Clinical Laboratory Analyzers Segment to Account for Largest Share in Coagulation Analyzers Market During 2022–2028

According to our latest study on Europe Biosimilars Market Forecast to 2030 – COVID-19 Impact and Analysis – by Disease Indication, Route of Administration, Drug Class, and Distribution Channel," the market is expected to grow from US$ 10,344.86 million in 2022 to US$ 115,125.91 million by 2030; it is expected to grow at a CAGR of 35.1% from 2022 to 2030. The report highlights the key factors driving the market growth and prominent players with their developments in the market.

Patent Expiry of Blockbuster Biologics Provides Lucrative Market Opportunities

Biologicals represent promising new therapies for previously incurable diseases and are becoming highly important in the pharmaceuticals market. However, patents for originator biologicals are expected to expire in the coming years.

Estimated patent and exclusivity expiry dates for best-selling biologicals are given in the following table .

Biologicals | Expiry Month & Year |

Avastin | January 2022 |

Cyramza | May 2023 |

Adcetris | August 2023 |

Abthrax | October 2024 |

Gazyva/Gazyvaro | November 2024 |

Darzalex | May 2026 |

Ocrevus | April 2027 |

Emgality | September 2028 |

Hemlibra | February 2028 |

Llumetri | March 2028 |

Imfinzi | September 2028 |

Mylotarg | April 2028 |

Imfinzi | September 2028 |

Mylotarg | April 2028 |

Sylvant | July 2034 |

Source: Generics and Biosimilars Initiative (GaBI) Journal

The patent expiration and other intellectual property rights for originator biologicals will create a need to introduce new biosimilars in the future. As a result, competition among market players will surge in the industry shortly. Thus, the patent expiry of blockbuster biologics is expected to create lucrative opportunities for the biosimilar market during the forecast period.

Collaborations for Biosimilars and Clinical Trials

Joint ventures and other collaboration models will help biosimilar medicine manufacturers maintain a competitive edge over rivals in the market in the upcoming years.

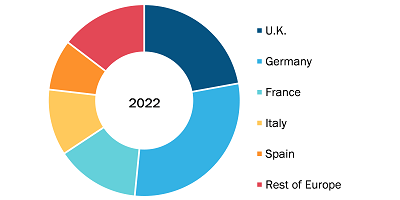

Europe Biosimilars Market, by Region, 2022 (%)

Europe Biosimilars Market Forecast to 2030 - Regional Analysis By Disease Indication (Cancer, Diabetes, Autoimmune Disease, and Other Disease Indication), Route of Administration (Intravenous, Subcutaneous, and Others), Drug Class (Granulocyte Colony-Stimulating Factor, Insulin, TNF Blockers and Monoclonal Antibodies, and Others), Distribution Channel (Hospital Pharmacies, Compounding Pharmacies, Retail Pharmacies, and Online Pharmacies), and Region

Europe Biosimilars Market SWOT Analysis by 2030

Download Free Sample

Source: The Insight Partners Analysis

By collaborating with other companies planning to research, launch, and market biosimilar drugs, biosimilar manufacturers can develop their products rapidly and launch products effectively in a way that overcomes patent risks and gain clinician and patient confidence in the product. Product development can be expedited by gaining local and foreign expertise, development platform access, and research and clinical trial funding.

Collaborating with a bigger biopharmaceutical manufacturer allows access to established manufacturing facilities. The collaboration can be done for outsourcing activities such as cell line development, biologics and biosimilar manufacturing, process scaling, and any required technology transfer.

There are long-term benefits from collaborations. They can make it easy to tender for future biosimilar production projects within the country and offer early and efficient product development and market penetration. In a sizeable market such as Europe, which has significant country-level diversity in healthcare policies and market dynamics, access to local knowledge obtained through such collaborations can also prove invaluable.

The immense potential of the biosimilars market has led to many recent, high-profile collaborations. A few instances are given below:

- In June 2023, Samsung Biologics announced a strategic partnership with Pfizer for the long-term commercial manufacturing of Pfizer's multi-product portfolio. The agreement aims that Samsung Biologics will offer Pfizer additional capacity for large-scale manufacturing of a multi-product biosimilar portfolio encompassing oncology and immunology, among others.

- In May 2023, Sandoz, a Novartis division, announced a biosimilar collaboration with Evotec Biologics. The agreement covers developing and manufacturing multiple biosimilar medicines intended for rapid development and the subsequent manufacturing of multiple biosimilars. The development of biosimilars at the Evotec Biologics facility will ramp up under the collaboration in the next 12–18 months.

Thus, collaborations of manufacturers for biosimilar production and clinical trials will be the key trend in the biosimilar market during the forecast period.

Amgen Inc, Celltrion Inc, Sanofi SA, Biocon Ltd, Samsung Bioepis Co Ltd, Elli Lilly and Co, Sandoz AG, Teva Pharmaceitical Industries Ltd, Pfizer Inc, Dr. Reddy's Laboratories Ltd. are among the leading companies operating in the Europe biosimilars market.

Various organic and inorganic strategies are adopted by companies operating in the Europe biosimilars market. Organic strategies mainly include product launches and product approvals. Further, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players strengthen their customer base and expand their product portfolios.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com