Flourishing E-Commerce Sector to Fuel Europe Electronic Signature Software Market Growth During Forecast Period

According to our latest study, “Europe Electronic Signature Software Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis – by Offering, Deployment Type, Type, End User, and Country," the market was valued at US$ 1.53 billion in 2024 and is expected to reach US$ 13.52 billion by 2031; it is estimated to record a CAGR of 36.6% from 2025 to 2031. The report includes growth prospects owing to the current Europe electronic signature software market trends and their foreseeable impact during the forecast period.

Over the past decade, business-to-business (B2B) e-commerce has grown consistently in Europe. This growth can be ascribed to the ongoing digital transformation of industries in the region, as more businesses set up e-commerce platforms to streamline operations, improve supply chains, and enhance customer experiences. According to the European E-commerce Report 2024, the total B2C e-commerce turnover in Europe increased from US$ 933.12 billion to US$ 958.96 billion during 2023. The rapid expansion of B2B e-commerce has revolutionized how businesses interact; many of them now prefer digital transactions owing to their efficiency, scalability, and cost-effectiveness. As businesses continue to embrace online platforms for goods sales and purchases, the need for robust digital security solutions has also intensified amid the mounting risk of cyber threats and fraud, in turn propelling the demand for electronic signatures to ensure the authenticity, integrity, and non-repudiation of online agreements.

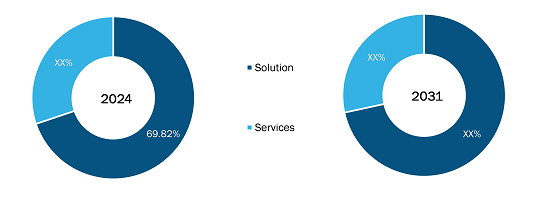

Europe Electronic Signature Software Market Share (%) – by Offering, 2024 and 2031

Europe Electronic Signature Software Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Offering (Solution and Services), Deployment Type (Cloud and On-Premises), Type (Advanced Electronic Signatures, Qualified Electronic Signatures, and General Electronic Signatures), End User (BFSI, Government, Manufacturing, IT and Telecom, Retail and E-Commerce, Pharmaceuticals, Legal, and Others), and Country

Europe Electronic Signature Software Market Size 2021-2031

Download Free Sample

Source: The Insight Partners Analysis

According to the International Trade Administration, the UK has the third largest e-commerce market in the world, after China and the US. Consumer e-commerce accounted for 36.3% of the total retail market in the UK as of January 2021, and the revenue is projected to surge to US$ 285.60 billion by 2025. In 2022, UK online sales saw its highest annual growth (36%) since 2007. Such a significant rise in e-commerce sales underscores the shift toward online transactions, further emphasizing the need for robust digital security solutions such as electronic signatures to ensure the security and authenticity of online transactions. Electronic signatures provide a reliable solution by ensuring the integrity and non-repudiation of electronic documents, such as payment authorizations, invoices, and purchase agreements. The enhanced security is crucial for maintaining consumer trust and reducing fraud risks in transactions. Thus, the surging need for secure digital interactions with the proliferation of the e-commerce industry bolsters the Europe electronic signature software market growth.

Zoho Corp Pvt Ltd, sproof GmbH, DocuSign Inc., Adobe Inc, EDICOM, Signable, secrypt GmbH, Aruba S.p.A, D-Trust GmbH, and Yousign are among the key players profiled in the Europe electronic signature software market report. Several other major players were also studied and analyzed during the market study to get a holistic view of the market and its ecosystem.

The report includes the Europe electronic signature software market forecast by offering, method, deployment type, and end user. Based on offering, the market is bifurcated into solutions and services. In terms of revenue, the solutions segment held a larger electronic signature software market share, and it is further expected to record a higher CAGR during the forecast period.

The scope of the Europe electronic signature software market report focuses on France, Germany, Russia, Italy, the UK, and the Rest of Europe. In terms of revenue, the UK held the largest Europe electronic signature software market share. Electronic signatures are legally recognized in the UK, with their use governed by a combination of regulations. These include the Electronic Identification and Trust Services for Electronic Transactions Regulations (2016); the Electronic Communications Act of 2000 (ECA); and the UK's retained version of EU Regulation No. 910/2014, i.e., known as the eIDAS Regulation. The eIDAS Regulation was later amended by the Electronic Identification and Trust Services for Electronic Transactions Regulations 2019 (SI 2019/89) to ensure continued applicability after Brexit. This legal framework establishes the validity and security of electronic signatures in the UK, making them a widely accepted tool for digital transactions. As businesses and organizations increasingly turn to electronic solutions for efficiency and security, the demand for legally compliant and reliable electronic signature services continues to rise in the UK. This trend drives the expansion of the electronic signature software market in the UK, particularly as more sectors, including finance, legal services, and government, adopt this form of signature to streamline processes and improve security in electronic transactions.

Key players operating in the UK are focusing on launching more advanced electronic signature software. For instance, in February 2025, Sumsub launched eSignature QES electronic signature verification solution to enhance remote user onboarding. This innovative solution has been designed to enhance security, compliance, and efficiency in remote user onboarding across the European Union (EU) and Norway, ensuring complete compliance with all national laws and eIDAS framework regulations. Thus, the growing focus of companies on product launch and innovation contributes to the expansion of the electronic signature software market in the UK.

Zoho Corp Pvt Ltd, sproof GmbH, DocuSign Inc., Adobe Inc, EDICOM, Signable, secrypt GmbH, Aruba S.p.A, D-Trust GmbH, and Yousign are among the key players profiled during the Europe electronic signature software market analysis. Several other essential market players were also studied and analyzed to get a holistic view of the Europe electronic signature software market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com