Growing Focus on Water and Wastewater Treatment Activities Propels Polyacrylic Acid Market Growth

According to the latest study on “Polyacrylic Acid Market Forecast to 2031 – Global and Regional Share, Trend, and Growth Opportunity Analysis – by Form, Application, and End-Use Industry,” the market was valued at US$ 2.43 billion in 2023 and is projected to reach US$ 3.34 billion by 2031; it is anticipated to record a CAGR of 4.1% from 2023 to 2031. The report highlights key factors contributing to the growing polyacrylic acid market size and prominent players along with their developments in the market.

Polyacrylic acid (PAA), also termed Carbomer, is a widely used synthetic polymer. However, concerns about its environmental impact have led to research for green alternatives. These alternatives are typically bio-based, biodegradable or derived from renewable resources. PAA is derived from fossil fuel, which makes it challenging to recover or recycle after utilization. Bio-based polymers are environmentally friendly and are the subject of extensive research in various fields. Bio-based materials exhibit sustainability, thereby driving their use in commercial applications. The easy availability of natural raw materials for the production of bio-based polymers is an added factor fueling its supply and demand.

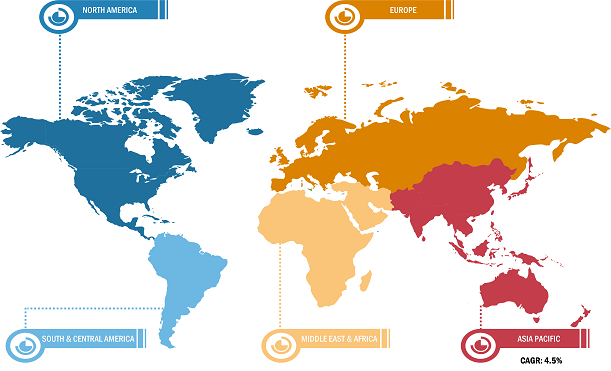

Polyacrylic Acid Market Breakdown – by Region

Polyacrylic Acid Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Form (Powder and Liquid), Application (Dispersing Agent, Anti-Scaling Agent, Thickeners, Emulsifiers, Ion-Exchanger, and Others), and End-Use Industry (Water Treatment, Personal Care & Cosmetics, Detergents & Cleaners, Leather & Textiles, Pulp & Paper, Paints & Coatings, Ceramics, and Others)

Polyacrylic Acid Market Growth Report | Size & Forecast 2031

Download Free Sample

The development of bio-based and sustainable products is expected to emerge as one of the polyacrylic acid market trends during the forecast period. Stringent government regulations pertaining to the utilization of toxic chemicals across the world have encouraged many market players to develop nontoxic alternatives, aiding global sustainability goals. The rising demand for bio-based materials has prompted manufacturers to develop green alternatives to polyacrylic acid for various applications. Interreg VlaNed project GREENER aims to develop polymers with the same properties as water-soluble polymer polyacrylic acid, but with the advantage that they will be bio-based and biodegradable.

Water and wastewater treatment is becoming increasingly important in many countries and regions across the world. Various European countries are progressing toward wastewater treatment targets and the protection of sensitive water systems. Data published by the European Environment Agency (EEA) in 2021 shows that ~90% of urban wastewater is collected and treated in accordance with the EU Waste Water Treatment Directive across the EU. Country analysis based on the implementation of EU rules on wastewater treatment shows that the EU member states are significantly applying the rules, and the compliance rate slightly increased between 2016 and 2018. As per the data from the EEA, Austria, Germany, Luxembourg, and the Netherlands treat 100% of urban wastewater in compliance with the Directive’s requirements, and ten additional countries have reached over 90% compliance rate. In France, 90% of the urban wastewater is treated according to the requirements of the Urban Waste Water Treatment Directive (UWWTD). Polyacrylic acid is used as a flocculant to remove suspended solids and particles from water. It finds application as a clarifying agent, dispersing agent, and anti-scaling agent in membrane-based water treatment processes. Thus, all these factors fuel the growth of the polyacrylic acid market.

In February 2023, the US government declared a US$ 5.8 billion investment in the development of potable water and wastewater infrastructure. In February 2024, EPA announced an investment of more than US$ 3.2 billion through the Drinking Water State Revolving Fund for the expansion of clean drinking water infrastructure across the US. The Bipartisan Infrastructure Law provides funding for drinking projects, including the upgradation of water treatment plants, water distribution and piping systems. EPA also announced US$ 2.6 billion through the Clean Water State Revolving Fund for a range of projects to upgrade wastewater, sanitation, and stormwater infrastructure. Therefore, the development of sustainable polyacrylic acid is expected to drive the polyacrylic acid market growth during the forecast period.

The polyacrylic acid market analysis is carried out by identifying and evaluating key players operating in the market across different regions. Arkema SA, Ashland Inc, BASF SE, Evonik Industries AG, Nippon Shokubai Co Ltd, Sumitomo Seika Chemicals Co Ltd, The Dow Chemical Co, The Lubrizol Corp, Shandong ThFine Chemical Co Ltd, and Glentham Life Sciences Limited are among the key players profiled in the polyacrylic acid market report.

Polyacrylic Acid Market Report Segmentation:

The global polyacrylic acid market is segmented on the basis of form, application, and end-use industry. Based on form, the market is bifurcated into powder and liquid. By application, the market is divided into dispersing agent, anti-scaling agent, thickeners, emulsifiers, ion-exchanger, and others. Based on end-use industry, the market is segmented into water treatment, personal care and cosmetics, detergents and cleaners, leather and textiles, pulp and paper, paints and coatings, ceramics, and others.

Based on application, the market is segmented into dispersing agent, anti-scaling agent, thickeners, emulsifiers, ion-exchanger, and others. The dispersing agent segment accounted for the largest polyacrylic acid market share in 2023. PAA is commonly used as a dispersing agent in various industries due to its ability to improve the dispersion of solid particles in liquid media. PAA is used to formulate paints and coatings to disperse pigments, fillers, and additives uniformly throughout the liquid medium. In the ceramics industry, PAA serves as a dispersing agent for ceramic powders such as alumina, silica, and zirconia. As an anti-scaling agent, PAA inhibits the deposition of insoluble mineral salts onto a surface, thereby making it a significant chemical in water treatment. It prevents deposit formation in the oil and gas processes and industrial cleaning applications. PAA is widely used in water treatment to prevent scale formation in water cooling systems, boilers, and reverse osmosis membranes. PAA serves as a versatile thickening agent in various industries due to its unique rheological properties and water-absorbing capabilities.

Based on end-use industry, the water treatment segment held the largest polyacrylic acid market share in 2023. The rising demand for clean water and increasing regulatory requirements for water quality standards drive the adoption of advanced water treatment solutions incorporating PAA-based additives. As water treatment processing continues to evolve and expand globally, the demand for PAA rises because of ongoing investments in infrastructure development and environmental stewardship. PAA finds application as a clarifying agent, dispersing agent, and anti-scaling agent in membrane-based water treatment processes such as reverse osmosis and ultra-filtration. In the textile industry, PAA finds widespread use as a dispersing agent, thickener, and sizing agent in textile printing and finishing processes. PAA can disperse and stabilize pigments and dyes to achieve uniform coloration on textile substrates. As a sizing agent in textile processing, PAA imparts strength, stiffness, and dimensional stability to yarns and fabrics during weaving and finishing operations.

The polyacrylic acid market scope is broadly segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com