According to our latest market study on “Land Survey Equipment Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Solution, Industry, Application, and Hardware,” the market was valued US$ 8,068.0 million in 2022; it is projected to grow at a CAGR of 7.7% from 2022 to 2028.

Real estate is one of the world’s most recognized sectors. It comprises hospitality, housing, commercial, and retail. With the increasing urbanization, people are migrating to metropolitan cities. As a result of the growing population, property development is also increasing rapidly. In June 2022, the US Census Bureau and the US Department of Housing and Urban Development announced that 1 million buildings and 1 million privately-owned housing construction were permitted. Moreover, in Japan, real estate is the third largest contributor to the country’s GDP, with the presence of over 3,50,000 real-estate companies. According to Savills, a real estate company in India, the real estate demand for data centers will increase by 15-18 million square feet by 2025. Due to growing urbanization and increasing household income, the demand for residential properties is increasing, resulting in India ranking among the top 10 international housing markets in terms of price appreciation. By 2023, the country’s organized retail real estate stock is expected to rise to 82 million square feet, i.e., by 28%. In June 2018, Leica Geosystems launched Leica BLK360, a technologically advanced portable 3D imaging laser scanner for real estate, construction, engineering, and architecture. Thus, real estate developments are positively influencing the demand for land survey equipment, which is driving the land survey equipment market growth.

Impact of COVID-19 Pandemic on Land Survey Equipment Market

The US was the most severely affected North American country by the COVID-19 pandemic. Amid the strict regulations imposed by the US government during Q2 of 2020, most manufacturing facilities were either temporarily shut down or were operating with minimum staff. Moreover, the travel and trade restrictions and social distancing measures caused disruptions in component and part supply chains. The US has the largest number of surveying equipment manufacturers in the region and is one of the major factors driving the growth of land survey equipment market. However, these companies had to face several challenges during the pandemic. In March 2020, Robert Bosch Tool Corporation announced that there would be a delay in the shipment of the tools. The company's shipping partners, FedEx and UPS, announced shipping delays and suspensions of their shipping guarantees. This severely affected the company's surveying equipment business during the pandemic. Thus, hampering the land survey equipment market growth.

Hexagon AB; GUANGDONG KOLIDA INSTRUMENT CO., LTD.; Shanghai Huace Navigation Technology Ltd.; South Surveying & Mapping Technology CO., LTD.; Topcon Corporation; Trimble Inc.; Hi-Target; PENTAX Surveying; Suzhou FOIF Co., Ltd.; and Robert Bosch Tool Corporation are a few of the key players that are profiled during the land survey equipment market study. Moreover, the performances of several other essential players were analyzed to get a holistic view of the land survey equipment market and its ecosystem. Organic and inorganic growth strategies adopted by these companies to expand their product portfolio and global presence are expected to contribute to the land survey equipment market share and growth in the coming years. For instance, in 2021, Shanghai Huace Navigation Technology Ltd. launched HCE600 rugged field controller. HCE600 is a professional, lightweight, and compact field data collector that has an alphanumeric keypad specifically designed for field surveying and mapping operations.

Several peripheral stakeholders in the land survey equipment market study plays a crucial role in enabling the adoption of these machines among end-users and promoting technology advancements for sustainable future land survey equipment market growth. The key stakeholders in the land survey equipment market ecosystem include hardware, component, material providers, land survey equipment manufacturers, government agencies, industry associations, regulatory bodies, system integrators, and end-users.

For instance, in 2022, GUANGDONG KOLIDA INSTRUMENT CO., LTD. announced that they had delivered 59 units of KTS-472R10 Windows Total Stations to Technical Education & Vocational Training Authority (TEVTA) in Lahore city, Pakistan. The system features a WinCE6.0 operation system and advanced mapping software with graphic display, Bluetooth, and Wi-Fi. Such factors are likely to contribute towards the growth of land survey equipment market.

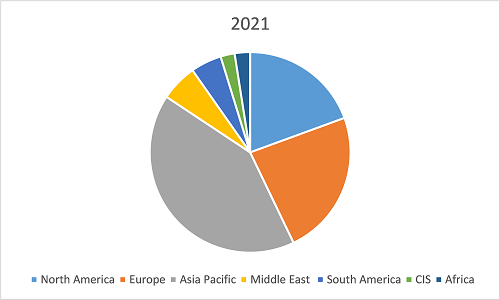

Land Survey Equipment Market Share – by Region, 2021

Land Survey Equipment Market by Size, Share & Trend Analysis 2028

Download Free SampleLand Survey Equipment Market Forecast to 2028 - Analysis by Solution (Hardware, Software, and Services), Industry (Mining, Construction, Agriculture, Oil & Gas, and Others), Application (Volumetric Calculations, Inspection, Layout Points, Monitoring, and Others), and Hardware (GNSS Systems, levels, 3D Laser Scanners, Total Stations, Theodolites, Unmanned Aerial Vehicles, Machine Control Systems, Machine Guidance Systems, and Others)

Source: The Insight Partners Analysis

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com