enzyme replacement therapy market is segmented into oral and parenteral. The parenteral segment is likely to account for a larger market share during 2022–2028. By end user, the market is segmented into hospitals, infusion centers, and others. The hospitals segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period.

In February 2022, the study on “Antibodies against recombinant human alpha-glucosidase do not seem to affect clinical outcome in childhood-onset Pompe disease” published in Orphanet Journal of Rare Diseases found that many children suffering from Pompe disease had developed antibodies against Myozyme (alglucosidase alfa) enzyme replacement therapy but the presence of antibodies did not hampered the treatment efficacy of enzymes. Thus, the higher efficacy of the enzyme will enhance its adaptability among the population, which supports the market growth.

The COVID-19 pandemic significantly increased the adoption of enzyme replacement therapy and will continue a similar trend in the coming years. The pandemic altered economic conditions and social behaviors in all regions. Containment measures enacted by governments to mitigate the spread of the novel coronavirus changed the healthcare service delivery pattern in the US. According to the Department of Emergency Medicine, in many cities across the country, emergency department (ED) visits decreased by ~40% in 2020. Moreover, outpatient appointments and elective treatments were postponed or replaced by telemedicine practices. Thus, the factors mentioned above limited the growth of the global enzyme replacement therapy market during the COVID-19 pandemic.

Takeda Pharmaceutical Company Limited; Sanofi; AbbVie Inc.; BioMarin Pharmaceutical Inc.; Amicus Therapeutics; Alexion Pharmaceuticals, Inc. (AstraZeneca); Janssen Pharmaceuticals (Johnson and Johnson Services, Inc.); Recordati S.p.A.; Pfizer Inc.; and CHIESI Farmaceutici S.p.A. are among the leading companies operating in the global enzyme replacement therapy market.

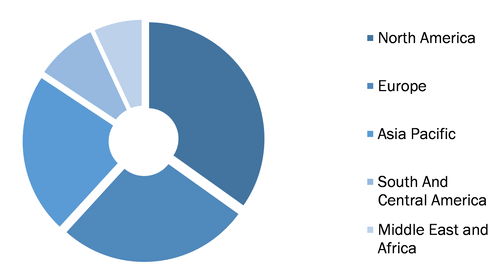

Global Enzyme Replacement Therapy Market, by Region, 2021 (%)

Enzyme Replacement Therapy Market Forecast to 2028 - Analysis By Enzyme Type (Alglucosidase Alfa, Agalsidase Beta, Imiglucerase, Idursulfase, Galsulfase, Velaglucerase Alfa, and Other Enzymes), Therapeutic Conditions (Gaucher's Disease, Fabry's Disease, MPS, Pompe's Disease, SCID, and Other Therapeutic Conditions), Route of Administration (Parenteral and Oral), and End User (Hospitals, Infusion Centers, and Others)

Enzyme Replacement Therapy Market Report | Size, Share by 2028

Download Free Sample

Various organic and inorganic strategies are adopted by companies operating in the global enzyme replacement therapy market. Organic strategies mainly include product launches and product approvals. Further, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players in strengthening their customer base and expanding their product portfolios. A few of the significant developments by key players in the global enzyme replacement therapy market are listed below.

- In May 2022, AbbVie and Cugene Inc., a clinical-stage biotechnology company focused on developing next-generation precision immunology and oncology medicines to treat autoimmune disease and cancer, announced an exclusive worldwide license option agreement for CUG252, a potential best-in-class Treg-selective IL-2 mutein, as well as other novel IL-2 muteins, for the potential treatment of autoimmune and inflammatory diseases.

- In August 2021, the US Food and Drug Administration (FDA) approved Nexviazyme (avalglucosidase alfa-ngpt) for the treatment of patients aged one year and above suffering from late-onset Pompe disease, a progressive and debilitating muscle disorder that impairs a person’s ability to move and breathe. Nexviazyme is an enzyme replacement therapyss (ERT) designed to specifically target the mannose-6-phosphate (M6P) receptor, the key pathway for cellular uptake of enzyme replacement therapy in Pompe disease. Nexviazyme has been shown in clinical trials to provide patients with improvements in respiratory function and walking distance.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com