According to our latest market study on “Trade Finance Software Market to 2027 – COVID-19 Impact, and Global Analysis and Forecast – by Component (Solution and Services); Deployment (Cloud and On-Premise); Enterprise Size (Large Enterprises and SMEs); and End-Use (Banks, Traders, and Others)and Geography,” the market was valued at US$ 1,573.8 million in 2021 and is projected to reach US$ 2920.4 million by 2027; it is expected to grow at a CAGR of 10.3% from 2020 to 2027.

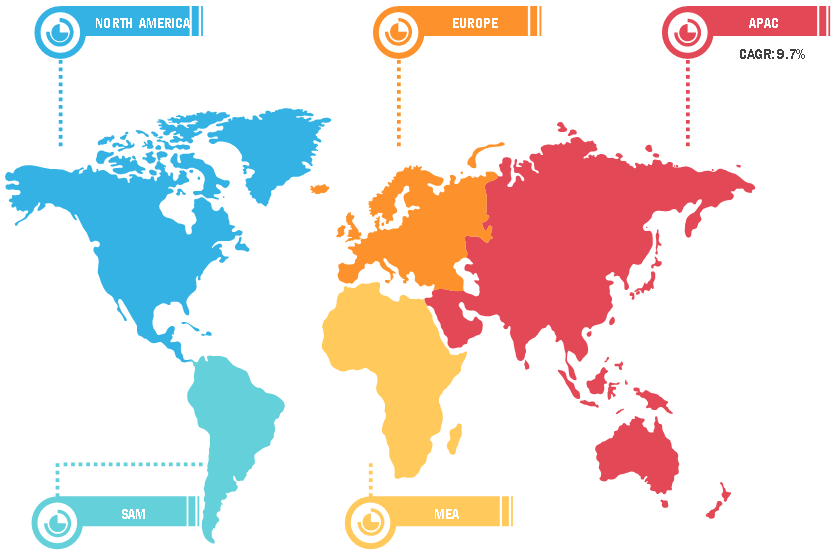

In 2019, APAC led the global trade finance software market with 36.81% revenue share, followed by Europe, and North America. APAC includes Australia, China, India, Japan, South Korea, and Rest of APAC. APAC is the world's largest continent and is well known for its technological innovations in the above mentioned countries. Rise in smartphone and internet penetration in the APAC countries is acting as a significant opportunity for the key players in the trade finance software market. Rapid technological advances, policy support, and economic digitization are among the factors that assist the transition of economies in this region from the growing stage to the developed stage. Also, the market in APAC is anticipated to grow at a fast pace during the forecast period due to increasing demand for trade finance software and services. Trade finance software allows SMEs and large enterprises to fine-tune their trade process. China, Australia, and Japan have emerged as unchallenged leaders in the trade finance software market.

In 2019, Europe stoodsecond in the trade finance softwaremarket with a decent market share and it is anticipated to witness a steady CAGR from 2020 to 2027.Over the past five years, capital invested in European technology has grown by 124%, rising by 39% between 2018 and 2019, to reach US$ 34.3 billion of capital investment in 2019. This compares to the cutbacks between 2018 and 2019 in capital investment in both the US and Asia. Europe's software development services are increasingly in demand. An increase in adoption of IT and telecommunication and digital transformation and automation are the key drivers of this growth. Moreover, European countries house a number of industries offering critical and important products. The medical sector in the region is advancing at a rapid rate. Likewise, numerous automakers have their establishments across countries, which are supported by innumerable component manufacturers. Other industries such as aerospace & defense, agriculture, consumer electronics, e-commerce, transportation & logistics are showcasing significant import-export activities with respect to their respective products, which, in turn has boosted trade finance market in the region. Further, in order to manage trade finance operations more efficiently various banks and traders are adopting trade finance solutions and services, thereby providing visibility to their clients.

Companies adopt inorganic market strategies to expand their footprints across the world and meet the growing demand. The trade finance softwaremarket players mainly focus on the acquisition strategy to expand their business and maintain their brand name globally. For instance, in 2020,ClickSWITCH, declared a combined partnership with Newgen Software Technologies to deliver mutual customers with a seamless integrated experience.

Impact of COVID-19 on Trade Finance Softwaremarket

The commencement of the COVID-19 epidemic has brought about momentous supply chain and logistics disruptions across the world.The COVID-19 pandemic is one of the largest disrupting forces, with the region’s three countries continuing to combat outbreaks and significant community spread. The huge increase in the number of confirmed cases and rising reported deaths in the country has affected software providers to some extent due to the decrease in demand for their products. The business shutdowns as well as disruption in supply chain across the worldare impacting the adoption of the trade finance software market. The North America region is home to a large number of technology companies, and the impact of coronavirus outbreak is anticipated to be moderate in the year 2020 and likely in first quarter of 2021. The impact of COVID-19 is short-term; it is likely to decrease in the coming years.

Trade Finance Software Market — Geographic Breakdown, 2019

Trade Finance Software Market Report | Growth & Size by 2031

Download Free Sample

Trade Finance Software Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Deployment (Cloud and On-Premise), Enterprise Size (Large Enterprises and SMEs), End-Use (Banks, Traders, and Others), and Geography

Trade Finance Software Market Report | Growth & Size by 2031

Download Free SampleTrade Finance Software Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Deployment (Cloud and On-Premise), Enterprise Size (Large Enterprises and SMEs), End-Use (Banks, Traders, and Others), and Geography

The report segments the global Trade Finance Software market as follows:

By Component

- Solution

- Services

By Deployment

- Cloud

- On-Premise

By Enterprise Size

- Large Enterprises

- SMEs

By End-User

- Banks

- Traders

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Contact Us Phone: +1-646-491-9876Email Id: sales@theinsightpartners.com