Tube Pumps Segment, by Type, to Account for Largest Share in Insulin Pumps Market During 2019–2025

According to our latest study on “Insulin Pumps Market Forecast to 2025 – Global Analysis – by Type, Product, and Application,” the market is expected to grow from US$ 4,421.0 million in 2019 to US$ 8,264.0 million by 2025; it is expected to grow at a CAGR of 10.5% from 2019 to 2025. The report highlights the key factors driving the market growth and prominent players with their developments in the market.

Based on type, the insulin pumps market is bifurcated into tube pumps and patch pumps. The tube pumps segment held the largest share of the market in 2019, whereas the patch pumps segment is expected to register the highest CAGR during the forecast period. Based on product, the insulin pumps market is bifurcated into pumps and accessories. The pumps segment held the largest share of the market in 2019, and the accessories segment is expected to register the highest CAGR during the forecast period. Based on application, the insulin pumps market is segmented into type I diabetes and type II diabetes. The type I diabetes segment held the largest share of the market in 2019. Also, the same segment is expected to register the highest CAGR during the forecast period.

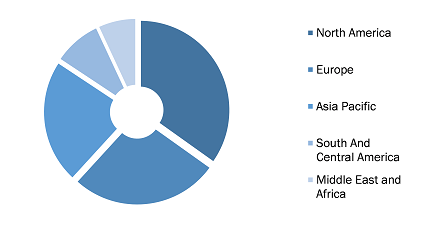

Global Insulin Pumps Market, by Region, 2019 (%)

Insulin Pumps Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Tube Pumps and Patch Pumps), Product (Pumps and Accessories), Application (Type I Diabetes and Type II Diabetes), and Geography

Insulin Pumps Market Trends, Share & Demand by 2031

Download Free Sample

Source: The Insight Partners Analysis

Insulin pumps are the alternative for diabetes patients who are tired of insulin injection. Insulin pumps are small computerized diabetes management devises, connected with cannula under the skin that is used to deliver a slow continuous level of insulin. The individual can control the program depending on the more or less requirement. Additionally, the growing geriatric population globally is increasing the demand for insulin pumps. The number of aging people with diabetes is increasing due to increased lifespan and the increased prevalence of diabetes in the geriatric population in the United States and worldwide. The elderly population is defined as a group of people aged 65 and over. Population aging is poised to become one of the most significant social transformations of the twenty-first century. According to the report of United Nations, in 2017, there were approximately 962 million people aged 60 or over across the globe, which consists of 13% of the global population. The population aged 60 or above is growing at a rate of about 3 per cent per year. Across the globe, the number of persons aged 80 or above is projected to triple by 2050. The elderly people are more likely to have diabetes than younger people, and the effect of the disease on quality of life is particularly deep in this population. With increase in the number of geriatric populations, the prevalence of the diabetes has increased. Therefore, the demand for insulin pumps products is expected to increase in the forecast period.

Medtronic, Insulet Corporation, Tandem Diabetes Care, Inc., KARL STORZ SE & Co. KG, Cell NoVo, SOOIL Developments Co., Ltd, Micro Port Scientific Corporation, Valeritas Inc., F. Hoffmann-La Roche Ltd., and Psalmed AG are among the leading companies operating in the global insulin pumps market.

Various organic and inorganic strategies are adopted by companies operating in the global insulin pumps market. Organic strategies mainly include product launches and product approvals. Further, acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players strengthen their customer base and expand their product portfolios. A few of the significant developments by key players in the global insulin pumps market are listed below.

- In August 2018, Valeritas stated that V-Go is available in New Zealand via its selective distribution agreement with NZMS Diabetes. The agreement signifies the first contract outside the US in which the company’s major product V-Go is launched.

- In May, 2018, Insulet Corporation entered into two partnerships with skilled diabetes distributors namely, Nordic Infucare and Theras Group to offer full-service distribution of the Omnipod System in Italy. These partnerships aim to direct the operations in Europe to support its Omnipod System.

- In February, 2017, Roche and Medtronic entered into an agreement to develop a next-gen BG meter that will intertwine Accu-Chek glucose monitoring technology into a future Medtronic pump system. This agreement is expected to enhance the growth of Medtronic in insulin pumps market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com