The injection pen market is projected to reach US$ 60,332.97 million by 2028; registering at a CAGR of 7.14% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Disposable Segment to Account for Larger Share in Injection Pen Market During 2022–2028

The report highlights the key factors driving the injection pen market growth and prominent players with their developments in the market.

Based on type, the injection pen market is bifurcated into disposable and reusable injection pen. In 2021, the disposable segment held a larger share of the market and is expected to register a higher CAGR during the forecast period. By therapy, the market is categorized into diabetes therapy, growth hormone therapy, autoimmune diseases therapy, fertility therapy, cancer therapy, and other therapies. The other therapies segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period. In terms of end user, the market is divided into hospital & clinics, home care, and others. The home care segment held the largest market share in 2021 and is likely to continue its dominance during the forecast period.

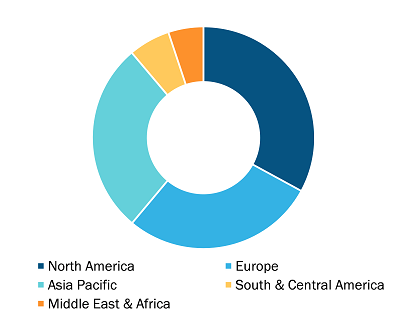

Global Injection Pen Market, by Region, 2021 (%)

Injection Pen Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Injection Pens and Reusable Injection Pens), Therapy (Diabetes, Growth Hormone Therapy, Autoimmune Diseases, Fertility, Cancer, and Other Therapies), and End User (Hospitals and Clinics, Home Care, and Others), and Geography

Injection Pen Market Size & Share with Growth Scope and Analysis 2031

Download Free Sample

The global injection pen market size is expected to grow significantly during the forecast period. The growth is mainly attributed to prevalence of chronic disorders and increase in strategic developments. The aging population and changes in social behavior contribute to a few common and costly long-term health problems. According to the World Health Organization (WHO), the prevalence of chronic lifestyle diseases is projected to reach 57% by 2026. Emerging markets will be hit hardest, as population explosion is expected in developing countries. With the accelerating urbanization, people are more inclined toward sedentary lifestyle, which results in obesity and diabetes. Diabetes is one of the biggest global health problems of the 21st century. According to the International Diabetes Federation (IDF), the number of people with diabetes in North America was about 46 million in 2019 and is projected to increase to 62 million by 2045. The increase in disease prevalence is about 35% over the predicted period. Furthermore, other chronic conditions such as osteoporosis, cardiovascular disorders, and multiple sclerosis require frequent drug administration for treatment and disease management. As per the WHO, cardiovascular disorders are the leading cause of death—nearly 17.9 million deaths are reported every year due to cardiovascular disorders. It has become new standard for injectable drug delivery among large patient population on a global level. Moreover, it can be easily used by the large patient population with minimal training with does not require constant assistance from of healthcare professionals, owing to which injection pens are largely adopted in home healthcare settings, thereby driving its injection pen market growth.

Future Trends

Technological Advancements and Healthcare Waste Reduction

Various market players are operating globally and striving hard to acquire a significant market share. There has been a notable growth in the use of injection pen for the treatment of various chronic disorders such as cancer, diabetes, cardiovascular disorders, and multiple sclerosis. Increase in home healthcare has further propelled the demand for injection pens. This has boosted the technological advancement in the injection pens. The manufacturers are focused on developing the next generation smart insulin pen for the delivery of metered insulin dosage. For instance, Medtronic plc launched InPen integrated with real-time Guardian Connect CGM data. InPen is the first and only FDA-cleared smart insulin pen on the market for people on multiple daily injections (MDI). This integrated system provides real-time glucose readings alongside insulin dose information giving users everything they need to manage their diabetes in one view. Rather than switching between apps, users can see all the required information in real time in one view, making it easier to make smarter dosing decisions to manage their sugar levels. Furthermore, the use of artificial intelligence will be the game changer, as it will keep a track of dose, date, and timing of drugs or insulin, which will be beneficial in a long term and helpful for the treatment and management of various conditions.

Conventional syringes used for the delivery of insulin and other injectables can be painful and uncomfortable for the patient on daily basis, and it also generate huge quantity of healthcare waste. Around 73% of insulin waste is associated with the use of conventional technology. With the use of injection pen, this waste is reduced to 3.6%, making a huge difference. Therefore, technological advancement and rising demand in the reduction of healthcare wastage are among the trends expected to propel the growth of injection pen market in the coming years.

Eli Lilly and Co, Novo Nordisk AS, Owen Mumford Ltd, Sanofi SA, Merck KGaA, Haselmeier GmbH, Gerresheimer AG, Becton Dickinson and Co, AstraZeneca Plc, and Teva Pharmaceutical Industries Ltd. are among the leading companies operating in the global injection pen market.

Various organic and inorganic strategies are adopted by companies operating in the global injection pen market. Organic strategies mainly include product launches and product approvals. Further, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players strengthen their customer base and expand their product portfolios. A few of the significant developments by key players operating in the global injection pen market are listed below.

- In May 2022, Eli Lilly and Co announced receiving approval from the FDA for Lilly's Mounjaro injection. The injection is the first and only GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptor agonist for the treatment of adults with type 2 diabetes. Mounjaro will be available in six doses (2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, 15 mg) and will come in Lilly's well-established auto-injector pen with a pre-attached, hidden needle that patients do not need to handle or see.

- In June 2020, Sanofi SA announced receiving approval by the FDA for Dupixent injection pen. FDA approved Dupixent pre-filled pen atopic dermatitis, asthma and chronic rhinosinusitis with nasal polyposis for at-home administration. Dupixent pre-filled pens were developed specifically to provide patients with a simple, convenient way to administer injections.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com