Upsurge in Seaborne Trade Boosts Middle East & Africa Marine Vessel Market Growth

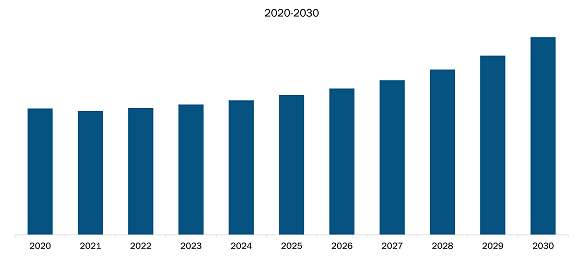

According to The Insight Partners market study titled "Middle East & Africa Marine Vessel Market Forecast to 2030 – COVID-19 Impact and Regional Analysis – by Type and System," the market is expected to grow from US$ 9,054.90 million in 2023 to US$ 13,244.79 million by 2030; it is estimated to record a CAGR of 5.6% from 2023 to 2030. The report provides trends prevailing in the market along with drivers and restraints.

Seaborne trade is continuously expanding in the Middle East & Africa (MEA). It is the most common mode of transport in the region due to the high efficiency of shipping operations and the increase in economic liberalization. According to the Standard Bank Group, 90% of freight in the UAE arrives as ocean freight, carried in shipping containers. Jebel Ali, Dubai, is the UAE's most important ocean freight port and the world’s largest artificial harbor. The UAE has 12 commercial trading ports, other than oil ports, and 61% of cargo destined for GCC states arrives via the UAE's seaports. During the COVID-19 pandemic, the MEA witnessed a decrease in seaborne trade; however, the gradual reopening of economies with the widescale availability of vaccines favored the recovery of maritime trade in 2021, further fueling the growth of the Middle East & Africa marine vessel market.

Middle East & Africa Marine Vessel Market Revenue and Forecast to 2030 (US$ Million)

Middle East & Africa Marine Vessel Market Forecast to 2030 - Regional Analysis by Type (Commercial Vessels, LNG/LPG, Passenger Ships, and Special Purpose Vessels) and System (Marine Engine, Control System, Communication System, and Others)

Middle East & Africa Marine Vessel Market Outlook by 2030

Download Free Sample

Africa recorded a 5.1% rise in its overall GDP in 2021 after a drop of 2.6% in 2020. The region has also seen growth in merchandise trade volume. According to the United Nations Conference on Trade and Development (UNCTAD), in Africa, export volumes increased by 5.2% in 2021, in contrast to a decrease of 8.1% in 2020. The volume of imports increased by 7.7% in 2021, as opposed to a reduction of 14.7% in 2020. Similarly, export volumes in the Middle East rose by 1.4% in 2021, after an 8.9% decrease in 2020; the import volume surged by 8.4% in 2021, after a drop of 10.1% in 2020. New ports are being developed in the MEA to promote the growth of sea trade. In June 2023, the government of UAE announced that it would build a new Red Sea port in Sudan as part of a US$ 6 billion investment package. Thus, the growing seaborne trade in the region, along with the construction of new ports, fuels the growth of the Middle East & Africa marine vessel market.

Hyundai Heavy Industries (HHI); Hanwha Ocean co., Ltd.; Samsung Heavy Industries; Fincantieri S.p.A.; and MITSUBISHI HEAVY INDUSTRIES, LTD. are the key Middle East & Africa marine vessel market players profiled in this research study. These Middle East & Africa marine vessel market players adopt organic growth strategies, such as product launches and expansions, to sustain their position in the Middle East & Africa marine vessel industry.

The Middle East & Africa marine vessel market is segmented into type, system, and country. In terms of type, the market is divided into commercial vessels, passenger ships, LNG/LPG, and special-purpose vessels. Based on system, market is segmented into marine engines, control systems, and communication systems. Based on country, the Middle East & Africa marine vessel market is segmented into South Africa, the UAE, Qatar, Israel, Oman, and the rest of MEA.

South Africa is situated on one of the busiest international sea routes‚ critical for global maritime transportation, which creates a huge opportunity for the growth of the maritime market. The country has seven major commercial ports—Cape Town, Durban, Richards Bay, Port Elizabeth, Saldanha Bay, Port Ngqura, and East London. These ports carry out various trade activities for the country. According to the Observatory of Economic Complexity (OEC), in 2021, South Africa was ranked 34th in total exports and 43rd in total imports. The country exported products worth ~US$ 143 billion, while its imports were valued at ~US$ 96.7 billion in 2021. Thus, the growing trade activities in the country are fueling the growth of the marine vessel market in South Africa.

The rising number of ultra-high-net-worth individuals (UHNWI) in the country is simultaneously expanding the demand for personalized luxury services. According to the government of South Africa, in 2022, the country witnessed ~5.8 million visitors, including 4 million from African countries, indicating an annual increase of 152.6%. Thus, a rise in tourism has raised the demand for cruising activities in the country, which bolsters the marine vessel market growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com