Human Serum Albumin Segment Drives Natural Albumin Market Growth

According to our new research study named "Natural Albumin Market Forecast to 2031 – Global Analysis – by Source, Application, and End User," the market was valued at US$ 5.66 billion in 2024 and is projected to reach US$ 8.46 billion by 2031; it is expected to register a CAGR of 6.0% during 2025–2031. The increasing hypoalbuminemia in chronic liver diseases, expanding applications in critical care and surgery, advancements in plasma fractionation technologies, and blood collection infrastructure are key factors driving the growth of Natural Albumin Market size. However, the high cost and reimbursement challenges, risk of blood-borne pathogen transmission and supply chain vulnerabilities, availability of alternative treatments and fluid management strategies hinder market growth. Increasing preference for pathogen-free plasma-derived albumin in critical care, sustained use in chronic liver disease management amid hypoalbuminemia, expansion in plasma fractionation for blood product supply is projected to bring new Natural Albumin Market trends in the coming years.

According to the World Health Organization (WHO), viral hepatitis and cirrhosis caused 1.3 million deaths in 2022, rising to 1.43 million in 2023 and 1.5 million in 2024, with hypoalbuminemia affecting 60% of advanced cases requiring albumin supplementation for osmotic balance. In the US, the Centers for Disease Control and Prevention (CDC) reported 51,000 chronic liver disease deaths in 2022, 52,222 in 2023 and an estimated 53,000 in 2024, with NAFLD impacting 30% of adults and hypoalbuminemia in 70% of decompensated cirrhosis. South Korea's Korea Centers for Disease Control and Prevention (KDCA) documented 1,200 new NAFLD cases per 100,000 in 2022, escalating to 1,350 in 2023 and 1,450 in 2024. New product developments include the European Medicines Agency (EMA) authorization of Octapharma's Octalbin in March 2024 for hypoalbuminemia in cirrhosis, reducing transfusion needs by 30%. Other instances encompass the National Institutes of Health (NIH) 2023 guidelines maintaining albumin in 50% of ICU liver patients, with 2024 data showing 15% improved outcomes in NAFLD. These underscore natural albumin's vital therapeutic position amid escalating liver burdens globally.

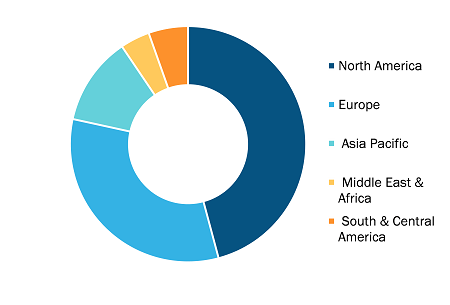

Natural Albumin Market, by Region, 2024 (%)

Natural Albumin Market Trends & Future Prospects 2031

Download Free SampleNatural Albumin Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Human Serum Albumin, Bovine Serum Albumin, and Plant Serum Albumin), Application (Therapeutic Applications, Drug Delivery, Disease Diagnostics, Research, and Others Applications), and End User (Hospitals and Clinics, Pharmaceutical and Biotechnological Companies, Research Institutes, Diagnostic Laboratories, Homecare Settings, and Others)

Source: The Insight Partners Analysis

Natural Albumin Market Analysis Based on Segmental Evaluation:

- Based on source, the natural albumin market is segmented into human serum albumin, bovine serum albumin, and plant serum albumin. The human serum albumin segment held a largest natural albumin market share in 2024. Human serum albumin dominates due to its extensive use in critical care, liver support, and fluid management. Its high biocompatibility and clinical acceptance continue to drive demand across healthcare systems.

- Based on applications, the natural albumin market is categorized into therapeutic applications, drug delivery, disease diagnostics, research, and other applications. The therapeutic applications segment held a significant share in 2024. Therapeutic applications include treatment of liver and kidney diseases, surgery support, hypovolemia, and hypoalbuminemia. Therapeutic use remains the largest segment, driven by rising incidences of liver disease, kidney disorders, and surgical needs. Its role in treating hypovolemia and hypoalbuminemia ensures consistent clinical demand.

- Based on end users, the natural albumin market is divided into hospitals and clinics, pharmaceutical and biotechnological companies, research institutes, diagnostic laboratories, home care settings, and other end users. The hospitals and clinics segment held the largest natural albumin market share in 2024. Hospitals lead demand due to high utilization of albumin in emergency care, surgeries, and chronic disease management. Continued rise in patient volume and critical-care procedures supports this dominance.

The geographical scope of the Natural Albumin Market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South and Central America, and the Middle East and Africa. North America dominated the Natural Albumin Market share in 2024. Rising demand for volume expansion in critical care and sepsis management, increasing hypoalbuminemia in chronic liver disease, and growing demand for plasma-derived therapies drive the Natural Albumin Market in North America. The US leads the region, supported by a well-established biopharmaceutical sector, extensive plasma collection networks, and strong R&D investments in drug delivery and recombinant technologies.

The natural albumin Market in North America is segmented into the US, Canada, and Mexico. The growth of the US natural albumin Market can be attributed to the rising prevalence of chronic diseases and advancements in medical applications. According to the Centers for Disease Control and Prevention (CDC), liver disease affected approximately 4.5 million Americans in 2022, and this figure is projected to rise to over 5 million by 2024. This surge creates a greater demand for therapeutic solutions, particularly human serum albumin (HSA), which plays a critical role in managing liver-related conditions. The Canadian Liver Foundation estimated NAFLD prevalence at 25% among adults in 2022-2024 reports, exacerbating hypoalbuminemia risks. New product developments include Health Canada's authorization of Grifols' Albutein 20% extension in 2023 for hypoalbuminemia management, improving serum levels by 40% in trials. Other instances encompass PHAC's 2022-2024 guidelines recommending albumin in refractory sepsis, with 15% reduced mortality in treated patients. These factors, combined with Canada's ageing population and stable plasma collection, sustain demand for natural albumin in clinical practice. The natural albumin market in Mexico is shaped by growing demand for plasma components, a slow but improving donor base, and structural challenges in blood collection. In 2023, Mexico recorded 1.6 million blood donations, according to the The National Blood Transfusion Council (NBTC).

Rising Chronic Kidney Disease (CKD) Prevalence Driving Therapeutic Demand to Provide Market Opportunities in Future

CKD remains a major global health burden: according to the International Society of Nephrology’s Global Kidney Health Atlas, approximately 850?million people worldwide suffer from CKD, i.e., roughly 10% of the global population. A meta analysis published in Nephrology Dialysis Transplantation found a global CKD prevalence of 13.0% (2014–2022), with socio economic and demographic disparities. Importantly, low serum albumin (hypoalbuminemia) is associated with worse renal outcomes. A 2023 cohort study in BMC Nephrology showed that when albumin falls below ~4.1?g/dL, patients have faster eGFR decline and higher risk of dialysis initiation. This underscores a direct clinical rationale: increased CKD prevalence means more patients who might benefit from natural albumin therapy to stabilize serum protein levels and slow progression, creating a sustained opportunity for albumin producers.

Regulatory support from the FDA for novel albumin-based formulations, combined with the strong market presence of key players such as Grifols, CSL, and Takeda, enhances product accessibility. Canada and Mexico are expanding their healthcare services, contributing to regional demand. Overall, clinical need, biotechnological advancement, and healthcare spending are key factors driving the North America Natural Albumin Market growth.

CSL Ltd, Grifols SA, Taibang Bio Group Co. Ltd., Merck KGaA, Octapharma AG, HiMedia Laboratories Pvt Ltd, Takeda Pharmaceutical Co Ltd, Biotest AG., Lee BioSolutions, and Sartorius AGare among the leading companies profiled in the Natural Albumin Market report.

Based on source, the Natural Albumin Market is divided into human serum albumin, bovine serum albumin, and plant serum albumin. Based on application, the Natural Albumin Market is divided into therapeutic applications, drug delivery, disease diagnostics, research, and other applications. Based on end user, the Natural Albumin Market is categorized into hospitals and clinics, pharmaceutical and biotechnological companies, research institutes, diagnostic laboratories, home care settings, and other end users. Geographically, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East and Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East and Africa), and South and Central America (Brazil, Argentina, and the Rest of South and Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com