Extracorporeal Shockwave Lithotripsy Device Segment to Contribute to Growing Lithotripsy Market Size During 2023–2031

According to our latest study on "Lithotripsy Market Forecast to 2031 – Global Analysis – by Product Type, Application, and End User," the market was valued at US$ 1.4 billion in 2023 and is expected to reach US$ 2.3 billion by 2031; it is estimated to record a CAGR of 6.6% from 2023 to 2031. The market report includes growth prospects in light of current lithotripsy market trends and driving factors influencing the market growth. Medical reimbursement/coverage for noninvasive lithotripsy procedures is a crucial factor propelling the lithotripsy market growth. However, the rise in product recalls by the Food and Drug Administration (FDA) impedes the market growth.

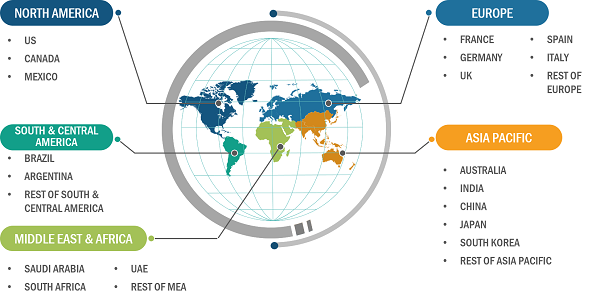

Regional Overview:

Based on geography, the lithotripsy market is primarily segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The market in North America held the second-largest share in 2023; the US dominates the market in North America. Asia Pacific will account highest CAGR for the lithotripsy market; China dominates the market in Asia Pacific. According to the AME Publishing Company report, urolithiasis is one of the most prevalent diseases in China, with patients suffering from upper urinary stones. With high prevalence and recurrence rates, urolithiasis represents a major burden on the healthcare system in the country. Therefore, with the rising prevalence of urolithiasis, there is a high demand for extracorporeal shockwave lithotripsy (ESWL). ESWL is an advanced treatment device that has been widely adopted by doctors and patients in hospitals. Additionally, there are many hospitals in China where more than 5,000 cases annually have been treated with urolithiasis, as per the Chinese Medical Association Publishing House report. Furthermore, in a few hospitals, over 10 cases were treated in one day. Therefore, the rising prevalence of urolithiasis and the high adoption of lithotripsy in hospitals are a few factors responsible for the market growth in China.

Lithotripsy Market

Lithotripsy Market Growth & Scope Report | Size & Forecast 2031

Download Free SampleLithotripsy Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Extracorporeal Shock Wave Lithotripsy Devices and Intracorporeal Lithotripsy Devices, and Ureteroscopic), Application (Kidney Stones, Ureteral Stones, Pancreatic Stones, Bile Duct Stones, and Bladder Stones), Â End User (Hospitals, Specialty Clinics, and Others), and Geography

Several top lithotripsy manufacturers are investing in Japan to promote lithotripsy treatment. For instance, in July 2018, Dornier MedTech, a global medical device company, announced launching Delta 3 in Japan. It has received Pharmaceuticals and Medical Devices Agency (PMDA) and is the latest generation of the world's best-selling and most clinically cited lithotripter. Delta 3 is committed to developing the most cutting-edge solution for kidney stone treatment with improved imaging quality, four times more power, and two times more advanced imaging modalities. Similarly, in March 2022, Shockwave Medical, Inc. announced receiving product approval for the Shockwave C2 Coronary IVL Catheter in Japan. The new product regulatory approval is capable of safely and effectively treating severely calcified coronary lesions. The approval of Shockwave C2 is supported by 30-day clinical trial results from the Disrupt CAD IV study to assess the safety and effectiveness of intravascular lithotripsy (IVL) in 64 Japanese patients and was published in the Circulation Journal. Therefore, manufacturers' interest in the development of advanced lithotripsy devices and regulatory support will boost device adoption to treat several healthcare complications in patients, which is expected to provide lucrative market opportunities in the coming years.

Preference for Lithotripsy Technique in Coronary Lesion Treatment

Traditionally, lithotripsy is the most recommended noninvasive procedure for kidney stone removal. However, manufacturers are studying lithotripsy medical devices that can be utilized for several other healthcare applications, including the treatment of coronary lesions. With the rise in the aging population, there is a high risk of patients suffering from coronary lesions. Currently, several challenges are associated with the coronary intervention, including dissections/incisions. Also, only a few methods are available to manage calcified coronary lesions, including interventional balloons and rotational atherectomy. Furthermore, incisions and incorporating balloons do not remove calcium deposits as they only improve vessel compliance by creating incisions. Such uncontrolled incisions can lead to a high risk of vessel perforation and increased chances of myocardial infarction among patients undergoing cardiac surgery. The new technology of shockwave lithotripsy is set to revolutionize disease treatment through the proper management of severely calcified coronary lesions. In February 2021, the FDA announced approval for a shockwave intravascular lithotripsy (IVL) system for the treatment of severely calcified coronary artery plaques. For example, Shockwave Medical Inc.'s SHOCKWAVE IVL removes coronary lesions by reducing the risk of complications and making the procedure safe and efficient. Thus, preference for the lithotripsy technique in coronary lesion treatment is anticipated to fuel the lithotripsy market growth in the coming years.

Market Driver

Launch of Innovative Lithotripsy Devices Accelerate Market Growth

- In May 2024, KARL STORZ announced an exclusive agreement with Well Lead Medical to offer ClearPetrasuction-evacuation ureteral access sheath in conjunction with KARL STORZ endoscopic visualization devices for comprehensive urinary stone management.

- In February 2024, BD announced a partnership with Camtech Health to advance cervical cancer screening, providing the first-ever option for women in Singapore to self-collect samples at home.

- In May 2022, BD announced a partnership with Babson to move blood sample collection into new healthcare settings, especially at patient homes for diagnostic testing.

Lithotripsy Market, by Product Type:

Based on type, the lithotripsy market analysis is carried out by considering the following subsegments: extracorporeal shock wave lithotripsy devices and intracorporeal lithotripsy devices, and ureteroscopic. The extracorporeal shock wave lithotripsy devices segment held a larger lithotripsy market share in 2023 and is anticipated to register a higher CAGR of 7.3% during the forecast period.

Lithotripsy Market, by Application:

By application, the lithotripsy market is segmented into kidney stones, ureteral stones, pancreatic stones, bile duct stones, and bladder stones. The kidney stones segment dominated the market in 2023 and the same segment is anticipated to register the highest CAGR of 7.4% during the forecast period.

Lithotripsy Market, by End User:

By end user, the lithotripsy market is segmented into hospitals, specialty clinics & centers, and others. The hospitals segment held the largest lithotripsy market share in 2023 and the same segment is anticipated to register the highest CAGR of 7.2% during the forecast period.

Industry Developments and Future Opportunities:

In April 2024, Cook Medical Holdings LLC announced the launching of LithAssist suction control device. It is used in conjunction with a holmium laser system for lithotripsy to suction fluid, soft tissue, and stone fragments. The 5fr lumen accommodates a laser fiber during kidney-bladder-stone lithotripsy. The other lumen provides suction assistance when the device is used with an independent vacuum source. The trigger on the handle controls the amount of suction. The Tuophy-Borst adapter secures the laser fiber and the syringe can be attached to the Luer lock to flush out the clots and clogs.

Lithotripsy Market, by Geography:

The geographic scope of the lithotripsy market report encompasses North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). Developments and launch of technologically advanced medical devices by several market players, along with approvals by regulatory authorities, help in the market expansion.

Apart from factors driving the market, the lithotripsy market report emphasizes prominent players' developments. Edap Tms SA, Becton Dickinson and Co, Olympus Corp, Cook Medical Holdings LLC, Boston Scientific Corp, Karl Storz SE & Co KG, DirexGroup, Dornier MedTech, ELMED Medical Systems, EMS+, NOVAmedtek, and Potent Medical are among the prominent players operating in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com