Surge in Fire Incidents Boosts North America and MEA Fire Alarm Systems Market Growth

According to our latest market study on "North America and MEA Fire Alarm Systems Market Size and Forecast (2021–2031), Regional Share, Trend, and Growth Opportunity Analysis — by Technology, Product Type, and Application," the market was valued at US$ 13.63 billion in 2023 and is anticipated to reach US$ 22.81 billion by 2031; it is estimated to record a CAGR of 6.6% from 2023 to 2031. The report includes growth prospects in light of current North America and MEA fire alarm systems market trends and driving factors influencing the market growth.

North America and the MEA are witnessing continuous growth in the number of fire incidents. According to the Ministry of Interior, civil defense teams responded to 2,473 fires in 2023 in the UAE. The majority of these incidents occurred in residential areas, with homes accounting for 1,636 fires, up from 1,385 in 2022. Also, commercial buildings experienced 293 fires, followed by farms (128), industrial properties (106), and public service buildings (97). Similarly, as per the National Fire Protection Association (NFPA), in 2022, the US experienced 36 large-loss fires or explosions, which is the second-highest number of such accidents in the previous ten years; these 36 incidents consisted of 29 structure fires and seven non-structure fires, which included 3 wildland/urban interface (WUI) fires, 3 vehicle fires, and 1 fire outside a structure. These large-loss fires caused an estimated US$ 1.39 billion in direct property damage, accounting for approximately 8% of the total projected financial loss from all fires reported in 2022. The largest incident in the US in 2022 occurred at a gas distribution plant in Haven, Kansas, with a loss of more than US$ 200 million. Furthermore, the structural fires caused a total property loss of US$ 1 billion, accounting for ~81% of the total losses of large-loss fires. Eight of the structural fires occurred at manufacturing plants, four of which emerged from food-related processes, one in a maintenance equipment facility, one in a natural gas production plant, and one in an electronic appliance factory. These fires caused a cumulative property loss of US$ 256.4 million. Also, five fires broke out in storage properties: four in warehouses and one in a food storage building. These resulted in a collective loss of US$ 175.6 million—two other incidents involved storage units: an outside fire and a vehicle fire. Four large-loss fires happened in structures under construction, three in apartment buildings, and one in a hotel. These fires caused a total loss of US$ 156.2 million. Three fires in industrial enterprises caused a total loss of US$ 243.1 million. One of the plants was responsible for gas distribution, one for electricity generation, and one for sanitary waste disposal. There were also three fires in stores and offices, with a total loss of US$ 6.7 million. Also, seven non-structure fires resulted in cumulative losses of US$ 351.8 million, or more than 19% of the total losses from all large-loss fires. Therefore, the growing number of fire incidents fuels the need for fire alarm systems, which fuels the North America and MEA fire alarm systems market growth.

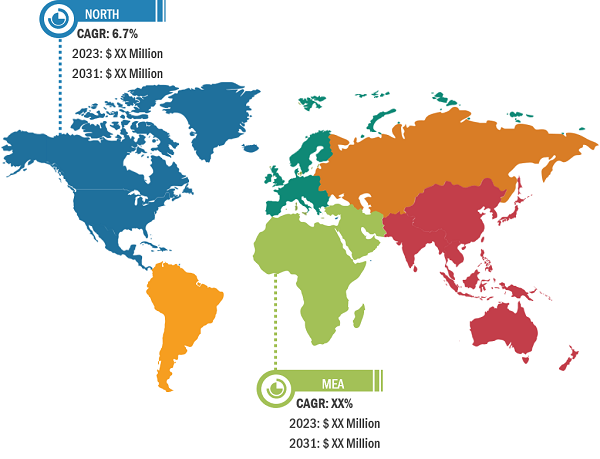

North America and MEA Fire Alarm Systems Market Analysis – by Geography, 2023

North America and MEA Fire Alarm Systems Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Addressable Systems and Conventional Systems), Product Type [Detector Type (Smoke Detectors, Heat Detectors, Flame Detectors, and Others), Alarm Type (Audible Alarms, Visual Alarms, and Manual Call-points Alarms), and Control Panels], Application (Commercial, Industrial, and Residential), and Geography

North America and MEA Fire Alarm Systems Market Size 2031

Download Free Sample

Source: The Insight Partners Analysis

The scope of the North America and MEA fire alarm systems market report focuses on North America (US, Canada, and Mexico) and Middle East & Africa (Saudi Arabia, UAE, and Rest of Middle East & Africa. In North America, the US held the largest North America and MEA fire alarm systems market share in 2023. The US is witnessing tremendous growth in its construction industry. According to the US Census Bureau, as of August 2024, the residential construction spending of the US was ~US$ 911,429 million, and the nonresidential construction spending was US$ 1,220,507 million. Such growth in the construction industry is expected to raise the demand for fire alarm systems as it helps provide faster response times from emergency services, detect fire in isolated areas, help in better planning in case of a necessary evacuation, meet regional health and safety codes, and keep essential operational assets safe. In addition, the country is witnessing a rise in the number of fire incidents. As per the National Fire Protection Association (NFPA), in 2022, local fire departments in the US responded to ~1.5 million fires. These incidents resulted in 3,790 civilian fire deaths and 13,250 civilian fire injuries. Also, the property damage caused by these fires was anticipated at US$ 18 billion. Also, in 2022, a fire department responded to a fire somewhere in the US once every 21 seconds. A house structure fire was reported every 88 seconds, a home fire death every three hours and fourteen minutes, and a home fire injury every 53 minutes. Further, 522,500 fires, or 35% of the total number of fires, started in or on structures. Also, 25% of the fires happened in residing properties, including one- or two-family homes, apartments, or other multifamily structures. Thus, the rise in the number of fire incidents in the US is likely to have a significant impact on the North America and MEA fire alarm systems market forecast in the next few years.

In MEA, the UAE held the largest North America and MEA fire alarm systems market share in 2023. The fire alarm system market is growing in the UAE, as various companies are taking initiatives to deploy these systems, such as product launches, partnerships, etc. For instance, in November 2022, UL Solutions introduced a new product category covering fire alarm control units and systems intended to be used in the UAE as part of a household fire alarm system. Similarly, in July 2023, Honeywell announced the launch of the Morley-IAS Max fire detection and alarm system that helps improve occupant and building safety. The powerful, compact, performance-driven intelligent fire alarm control panel provides installers and end users with a technically advanced range of functions that are easy to commission, install, and maintain. In addition, in January 2024, Panasonic Life Solutions Middle East & Africa (PLSMEA), a subsidiary of Panasonic Marketing Middle East & Africa FZE (PMMAF), announced the launch of its user-oriented fire alarm system (FAS) in the UAE.

Eaton Corp Plc, Bosch Sicherheitssysteme GmbH, Fike Corporation, Gentex Corp, Honeywell International Inc, Napco Security Technologies Inc, Schneider Electric SE, Siemens AG, Johnson Controls International Plc, Carrier Global Corp, and Mircom Technologies Ltd are among the key players profiled in the North America and MEA fire alarm systems market report. Several other major players were also studied and analyzed in the market report to get a holistic view of the market and its ecosystem. The market analysis provides detailed market insights, which help the key players strategize their growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com