Growth of Pharmaceuticals and Nutraceuticals Industry Drives Hydrocolloids Market

According to our latest market study on “Hydrocolloids Market Forecast to 2030 – COVID-19 Impact and Global Analysis – by Type, Category, and Application,” the hydrocolloids market size is projected to grow from US$ 13,563.87 million in 2022 to US$ 20,851.46 million by 2030; the market is expected to register a CAGR of 5.5% from 2022 to 2030. The report highlights key factors driving the market and prominent players along with their developments in the market.

Hydrocolloids are high molecular weight polysaccharides exhibiting thickening, gelling, emulsifying, and stabilizing properties. They are extracted from plants, algae, and seaweed, and can be synthesized using microbial processing. Thus, these polymers can be classified as natural and synthetic based on their sources. Various types of hydrocolloids include gelatin, pectin, agar, xanthan gum, carrageenan, gellan gum, alginates, guar gum, locust bean gum (LBG), modified starches, cellulose, chitin, and chitosan. They are known for their high-water binding capacity and gelling properties owing to which they are used in a variety of food applications such as baked goods, chocolates and confections, fruit juices, RTD beverages, dairy and frozen desserts, meat products, soups, sauces, and dressings. Non-food applications of hydrocolloids include cosmetics, personal care products, paper, textiles, ceramics, oil drillings, and adhesives. The rising demand for hydrocolloids across various end-use industries due to their versatile thickening and stabilizing properties is driving the hydrocolloids market growth.

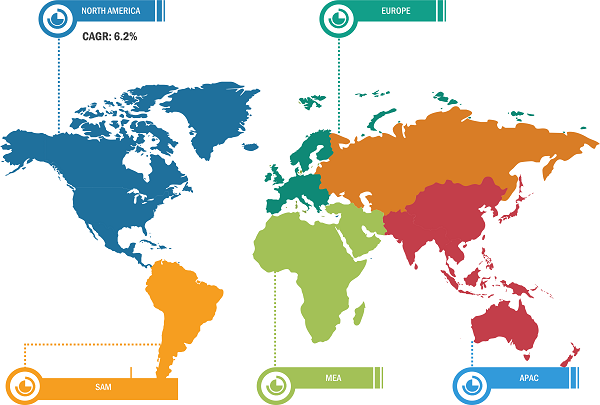

Hydrocolloids Market Breakdown – by Region

Hydrocolloids Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Gelatin, Starches, Pectin, Xanthan Gum, Carrageenan, Alginates, and Others), Category (Natural and Synthetic), Application [Food & Beverages (Bakery and Confectionery; Dairy and Frozen Desserts; Meat, Poultry, and Seafood; Beverages; and Others), Pharmaceuticals and Nutraceuticals, Personal Care, and Other Applications], and Geography

Hydrocolloids Market Report | Size, Share & Growth by 2030

Download Free Sample

Since the past few years, consumers have increasingly focused on product labels as they prefer to consume minimally processed food products containing clean ingredients. Moreover, they are ready to pay an extra price for clean-label products as they perceive these products to be healthier than the conventional ones. According to a survey conducted by Ingredient Communications in 2017, including 1,300 consumers from Europe, North America, and Asia Pacific, 73% of the respondents are happy to pay additional prices for food products and beverages with clean labels. This trend toward clean-label ingredients is expected to positively favor the hydrocolloids market growth in the coming years. Packaged food manufacturers are using hydrocolloids such as gellan gum, xanthan gum, pectin, and acacia gum to develop clean-label products. Excellent thickening and gelling properties of these polymers are employed in the manufacturing of jellies, jams, yogurt, ice cream, dairy products, plant-based meat products, and dairy alternatives.

The demand for plant-based food and beverages is increasing tremendously with a growing focus on sustainability and conscious eating. People are rapidly shifting toward plant-based meat and dairy products due to rising awareness about the ill-treatment given to animals at slaughterhouses. This leads them to seek alternatives to conventional animal-derived products, eventually nurturing the trends of veganism and vegetarianism. According to Good Food Institute, which is a nonprofit organization, the US retail market for plant-based food accounted for nearly US$ 8 billion in 2022. The thriving alternative protein industry is also boosting the demand for plant-based ingredients including hydrocolloids such as guar gum, gum Arabic, alginates, pectin, starch, and locust bean gum and is projected to provide lucrative growth opportunities to the hydrocolloids market in the coming years.

Impact of COVID-19 Pandemic on Hydrocolloids Market

Various industries including food & beverages and pharmaceuticals & nutraceuticals suffered severe disruptions due to disturbances in supply chains and shutdowns of production plants amid the COVID-19 pandemic. The shutdown of various manufacturing plants and factories in regions such as North America, Europe, Asia Pacific, South America, and the Middle East & Africa negatively impacted the supply chains, manufacturing, delivery schedules, and sales. Many businesses announced possible delays in product deliveries and slumps in their future sales. Thus, suspended operations in various industries hindered the hydrocolloids market growth in 2020.

On the other hand, the COVID-19 pandemic altered global consumer preferences as health became their top priority. The preference for all-natural, organic, and GMO-free ingredients increased as these products are perceived to be healthier than conventional ones. Moreover, the demand for clean-label and plant-based food products and beverages has increased dramatically as consumers focus on eating healthy food with lower environmental impact. This factor triggered the demand for natural hydrocolloids. Thus, severe distribution network disruptions and business shutdowns resulted in a demand–supply gap in the world. Manufacturers in the hydrocolloid market witnessed labor shortages and faced challenges in sourcing the raw materials, which negatively impacted their profitability. In 2021, the governments of various countries announced relaxations in the restrictions such as trade bans, lockdowns, and business shutdowns. Manufacturers were permitted to operate at full working capacities, which helped them overcome the demand and supply gaps. Also, with the introduction of vaccines, the marketplace witnessed recovery, which benefitted the hydrocolloids market.

The report includes the segmentation of the hydrocolloids market as follows:

The global hydrocolloids market is segmented on the basis of type, category, application, and geography. Based on type, the market is segmented into gelatin, starches, pectin, xanthan gum, carrageenan, alginates, and others. The market, based on category, is bifurcated into natural and synthetic. In terms of application, the hydrocolloids market is categorized into food & beverages, pharmaceuticals and nutraceuticals, personal care, and other applications. The market for the food & beverages segment is further segmented into bakery and confectionery; dairy and frozen desserts; meat, poultry, and seafood; beverages; and others. By geography, the hydrocolloids market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The European hydrocolloids market is subsegmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The market in Asia Pacific is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The hydrocolloids market in the MEA is subsegmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The market in South & Central America market is categorized into Brazil, Argentina, and the Rest of South & Central America

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com