Increasing Demand for Smart Home Automation across North America Boost North America Hearth Market Growth

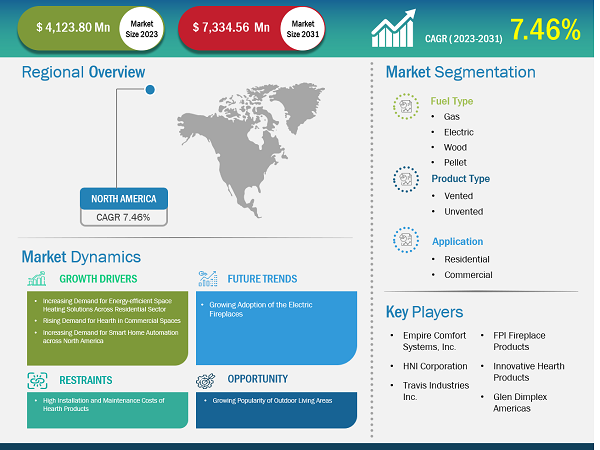

According to our latest market study on "North America Hearth Market to 2031 – Regional Analysis – by Fuel Type, Product Type, and Application," the North America hearth market size is projected to reach US$ 7.33 billion by 2031 from US$ 4.12 billion in 2023; it is anticipated to register a CAGR of 7.5% from 2023 to 2031.

The adoption of smart home automation for aesthetically appealing fireplaces is increasing across North America, especially in the US. According to the Insight Partners Estimate, approximately 54% of homeowners in the US agreed to install smart home products, including aesthetically appealing products. Also, more than 3 in every 5 residential consumers are expected to adopt smart home technologies by 2025. On average, more than US$ 1,200 is spent on smart home products, including remote control devices, hearth products, and locks, among other products, in the region. A few of the key players are developing home automation-based products to offer space heating solutions. For instance, in March 2024, URC, a global smart commercial and residential automation company, launched next-generation integration with a smart hearth control system for residential and commercial applications. Commercial and residential users are seamlessly integrating home automation hearth systems with URC's Total Control system. It allows the management of hearth units equipped with home automation Wi-Fi Modules using the IntelliFire Touch technology. Total Control’s hearth product allows integration with customized activities such as hearth fire, audio, lighting, visual, etc. Thus, the increasing adoption of smart home automation, including the incorporation of smart hearth products, is contributing to the growing North America hearth market size.

North America Hearth Market Share — by Country, 2023

North America Hearth Market Size and Forecast (2021-2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Fuel Type (Gas, Electric, Wood, and Pellet), Product Type (Vented and Unvented), Application (Residential and Commercial), and Country

North America Hearth Market Trends and Scope by 2031

Download Free Sample

Source: The Insight Partners Analysis

The North America hearth market comprises countries such as the US, Canada, and Mexico. The US and Canada acquire the majority of the North America hearth market share as there is a constant demand for fireplaces in these countries. This can be mainly attributed to the rise in the deployment of electric hearth systems across residential applications, which is supported by the increase in replacements of gas/fuel-powered hearths with electric and pellet-based hearths.

The North America hearth market report includes an analysis carried out by identifying and evaluating key players in the market. The presence of a large number of hearth manufacturers, such as HNI Corporation; Wolf Steel Ltd; Empire Comfort Systems, Inc.; Travis Industries, Inc.; Innovative Hearth Products; FPI Fireplace Products International Ltd; Pacific Energy Fireplace Products Ltd.; GHP Group Inc; Glen Dimplex Americas; and Stove Builder International, is one of the major drivers for the North America hearth market. These companies are constantly working on providing reliable solutions to their respective customers to remain competitive in the highly fragmented market.

The report includes growth prospects in light of current North America market trends and driving factors influencing the market growth. The rise in the number of tourism and hospitality sector engagements with tourists traveling to the US or Canada is another major factor supporting the North America hearth market growth in the commercial segment. The majority of the hotels in both countries have installed fireplaces or portable hearths to provide comfort to their respective customers.

Several factors, including the construction of new residential houses across various cold states such as Washington, California, Minnesota, North and South Dakota, Michigan, and Wisconsin, drive the demand for hearths in the US. These states have the majority of the locations with the cold atmosphere where the residents require hearth installed at their houses. Moreover, the increase in energy consumption prices is another major factor pushing consumers to shift from electric-based heating appliances to eco-friendly heating systems. The hearth system allows the production of heat that can be utilized to maintain a warm atmospheric environment inside houses. All these factors are driving the hearth market in the US.

The rise in demand from existing residential houses and commercial buildings across the US is another major factor supporting the installation of hearth systems nationwide. Moreover, the rising awareness for better aesthetics inside the houses is one of the secondary factors driving the adoption of hearth systems. The US also has a wide presence of companies such as IHP Corporate, ACME Stove, Empire Comfort Systems Inc, Hearth & Home Technologies, US Stove Company, The Fireplace Factory, American Panel Hearth Products, Hearth & Home Incorporated, Hearthstopper, and Heatilator.

The stakeholders in the North America hearth market include raw material and component suppliers, hearth manufacturers, distributors, and end users. Raw material suppliers and component suppliers provide products such as stones, marble, granite, slate, cover plates, grates, and screens to hearth system manufacturers. Hearth manufacturers then utilize the raw materials and components to make the final fireplace products, which are further supplied to the distributors or directly to the customers.

Manufacturers of fireplaces/hearths are facing difficulties in efficiently maintaining the supply chain and retaining the smooth flow of transactions within the value chain. This is mainly due to the fluctuations in the sales/shipments of hearth products year-on-year. Further, the government regulations regarding the installation/usage of fireplaces in a few cities of Canada are impacting the demand for gas-based hearth/fireplace products. For instance, according to the Ontario Building Code, customers must obtain a permit to install a fuel-burning fireplace or wood stove in their home in Canada. Further, the shipments of hearth systems have been witnessing fluctuations in terms of yearly growth. For instance, according to the Hearth, Patio & Barbecue Association, in Canada, the shipments of gas hearth appliances witnessed a y-o-y growth of -19%, 5%, 22%, and -24% in the years 2019, 2020, 2021, and 2022 respectively. Similarly, in the US, the shipments of gas hearth appliances witnessed a y-o-y growth of -7%, 5%, 15%, and -20% in 2019, 2020, 2021, and 2022, respectively. Such factors have also been impacting the adoption of hearth systems across North America, and hearth appliance vendors have been facing the challenge of retaining their respective customers.

The North America hearth market analysis is carried out by identifying and evaluating key players in the market. SBI–International Stove Manufacturer Inc.; Glen Dimplex Europe Holdings Limited; GHP Group Inc.; Pacific Energy Fireplace Products; FPI Fireplace Products International Ltd.; HNI Corporation; Wolf Steel Ltd; Empire Comfort Systems, Inc.; Travis Industries, Inc.; and Innovative Hearth Products are among the key players covered in the North America hearth market report.

Companies in the North America hearth market adopt various strategies to remain competitive in the market. As per company press releases, a few recent developments by key players are listed below:

Year | News |

January, 2023 | TRM Equity II, the Michigan-based private equity fund, acquired substantially all of the assets of Innovative Hearth Products (IHP). With production facilities in Russellville, AL, and Auburn, WA, IHP is a leading manufacturer of indoor and outdoor fireplaces, free-standing stoves, gas logs, fireplace inserts, venting products, and accessories for the specialty retail, residential, new construction, and other industrial products. |

September. 2023 | Empire Group, the parent company of Empire Comfort Systems, has acquired Canadian Heating Products Inc. (conducting business as Montigo Fireplaces) of Langley, British Columbia, Canada. |

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com