Hearing Aid Devices Segment to Lead Hearing Aids Market Based on Product Type During 2025–2031

According to our new research study on “Hearing Aids Market Forecast to 2031 – Global Analysis – by Type, Product Type, Technology, Type of Hearing Loss, Patient Type, and Distribution Channel,” the hearing aids market size is expected to grow from US$ 28.75 billion in 2024 to US$ 45.68 billion by 2031; the market is expected to register a CAGR of 6.9% during 2025–2031. Major factors driving the hearing aids market growth include the increasing prevalence of hearing loss and surging strategic initiatives by market players.

A hearing aid is a small electronic device used by hearing-impaired patients. It helps people with hearing loss hear more clearly in both quiet and noisy environments. Hearing aids amplify sound, making it easier for the user to hear speech and environmental sounds. Technological innovations in hearing aids and an increasing focus on aesthetics and customization are emerging as significant hearing aids market trends.

Hearing Aids Market, by Region, 2024(%)

Hearing Aids Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Type (Prescription Hearing Aids and OTC Hearing Aids), Product Type [Hearing Aid Devices (Behind the Ear (BTE) Hearing Aid, In the Ear (ITE) Hearing Aid, Receiver In the Canal (RITE) Hearing Aid, Canal Hearing Aid, and Others) and Hearing Implants (Cochlear Implants and Bone Conduction Implants)], Technology (Conventional Hearing Aids and Digital Hearing Aids), Type of Hearing Loss (Sensorineural Hearing Loss and Conduction Hearing Loss), Patient Type (Adults and Pediatrics), Distribution Channel (Pharmacies, Retail Stores and Online), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South and Central America)

Hearing Aids Market Size, Share & Forecast 2024-2031 | Get Sample

Download Free Sample

Source: The Insight Partners Analysis

Hearing Aids Market Analysis Based on Segmental Evaluation:

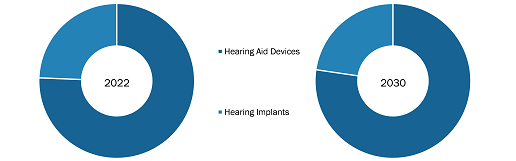

Based on product type, the hearing aids market is bifurcated into hearing aid devices and hearing implants. In 2024, the hearing aid devices segment held a significant hearing aids market share. Hearing aids are small electronic sound-amplifying devices designed to help people with hearing loss. The hearing aid devices are further classified into behind-the-ear (BTE) hearing aids, canal hearing aids, in-the-ear (ITE) hearing aids, receiver-in-the-ear (RITE) hearing aids, and other hearing aid devices. BTE hearing aids rest behind the ear and are known for durability, ease of cleaning, and handling. Modern BTE models feature directional microphones and streamlined designs that are barely visible. RITE devices have receivers placed inside the ear, making them smaller than traditional BTE models. They offer effective sound transmission, come in various sizes (mini, micro), and are often invisible when worn. Users can choose between standard domes or custom earmolds.

Manufacturers now offer devices that fit deep in the ear canal, such as Invisible-in-Canal (IIC) models. These are compact, close to the eardrum, require less power, and deliver clear, natural sound. BTE devices also support Bluetooth connectivity. For example, Vintone Hearing launched high-quality BTE models in July 2023. For users prioritizing comfort, receiver-in-canal models are ideal. In January 2022, Soundwave Hearing LLC introduced a mobile app-enabled self-fitting hearing aid.

Key players continue to innovate. In November 2021, Widex USA Inc. launched the first rechargeable BTE with PureSound technology, direct audio streaming for iPhones and Android, and a built-in microphone.

The segment is growing due to the availability of a broad range of advanced products offered by the market players, rising adoption of these devices, and growing cases of hearing loss among the population. The rising focus of the government to reduce the price of hearing aids is also anticipated to fuel the adoption of hearing aid devices among people.

The scope of the hearing aids market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. In terms of revenue, North America dominated the hearing aids market share in 2024.

The US dominated the North America hearing aids market in 2024. Hearing loss is the third most common chronic physical condition in the US, twice as prevalent as diabetes or cancer. As per Key Facts and Statistics from the Hearing Loss Association of America (HLAA) published in February 2025, over 50 million Americans have some degree of hearing loss, which is ~1 in 7 people in the US. ~21.5 million (65.3%) of people aged 71 years or above have hearing loss in the country. Over one in 10 (5.1 million) children and teenagers aged 6–19 years have some degree of hearing loss. ~2–3 of every 1,000 children in the US are born with a detectable hearing loss in one or both ears.

Excessive noise exposure is a leading cause of hearing loss among both young and older adults. Hearing aids improve quality of life by amplifying sounds, enhancing speech clarity, and supporting better communication, mental health, and social interaction. As per the National Institute on Deafness and Other Communication Disorders (NIDCD), ~28.8 million adults could benefit from hearing aids in the US. ~183,100 adults and children in the country have cochlear implants as of 2022, to treat more severe hearing loss.

The Food and Drug Administration (FDA) Over-the-Counter Hearing Aid Act, effective since August 2022, has made hearing aids more accessible by allowing consumers to purchase them without a prescription. Users with mild to moderate hearing loss to purchase over-the-counter (OTC) hearing aids directly from online retailers or stores without needing an audiology exam, prescription, or a custom fitting by an audiologist. FDA approval for OTC hearing aids is expected to create ample growth opportunities in the market in the coming years. In October 2023, Audien Hearing launched the world’s first FDA-compliant hearing aid sold over-the-counter (OTC)—ATOM ONE—for less than US$ 100. The ATOM ONE will allow millions of people suffering from hearing loss to walk in and purchase an economical device that suits their needs or those of their loved ones. In October 2023, ELEHEAR, a provider of AI-powered hearing aids and audio solutions, introduced its first OTC hearing aid devices, the ELEHEAR Alpha and ELEHEAR Alpha Pro.

Technological innovations are transforming the hearing aids landscape. In September 2024, the US FDA authorized the first over-the-counter (OTC) hearing aid software—Hearing Aid Feature—for compatible Apple AirPods Pro models. Once installed and personalized, the feature enables supported AirPods Pro to function as OTC hearing aids for individuals aged 18 and older with mild to moderate hearing loss. In October 2024, Unitron introduced its novel Ativo hearing aids and two additional Vivante styles, Stride V-M and Stride V-SP, offering more device choices to meet the diverse hearing care needs in the country. In February 2025, Beltone introduced its latest innovation, Beltone Envision hearing aids. The product redefines noise management and voice clarity, helping users stay connected to their environment while making essential sounds, such as a friend's voice in a bustling restaurant, stand out with remarkable clarity. Therefore, increasing prevalence of hearing impairment among large populations, new product launches, and availability of OTC hearing aids favor the market growth in the US.

Starkey Laboratories Inc, Audina Hearing Instruments Inc, SeboTek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, WS Audiology AS, Sonova Holding AG, Sonic Innovations Inc, Amplifon Hearing Health Care Corp, and Demant AS are among the leading companies profiled in the hearing aids market report.

Based on type, the hearing aids market is bifurcated into prescription hearing aids and OTC hearing aids. Based on product type, the hearing aids market is bifurcated into hearing aid devices and hearing implants. By technology, the hearing aids market is segmented into conventional hearing aids and digital hearing aids. Based on type of hearing loss, the hearing aids market is bifurcated into sensorineural hearing loss and conductive hearing loss. Based on patient type, the hearing aids market is bifurcated into adults and pediatrics. Based on distribution channel, the hearing aids market is segmented into pharmacies, retail stores, and online. In terms of geography, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East and Africa (Saudi Arabia, South Africa, UAE, and the Rest of Middle East and Africa), and South and Central America (Brazil, Argentina, and the Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com