According to our latest study on "Respiratory Care Devices Market Forecast to 2028 – COVID-19 Impact and Global Analysis – Product, Indication, and End User," the market is expected to grow from US$ 18,114.31 million in 2021 to US$ 32,761.82 million by 2028; it is estimated to grow at a CAGR of 8.9% from 2021 to 2028. The report highlights the major factors driving the respiratory care devices market and prominent players and their developments. The global respiratory care devices market is majorly driven by increasing prevalence of infectious respiratory diseases, rapidly increasing cases of asthma and COPD, rising number of product launches and approvals, and growing R&D investment for respiratory care devices. However, cutthroat competition among market players and unfavorable reimbursement scenarios are hampering market growth.

COVID-19 is a lethal infectious respiratory disease. The rapid growth of the COVID-19 crisis led to the rising demand for respiratory medical devices. Owing to the capacity limitation, it became crucial to avoid any further risks of potential shortages or delays in the availability of such devices, authorities related to the implementation of the Medical Devices Regulation (MDR). In April 2020, the European Commission adopted revised harmonized standards to expedite the production of medical devices such as ventilators and oxygen concentrators. Also, in March 2020, a group of British manufacturers across different industries, such as aerospace, automotive, and medical sectors, formed the Ventilator Challenge UK Consortium. The challenge was to produce 10,000 medical ventilators for National Health Service (NHS) under the twin codenames Project Oyster and Project Penguin. Ventilator Challenge UK was a consortium of 14 firms, such as Ford, Haas, McLaren, Mercedes-AMG, Red Bull, Racing Point, Renault, and Williams F1 teams. Non-automotive firms included Airbus, BAE, Dell, GKN, Microsoft, Siemens, and Rolls-Royce. Before the VentilatorChallengeUK, the Britain government had 8,175 ventilators but had turned to British industry to help produce 30,000 ventilators in a matter of weeks to combat an expected surge in new cases.

In 2020 and 2021, many hospitals ran out of ventilators due to the rapid spread of SARS-CoV-2 variants and drastically rising number of cases, which was one of the reasons that caused pneumonia and troubled breathing among patients. Thus, the demand for ventilators increased significantly with the surging cases of COVID-19 in these years. As India faced the second wave of the COVID-19 pandemic in 2021, the Indian Space Research Organisation (ISRO) developed three types of ventilators and offered to transfer the technology to other companies in the medical device manufacturing industry for clinical use. Also, NASA granted licenses to three Indian companies to manufacture its in-house developed ventilators to treat COVID-19 patients. Further, over 800 ventilators were provided for COVID-19 relief efforts in India by the Philips Foundation, Prosus, Johnson Foundation, and the Johnson & Johnson Family of Companies in June 2021. Therefore, increased production by the companies resulted in profits, and the COVID-19 outbreak has positively impacted the respiratory care devices market growth.

Based on indication, the respiratory care devices market is segmented into several subsegments, such as chronic obstructive pulmonary disease (COPD), sleep apnea, asthma, infectious diseases, and others. The COPD segment held the largest share of the market in 2021. Moreover, the asthma segment is anticipated to register the highest CAGR of 9.1% in the respiratory care devices market during the forecast period. Chronic obstructive pulmonary disease (COPD) is considered a common, preventable, treatable disease with constant respiratory symptoms such as breathing issues and airflow limitation. Additionally, it is anticipated that chronic inflammation in the airways, which leads to alveolar abnormalities, is majorly caused by long-term exposure to toxic particles or gases, for instance, cigarette smoke and environmental pollution. Moreover, manufacturers of respiratory care devices are integrating enhanced patient monitors, innovative parameters, workflows, wireless devices, and integrated information technology solutions. The indication can be treated by drug powder inhalers (DPIs), metered-dose inhalers (MDIs), soft mist inhalers (SMIs), compressor nebulizers, and ultrasonic nebulizers, and mesh nebulizers. Key players involved in the commercialization of COPD treatment devices include GlaxoSmithKline plc., Smiths Medical, Novartis AG, 3M, Koninklijke Philips N.V., and AstraZeneca. Thus, the increasing prevalence of COPD is expected to fuel the demand for respiratory care devices, boosting the growth of the respiratory care devices segment.

Koninklijke Philips N.V.; ResMed Inc; Medtronic; Masimo; THERMO FISHER SCIENTIFIC INC.; Dragerwerk AG & Co. KGaA; Invacare Corporation; Getinge AB.; Nihon Kohden Corporation; Air Liquide; and Teleflex Incorporated are among the leading companies in the respiratory care devices market.

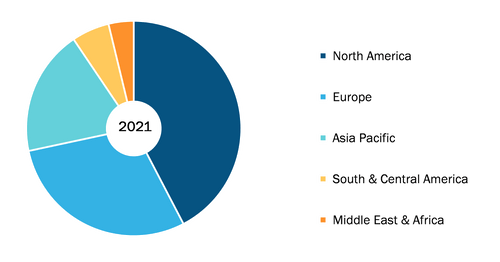

Respiratory Care Devices Market, by Region, 2021 (%)

Respiratory Care Devices Market Growth 2031| Size, Share

Download Free SampleRespiratory Care Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Therapeutic Devices, Monitoring Devices, Diagnostics Devices, and Consumables & Accessories), Indication (Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, Asthma, Infectious Diseases, And Others), End User (Hospitals, Home Care, And Ambulatory Care), and Geography

The report segments the respiratory care devices market as follows:

The respiratory care devices market is segmented based on product, indication, end user, and geography.

Based on product, the market is segmented into therapeutic devices, monitoring devices, diagnostics devices, and consumables & accessories. The therapeutic devices segment is further subsegmented into positive airway pressure (PAP) devices, oxygen concentrators, ventilators, inhalers, nebulizers, humidifiers, and others. The positive airway pressure (PAP) devices segment is subsegmented into CPAP devices, APAP devices, and BiPAP devices. The oxygen concentrators segment is subsegmented into fixed oxygen concentrators and portable oxygen concentrators. The inhalers segment is subsegmented into metered dose inhalers and dry powder inhalers. The monitoring devices segment is segmented into pulse oximeters, capnography, and gas analyzers. The diagnostics devices segment is subsegmented into spirometers, polysomnography devices, peak flow meters, and other diagnostic devices. The consumables & accessories segment is further subsegmented into masks, disposable resuscitators, tracheostomy tubes, among others.

Based on end user the market is segmented into hospitals, home care, and ambulatory care. By geography, the respiratory care devices market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com